Update on Wuhan 2019 Novel Coronavirus Outbreak: 31,000+ Infections, 630+ Deaths

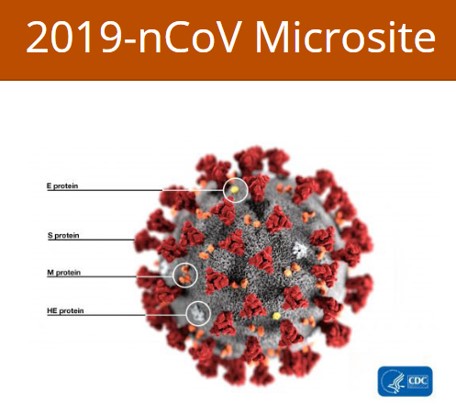

Image Source: 2019-nCoV, Centers for Disease Control and Prevention

The number of infections and deaths related to the Wuhan 2019 Novel Coronavirus has surged since our last update, but we maintain our view that investors should keep a level head. We continue to wait to add protection to the newsletter portfolios as the market absorbs a massive liquidity injection from the PBOC.

By Brian Nelson, CFA

The week of trading ending February 7 was a very strange one. Last Sunday, one could have only expected that given the news related to the Wuhan 2019 Novel Coronavirus outbreak, the bad news related to airlines (JETS) and aerospace players--Boeing (BA), in particular--and the speculative frenzy associated with Tesla’s (TSLA) rise, that the baseline view would be for the markets to experience some weakness during the week, particularly following the 600+ point swoon Friday, January 31.

Well, as is sometimes the case in the equity markets, what seems to be the more obvious play is offset by some confounding factor-- this time the stimulus that China (FXI, MCHI, KWEB) injected into its economy. The PBOC used reverse repos earlier in the week to inject 1.7 trillion yuan ($242.74 billion) to prop up its markets, which fell nearly 8% the first trading session after opening from the New Year holiday. It’s very likely most of this capital made its way into the “safer” US stock markets, and what can be best described as a “buy the dip at any price” almost certainly buoyed the impact from the new capital being deployed.

We took a few winning ideas off the table on the long side in the Exclusive publication, but we didn’t do much more than that. The acquittal of President Trump this week coupled with more accommodative trade dealings from China, which cut tariffs on $75 billion of U.S. goods February 6 amid the Wuhan 2019 Novel Coronavirus outbreak, not only helped to aid the stock market advance, but the combination even propelled the stock market to brand new highs again. We continue to monitor market activity before we layer on any portfolio protection (in the form of broader market put options).

The newsletter portfolios, which came off a fantastic 2019, have been re-positioned more defensively in 2020. On January 13, we removed Apple (AAPL) and GM (GM) from the Best Ideas Newsletter portfolio, and added to PayPal (PYPL), while initiating new positions in Disney (DIS) and SPDR S&P Aerospace & Defense ETF (XAR). In the Dividend Growth Newsletter portfolio, we removed Apple and GM and added Bank of America (BAC), Newmont Mining (NEM), Republic Services (RSG), and Lockheed Martin (LMT). Both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio have roughly a 10% cash weighting; given the income-oriented mandate for the High Yield Dividend Newsletter portfolio, it remains fully invested.

From our perspective, the outbreak of the Wuhan 2019 Novel Coronavirus is showing little signs of slowing, but it does seem that a widespread global outbreak is growing less and less likely, as China keeps a large percentage of its population under quarantine and other countries keep a close eye on infected and suspected patients. As of the last update, there are more than 31,000 cases of the Wuhan 2019 Novel Coronavirus with the number of deaths now north of 630. More than 40 cases have also been confirmed on the still-quarantined Carnival Corp’s (CCL) Diamond Princess cruise liner in Japan.

As we evaluate the impact of the Wuhan 2019 Novel Coronavirus on the global economy, here are some takeaways from key bellwethers. Yum China’s (YUMC) outlook may be most informative, in our view, of the ongoing impact. Yum China is the licensee in mainland China for KFC, Pizza Hut, and Taco Bell (it also owns Little Sheep). The company has 9,200 restaurants in over 1,300 cities. Here’s what Yum China had to say about the Wuhan 2019 Novel Coronavirus:

Since the start of the year, the novel coronavirus outbreak in China has significantly impacted the Company's operations. The situation is complex and rapidly evolving, and the Company cannot yet fully ascertain the expected impact. However, based on information currently available, the Company believes that the outbreak is likely to have a materially adverse impact on the Company's operating and financial results for the first quarter of 2020 and full year 2020.

The Company has taken a number of measures to protect its employees, customers and business partners, including the temporary closure of more than 30% of its restaurants in China. For restaurants that remain open, same-store sales since the Chinese New Year holiday period were down 40-50% compared to the comparable Chinese New Year holiday period in 2019, due to shortened operating hours, reduced traffic and other factors related to the outbreak. At this time, the Company cannot forecast when the closed restaurants will re-open (and at what rate) and the traffic will be restored (and at what level), or the other factors relating to the outbreak that will continue to impact the Company's operations. Furthermore, the Company may be required or otherwise decide to close additional stores, reduce operating hours, or take other steps, as the situation warrants.

As a result of the outbreak, the Company may experience operating losses for the first quarter of 2020, and if the sales trend continues, for the full year 2020. Future operations, as well as the Company's cash flows and financial position, may be materially and adversely influenced by further developments related to the outbreak, including potential additional announcements and actions from the central government and local authorities, disruption in our supply chain, inability to provide safety measures to protect our employees, or other reasons.

