Crown Castle Continues to Shine

Image Shown: Crown Castle International Corp.’s growth trajectory continued in the third quarter of 2020. Image Source: Crown Castle International Corp. – Third Quarter of 2020 IR Earnings Presentation

By Callum Turcan

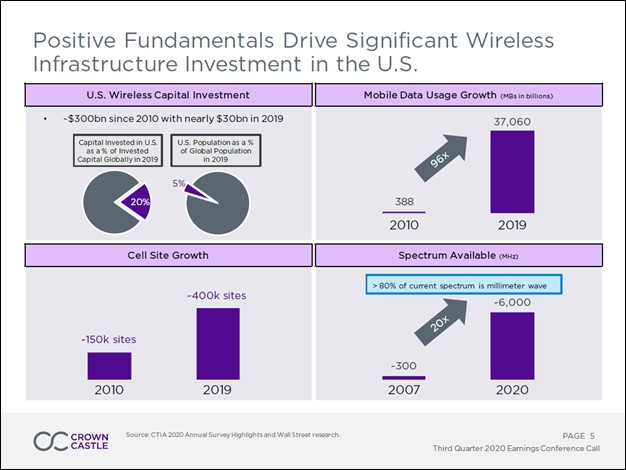

Crown Castle International Corp. (CCI)--3.3% yield (as of this writing)--is a real estate investment trust (‘REIT’) that owns 40,000+ cell towers, ~70,000 small cell nodes (on air or under contract) and ~80,000 route miles of fiber that support numerous networking operations all across the US. We include shares of Crown Castle as a holding in our High Yield Dividend Newsletter given its ability to generate sizable free cash flows even after investing heavily in expanding its asset base.

From 2017 to 2019, Crown Castle generated ~$0.75 billion in annual free cash flows, though the firm had to tap capital markets to cover its annual common dividend obligations which averaged ~$1.75 billion during this period (its annual preferred dividend obligations averaged just under $0.1 billion during this period). While the REIT is capital market dependent, given the importance of its asset base which is primarily made up of essential infrastructure that supports telecommunications services in the US (including 5G services) and its ability to generate consistent free cash flows (rare in the REIT industry), we see Crown Castle maintaining access to both debt and equity markets at attractive rates going forward.

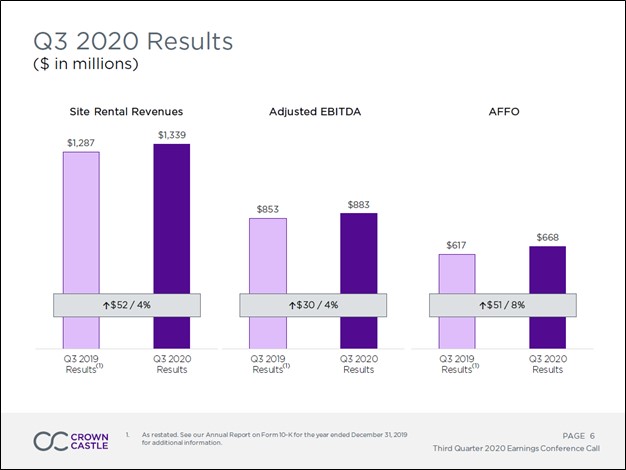

When the REIT reported third quarter 2020 earnings on October 21, management had enough confidence in Crown Castle’s outlook to boost the firm’s quarterly dividend by 11% on a sequential basis. Though management has had to adjust Crown Castle’s 2020 guidance several times (including to the downside), largely due to headwinds created by the ongoing coronavirus (‘COVID-19’) pandemic, the REIT still expects to generate meaningful revenue and adjusted funds from operations (‘AFFO’) growth this year.

Image Shown: A snapshot of the market Crown Castle operates in and why its asset base is essential to supporting US networking operations. Image Source: Crown Castle – Third Quarter of 2020 IR Earnings Presentation

