AT&T and Warner Bros. Discovery Go Their Separate Ways

Image Shown: AT&T Inc is spending heavily to grow its 5G wireless network while expanding the reach of its broadband footprint. Image Source: AT&T Inc – March 2022 Analyst & Investor Day Event Presentation

By Callum Turcan

On April 8, AT&T Inc (T) closed the merger of the WarnerMedia business with Discovery to create a powerhouse in the media and entertainment industry after then-Discovery shareholders voted to approve the deal on March 11. The new entity, Warner Bros. Discovery Inc (WBD), is home to various streaming services (HBO Max, discovery+, CNN+) along with linear and premium TV channels (Discovery Channel, HBO, TNT, HGTV, CNN, Animal Planet, Adult Swim, Cartoon Network).

Warner Bros. Discovery began trading on the NASDAQ stock exchange on April 11 with shareholders of AT&T receiving 0.241917 shares of WBD for each share of T they held at closing. Part of this process involved Discovery, now Warner Bros. Discovery, consolidating its share class structure. In return for spinning off its WarnerMedia unit, AT&T received $40.4 billion in cash and the retention of certain WarnerMedia debt.

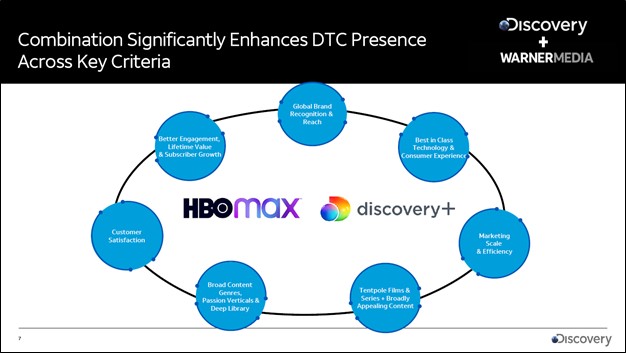

Looking ahead, Warner Bros. Discovery is focused on building up a vast video streaming services business and eventually consolidating its HBO Max with discovery+ services onto one platform. AT&T intends to invest heavily in its 5G wireless networks to expand its ability to provide reliable 5G services in the US while also investing heavily in its fiber optic networks to expand the reach of its domestic Internet service providers operations. Both companies intend to aggressively delever their respective balance sheets and improve their cost structures going forward.

AT&T roughly cut its dividend in half to $1.11 per share on an annualized basis in February 2022 to make deleveraging efforts possible while ramping up its capital expenditures. Shares of T yield ~5.7% as of this writing. Warner Bros. Discovery does not pay out a common dividend at this time, which will make deleveraging efforts easier going forward.

We covered this merger in a March 2022 article AT&T’s WarnerMedia Unit and Discovery Are Close to Finalizing Their Blockbuster Merger (link here) that we encourage our members to check out. AT&T is scheduled to report its first quarter earnings before the market opens on April 21 and Warner Bros. Discovery will likely soon announce its earnings date.

AT&T

At the end of December 2021, AT&T had $178.6 billion in total debt when including short-term debt, which was moderately offset by $21.2 billion in cash and cash equivalents on hand. The proceeds from spinning off WarnerMedia will certainly help improve this picture, though the firm still has a lot of work to do as it concerns repairing its financial strength after a series of major acquisitions over the past decade (DirecTV, Time Warner) did not pan out favorably.

AT&T’s annual financing obligations are expensive and a drain on its cash flow performance, and in the wake of rising interest rates, that burden could grow substantially going forward. However, AT&T can lessen the blow of rising interest rates by reducing its total debt load. The goal is to pare down its debt load by a significant margin that will reduce its annual financing expenses, even in the face of rising interest rates.

Here is a key excerpt from our March 2022 article concerning AT&T:

Companies with large net cash positions can use their balance sheet to help cover their dividend obligations. On the other hand, companies with large net debt positions effectively have financing concerns competing with their dividend programs for capital, which can slow the pace of dividend growth, or even worse lead to dividend cuts.

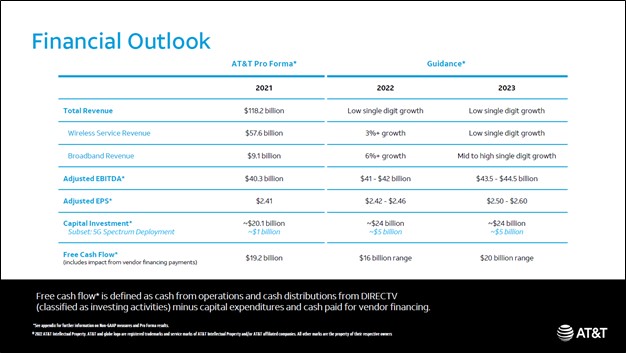

In 2021, AT&T spent $15.1 billion covering its dividend obligations and its payout was fully covered by its free cash flow. The company expects to generate $20.0 billion (or more) in annual free cash flow when the deal closes [starting in 2023], and its smaller dividend is expected to consume ~40% of its annual free cash flow (roughly $8.0 billion per year). AT&T is freeing up the financial capacity to step up its annual capital expenditures to ~$24 billion, a sharp increase from the $16.5 billion spent in 2021.

Looking ahead, growth at its wireless services and Internet provider services businesses are expected to drive AT&T’s revenues higher by a low single-digit CAGR while its non-GAAP adjusted EBITDA and adjusted EPS are expected to grow by a mid-single-digit CAGR in the coming years.

When the merger of WarnerMedia and Discovery closes, AT&T forecasts it will have a net debt to adjusted EBITDA ratio of 2.6x, which is expected to drop down below 2.5x by the end of 2023. AT&T noted that when its leverage ratio is below 2.5x, share buybacks could enter the picture, though such a move would compete for capital against its dividend program and much needed deleveraging efforts.

On March 11, AT&T provided an update on its medium-term outlook during its 2022 Analyst & Investor Day event. The firm plans to generate around $20.0 billion in free cash flow in 2023, up from an estimated $16.0 billion in 2022, as it benefits from expected cost structure improvements along with reduced annual financing expenses due to deleveraging efforts and working capital improvements. Cost structure improvements are expected to come from network effeciencies, dispatch improvements, product simplification, back office restructuring (to reduce G&A costs), and other measures. The firm notes that it has realized $3.0+ billion in cost structure improvements so far and intends to achieve around $6.0 billion in run-rate cost structure improvements by 2023.

AT&T forecasts that its capital expenditures will begin to taper in 2024, falling down to around $20.0 billion from an estimated $24.0 billion in both 2022 and 2023. The firm intends to stick with its deleveraging goals and expects that its revenues will grow by low single-digits on a pro forma basis in 2022 and 2023. Forecasted revenue growth, cost structure improvements, and eventually a tapering of its capital expenditures supports AT&T’s longer term free cash flow growth outlook.

Image Shown: AT&T expects its capital expenditures will rise considerably in 2022 and 2023 versus 2021 levels before shifting lower, which supports its longer term free cash flow growth outlook. Image Source: AT&T – March 2022 Analyst & Investor Day Event Presentation

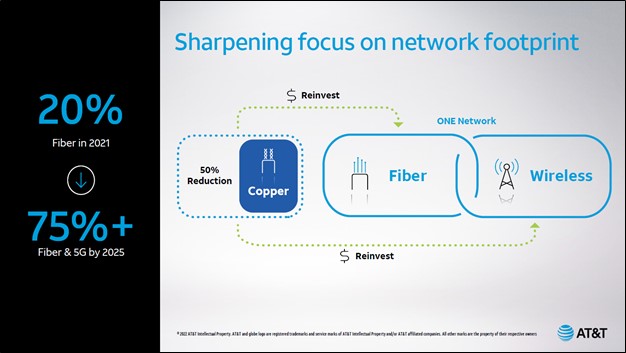

Operationally speaking, AT&T intends to double the number of customer locations its broadband services can cater by 2025, bring that up to 30+ million. This includes doubling the number of business locations its broadband services can serve, bringing that up to 5 million. Growing its market share in the small business broadband space is a key goal for AT&T. The firm aims to boost its market share in this arena to ~30% from the low 20s currently over the coming years. It also intends to reduce the footprint of its legacy copper wires business. AT&T forecasts that revenue growth at its broadband business will exceed growth at its wireless business by a meaningful margin going forward, one of the reasons why the firm is placing a great emphasis on investing in its fiber optic networks.

Image Shown: AT&T is spending heavily to grow the footprint of its fiber optic network. This is expected to increase its broadband customer base and will assist in AT&T’s efforts to increase its market share in regions where it operates. Image Source: AT&T – March 2022 Analyst & Investor Day Event Presentation

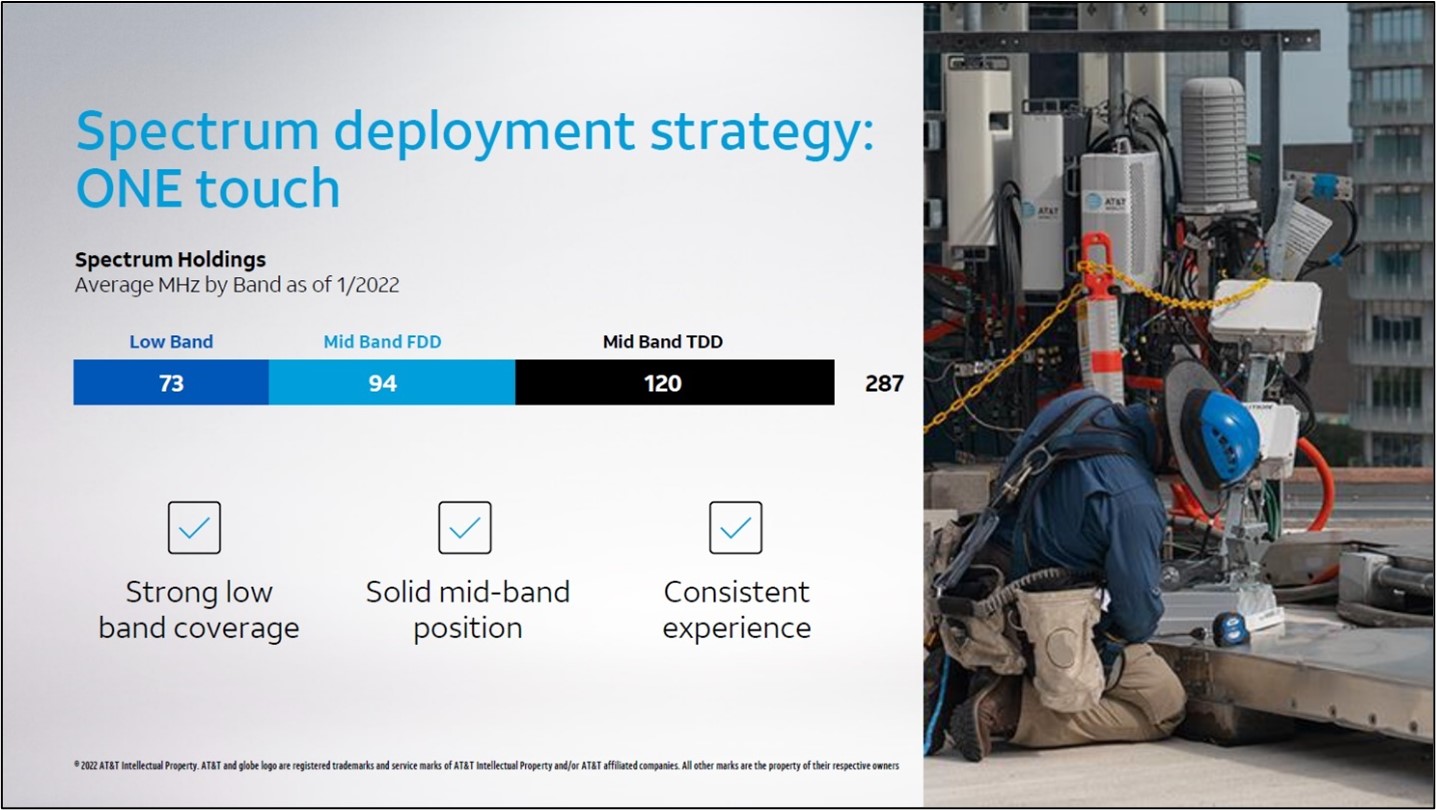

AT&T intends to grow its 5G wireless network by expanding its 120 MHz of mid-band spectrum coverage to include over 200 million people by the end of 2023. The company has spent heavily building up its spectrum holdings to make that possible. Connected automobiles are a potential revenue growth driver over the long haul as the computing power and capabilities of cars and trucks increases exponentially, and considering AT&T already has a dominant position in this space in the US. We're excited about what the future might bring.

Image Shown: AT&T is steadily bulking up its 5G wireless network across the US. Image Source: AT&T – March 2022 Analyst & Investor Day Event Presentation

Effectively, AT&T is pivoting back to its roots as it positions for these changing times. We would like to see AT&T push its leverage ratio down lower once its capital expenditures begin to taper, taking advantage of its strong free cash flow generating abilities to do so as its total debt load is simply massive and a big overhang on the stock. Its huge net debt position is a big reason why we are not interested in shares of T at this time and why we removed AT&T from the simulated High Yield Dividend Newsletter portfolio a while back.

Warner Bros. Discovery

There is not much new to say on Warner Bros. Discovery that we did not cover in our March 2022 article, though reportedly, its new CNN+ streaming service is off to an incredibly slow start. According to CNBC, fewer than 10,000 people are using CNN+ on a daily basis which does not speak favorably towards its economic potential given that WarnerMedia spent heavily on obtaining well-known anchors to host shows on the nascent service. The company will need to work hard to improve the performance of the service, or potentially accept that it needs to be shuttered.

Here is what we had to say on Warner Bros. Discovery’s financial outlook and key priorities in our March 2022 note:

For Warner Bros. Discovery, the deal is expected to unlock $3.0 billion in annualized cost synergies. The firm will be a juggernaut in the video streaming services space with HBO Max and Discovery+ representing its two leading services. When the deal was first announced, AT&T and Discovery noted that WBD would generate ~$52 billion in revenue, adjusted EBITDA of ~$14 billion, and would have a free cash flow conversion rate of ~60%.

Within the relevant press releases, presentations, and transcripts of management commentary, the calculations of the forecasted free cash flow conversion rate were not explicitly laid out, though usually it is as a percentage of net income for a given period. In any event, WBD is expected to be a very free cash flow positive entity.

By 2023, WBD aims to generate around $15.0 billion in revenue per year from its direct-to-consumer (‘D2C’) business, made possible through expected paid subscriber growth at its video streaming services and potential price increases. When the deal closes, WBD will have a bloated balance sheet with a net debt to adjusted EBITDA ratio of roughly 5x that is expected to fall down to around 3x within 24 months after closing.

The single biggest thing Warner Bros. Discovery needs to focus on is bringing its mountain of debt down to a more manageable size. As households return to the movie theaters and its video streaming services continue to grow their paid subscriber bases (HBO Max and discovery+ have both performed well on this front) while sporting events resume in earnest, that should support the firm’s revenue growth outlook. Combined with expected cost structure improvements and the lack of a common dividend program, Warner Bros. Discovery should be able to utilize its free cash flows to repair its balance sheet within a few years. However, we would like to see Warner Bros. Discovery further delever its balance sheet once its current two-year goal is achieved (assuming it is).

Image Shown: The HBO Max and discovery+ video streaming services are expected to get consolidated onto one platform. Image Source: Warner Bros. Discovery – May 2021 IR Presentation

Concluding Thoughts

Now that the merger is in the rearview mirror, AT&T and Warner Bros. Discovery can begin to fully implement their respective strategic initiatives. All of this analysis considered, however, we are not interested in either company at this time as they need to aggressively pare down their debt loads, and in our view, their targeted deleveraging goals don’t go far enough. We continue to point investors to ideas held in the simulated newsletter portfolios, the Exclusive publication, as well as our options ideas generation during these volatile times.

----

Telecom Services Industry - CMCSA, LUMN, DISH, T, TMUS, VZ, SBAC, AMT, CCI, VIAC

Related: AMZN, DIS, FUBO, NFLX, ROKU, DISCA, DISCB, DISCK, SONY, PARA, PARAA, CNK, CNNWF, IMAX, MCS, RDI, CPXGF, NCMI, FOX, FOXA

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. American Tower Corporation (AMT) and Crown Castle International Corp (CCI) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment