S&P 500 Hits Target Range, Nibbling at Ideas?

publication date: Mar 10, 2020

|

author/source: Brian Nelson, CFA

This article was emailed to members the morning of March 10. The email can be accessed here.

---

By Brian Nelson, CFA

---

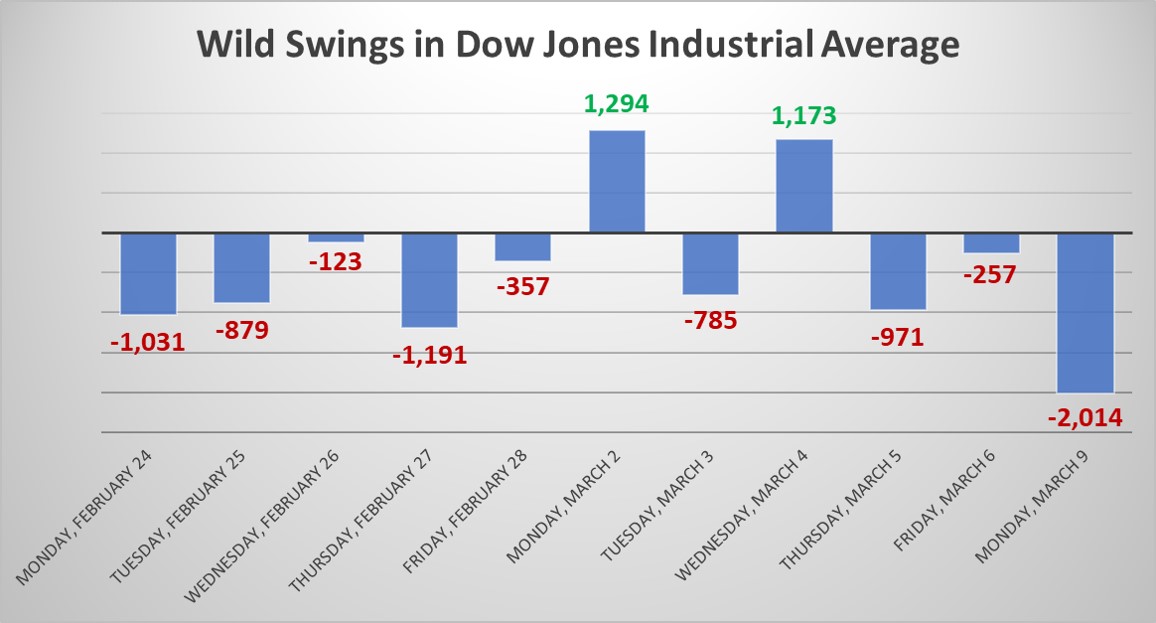

Very few bearish targets on the S&P 500 (SPY) ever get hit, but with the momentous all-time worst decline in the stock market March 9 (on a point basis), our target range of 2,350-2,750 has been breached--yet, another great call for those watching at home. The S&P 500 closed at 2,746.56 March 9, off about 19% from the all-time highs it reached just a few weeks ago. You have been ahead of developments.

---As we have outlined extensively in Value Trap: Theory of Universal Valuation, the combination of indexing and quantitative algorithmic trading is creating a situation of tremendous volatility. When indexers sell, they're not selling overpriced equities, they're selling everything in the index, indiscriminately. This has profound implications on the levels of broad market volatility, as we've been witnessing, exacerbated by the quants that pay little attention to fundamental analysis.

---None of this should be surprising. We've put it all in front of you before it happened, and we would expect this volatility to continue for some time. Last night, for example, futures indicated the Dow Jones Industrial Average would open 400 points lower, and now this morning, the Dow Jones Industrial Average has opened about 800 points higher on fiscal stimulus hopes, "Fiscal Stimulus Coming to the US?"

---What are we doing? Well, we're watching and waiting. For those that have yet to consider some of our best ideas in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio and the High Yield Dividend Newsletter, now may be a time to consider nibbling at them, but we're still rather cautious on developments. We've yet to see the bottom fall out of the oil makets yet, and COVID-19 has yet to spread aggressively in the US, two negative catalysts looming in the not-so-distant future.

---With that said, expect heightened levels of market volatility, and pick your spots wisely. The markets are still up significantly from the March 2009 panic bottom, and the midpoint of our S&P 500 target range still indicates the potential for downside. We're available for any questions. Thank you!

---

Tickerized for the DIA.

0 Comments Posted Leave a comment