The Energy Sector Has Had a Great Run

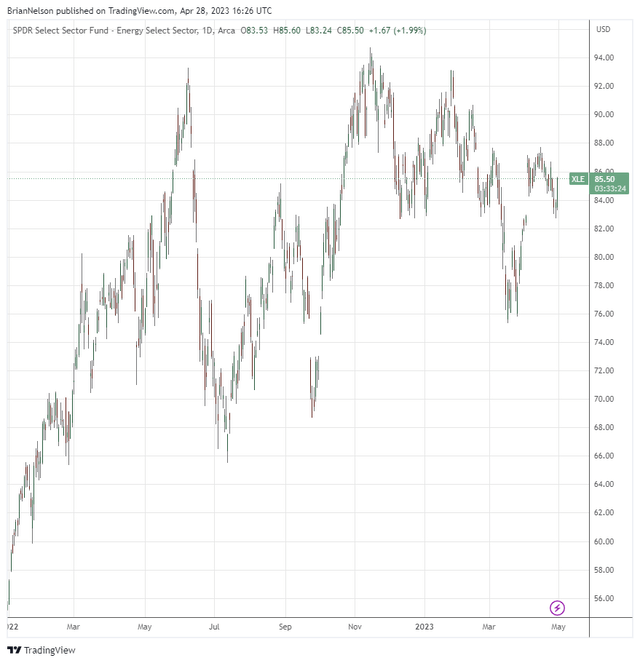

Image: The energy sector was the top-performing sector during 2022. Exxon Mobil's and Chevron's first-quarter 2023 results were strong but as expected.

By Brian Nelson, CFA

2022 could have been a very painful year for many if they had ignored the energy sector. In fact, the only sector in the green last year was energy, which advanced ~59% during the year, according to data from S&P Global (SPGI). The next best-performing sector during 2022 was the utilities sector, which fell 1.44%. Even the consumer staples sector experienced a 3.17% decline during 2022. Quite simply, if you didn’t have energy exposure during 2022, one likely had a very painful year and a reduced chance of outperforming the S&P 500.

Heading into 2022, we at Valuentum included the Energy Select Sector SPDR (XLE) as well as sizable “weightings” in each of Exxon Mobil (XOM) and Chevron (CVX) in the Best Ideas Newsletter portfolio (December 15, 2021 edition here pdf) as well as hefty exposure to Exxon Mobil and Chevron in the Dividend Growth Newsletter portfolio (January 1, 2022 edition here pdf). This was unique because we didn’t add material “positions” in Exxon Mobil and Chevron until June 2021, avoiding much of the energy fallout during the COVID-19 meltdown and the back half of the prior decade.

Though Meta Platforms (META) and PayPal (PYPL) were unfortunately huge drags on newsletter portfolio “returns” during 2022, the significant overweight position in energy within the newsletter portfolios heading into 2022 proved to be one the best “calls” we’ve made since inception. Down-markets tend to hide a lot of the good things, and we suspect that many market participants had little energy exposure or didn’t have any energy exposure at all during much or maybe all of 2022.

In the book Value Trap, we noted that there may be little reason to own energy in the long run, but as a “trade,” energy worked out quite well during 2022. We recently removed Exxon Mobil and Chevron from the newsletter portfolios after their huge share-price run-ups, “Not Being Greedy as Shares of Exxon Mobil and Chevron Have Soared,” and we’re not looking back. Both Exxon Mobil and Chevron reported strong first-quarter 2023 results on April 28, but the good news was largely expected given recovered energy resource prices.

The energy sector may have another good year or two in the next five-to-seven years, but our favorite areas for long-term investors remain large cap growth and big cap tech. Let’s say the only thing you ever read about investing was the book Value Trap, and after reading it, you decided to go long large cap growth and stay away from small cap value. You would be dancing right now.

An ETF tracking large cap growth (SCHG) has nearly doubled since the release of the first edition of Value Trap on December 19, 2018, while an ETF tracking small cap value (IWN) is up only ~27% since then. The past five years have flown by, and it’s good to see that we’ve not only highlighted ideas in the strongest of areas, but also that we were able to position the newsletter portfolios nicely during 2022 when energy had one of its best years. We continue to like the resilience of this market, especially the areas of large cap growth and big cap tech in the face of bank failures.

----------

Tickerized for holdings in the XLE.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment