Walgreens Begins to Recover

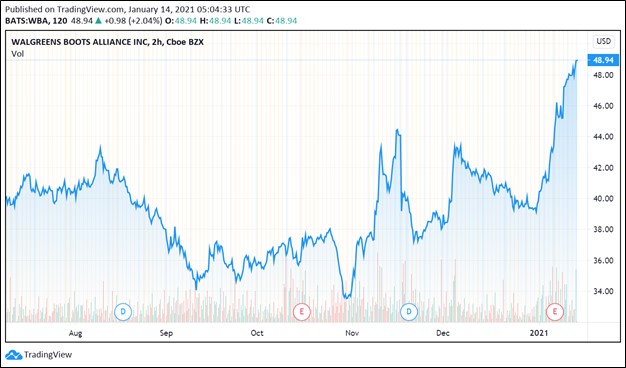

Image Shown: Shares of Walgreens Boots Alliance Inc are beginning to recover.

By Callum Turcan

Shares of Walgreens Boots Alliance Inc (WBA) are on the rise after the company recently posted a solid earnings report while also reaching a big divestment deal. As we recently covered, Walgreens is divesting most of its European-focused wholesale pharmaceutical distribution business to AmerisourceBergen (ABC) and that article can be viewed here. Please note Walgreens has a material strategic stake in AmerisourceBergen’s equity which will grow in terms of total shares once the divestment closes. Here is a brief excerpt from that article:

On January 6, Walgreens Boots Alliance Inc announced it had reached a deal with AmerisourceBergen Corporation (ABC) to sell the "the majority of” its European-focused wholesale pharmaceutical distribution business, Alliance Healthcare, for about $6.5 billion ($6.275 billion in cash along with 2 million shares of ABC). Please note that Walgreens already owns a sizable stake in AmerisourceBergen as the former owned ~28% of the latter’s outstanding shares as of August 31, 2020. The deal is expected to close by the end of AmerisourceBergen’s fiscal 2021 (at the end of September 2021).

Our fair value estimate for Walgreens stands at $43 per share, though the top end of our fair value estimate sits at $52 per share. As of this writing, Walgreens is trading in the upper $40s per share range and looks to be fairly valued. Shares of WBA yield a nice ~3.8% as of this writing, though we caution that its Dividend Cushion ratio of 0.5 and “POOR” Dividend Safety rating indicates that payout is not well-covered due to Walgreens’ hefty net debt load (we will cover that later).

Business Overview

In the US, Walgreens operates its namesake pharmacies. These stores are spread out across the country and the firm utilizes the bigger store format to also sell meaningful quantities of consumer staples goods, health products, beauty products, and other items. Walgreens also sells various items, such as beauty products, under its namesake brand. Additionally, Walgreens operates Duane Reade stores in the US (smaller pharmacies focused on the New York City area).

Walgreens operates Boots pharmacies (certain locations also have Boots Opticians operations) in Europe and Asia, though this business is heavily focused on the UK and Ireland. Finally, Walgreens also operates an international pharmaceutical wholesale and distribution business under its Alliance Healthcare brand. This business is set to shrink, at least in the medium-term, due to the aforementioned divestment agreement.

Earnings Update

On January 7, Walgreens reported first quarter earnings for fiscal 2021 (period ended November 30, 2020) that saw its GAAP revenues grow by 6% year-over-year. Management highlighted growth at the firm’s ‘Retail Pharmacy USA’ and ‘Pharmaceutical Wholesale’ business segments as being key here. However, Walgreens’ gross margins shifted lower (down ~150 basis points year-over-year) last fiscal quarter and the modest year-over-year decline in its SG&A expenses only somewhat offset those headwinds.

Gross margin pressures came from reduced retail sales in the UK (largely a product of quarantine efforts) and increased fulfillment costs. The company reported a GAAP operating loss in the fiscal first quarter due to the negative equity earnings generated via its a strategic stake in AmerisourceBergen (accounted for as an equity method investment), creating some noise in its financial performance given the decent underlying results generated by its core operations considering the headwinds facing the firm. On a non-GAAP adjusted basis, Walgreens’ reported $1.3 billion in operating income last fiscal quarter, down about 10% year-over-year.

Walgreens aims to improve its cost structure through its ‘Transformational Cost Management Program,’ a strategy that rests in part on rationalizing its store footprint in the US. In the long run, Walgreens’ appears confident that its cost structure will improve significantly through this program. Management reiterated in the earnings press release that Walgreens aims to generate “low single-digit growth in adjusted earnings per share at constant currency rates” in fiscal 2021, keeping in mind this is a non-GAAP metric.

In the fiscal first quarter, Walgreens generated $0.8 billion in free cash flow while spending $0.4 billion covering its dividend obligations and another $0.1 billion buying back its stock during this period. The firm had ~$15.1 billion in net debt on the books (inclusive of short-term debt) as of the end of November 2020, though its pending divestment proceeds will help improve that picture. Furthermore, this picture does not include Walgreens’ equity stake in AmerisourceBergen. Walgreens’ equity method investments balance stood at $6.0 billion at the end of November, though please keep in mind this also includes the firm’s stakes in other companies as well.

We would prefer Walgreens pare down its net debt load with its divestment proceeds given that net debt competes for capital against its future dividend obligations. The company’s cash flow profile is stable, and it can generate free cash flows in almost any operating environment, meaning we view its net debt load as manageable for now. However, Walgreens noted it intends to invest at least a portion of its divestment proceeds towards growing its core pharmacy business.

Concluding Thoughts

Walgreens has various initiatives underway that are quite intriguing. Beyond cost cuts, the firm is working with VillageMD (Walgreens has built up a sizable investment in VillageMD) to add physician offices to some of Walgreen’s namesake stores in the US. With that in mind, we caution that competitive headwinds are growing for Walgreens and the pharmacy space more broadly as Amazon Inc (AMZN) recently launched its own online pharmacy. We are keeping an eye on the space.

-----

Downloads

Walgreen's 16-page Stock Report (pdf) >>

Walgreen's Dividend Report (pdf) >>

Amazon's 16-page Stock Report (pdf) >>

United Healthcare's 16-page Stock Report (pdf) >>

United Health's Dividend Report (pdf) >>

Johnson & Johnson's 16-page Stock Report (pdf) >>

Johnson & Johnson's Dividend Report (pdf) >>

-----

Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH

Tickerized for WBA, GDRX, KR, WBA, CVS, TDOC, TGT, WMT, RAD, MCK, ABC, XLV, CAH, UNH, CI, ANTM, WCG, CNC, MOH, GTS, CIVI, UHS, LPNT, CYH, HCA, HQY, QHC, THC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment