Exxon Mobil’s Weak Forward-Looking Dividend Coverage is Very Concerning

Image Source: Exxon Mobil Corporation – Third Quarter of 2020 IR Earnings Presentation

By Callum Turcan

Exxon Mobil Corporation (XOM) has contended with enormous headwinds so far in 2020 due to the ongoing coronavirus (‘COVID-19’) pandemic, and that has put its dividend at risk. Over the past couple of years, the company has come nowhere close to generating enough free cash flow to cover its dividend obligations. Exxon Mobil’s forward-looking dividend coverage appears quite weak and the company is currently leaning heavily on debt markets to keep making good on those obligations. As of this writing, shares of XOM yield ~9.7% as investors are increasingly pricing in the chance for a meaningful payout cut.

Deteriorating Upstream Outlook

The long-term slide in Exxon Mobil’s upstream production base (the side of the energy industry responsible for extracting oil, natural gas, and natural gas liquids from the ground) will be hard to reverse. Declines at its legacy upstream operations are largely responsible here. Exxon Mobil pumped out ~4.2 million barrels of oil equivalent per day (‘BOE/d’) in 2012, which fell down to ~3.8 million BOE/d in 2018 before rebounding to just under 4.0 million BOE/d in 2019. That rebound was made possible in large part through enormous investments in its unconventional upstream operations in the Permian Basin that stretches across West Texas and Southeastern New Mexico. Horizontal wells that are completed with hydraulic fracturing activities, known as “fracked” wells, represent the bulk of Exxon Mobil’s investment in this region.

Exxon Mobil’s major capital investments in the Permian Basin have helped (to a degree) offset natural production declines seen at other parts of its upstream asset base over the past few years. Additionally, Exxon Mobil’s upstream operations in Guyana (which achieved first-oil in late-2019) have more recently started helping the firm prop up its production of raw energy resources.

With that in mind, Exxon Mobil’s upstream output continued to slip lower in 2020. During the third quarter of 2020, the firm’s upstream production came in below 3.7 million BOE/d. Looking at its output during the first nine months of 2020, Exxon Mobil still reported a meaningful decline compared to year-ago levels (the firm’s output stood below 3.8 million BOE/d during the first three quarters of this year, down from 3.9 million BOE/d in the year-ago period).

Shale Treadmill

Some of these pressures were due to the company and its partners curtailing output in the face of low raw energy resources pricing, and in certain regions, due to government mandates. Also, Exxon Mobil is forced to contend with the “shale treadmill” given that unconventional upstream operations now represent a much bigger part of its overall upstream portfolio than they did just five years ago. The shale treadmill means that upstream operators need to continuously invest enormous sums towards developing unconventional assets or face significant production declines (which in turn greatly limits their revenue generating and ultimately cash flow generating abilities). This dynamic significantly limits the ability for the upstream shale-focus industry to generate free cash flows.

Exxon Mobil cut its capital expenditure budget for 2020 versus year-ago levels given management’s desire to defend the company’s dividend, and in light of subdued raw energy resources pricing. In 2019, Exxon Mobil spent about $24.4 billion on its capital expenditures, which the company aims to bring down to ~$23.0 billion in 2020 (the firm was initially targeting ~$33 billion in capital expenditures this year). In 2021, that figure is forecasted to fall to $16.0 - $19.0 billion according to management. Some of the capital expenditure expectation reductions are coming from Exxon Mobil cutting its Permian Basin development budget.

Now that Exxon Mobil is taking its foot off the gas pedal when it comes to its capital expenditure expectations, sharp production decline rates in the region (“fracked” wells experience production declines in their first year that range form 45%-80%) will weigh very negatively on the trajectory of its upstream production in the medium-term. Though the company aims to keep growing its Permian Basin production in the near-term, given the drop off in capital expenditures planned for 2021, that growth trajectory is at risk of stalling out. More broadly, even a slowing of Exxon Mobil’s Permian growth story could see its upstream production base move much lower in the short-term due to output declines at its legacy assets.

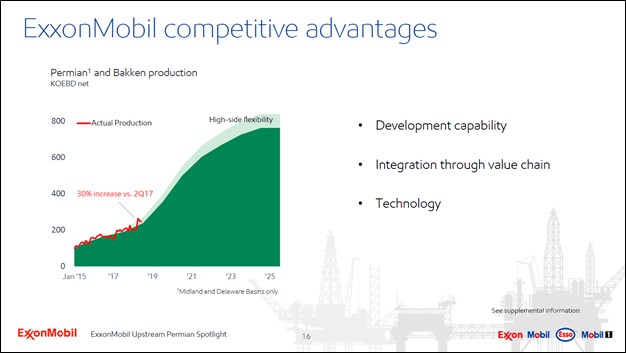

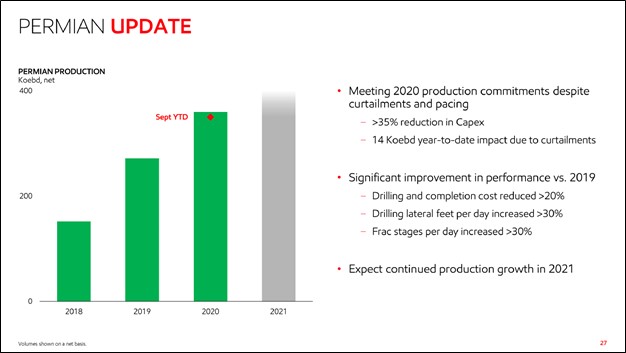

In the upcoming graphics down below, we highlight Exxon Mobil’s historical upstream production growth in the Permian Basin, along with its forecasts made before and after the pandemic. The first graphic is from an investor presentation given back in October 2018 and the second is from Exxon Mobil’s latest earnings update.

Image Shown: After making the Permian Basin a core part of its business profile in the middle of the 2010s decade, Exxon Mobil started dedicating enormous sums towards developing unconventional upstream opportunities in the region. These short-cycle projects soon yielded material production growth, helping Exxon Mobil offset production declines elsewhere. Image Source: Exxon Mobil – October 2018 IR Presentation

Image Shown: Exxon Mobil expects its Permian Basin production will continue to grow in 2021, though at a much slower pace than in the recent past. Image Source: Exxon Mobil – Third Quarter of 2020 IR Earnings Presentation

Upstream Operations and Exxon Mobil’s Weak Dividend Coverage

Exxon Mobil’s refining, petrochemical, and distribution operations are impressive. However, it is the upstream assets of large energy companies that generate the bulk of their cash flows in most instances (save for when raw energy resources pricing gets exceptionally low). Therefore, we pay close attention to the upstream performance of these energy giants. Please be aware that in terms of cash flow, its upstream segment generally is even a larger part of Exxon Mobil’s financial performance than its segment-level operating income/loss would indicate due to significant non-cash DD&A expenses (a product of sizable upstream capital investments).

In the third quarter of 2020, Exxon Mobil’s ‘Chemicals’ segment generated ~$0.55 billion in adjusted segment-level operating income, more than double year-ago levels. Stronger sales volumes of its petrochemical products were the main reason for the improvement. However, Exxon Mobil’s ‘Upstream’ segment reported a $0.4 billion adjusted segment-level operating loss in the third quarter of 2020, down sharply from a $2.2 billion adjusted segment-level operating profit in the same period last year. Lower raw energy resources pricing was the main culprit here, though modestly lower production volumes also weighed negatively on Exxon Mobil’s upstream performance.

Usually Exxon Mobil’s ‘Downstream’ segment (includes its refineries and various distribution operations) lends a helping hand. However, as global refined petroleum product demand remains subdued due to the COVID-19 pandemic, this segment reported an adjusted segment-level operating loss of $0.2 billion in the third quarter of 2020, down from an adjusted segment-level operating profit of $1.2 billion in the same quarter last year. Exxon Mobil’s refining margins have been crushed by the pandemic, as has its sales volumes.

In 2019, Exxon Mobil generated $5.4 billion in free cash flow which covered just a portion of the $14.7 billion it spent covering dividend payments to its common shareholders. During the first nine months of 2020, Exxon Mobil generated -$3.0 billion (negative $3.0 billion) in free cash flow yet spent $11.2 billion covering dividend payments to its common shareholders. We are not fond of Exxon Mobil’s forward-looking dividend coverage. The company is entirely reliant upon its ability to keep tapping capital markets for funds to cover these obligations, debt markets in particular given its weak stock price performance over the past few years.

Exxon Mobil exited September 2020 with a net debt position of $60.0 billion (inclusive of short-term debt), and that burden will only continue to grow as long as its dividend remains as is. Exxon Mobil’s net debt load stood at $43.8 billion (inclusive of short-term debt) at the end of 2019.

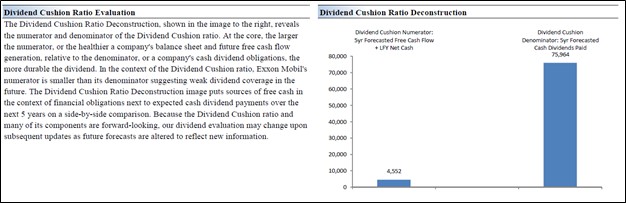

Our Dividend Cushion ratio for Exxon Mobil sits at 0.1 and the firm has a “VERY POOR” Dividend Safety rating. In the upcoming graphic down below, we compare Exxon Mobil’s forecasted free cash flows over the next five full fiscal years less its net debt load at the end of its last fiscal year (net debt is very punitive in the Dividend Cushion ratio) in the left-hand column versus its expected total dividend obligations (at its current payout rate) during this period in the right-hand column. Please note Exxon Mobil’s forward-looking dividend coverage has further deteriorated during the course of 2020 as its net debt load grew. Click here to view Exxon Mobil’s Two-page Dividend Report.

Image Shown: We are not fans of Exxon Mobil’s forward-looking dividend coverage. There is a growing chance that the energy giant may have to cut its dividend in the medium-term.

Unless raw energy resources pricing improves considerably, Exxon Mobil will be forced to continue accumulating a lot of debt on the books in order to keep making good on its onerous dividend obligations. In our view, there is a very real chance Exxon Mobil will be forced to cut its dividend in the medium-term. Though management has pledged to push through sizable operating expense reductions (this strategy involves headcount reductions as well as other cost savings initiatives) on top of planned cuts in the firm’s capital expenditure expectations, that can only do so much in a world with subdued refined petroleum product demand and low raw energy resources pricing. Here is what management had to say during Exxon Mobil’s latest earnings call (emphasis added):

“In terms of cash OpEx, in April [2020], we gave the organization a target to reduce operating expenses for the year by 15%. We're well on our way to delivering even larger reductions and will achieve further structural efficiencies next year. We reduced this year's CapEx plan by 30% to $23 billion and similar to OpEx, expect to finish the year below our reduction target. To achieve this, we took steps to delay or postponed projects in construction. We challenged our organization and partners to offset any value impact from these delays with additional execution efficiencies, and our project teams delivered.

In 2021, we expect to drive CapEx lower than this year to between $16 billion and $19 billion. Portfolio high grading activities are continuing. Our current conditions are challenging. We're making progress and anticipate additional assets in the market over the next 12 months.

And finally, there will be no change to our capital allocation priorities of investing in industry advantaged projects, maintaining a strong balance sheet and paying a reliable dividend. The progress we've made this year gives us confidence as we head into 2021. The work done over the last couple of years to improve our organization and drive efficiencies paid off in responding to the pandemic.” --- Jack Williams, Senior VP of Exxon Mobil

We find to hard to believe that Exxon Mobil can continue investing heavily in its asset base (though the company’s capital expenditure expectations have come down considerably, they remain elevated due in part to the shale treadmill dynamic) while “maintaining a strong balance sheet and paying a reliable dividend.” There is no way Exxon Mobil, in the current environment, can accomplish those three things. Asset sales will only do so much, especially given how difficult it will be to get a good price for those assets in the current environment.

Concluding Thoughts

The ongoing COVID-19 pandemic has devastated the oil & gas industry, and the pain goes well beyond just low oil prices. Exxon Mobil has put on a brave face, though we caution that its financial position is becoming precarious. OPEC and OPEC+ members may consider extending and/or deepening their existing production curtailments agreement, but that would be a hard sell for some countries, and furthermore, this task is made more difficult now that most of Libya’s oil production is back online. Soon Exxon Mobil may have to make some very tough, but necessary, decisions regarding its capital allocation priorities.

View Exxon Mobil's stock page >>

-----

Oil and Gas Complex Industry - BKR, HAL, SLB, BP, CVX, COP, XOM, RDS, TOT, COG, EOG, OXY, PXD, ENB, ET, EPD, MMP

Related: XLE, XOP, BNO, USO, UNG

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares or units in any of the securities mentioned above. Enterprise Products Partners L.P. (EPD) and Magellan Midstream Partners L.P. (MMP) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment