Image Source: AT&T Inc – Fourth Quarter and Full-Year Earnings Presentation

By Callum Turcan

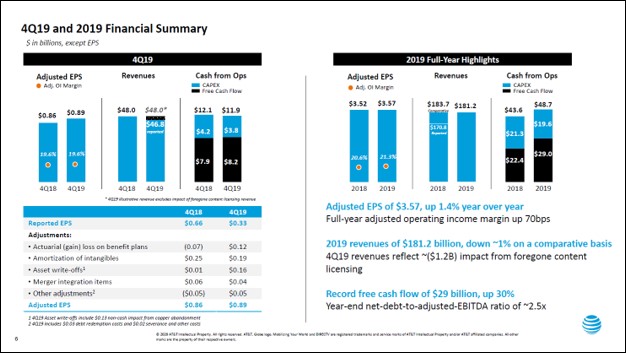

One of our holdings in the High Yield Dividend Newsletter portfolio, AT&T Inc (T), reported full-year and fourth quarter results for 2019 on January 29. Shares of T sold off modestly on the mixed report (adjusted non-GAAP EPS beat consensus estimates but revenues fell short of expectations), and now shares of T yield ~5.6% as of this writing. We continue to like what we see in AT&T as management is delivering on major value creating initiatives: deleveraging, margin expansion, and ultimately free cash flow growth. More information on the High Yield Dividend Newsletter >>

Free Cash Flow Giant

AT&T generated almost $48.7 billion in net operating cash flow and spent over $19.6 billion in capital expenditures in 2019, allowing for ~$29.0 billion in free cash flow. Management was guiding for ~$26 billion in free cash flow for 2019, and AT&T easily beat that target which we appreciate. Please note that above all else, the sheer size and resilience of AT&T’s free cash flow profile is why we like the firm as a top quality high yield play. In 2018, AT&T generated $43.6 billion in net operating cash flow and $22.4 billion in free cash flow.

In 2019, AT&T spent $14.9 billion on its dividend obligations and another $2.4 billion repurchasing its common stock (most of which was spent during the fourth quarter). Management directed most of the remaining free cash flow towards deleveraging activities and debt reduction efforts were assisted by divestment proceeds of $4.7 billion in 2019 (acquisitions consumed $1.8 billion net of cash acquired last year). AT&T plans to continue monetizing part of its asset base going forward, and additionally, the company intends on increasing preferred equity as part of its capital stack. Please note AT&T issued out $1.2 billion in preferred equity during the fourth quarter of 2019.

Deleveraging Activities Continue

The upcoming graphic provides an overview of where management would like to take AT&T’s capital stack going forward. Since closing on the big Time Warner deal last year, the company has reduced its net debt load by roughly $29-$30 billion, which dropped its net debt load to ~$151 billion at the end of 2019 (we’ll have more to say on AT&T’s financial status when it publishes its annual report for 2019). That in turn helped reduce its leverage ratio, defined as net debt to adjusted EBITDA, from 3.0x at the time of the Time Warner deal closing to ~2.5x at the end of 2019.

Image Shown: AT&T plans to issue preferred equity, sell off additional assets, and leverage its strong free cash flow profile to materially reduce its net debt load and outstanding common share count through the end of 2022 while still making good on its hefty dividend obligations. Image Source: AT&T – Fourth Quarter and Full-Year 2019 Earnings Presentation

Going forward, management intends on reducing AT&T’s net debt load down further to $130-$140 billion by the end of 2022, which will see its leverage ratio drop down to 2.0-2.25x if everything goes as planned. During this period, management also intends on allocating a material amount towards share repurchases, which will see AT&T’s outstanding share count drop by roughly 1 billion shares at the midpoint according to guidance. We caution that meaningful per share payout growth will likely have to wait until after these programs are completed.

Looking Ahead

In the near term, AT&T was happy to report that 56 million common shares were retired in 2019 and that under an accelerated share repurchase program, an additional 85 million were retired in January 2020. AT&T plans to retire at least 250 million common shares this year. Given that shares of AT&T are trading below our fair value estimate of $40 per share, and that the company’s intrinsic value is likely increasing over time, we see share buybacks as a good use of capital.

For 2020, AT&T aims to generate ~$28 billion in free cash flow, revenue growth of 1-2% and non-GAAP adjusted EPS of $3.60-$3.70. In 2019, AT&T generated non-GAAP adjusted EPS of $3.57 (up 1% year-over-year) and its non-GAAP adjusted revenue (taking the Time Warner deal into account) slipped by 1% year-over-year (this was due in part to AT&T willingly sacrificing some revenue from selling the rights to its TV shows, which we’ll cover later on in this article). Cost synergies are going to play an essential role in augmenting AT&T’s future free cash flows.

The firm secured $0.7 billion in annualized synergies in 2019, and management is angling for material labor synergies (~$1.5 billion) to be locked in this year. Furthermore, cost savings will come from simplifying its portfolio (divestments are part of this strategy), rationalizing its call center operations and using technology to enhance customer service operations (allowing for headcount reductions while still being able to offer quality customer service across its business portfolio), cost procurement savings (leveraging its ever-growing scale to drive down third-party rates), and simplifying its offerings in certain areas to reduce complexity.

AT&T’s long-term goals remain the same. By 2022, AT&T wants to grow its adjusted EBITDA margin by 200 basis points while generating modest revenue growth each year, which is expected to add ~$6 billion in incremental annual adjusted EBITDA generation to its financials. Management forecasts AT&T will generate $4.50-$4.80 in adjusted non-GAAP EPS in 2022, up sharply from 2019 levels. Most importantly, AT&T is targeting $30-$32 billion in free cash flow in 2022, with its dividend payout ratio (defined here as annual dividend obligations divided by free cash flow) moving below 50% by then (from 51% in 2019). We appreciate that AT&T’s dividend payout ratio came in at just 51% in 2019, versus guidance calling for a payout ratio around the high 50’s% range last year.

Operational Commentary

Management was happy to report during AT&T’s fourth quarter conference call with investors that the firm’s Mexican operations experienced a nice turnaround last quarter. Here’s what AT&T had to say on the issue (emphasis added):

“The big news in our Latin American operations is Mexico turning EBITDA positive in the quarter. The team has done an excellent job of reducing costs and growing revenue in a challenging environment. Fourth quarter Mexico EBITDA improved nearly $200 million year-over-year and improved by more than $300 million for the full year. We continue to press for further gains. A new wholesale agreement with Telefónica (TEF) will add to both revenues and EBITDA. Going forward we expect continued improvement. Vrio continues to work against economic and foreign exchange headwinds. But even in this environment, it continues to be profitable and generate positive cash flows.”

The agreement with Telefonica was signed during the fourth quarter of 2019 and should provide a nice uplift to AT&T’s financial and operational performance going forward. From the fourth quarter of 2018 to the fourth quarter of 2019, AT&T’s Latin American business unit saw its revenue came in flat at $1.8 billion however, its segment EBITDA grew more than five-fold due to margin expansion.

Where AT&T will experience some volatility comes down to the success of its HBO Max streaming service which is set to launch in May 2020. The firm plans to leverage its current subscriber base at HBO to jump-start its streaming growth ambitions, and it appears that there are over 10 million HBO subscribers currently according to the company’s IR presentation. We caution that the firm is making material original content investments to support the upcoming launch of HBO Max, which will pressure its financial performance on the margins until the service takes off.

Please note that AT&T intends on offering HBO Max at a “reduced” rate meaning that it will be priced the same as HBO for starters (at ~$15 per month), a price point that will likely be increased in the near-future to support the cost of the additional content within HBO Max. The ability to push through future price increases while maintaining its subscriber base will be a tricky task, but one that AT&T has a lot of experience in given its enormous ‘Communications’ business segment (which includes its wireless telecommunications and wired internet provider services, along with its embattled DirecTV business).

The next big opportunity for AT&T is 5G. By the middle of 2020, AT&T hopes to rollout nationwide 5G service in the US. What 5G offers for a telecommunications giant like AT&T is the ability to sell higher priced data packages and to upsell customers on wireless plans in general, as unlimited data packages for the whole family is a more enticing proposition when considering what 5G offers (i.e. the ability to quickly download apps, games, TV/movie entertainment, music, and more). Heading into the launch of 5G services, AT&T’s wireless business has been performing well as the firm continues to grow its subscriber base. Here’s what management had to say during the firm’s fourth quarter conference call:

“In our Communications segment, mobility continues to build momentum and deliver solid results. Service revenue grew by about 2% in the quarter and for the year. EBITDA grew both in the quarter and for the year. And EBITDA margins expanded by 40 basis points for the year, while service margins were stable even with a heavily promotional fourth quarter. Postpaid phone growth was solid adding 229,000 in the quarter. For the year, we had about one million phone net adds both postpaid and prepaid. This strong performance was driven by our industry-leading network and came even while postpaid phone churn was up as competitors ramped up promotional efforts. You should note total churn postpaid and prepaid combined improved year-over-year by 12 basis points.”

Turning now to AT&T’s fiber and “premium video” businesses. On the fiber internet front, this segment has seen nice growth in the recent past as high-speed internet services are still in demand. However, please note that AT&T’s DirecTV subscriber base has been withering away due to structural changes in the way consumers watch TV entertainment (namely the pivot towards streaming services). The firm lost 945,000 net premium video subscribers in 2019. Here’s what management had to say during AT&T’s latest quarterly conference call (emphasis added):

“Long-term customer value continues to be our focus as we head into 2020. That focus has helped drive growth in video and IP broadband ARPUs. AT&T Fiber continues to grow adding nearly 200,000 customers. That brings us to nearly four million AT&T Fiber customers and we have lots of room left to grow. Premium video net losses improved sequentially by more than 200,000 subscribers, but video losses continue to impact our broadband numbers, especially our bundled customers. Our new simplified video offerings position us for the long term and our subscriber trends are improving.”

There’s not much AT&T can do about premium video losses as it relates to that segment’s performance, but its upcoming HBO Max launch in many ways is the firm’s way of dealing with the issue. If AT&T can’t see any reasonable way to turn that segment around in terms of subscribers, the company will instead find subscriber growth elsewhere. Here’s what management had to say about some of the content and financial decisions concerning HBO Max during AT&T’s latest quarterly conference call:

“We made the strategic decision to give HBO Max exclusive streaming rights for top programs including Friends, Big Bang Theory and other popular shows. In the past, we would have sold these externally.”

Initially, that will further pressure AT&T’s financial performance on the margins as the company is giving up a source a revenue (selling the streaming rights to its top performing TV shows), but in the long run this could give HBO Max the competitive edge needed to stay ahead of its many competitors. Please note that one of the reasons AT&T’s revenues didn’t perform quite as well as expected during the fourth quarter of 2019 was due to the company’s decision to not sell the rights to these aforementioned TV shows. Excluding that impact, AT&T’s ‘WarnerMedia’ segment would have seen its revenues grow by 10% organically during the quarter on a year-over-year basis and its segment EBITDA would have grown by 11%. Instead, the segment’s revenues and EBITDA both shrunk on a year-over-year basis.

Concluding Thoughts

AT&T continues to follow through with its long-term strategy of modest top-line growth (which is set to return this year, aided by the launch of HBO Max and the rollout of nationwide 5G services in the US), meaningful margin expansion (due to synergies and efficiency-led cost savings), and material deleveraging (made possible primarily through the sheer size of AT&T’s impressive free cash flows). Share buybacks and activist activity from some big fund managers (including Elliott Management, founded by Paul Singer) could help shares of T converge towards their fair value estimate in the foreseeable future. We continue to like AT&T as a top quality high yield name.

Telecom Services – BCE CTL EQIX FTR S T TMUS VZ VOD

Media Entertainment Industry – CNK DIS IMAX ISCA LYV MSG NFLX NWSA SIRI

Media (CATV) Industry – AMCX CMCSA DISCA DISH VIAC

Related: TEF

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.