Other key bellwethers have commented on the impact that the Wuhan 2019 Novel Coronavirus is having on their business. Nike (NKE) generated roughly 17% of revenue from the ‘Greater China’ region in fiscal 2019, and here’s what the company had to say about the impact:

In the context of the evolving dynamics related to the coronavirus in China, Nike is prioritizing the health and safety of our teammates and partners, in cooperation with local authorities. Similar to others in the marketplace, approximately half of Nike-owned stores have been temporarily closed, with corresponding dynamics across our partner stores. In addition, we are operating with reduced hours and experiencing lower than planned retail traffic in stores that do remain open. In the short term, we expect the situation to have a material impact on our operations in Greater China. However, Nike’s brand and business momentum with the Chinese consumer remains strong, as reflected in the continued strength of our Nike digital commerce business.

Luxury is also being impacted. Here’s what Tapestry (TPR) had to say when it reported fiscal 2020 second-quarter results February 6:

At Tapestry, we entered our third fiscal quarter with strong underlying trends, notably at Coach, as sales growth accelerated from the holiday period. Therefore, we had anticipated maintaining our FY20 guidance despite continuing headwinds in Hong Kong SAR (EWH) and challenges at Stuart Weitzman. However, the escalating coronavirus outbreak is now significantly impacting our business in China, resulting in the closure of the majority of our stores on the Mainland.

We now expect that our second half results could be negatively impacted by approximately $200-$250 million in sales and $0.35-$0.45 in earnings per diluted share, given current trends in China. If the situation further deteriorates, or the outbreak affects demand outside of the country, this impact could be worse.

We are confident in our ability to effectively navigate through this period of uncertainty. We are managing our response to best protect our people, our brands and every aspect of our business.

Our primary concern is the health and well-being of our team, their families and their local communities who are dealing with the daily reality of this situation. We believe in the resilience of the Chinese people and our view that China represents a significant opportunity for our brands is unchanged. Our strong balance sheet, cash position and globally diversified sourcing base and supply chain provide the flexibility to operate our Company for the long term and to emerge stronger, as we have many times in the past.

Here's what owner of Michael Kors, Capri (CPRI), had to say in its third-quarter fiscal 2020 results, released February 5:

We are in the midst of a dynamic global health emergency related to the coronavirus. Our thoughts and prayers go out to the people of China, including our own employees located in this region, as well as all of those affected by the virus globally. We hope for a speedy and positive resolution to this crisis. The situation in China and the measures being taken to protect the population are having a material impact on our business. Given our current visibility, we now anticipate annual revenue of approximately $5.65 billion and adjusted earnings per share of $4.45 to $4.50. This estimate could materially change if the severity of the situation in China worsens.

During the fourth quarter of fiscal 2020, there has been an outbreak of coronavirus in China which the Company expects will materially impact its financial results. As of February 5, 2020, approximately 150 of the Company’s 225 stores in mainland China are closed. Additionally, most of the stores that remain open are operating with reduced hours and experiencing significant declines in customer traffic. While this global health emergency is expected to be temporary, the duration and intensity of the disruption is uncertain, including potential broader impact outside of China if travel and tourist traffic is further restricted and there is a resulting decline in Chinese tourist spending in other regions. Given the dynamic nature of these circumstances, the Company currently expects the situation in China to reduce revenue by approximately $100 million and earnings per share by $0.40 to $0.45 for the fourth quarter and full year. This estimate could materially change if the severity of the situation worsens, including potential broader impact on our business outside the region if outbound travel and tourist traffic is further restricted out of China and into other countries and regions. In addition, given the lower than normal visibility, the Company will not be providing brand comparable store sales guidance ranges in the fourth quarter.

It is very clear to us that the Chinese economy is under a tremendous amount of pressure as we speak, and the country’s easing of tariffs on US goods speaks loudly to a country that has been materially wounded from the Wuhan 2019 Novel Coronavirus (and may even require US assistance to get back on its feet). Right now, we also can’t rule out some major long-term changes in China, as the death of a “reprimanded” whistle-blower doctor that had warned about the Wuhan 2019 Novel Coronavirus has enraged citizens that are demanding freedom of speech across social media.

Former leader of the Soviet Union, Mikhail Gorbachev once said that “even more than my launch of perestroika, [Chernobyl] was perhaps the real cause of the collapse of the Soviet Union five years later.” Could the Wuhan 2019 Novel Coronavirus be China’s Chernobyl? Time will tell. In any case, we continue to be on high alert, as we maintain our view the global markets have not yet factored in global economic disruption from the outbreak and possible long-term political unrest across the Chinese state that may really cause an unraveling.

Related: RCL, NCLH, WYNN, MGM, MLCO, MSC

Seeking 2019-nCoV vaccine/cure: JNJ, REGN, GILD, GSK, MRNA, VXRT, NNVC, VIR

Related: IYM, EWH, EWT, VGK, NIO, GOOS, LK, YUMC, RL, PVH, TPR, FOSL, CPRI

Related (China): BIDU, BABA, CEA, CTRP, JD, TCEHY, KWEB, GXC, YINN, YANG, ZNH

Leisure: AOBC, CCL, CLCT, FUN, HAS, IGT, MAT, RCL, SIX, WWE

Luxury Goods - Established Brands: EL, LULU, NKE, PVH, REV, SIG, UA, UAA, VFC

Luxury Goods - Ultra & Aspirational: FOSL, CPRI, LVMHF, RL, TIF, TPR

Restaurants - Fast Food & Coffee/Snack: ARCO, DPZ, DNKN, JACK, MCD, PZZA, SBUX, WEN, YUM

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.