BHP Benefiting from an Industrial Rebound in China

Image Source: BHP Group – Fiscal 2019 Annual Report

By Callum Turcan

In recent months, iron ore futures prices have surged higher due to an ongoing recovery in China’s industrial sector and supply concerns in Brazil, which has culminated into the Dalian Commodity Exchange’s September 2020 iron ore deliveries hitting a record high since the futures contract was first launched in 2013. Pivoting to copper, three-month copper futures prices based on trading activity on the London Metals Exchange have also perked up on the back of an apparent recovery in Chinese economic activity. Rising metals prices bodes well for major and minor miners around the globe, including BHP Group (BHP) (BBL).

Brief Aside

Please note BHP is the ADR for the Australian-listed entity and BBL is the ADR for the UK-listed entity (additionally, the firm changed its name to BHP Group Limited and BHP Group plc back in 2018), which BHP’s FAQs webpage describes as such:

BHP Billiton was formed in June 2001 from the merger of BHP Limited (an Australian listed company) and Billiton Plc (a UK listed company). The merger was effected by way of a Dual Listed Companies (DLC) structure, meaning that although the companies technically continue to be separate legal entities (now renamed BHP Billiton Limited and BHP Billiton Plc) with separate share listings and share registers, they are managed and run as a single economic entity. The companies have a common Board of Directors and management team. Shareholders in BHP Billiton Limited and BHP Billiton Plc have equal economic and voting rights, as if they held shares in a single company. Our headquarters are located in Melbourne, Australia.

Furthermore, each US-listed ADR of BHP and BBL represents two common shares of the company, and there might be taxation differences (particularly as it relates to dividend tax withholding) between the two entities, which we won’t get into in this piece (please consult your tax specialist for more information on the subject).

Back to BHP

Our fair value estimate for BHP stands at $45 per share with the top end of our fair value estimate range sitting at $56 per share. As of this writing, BHP trades near $50 per share in large part due to the ongoing recovery in iron ore and to a lesser extent copper prices, in our view. We caution that BHP’s Dividend Cushion ratio sits at 0.8 and we rate its Dividend Safety as “POOR” due to its financials being heavily-influenced by exogenous forces, namely commodity prices, and due to its net debt position. BHP is supported by its investment grade credit ratings (A/A2) which makes tapping debt markets for funds at attractive rates an easier task, and its strong stock price performance of late makes tapping equity markets for funds an easier task as well.

BHP’s fiscal year ends on June 30, and the most recent financial report available is as of the end of December 31, 2019 (the end of the first half of BHP’s fiscal 2020). According to the company’s financial news release, BHP exited calendar year 2019 with approximately $12.85 billion in net debt (in US dollar terms). The firm had $26.8 billion in ‘total interest bearing liabilities’ and ~$0.35 billion in ‘total derivatives included in net debt’ less $14.3 billion in ‘cash and cash equivalents’ to arrive at the net debt figure of ~$12.85 billion.

BHP’s Operations

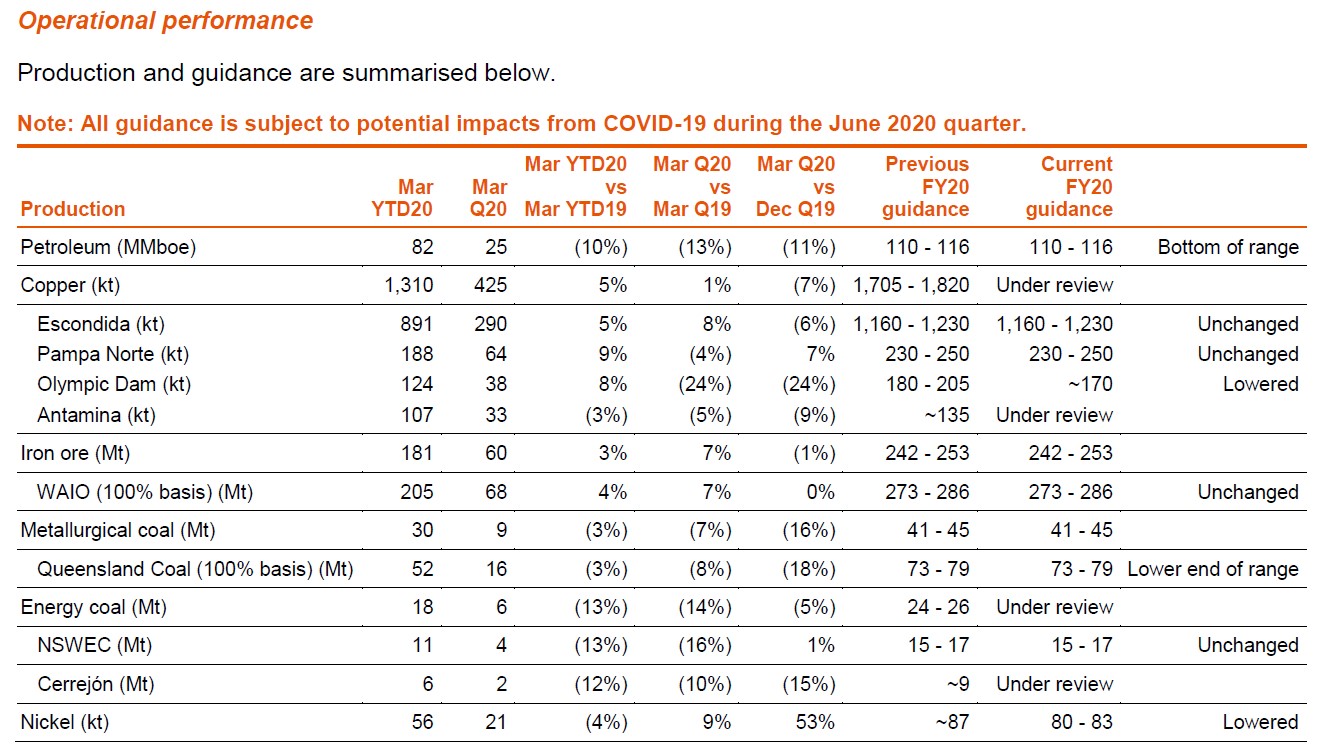

For all of fiscal 2020, BHP forecasted it will produce 242 million metric tons – 253 million metric tons of iron ore during its fiscal third quarter (period ended March 31, 2020) which was flat with its previous forecast, keeping uncertainties created from the ongoing coronavirus (‘COVID-19’) pandemic in mind. BHP’s expected copper production was listed as “under review” at this time, though BHP noted production forecasts at its massive Escondida and Pampa Norte mines were “unchanged” though the miner “lowered” its output forecast for its Olympic Dam mine and had placed its Antamina mine production forecast “under review.”

Let’s take a look at BHP’s copper operations. According to BHP’s fiscal 2019 Annual Report, the firm owns 57.5% (what appears to be the equity) of the Escondida copper mine in northern Chile (produces copper concentrate and copper cathodes, with the latter used as a primarily input for making copper rods and wiring) and 100% of the Pamapa Norte operation (consists of the Cerro Colorado and Spence mines that produce copper cathodes) in northern Chile. Both of these operations are referred to as “open-cut” or surface mines. Additionally, BHP owns 33.75% of the open-cut Antamina mine in northern Peru that produces copper and zinc. In Australia, BHP owns 100% of the underground Olympic Dam mine that produces copper along with uranium, gold, and silver.

These are massive operations and BHP’s economic stake in all four ventures is quite material, making them integral parts of its asset base. Generally speaking, open-cut mining operations tend to have significantly lower operating costs on a relative basis and thus are more economical all else held equal (though taxes, regulations, labor costs, the type and quality of the metals produced, and other factors make comparing mining economics across continents an apples-to-oranges comparison).

The good news is that the downward revisions in BHP’s expected copper production for fiscal 2020 so far has been quite modest given the circumstances, as you can see in the upcoming graphic down below. As you can see, the moderate reduction in expected output from the Olympic Dam operation is modest compared to BHP’s expected company-wide copper output.

Image Shown: Due to BHP maintaining its copper production forecasts from its massive Escondida and to a lesser extent Pampa Norte operations for fiscal 2020, the moderate reduction in expected output from its Olympic Dam operation this fiscal year only resulted in a modest decline in its expected copper production for fiscal 2020 as things stand today, depending on how its Antamina operation performs during the remainder of the fiscal year. Image Source: BHP – Second Quarter of Fiscal 2020 Earnings Press Release

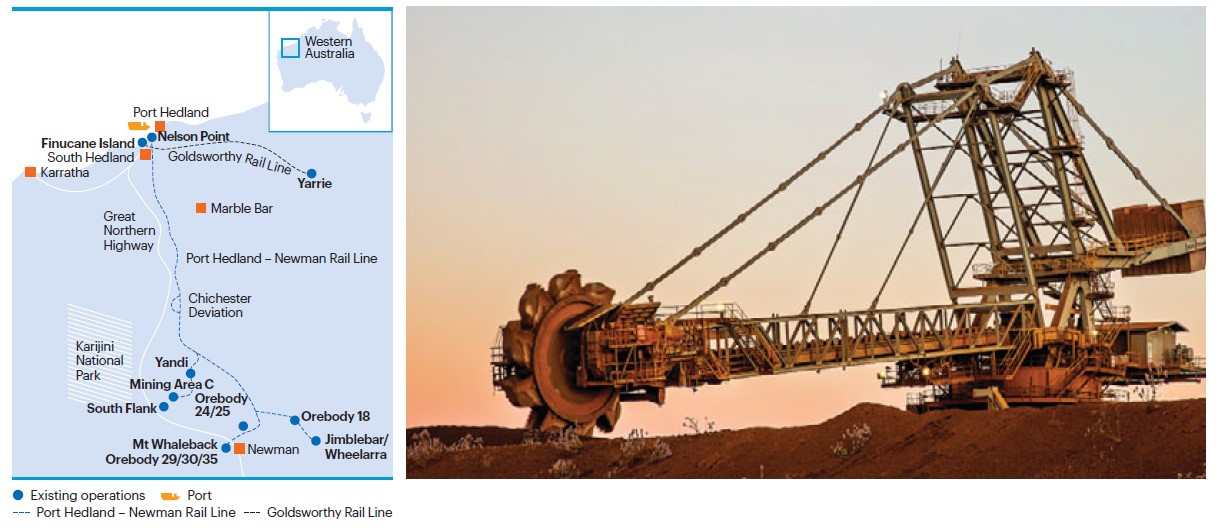

Pivoting to BHP’s iron ore operations, one of the prizes of its portfolio is dubbed the ‘Western Australia Iron Ore’ (‘WAIO’) asset. Located in in the northern part of western Australia in the well-known Pilbara region, this asset consists of five integrated mines and four processing facilities that are connected by 1,000 kilometers (~620 miles) of railroads and various port facilities. BHP develops these mines with its joint-venture partners (from BHP’s fiscal 2019 Annual Report):

WAIO’s Pilbara reserve base is relatively concentrated, allowing development to be planned around integrated mining hubs that are connected to the mines and satellite orebodies by conveyors or spur lines. This approach enables the value of installed infrastructure to be maximised by using the same processing plant and rail infrastructure for a number of orebodies. The ore is crushed, beneficiated (where necessary) and blended at each processing hub – Newman operations, Yandi, Mining Area C and Jimblebar – to create high-grade lump and fines products. Iron ore products are then transported along the Port Hedland– Newman rail line to the Finucane Island and Nelson Point port facilities at Port Hedland.

