Utility PPL Is Pursuing a Major Transformation and Has a VBI Rating of 9

Image Source: PPL Corporation – First Quarter of 2021 IR Earnings Presentation

By Callum Turcan

PPL Corporation (PPL) operates several utilities in the US and the UK, though the company is in the process of selling its UK utility business (Western Power Distribution) to National Grid plc (NGG). When including the assumption of approximately GBP£6.6 billion in debt, this deal has a transaction value of roughly GBP£14.4 billion and is expected to generate about USD$10.2 billion in net cash proceeds for PPL.

Additionally, as part of this arrangement, PPL will acquire National Grid’s Rhode Island utility business in the US (Narragansett Electric Company). When including the assumption of approximately USD$1.5 billion in debt, this deal has a total transaction value of around USD$5.3 billion, and some of the cash proceeds from PPL’s UK divestment will go towards funding the acquisition.

For reference, Narragansett Electric Company serves 780,000 customers in Rhode Island and provides electricity transmission and distribution, and gas distribution services. Western Power Distribution is the UK’s largest electricity distribution business. Both of these businesses represent high-quality utility operations with promising growth outlooks, underpinned by robust capital investment pipelines.

In our view, this arrangement represents a win-win for both parties. Specifically for PPL, the net cash infusion will improve its balance sheet strength while exiting the UK will simplify its corporate structure and sharpen PPL’s operational focus. The sale of Western Power Distribution is expected to close in the coming months, while the sale of Narragansett Electric Company is expected to close by the first quarter of 2022. For National Grid, this further strengthens its UK presence and complements its existing portfolio in the country while better enabling the company to grow its asset base over the long haul.

Earnings Update

Let's talk about recent fundamental performance. PPL reported first quarter 2021 earnings on May 6 that missed both consensus top- and bottom-line estimates. However, we appreciated that PPL’s management team communicated that the sale of its UK utility business was on track to close by the end of July and that its acquisition of National Grid’s Rhode Island utility business was on-track to close by the end of March 2022. PPL incurred meaningful expenses relating to these transactions last quarter as it prepares itself for the future.

Last quarter, PPL’s GAAP revenues rose by 4% year-over-year though its GAAP operating income dropped 2% year-over-year. However, its earnings from ongoing operations rose by 6% year-over-year, aided by strong performance at its regulated Kentucky utility operations, where electricity sales in gigawatt hour (‘GWh’) terms were up by almost 7% year-over-year, and steady performance at its regulated Pennsylvania utility operations, where electricity sales in GWh terms were up a bit over 4% year-over-year.

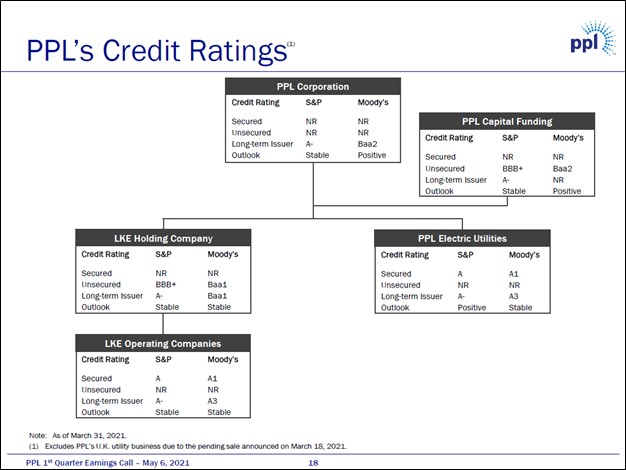

PPL’s underlying performance remained strong in the first quarter of 2021. The firm even generated $0.2 billion in free cash flow last quarter. Given its bloated balance sheet (i.e., large net debt load), hefty capital expenditure requirements, and sizable dividend obligations (it spent $0.3 billion covering its dividend last quarter), PPL needs to retain constant access to capital markets, ideally at attractive rates. We expect this not to be a problem in light of the large pending cash infusion from the aforementioned transactions with National Grid, and thanks to PPL and its subsidiaries having strong investment grade credits as you can see in the upcoming graphic down below.

Image Shown: PPL and its subsidiaries have rock-solid investment grade credit ratings, supporting their ability to tap capital markets at attractive rates. Image Source: PPL – First Quarter of 2021 IR Earnings Presentation

Medium-Term Outlook

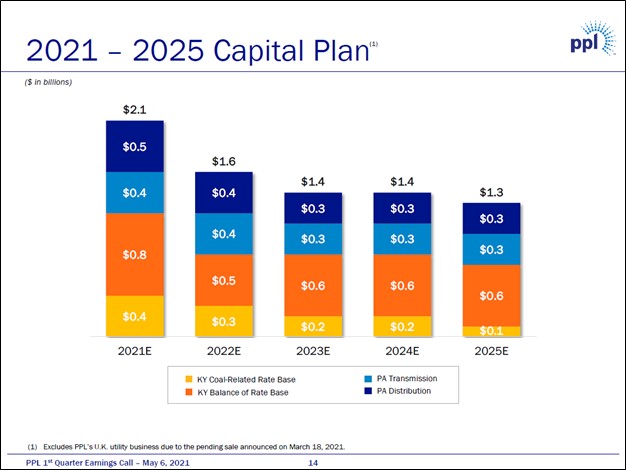

Going forward, PPL intends to grow its rate regulated utilities in the US through its sizable capital expenditure program through the middle of the 2020s (and likely beyond). Its capital expenditure expectations as things stood in early May 2021 can be viewed in the upcoming graphic down below, though please note that once it acquires Narragansett Electric Company, this forecast will likely change.

Image Shown: An overview of PPL’s planned capital expenditures from 2021-2025. Image Source: PPL – First Quarter of 2021 IR Earnings Presentation

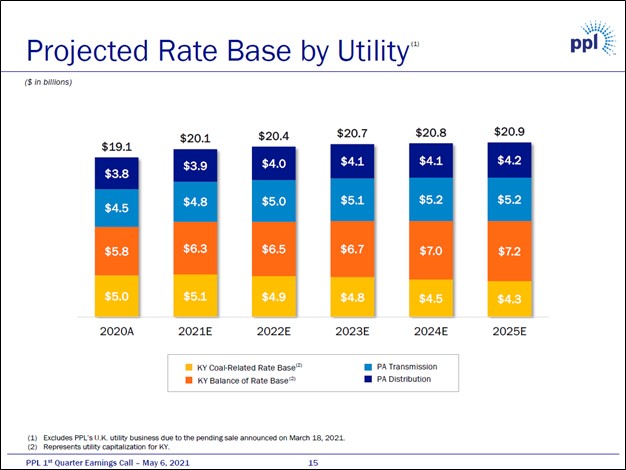

PPL expects these planned capital expenditures will grow its rate base from $19.1 billion in 2020 to $20.9 billion by 2025, representing growth north of 9% during this period. Expansion at PPL’s non-coal related regulated utility operations in Kentucky is expected to offset projected declines in the rate base of its coal-related regulated utility operations in the state. In Pennsylvania, PPL aims to grow the regulated rate base of its distribution and transmission operations. PPL’s capital investment pipeline is robust. Renewable energy investments are expected to play a leading role going forward, and the addition of Narragansett Electric Company is forecasted to create new growth opportunities in the distribution and transmission realm as well.

Image Shown: PPL’s robust capital investment pipeline and planned capital expenditures are expected to steadily grow the regulated rate base at its various US utilities over the coming years. Image Source: PPL – First Quarter of 2021 IR Earnings Presentation

When its deals with National Grid close, PPL expects its US regulated rate base to grow to around ~$22.0 billion. Looking ahead, we are interested to see how PPL intends to improve its growth trajectory and overall operations once the company is focused solely on the US.

Thoughts from Our Utility Coverage

We recently updated our utility models, which cover both PPL and National Grid along with more than a couple dozen other publicly-traded utilities. Here is what we had to say on PPL regarding its forward-looking dividend coverage and payout policy overall (emphasis added):

PPL’s major transactions with National Grid should go a long way in improving its earnings profile, growth outlook, and the strength of its balance sheet. Once these deals close, management is targeting a post-transaction payout ratio of 60%-65%. Expected growth in PPL’s rate base is expected to drive its earnings growth over the long haul, which in turn supports the company’s dividend growth trajectory. PPL has solid investment grade long-term issuer credit rating (Baa2/A-) with stable outlooks, aided by the stable nature of its regulated utility business. The company expects its earnings growth rate will be competitive with its peers once the deals close. PPL does not see the need for material equity issuances for the foreseeable future. Some of the transaction proceeds may go towards growth endeavors and/or share repurchases.

Most large public utility holding companies have unadjusted cash-flow-derived Dividend Cushion ratios below 1, indicating that future expected free cash flows over the near term are completely absorbed by net debt obligations and future expected dividend payments. Utilities’ high dividend payout ratios (dividends paid per share divided by earnings per share) and elevated capital outlays--both of which prevent the buildup of cash on the balance sheet--coupled with the ballast of hefty debt obligations, which are higher on the capital structure than any equity concerns, prevent most utilities from receiving a healthy Dividend Cushion ratio, a pure financial-statement based comprehensive assessment of the coverage of the dividend.

PPL has a weak unadjusted Dividend Cushion ratio, and its adjusted Dividend Cushion ratio is underwhelming, though that does not mean we expect the utility to cut its payout in the near term. Regulated utility operations have incredibly stable cash flow profiles, which makes managing large net debt loads while continuing to make good on sizable dividend obligations possible, as long as the utility in question retains access to capital markets. As noted previously, PPL is targeting a post-transaction payout ratio of 60%-65% and intends to grow its payout in line with its earnings per share growth, a reasonable strategy, in our view.

Concluding Thoughts

After updating our valuation models for the utility sector, PPL recorded a VBI of 9 and we are keeping a close eye on the firm. Our fair value estimate for PPL sits at $45 per share. As of this writing, shares of PPL yield ~5.8%. The utility’s outlook is bright, and we are excited by its potential upside once the pending transactions with National Grid are complete. In the High Yield Dividend Newsletter portfolio (more here), we include the Utilities Select Sector SPDR Fund ETF (XLU) to gain broad exposure to the space.

-----

Utilities (Mid/Small) Industry - AEE, ALE, CNP, CMS, DTE, ES, LNT, MGEE, NI, PEG, PNW, SCG, SJI, SR, SRE, WEC

Utilities (Large) Industry - AEP, D, DUK, ED, EIK, ETR, EXC, FE, NEE, NGG, PCG, PPL, SO, XEL

Related: XLU

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Utilities Select Sector SPDR ETF (XLU) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

3 Comments Posted Leave a comment