Image Source: BHP Group Ltd – Full Fiscal Year 2020 IR Earnings Presentation

By Callum Turcan

Though the ongoing coronavirus (‘COVID-19) pandemic has stymied economic activity in about every country worldwide, the stimulus-driven rebound in China (with an eye towards its resurgent construction activity) combined with supply disruptions in key commodity producing regions has seen the price of several metals bounce higher over the past few months. For instance, copper prices on the London Metal Exchange (‘LME’) recently hit a two-year high and COMEX silver prices have been surging higher (I, II) this year.

Background

A lot of global copper consumption comes from construction related activities and building power grids (distribution and transmission systems), with about half of the world’s refined copper consumption occurring in China. These two areas (construction activities and building power grids) represented ~41% of the world’s copper consumption in 2019 (in terms of metric tons) according to data provided by the Copper Alliance, an industry trade group. Given that construction activity is rebounding in China, the outlook for copper demand has improved significantly since the start of the pandemic, which is likely why copper prices have been rising of late. Copper is also a key component in motors for automobiles and industrial equipment, along with consumer electronics and various other uses (in other words, copper is a very versatile metal when it comes to economic applications).

Pivoting to silver, the outlook for this precious metal is supported by the promising outlook for hybrid and electric vehicle (‘EV’) sales over the coming years (silver is used extensively in modern automobiles of any kind). Additionally, silver is a key component in solar panels, and this space could benefit from increased government investment as part of various stimulus packages implemented in major economies worldwide. In both instances, silver is used because it has the highest electrical and thermal conductivity of any metal, which is important given that secular growth tailwinds support the demand growth outlook for silver from both areas.

According to S&P Platts Global (SPGI), metallurgical coal (used in the steelmaking process) prices in China have not fared well so far in 2020, though Chinese iron ore prices have performed very well this year due to supply disruptions in Brazil and the resumption of its industrial and construction activities in China. Nickel prices have also been moving higher recently, according to Argus Media, and the long-term outlook for nickel demand is also supported by rising EV sales given that nickel is a key component in lithium-ion batteries. Though not all metals have showed pricing strength recently, many of the key metals have.

Whether (most) metals prices continue to trend higher will depend on several factors including how well global health authorities are able to control the spread of the pandemic, when/if a safe and viable COVID-19 vaccine is discovered (our thoughts on that issue here), and the extent of the stimulus packages rolled out by national governments that can afford to do so. Recently, a major miner provided an update on the space that is worth keeping in mind.

Earnings Overview for BHP Group

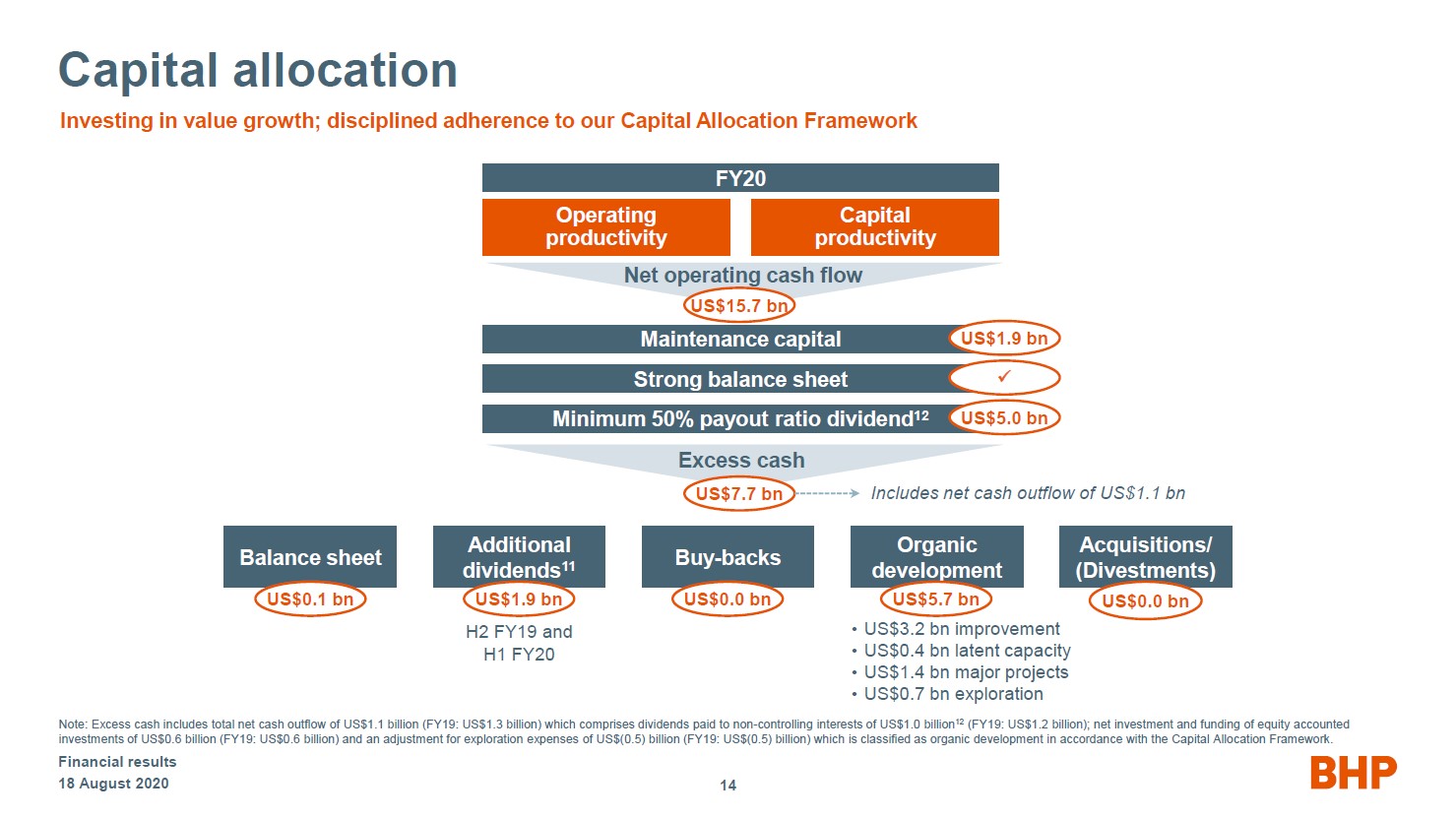

BHP Group Ltd (BHP) (BBL) reported its full-year results for fiscal 2020 (period ended June 30, 2020) on August 18 that saw the mining giant report $8.0 billion in attributable profit on an IFRS basis, down 4% year-over-year. Going forward, BHP Group’s outlook is quite promising given recent improvements in metals pricing, though we caution that the firm is also a major producer of raw energy resources (such as crude oil and natural gas). Prices for raw energy resources remain subdued and that is likely to be the case for some time. In the upcoming graphic down below, BHP Group provides an overview of its cash flow performance in fiscal 2020 along with its capital allocation priorities.

Image Shown: An overview of BHP Group’s capital allocation priorities and cash flow performance in fiscal 2020. We appreciate BHP Group’s commitment to its dividend-seeking investor base. Image Source: BHP Group – Full Fiscal Year 2020 IR Earnings Presentation

On an IFRS basis, BHP Group reported $15.7 billion in net operating cash flow in fiscal 2020 while spending $7.6 billion on capital and exploration expenditures according to its earnings press release. That is good for $8.1 billion in free cash flow. BHP Group’s net debt load rose to $12.0 billion at the end of fiscal 2020, up 28% from year-end fiscal 2019 levels, though that remains at the low end of management’s long-term target ($12.0 billion – $17.0 billion). Please note part of the increase had to do with the application of IFRS 16 Leases, which grew BHP Group’s net debt load by $1.6 billion from the end of fiscal 2019 to the end of fiscal 2020. We view BHP Group’s net debt load as manageable given that its debt maturities are staggered (as you can see in the upcoming graphic down below) and its free cash flows remain strong, though we prefer companies with net cash positions.

Image Shown: BHP Group’s debt maturity schedule is manageable, in our view, though we prefer companies with net cash positions. Image Source: BHP Group – Full Fiscal Year 2020 IR Earnings Presentation

Here is what BHP Group had to say about its fiscal 2020 financial performance during its latest earnings call (emphasis added):

“Turning to the numbers. The quality of our portfolio and the performance of the team meant we delivered a strong set of financial results. Margins were resilient at 53%. Return on capital employed was a solid 17% and our operating cash flow and disciplined approach to capital allocation enabled us to generate free cash flow of US$8.1 billion, while also investing in value growth. Our balance sheet remains strong and we have announced a final dividend of US$0.50 per share bringing our full year dividend to US$1.20 per share.

These results were underpinned by our ongoing improvements in operational performance. Most importantly, we were safer. We had no fatalities for the year, in fact for the past year and a half, and our other leading and lagging safety indicators improved. We will never be complacent here, safety remains our first focus.

We were also more operationally reliable, a result of our relentless focus over several years on maintenance, engineering, asset integrity, and capability. This added up to record production in a number of our operations. This consistent focus also helped lower average unit costs at our major assets, and accelerated reductions in overheads. Meanwhile, our major development projects are progressing well.” — Mike Henry, CEO of BHP Group (Mike Henry took on the CEO role at the start of calendar year 2020)

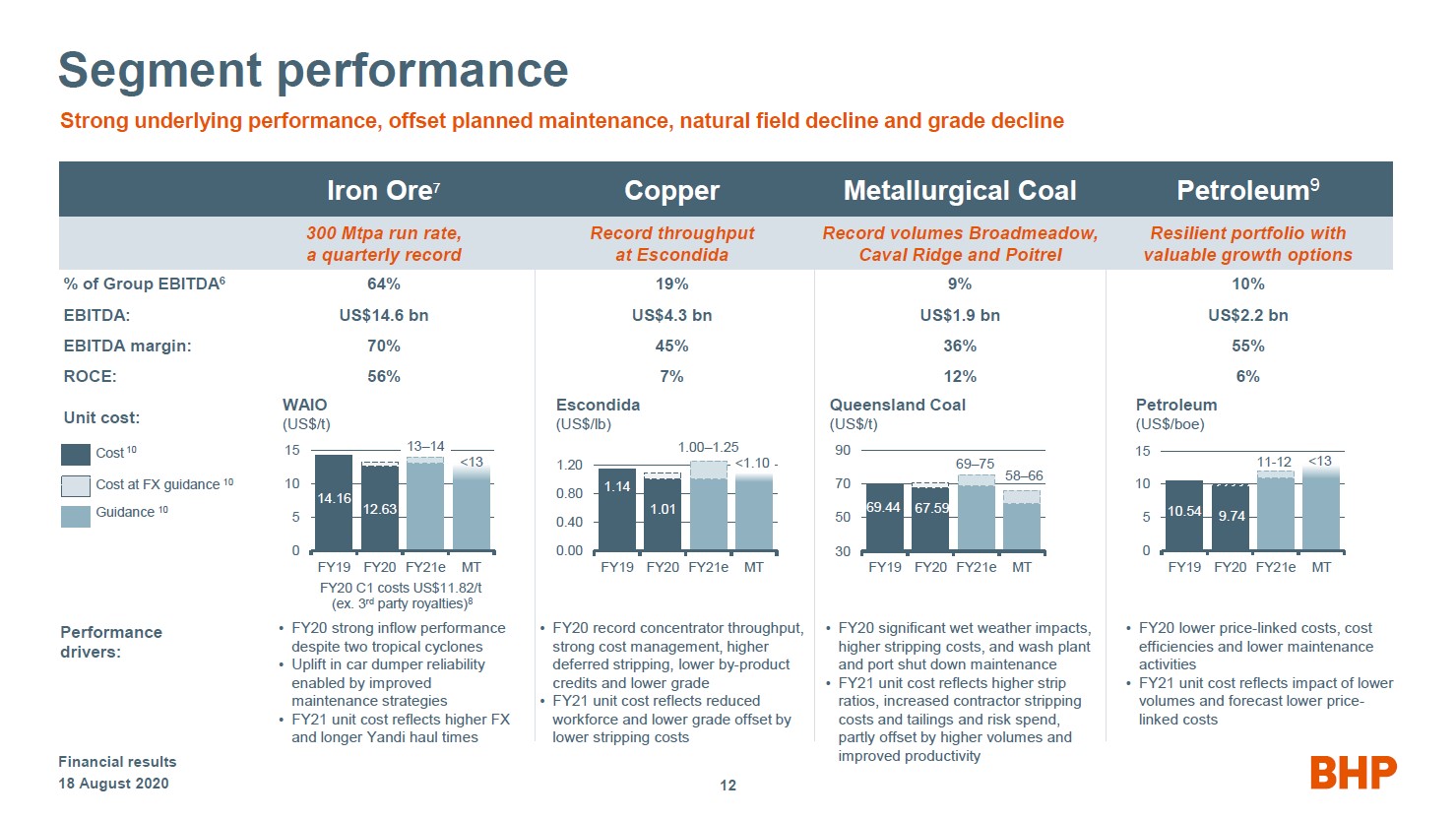

In the upcoming graphic down below, BHP Group provides an overview of its performance in fiscal 2020 by unit segment.

Image Shown: Iron ore and copper are the bedrock of BHP Group’s asset base in terms of group-wide EBITDA generation. Image Source: BHP Group – Full Fiscal Year 2020 IR Earnings Presentation

Adjusting the Asset Base

To adjust, BHP Group is delaying investment at some of its oil & gas assets and prospects. BHP Group notes it spent $7.6 billion on capital and exploration investments in fiscal 2020, which is expected to drop down to $7.0 billion in fiscal 2021 before rebounding to $8.5 billion in fiscal 2022. Reduced capital and exploration expenditures will improve its ability to navigate COVID-19 in the short-term.

BHP Group is a big player in the US Gulf of Mexico and offshore Australia, where it has economic interests in upstream assets (relating to the extraction of raw energy resources from the ground) and export facilities (including liquefied natural gas or ‘LNG’ export terminals in Australia). Additionally, BHP Group is active in Trinidad & Tobago and Algeria as it relates to developing raw energy resources. Please note that over the past couple of years, BHP Group exited the UK oil & gas industry and divested its onshore unconventional assets in the US. BHP Group is always adjusting its asset base to better position itself to capitalize on more lucrative commodity extraction operations.

Part of that adjustment process includes BHP Group shedding assets from time to time. For instance, management noted the company was looking at exiting its BHP Mitsui Coal (‘BMC’) joint-venture with partner Mitsui & Co Ltd (MITSF) either by spinning off or selling its 80% stake in BMC (Mitsui & Co owns the remaining 20% stake). BMC owns two metallurgical coal mines in Australia. BHP Group also seeks to divest its 100% stake in New South Wales Energy Coal (‘NSWEC’), which owns a thermal coal mine in Australia (thermal coal is used to generate electricity at power plants), and its 33.3% equity stake in the Cerrejón thermal coal mining endeavor in Colombia. The long-term outlook for thermal coal is dour as the world is swimming in supply though many key governments are keen to pivot towards renewable energy.

On the oil & gas side of things, BHP Group seeks to divest its 32.5% – 50% stake in the upstream Bass Straight operations in offshore Australia. BHP Group owns 50% of the Gippsland Basin joint-venture and 32.5% of the Kipper Unit joint-venture. However, that may be a tough task given its key partner Exxon Mobil Corporation (XOM) (owns half of the Gippsland Basin JV and 32.5% of the Kipper Unit JV) is also looking at selling its assets in the region.

New Metals Strategy

Management intends to pivot towards assets with more promising long-term outlooks, with an eye towards cooper and nickel. Both of those metals are likely to benefit from the “green revolution” as copper is required to build new power plants (such as solar or wind projects), transmission and distribution systems (to connect new power plants to existing and future sources of electricity demand), and the various electrical components in EVs. Nickel, as mentioned previously, is essential in making lithium-ion batteries (the current standard in most EV offerings).

Furthermore, there are still a little under one billion people in the world who do not have (consistent) access to electricity according to the International Energy Agency (‘IEA’), at least as of 2018. As power grids and power plants are built out in Southeast Asia, sub-Saharan Africa, and elsewhere, regardless of what development strategy is utilized (e.g. thermal coal versus renewable energy), demand for copper is likely to be supported by the need to build that infrastructure. Demand for other metals will also be supported by economic development in developing and emerging markets picking up pace over time.

BHP Group owns 57.5% of the Escondida copper mine in Chile and 100% of the Nickel West operation in Australia (involves mining, smelting, and refining operations), along with various other assets that produce meaningful amounts of copper and nickel (such as the underground Olympic Dam mine in Australia and the open-cut Cerro Norte and Spence mines in Chile). Here is what BHP Group had to say on its copper, nickel, and potash resource base during its latest earnings call (emphasis added):

“Decarbonization, electrification, diet, land use and population trends will all drive higher demand for copper, nickel and potash in the medium to longer-term. We are therefore looking to grow in these future-facing commodities…

In copper, we have a world-class, expandable resource base. We’ve added to our options through partnering with junior companies in Canada, Mexico and Ecuador. And the third phase of drilling at the Oak Dam copper discovery was completed in June, taking total drilling to over 21,000 meters. We’re analyzing the results and will share them later this year.

In nickel, we’ve expanded our footprint with the acquisition of the Honeymoon Well tenements, we’ve increased our reserves, and we’ve opened up new mines at Nickel West.And in potash, we have progressed the shafts at Jansen, continuing to de-risk the project.

Jansen is tier 1 deposit, with potential to be one of the lowest cost operations in the world. We are progressing towards a final investment decision on Jansen Stage 1, delayed slightly due to COVID-19 and the prior construction delays discussed earlier in the year. And, we now anticipate a decision in the middle of 2021. As always, this must satisfy our Capital Allocation Framework.” — Peter Beaven, CFO of BHP Group (though please note David Lamont will take over the CFO role by December 2020 as Peter Beaven is retiring)

The Jansen Potash Project is based in Saskatchewan, Canada, though BHP Group has long delayed sanctioning the endeavor. Potash is Categories Member Articles