There are four main WAIO joint ventures (JVs): Mt Newman, Yandi, Mt Goldsworthy and Jimblebar. BHP’s interest in each of the joint ventures is 85 per cent, with Mitsui (MITSY) and ITOCHU (ITOCY) owning the remaining 15 per cent. The joint ventures are unincorporated, except Jimblebar. BHP, Mitsui and ITOCHU are also participants in the POSMAC JV, a joint venture with a subsidiary of POSCO (PKX) that involves the sublease of parts of one of WAIO’s existing mineral leases. The ore from the POSMAC JV is sold to the Mt Goldsworthy JV. All ore is transported by rail on the Mt Newman JV and Mt Goldsworthy JV rail lines to the port facilities. WAIO’s port facilities at Nelson Point are owned by the Mt Newman JV and Finucane Island is owned by the Mt Goldsworthy JV.

In the upcoming graphic down below, BHP provides a map and visual overview of these operations. Additionally, please note BHP’s equity stake in the aforementioned WAIO operations ranges from 65%-85%.

Image Shown: A map of BHP’s massive WAIO operations in the Pilbara region of Australia that are a major source of global iron ore and iron ore products supplies. Image Source: BHP – Fiscal 2019 Annual Report

What makes the Pilbara region so intriguing is that iron ore mined is considered to be of high quality (or high grade), meaning it has a relatively large amount of Fe (the symbol for ferrum which is Latin for iron) per metric ton. Please note that iron ore does not consist of 100% Fe, and that usually these ores range from the 50s% - 60s% with a low-to-mid 60s% Fe content representing high grade iron ore (the kind produced from Australia’s Pilbara region). China is aggressively pushing its steel industry to use higher grade iron ore to cut down on air pollution levels, which benefits BHP immensely.

A large chunk of the iron ore and iron ore products produced in this region are exported to China as the Minerals Council of Australia reports that around 80% of Australia’s iron ore exports by volume go to the country. This dynamic makes the surge in Dalian Commodity Exchange’s iron ore futures pricing quite relevant to BHP’s future financial performance, at least in the near-term (China’s anti-pollution drive benefits BHP’s long-term outlook). BHP notes that 98% of iron ore is converted into pig iron that is used to make steel.

Virtually all of BHP’s iron ore output comes from the Pilbara region and its large equity stake in the WAIO operations. While BHP used to produce a material amount of iron ore from its Brazilian Samarco mining operations, which it has a 50% equity stake in, mining and processing activities at the asset have been suspended since 2015 due to the failure of the tailings dam at the site. As BHP reported that its iron ore production forecast for fiscal 2020 remains unchanged as of its fiscal third quarter report, indicating its Pilbara mining operations are continuing to function properly in the wake of the ongoing pandemic.

Going forward, BHP is developing the $3.6 billion (at 100% equity ownership) South Flank project in the region. Construction started in July 2018 and by the end of June 2019, the project was 39% complete according to BHP. First ore is targeted by calendar year 2021, when the mine will start ramping up to its peak production capacity of 80 million metric tons of iron ore per year to replace output from the Yandi mining operation (which also has the capacity to produce 80 million metric tons of iron ore per year) that’s nearing the end of its economic life (which is expected to occur by the early-to-mid 2020s). BHP owns 85% of the equity of the South Flank project and is expecting to spend roughly $3.1 billion on development costs.

Concluding Thoughts

Economic data out of China has been quite strong recently, relatively speaking, indicating the country’s massive industrial base is starting to recover after shutting down in early-2020 to contain the spread of COVID-19. We will continue to keep a close eye on this space going forward, and for now, it seems BHP’s outlook (at least in the short-term) has improved considerably. Members interested in reading more about the mining space should check out our recent article covering Southern Copper Corporation (SCCO) by clicking this link here.

On a final note, the gold miner Newmont Corporation (NEM) remains our favorite pick in the mining industry and shares of NEM are included as a holding in our Dividend Growth Newsletter portfolio, which members can read more about here.

-----

Diversified Mining Industry – BHP FCX NEM RIO SCCO VALE WPM

Related: MITSY, ITOCY, PKX, GMBXF, FXI, MCHI, KWEB, JJCTF, COPX, DBB, CPER, JJC, TECK, HBM, AAUKF, AAUKY, GLCNF, GLNCY, FSUMF, ANFGF, SLV, SIL, USLV, PSLV, AGQ, SIVR, SILJ, SLVP, EWW, MXF

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment