GE Cuts Guidance, All Eyes Turn to November 13

Image Source: darkon_turaas

On October 20, General Electric slashed its guidance for earnings and cash flow from operating activities after reporting another weak quarter. Could the dividend be next on the chopping block? Management will update investors on company strategy and its 2018 framework Monday, November 13, an event to which we’ll be paying close attention.

By Kris Rosemann

Our decision to rid the newsletter portfolios of shares of General Electric (GE) in mid-May was driven by expectations for material pressure to build on the industrial giant’s free cash flow generation, “Newsletter Alert: Title Withheld – Members Only.” Such concerns have all but materialized as management has slashed its adjusted EPS and Industrial CFOA targets for full year 2017 following a disappointing third quarter, results released October 20. It now expects Industrial CFOA (excluding deal taxes and GE Pension Plan funding) to be ~$7 billion in the year, down from previous guidance of $12-$14 billion, and adjusted EPS is now expected to be in a range of $1.05-$1.10 for the year, compared to initial guidance of $1.60-$1.70.

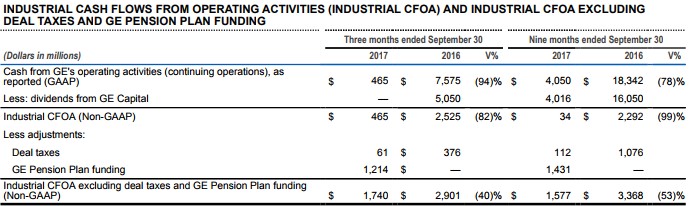

Image Source: GE third quarter report

The table above breaks down GE’s cash flow from operations, or lack thereof--Industrial CFOA has been virtually non-existent through the first nine months of the year when excluding contributions from GE Capital and other adjustments from management--but once 2017 expectations for this measure (~$7 billion) are compared to ~$6 billion in planned capital expenditures for the year and $8+ billion in annual run-rate cash dividend obligations, the cash flow shortfall plaguing GE’s business becomes clear. This does not even begin to consider the industrial giant’s pledge to return an additional $11-$13 billion to its shareholders via share repurchases in 2017. In this context, a dividend cut may be all too likely for the industrial giant, especially after considering the mountain of debt that resides on its balance sheet (net debt was nearly $58 billion at the end of the third quarter of 2017).

The culmination of these developments has caused new CEO John Flannery to embark on additional asset sales, and he plans $20+ billion in business exits over the next one to two years. Such proceeds will likely be necessary in shoring up the balance sheet and providing a potential bridge to more normalized levels of cash flow generation for the company. Flannery has told investors to think of 2018 as a “reset year,” but is confident that his team will be able to cut cost significantly moving forward. Investor frustration with the previous management team has only built since former CEO Jeff Immelt stepped down, and the combination of a poor third quarter report with allegations of massive amounts of corporate greed (see allegations of extravagant executive retreats and the unnecessary use of multiple corporate planes) seem to have brought such frustration to a head. The most prudent course of action for Flannery, beyond reigning in unnecessary corporate spending, may be cutting the dividend and putting an end to the firm’s massive share buyback program. If such an announcement does not come sooner, we would be less than surprised if management uses its November 13 update to announce a materially altered capital allocation program.