Looking Ahead

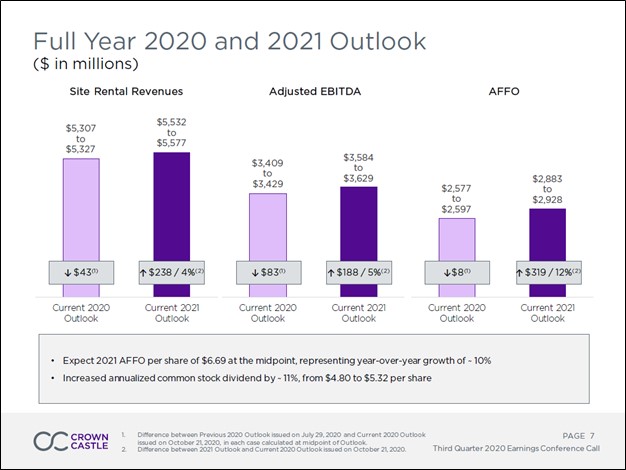

In 2019, Crown Castle generated $5.1 billion in ‘site rental’ revenue, and please note this does not include ‘services and other’ revenue. In 2020, the REIT’s current guidance calls for $5.3 billion in site rental revenue for the full-year. Additionally, Crown Castle expects to generate $5.6 billion in site rental revenue in 2021, indicating the REIT expects its core sales will continue to grow.

Pivoting to AFFO, though an imperfect non-GAAP measure, this metric is useful for gauging a REIT’s ability (or lack thereof) to maintain and grow its dividend. In 2019, Crown Castle generated $5.69 per share in AFFO, which management’s current forecast indicates will grow to $6.09 per share in 2020 (at the midpoint of guidance). Next year, management sees Crown Castle generating $6.69 per share in AFFO (at the midpoint of guidance).

Looking at its current annualized dividend of $5.32 per share and its expected AFFO in 2021, Crown Castle is targeting a payout ratio just under 80% next year (expected dividends per share divided by expected AFFO per share in 2021). We appreciate payout ratios south of 80% as that indicates the REIT has a solid handle on its dividend obligations, keeping their refinancing needs in mind.

Image Shown: An overview of Crown Castle’s outlook for 2020 and 2021. Image Source: Crown Castle – Third Quarter of 2020 IR Earnings Presentation

Financial Update

Crown Castle ended September 2020 with a little over $0.2 billion in cash and cash equivalents on hand along with a little under $0.2 billion in restricted cash on the books, versus $0.1 billion in short-term debt and $19.2 billion in ‘debt and other long-term obligations’ and please note the REIT also has sizable operating lease liabilities as well. To manage its liquidity needs, Crown Castle has a revolving credit line with $5.0 billion in total borrowing capacity that matures June 2024.

During Crown Castle’s latest earnings call, management noted that the REIT had ~$4.5 billion in remaining borrowing capacity under that credit facility. Here is what management had to say during Crown Castle’s latest earnings call regarding the REIT’s financial position (slightly edited, emphasis added):

“As… discussed earlier, we expect discretionary capital expenditures in 2021 to be approximately $400 million lower when compared to 2019, totaling approximately $1.5 billion as we apply a rigorous analytical approach to each capital investment decision. We anticipate the combination of lower capital expenditures and higher cash flow growth will allow us to fund our discretionary capital budget next year with free cash flow and incremental debt capacity consistent with our investment grade credit risk profile.

As it relates to the balance sheet, we finished the quarter with 5.4 times debt to EBITDA, a weighted average maturity of 9 years, no maturities until 2022 and approximately $4.5 billion of undrawn capacity on our revolving credit facility. Our debt maturity profile is a result of a deliberate approach to minimize financing risk and more closely match our debt maturities for the long-term nature of our asset base, while focusing on driving down our overall cost of capital.” --- Dan Schlanger, CFO of Crown Castle

Looking ahead, management sees Crown Castle being able to fund its 2021 capital expenditure needs without needing to tap equity markets. Effectively, that allows Crown Castle to fund its growth ambitions without diluting existing shareholders (the REIT’s outstanding diluted share count grew by 1% year-over-year during the first nine months of 2020, a relatively modest figure). Fitch Ratings upgraded Crown Castle’s credit rating (long-term issuer rating, unsecured rating, and revolving credit rating) to BBB+ from BBB with a staple outlook in May 2020. Moody’s Corporation (MCO) gives Crown Castle an investment grade credit rating of Baa3, specifically for its senior unsecured credit rating.

Concluding Thoughts

We continue to be big fans of Crown Castle and view the REIT’s long-term outlook quite favorably. Its cash flow profile is impressive, its growth runway is promising, and we appreciate its investment grade credit ratings and lack of near-term debt maturities. Crown Castle is well-positioned to capitalize on the rollout of 5G telecommunications services in the US and should be able to maintain its dividend growth trajectory going forward, keeping headwinds stemming from the ongoing COVID-19 pandemic in mind (which the REIT has been able to adeptly navigate so far, in our view).

-----

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Related: CCI, CUBE, MCO, PSA, VNQ, AMT, SBAC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Crown Castle International Corp. (CCI), Digital Realty Trust, CyrusOne Inc (CONE), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment