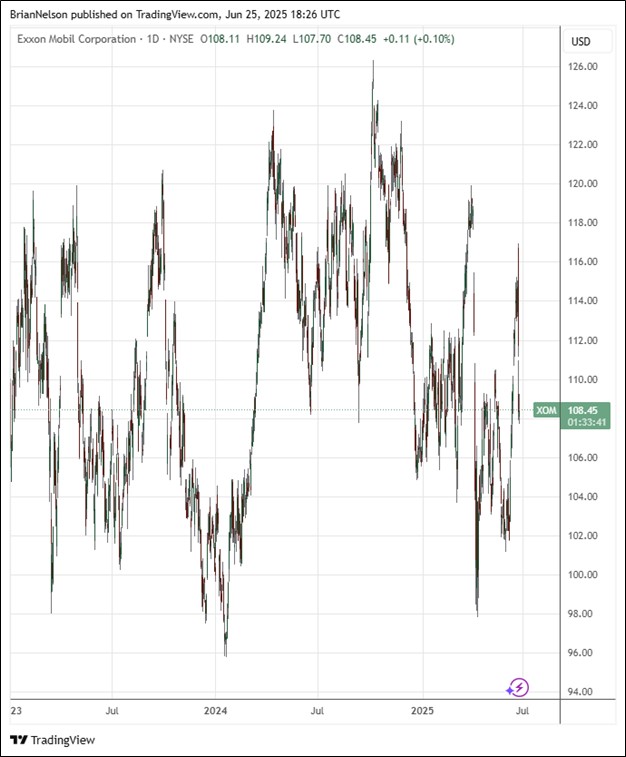

Image: Exxon Mobil’s shares have been choppy of late.

By Brian Nelson, CFA

Exxon Mobil (XOM) recently reported mixed first quarter results with revenue coming in a bit light, but non-GAAP earnings beating the consensus forecast. Revenue edged up modestly to $83.13 billion from $83.08 billion in the quarter, while first quarter earnings came in at $7.7 billion, or $1.76 per share, beating consensus by $0.03. Earnings, however, declined from $8.22 billion in the year-ago period. Management had the following to say about the results:

In this uncertain market, our shareholders can be confident in knowing that we’re built for this. The work we’ve done to transform our company over the past eight years positions us to excel in any environment. In the first quarter, we earned $7.7 billion and generated $13.0 billion in cash flow from operations. Since 2019, the strategic choices we made to reduce costs, grow advantaged volumes, and optimize our operations have strengthened quarterly earnings power by about $4 billion at current prices and margins. This year, we’re starting up 10 advantaged projects that are expected to generate more than $3 billion of earnings in 2026 at constant prices and margins. Continuously leveraging our competitive advantage is enabling the company to excel in the current market environment and deliver on our plans through 2030 and far into the future.

Exxon Mobil continues to be shareholder friendly while it exercises cost discipline. Shareholder distributions in the quarter totaled $9.1 billion, consisting of $4.3 billion of dividends and $4.8 billion of share repurchases. The oil and gas giant has now achieved $12.7 billion of cumulative structural cost savings versus 2019, with $0.6 billion of cost savings achieved during the quarter. Management expects to deliver $18 billion of cumulative savings through the end of 2030 versus 2019. Free cash flow in the quarter was $8.84 billion, and the company ended the quarter with industry-leading debt-to-capital and net-debt-to-capital ratios. We like Exxon Mobil as energy exposure in a diversified portfolio, but we don’t include shares in any newsletter portfolio at this time. Shares yield 3.5% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.