Earnings Brief: PEP, CMG, WHR, TSLA, TWTR, KMB

Second-quarter earnings season is coming in largely as expected. Many of the firms are reporting improving demand through the course of the quarter, and entities that were facing hardship are making the necessary adjustments to improve performance. Pandemic-driven demand has been evident across the consumer staples space, and innovative entities have not stopped innovating as a result of COVID-19. We maintain our view that the world is fight back against COVID-19, and we expect fundamental performance to continue to improve across myriad sectors and a greater “return to normalcy in 2021,” which is but six months away. Accommodative Fed/Treasury policy coupled with substantial increases in money supply may keep this market moving ever-higher.

This article was modified to correct the contextual commentary regarding Whirlpool's free cash flow generation on December 6, 2020.

By Brian Nelson, CFA

We’ve previously highlighted developments across second-quarter earnings season here and here, and we’d like to dig into a number of other earnings releases. Following quarterly developments closely is par for the course as we continuously evaluate our valuations of companies in our coverage, even if the reports are not refreshed daily, weekly or even monthly. Only when we expect to make a material change to the fair value estimate/range do we update the reports on the website. This could be three to six months, and sometimes longer or shorter, at times.

Said another way, our report updates are more valuation-driven than technical (chart) driven, and we stay away from the “systematic” quant process that leaves much of the thinking out of the methodology. When it comes to intrinsic value estimation, taking time to think about forecasts and building fair value estimates is par the course, and this takes expertise, experience and time. Lots of it. The small cap quantitative value factor (which leaves the thinking out of it), for example, fell a gut-wrenching 40%+ during the first quarter of 2020, despite being backed by the most overused word in all of finance, the infamous backtest.

Perhaps the small cap value factor is a good example of what could happen if you think the markets can be mapped with quant data. DCF modeling, on the other hand, takes time because it actually has value. Mr. T still pities the fool that believes all you have to do is invest in companies with seemingly attractive valuation multiples >> Quite simply, if we thought all one needed to do was buy a basket of low P/E ratios, or high B/M ratios or low P/S ratios, we wouldn’t be building discounted cash flow models and deriving fair value estimates for companies across our coverage universe. Investing is much more than using realized/reported, ambiguous data and multiples.

In fact, I might argue that the overabundance of data is why most active managers are losing today, and why a lot of investors are falling into terrible value traps. I talk about these types of things and more in the second of edition of our book Value Trap, which will be available shortly! Let’s now dig into a few quarterly updates.

PepsiCo’s Food/Snack Division Provides Resiliency

PepsiCo (PEP) reported a decent second-quarter report July 13, all things considered--one that was much better than that of Coca-Cola (KO), as the former’s operations were held up by its snacks business. Organic volume in PepsiCo’s Food/Snack business advanced 4%, while organic growth in its beverage business fell 11%. Quaker Foods North America and Frito-Lay North America performed quite well, as consumers sought to stuff their pantries during the COVID-19 crisis. As with many other companies, PepsiCo opted to not provide a financial outlook for fiscal 2020 at this time, but we expect greater visibility and a nice bounce back in its beverage business once things get back to “normal.”

Chipotle’s Digital Initiatives Paying Off

Chipotle (CMG) has been one of our favorite COVID-19 plays since we highlighted it during the depths of the March swoon a few months ago. The company reported second-quarter results July 22 that revealed the impact the pandemic is having on its business. The revenue and comp sales declines were expected during the period, but what was very exciting was the pace of digital sales growth, advancing 216%+ to account for more than 60% of second-quarter sales. The company is working hard to open up more “Chipotlanes” (drive-thru lanes), and we remain excited about new menu offerings, including cauliflower rice. Long term, the breakfast daypart at Chipotle will be its biggest catalyst, something that we think will eventually happen, despite fits and starts.

Whirlpool Not (Exactly) What We’re Looking For

Whirlpool’s (WHR) shares have broken out (technically) of a very long downtrend, but we’re not seeing too much to get excited about (yet). The company noted a “significant demand recovery across all regions in June” when it reported second-quarter results July 22, but for the most part the company hasn't been much of a free cash flow story this year, burning through nearly $880 million year-to-date in 2020 versus burning through nearly $1 billion over the same period a year ago (its longer-term free cash flow generating trends have been more encouraging, however, and there is a degree of seasonality). Organic net sales dropped nearly 14% in the second quarter, in part as a result of the COVID-19 pandemic. Though Whirlpool is doing a nice job protecting margins and enhancing liquidity during these challenging times, the company is not one of our very favorite ideas (we like newsletter portfolio holdings the best), but it's worth keeping on your radar. Whirlpool’s net debt stood at $4.1 billion at the end of the second quarter.

Tesla Proving the Bears Wrong

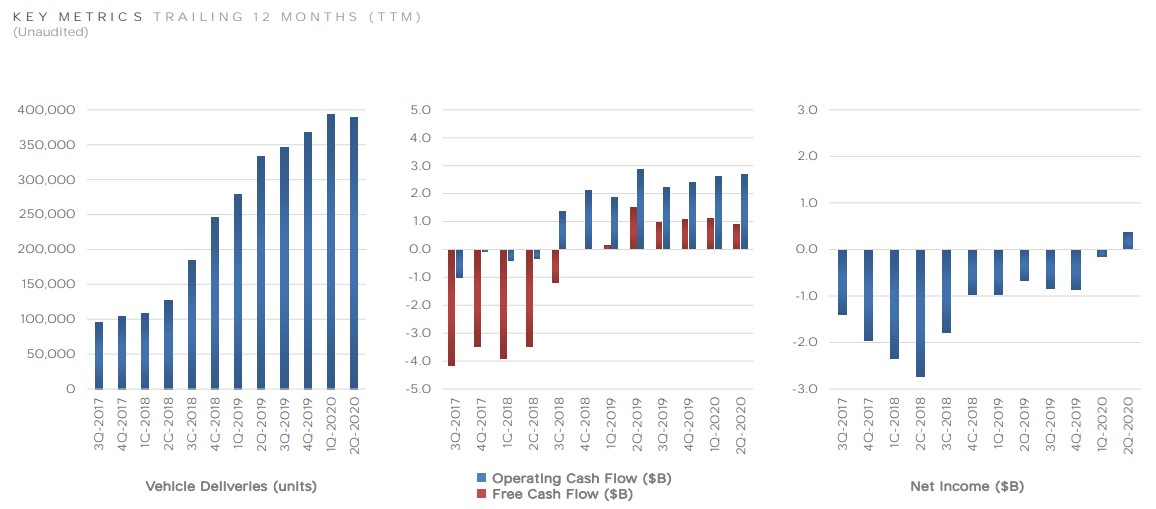

Image Source: Tesla has turned the corner regarding GAAP profitability, and the firm is now generating positive free cash flow, as it sits on billions of cash on the balance sheet. Q2 2020 Update.

No matter what the bears say, Tesla (TSLA) is doing a lot of things right. During the second quarter, the company hauled in $418 million in free cash flow, while generating $327 million in GAAP operating income on a 5.4% operating margin, one that we think has room for material expansion (management expects its operating margin to reach “industry-leading levels”). The electric-vehicle maker has now put up four quarter of sequential operating profitability (despite the disruption of COVID-19), and its thirst for innovation remains largely unmatched across our coverage universe. We’re very excited about the new Cybertruck--which we think is a game-changer—and it has now increased the range of the Model S to 402 miles. Though we view Tesla as largely “uninvestable,” given its wide range of fair value outcomes, it’s hard not to like the fundamental improvements. Congrats Elon (and stop tweeting)!

Twitter Hacking Evidence of Long Term Challenges

Let me put it this way: I don’t like Twitter (TWTR). I never have and I don’t think I ever will. The platform is just not conducive to small business, and it remains a platform with substantial abuse, not to mention security threats as evidenced by the most recent hacking. I miss the days without social media when people judged your skills based on your credentials and ability, and not by how many Twitter followers you have. If Twitter went away, I would not miss it at all. My guess is that a lot of people feel the same way, and that’s why I don’t think it will ever see the adoption rates as that of Facebook (FB). Twitter will remain an extension of the media/news, and for that reason, it will struggle to monetize its user base. We doubt we’ll ever become interested in Twitter’s shares. We prefer Facebook.

Kimberly-Clark Beaming with Confidence

Kimberly-Clark (KMB) is breaking out to new highs at the time of this writing, propelled by pandemic-driven demand for personal care items. It reported its second quarter July 23, a period that showed organic sales growth of 4% and substantial adjusted earnings per share expansion. Impressively, the firm hauled in $1.58 billion in cash flow from operations (an all-time record) compared to ~$610 million in the same period a year ago. Kimberly-Clark reinstated its 2020 guidance calling for organic sales growth in the range of 4%-5%, and it even restarted its share repurchase program. Adjusted earnings per share is now targeted in the range of $7.40-$7.60 for the year. Consumer staples names are a bit frothy at the moment, and we're not looking to dive head-first into the sector with any new exposure at the moment.

Concluding Thoughts.

Second-quarter earnings season is coming in largely as expected. Many of the firms are reporting improving demand through the course of the quarter, and entities that were facing hardship are making the necessary adjustments to improve performance. Pandemic-driven demand has been evident across the consumer staples space, and innovative entities have not stopped innovating as a result of COVID-19. We maintain our view that the world is fighting back against COVID-19, and we expect fundamental performance to continue to improve across myriad sectors as well as a greater “return to normalcy in 2021,” which is but six months away. Accommodative Fed/Treasury policy coupled with substantial increases in money supply may keep this market moving ever-higher in the meantime.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment