ICYMI: Questions for Valuentum’s Brian Nelson

Valuentum’s President Brian Nelson, CFA, answers your questions.

Q: What Is Valuentum?

A: In short, it is a strategy that combines the concepts of value and momentum within individual stocks. We measure value through the cash-based sources of intrinsic value – net cash on the balance sheet and future expected free cash flow. We measure momentum rather simply, generally via relative strength or other technical and momentum indicators.

We like stocks with strong net cash positions on the balance sheet, ones that are generating tremendous free cash flow, and have strong secular growth prospects such that the prospect for expectations of free cash flow can continue to be ratcheted higher. Today, most Valuentum stocks are included in the stylistic area of ‘large cap growth,’ but that won’t always be the case forever.

Our best ideas are always included in the simulated newsletter portfolios or in the Exclusive publication or within our options idea generation. We believe the discounted cash-flow model – enterprise valuation – is the key determinant behind stock price changes and market returns.

Q: What are your thoughts on dividends, in general?

A: They are part of total return, but not in the way that many believe they are. A dividend is capital appreciation that otherwise would have been achieved had the dividend not been paid.

We think most dividend investors understand this. After all, many pursue dividend reinvestment plans (DRIPs), which reinvest their dividends into the company, in some ways like a scenario where the company didn’t really pay a dividend at all. Dividends are okay, but investors shouldn’t let the tail wag the dog.

Stock prices and returns are a function of net cash on the balance sheet and changes in future expectations of free cash flow. The payment of a dividend reduces cash on the balance sheet and therefore the intrinsic value (and the capital appreciation) of the stock over time.

Dividend investors are largely getting paid with a part of the “return” they would have received as capital appreciation anyway.

Q: Can you give an example of a Valuentum stock that has worked out extremely well?

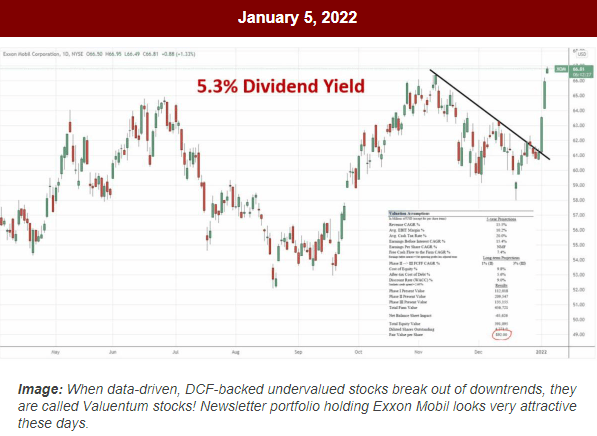

A: Yes, let’s cover one from last year, as 2022 was a tough year for many investors. We highlighted Exxon Mobil (XOM) as a key Valuentum stock at the beginning of 2022. Here is the email: “ALERT: XOM Is A Valuentum Stock with a Hefty Dividend Yield.” Exxon Mobil soared during 2022. It’s very likely that if investors didn’t have energy exposure during 2022, they would have trailed the market.

We don’t highlight many Valuentum stocks, so when we do, it matters. Some strategies highlight hundreds and hundreds of names each year. Our best ideas, however, are always included in the simulated newsletter portfolios, which house about 15-20 securities at most. The Valuentum strategy won’t work out for every name, of course, but 2022 was a big test that showed it can even lead to outperformance in a very difficult market environment.

Interestingly, both the simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio beat the market-cap weighted S&P 500 during 2022. They also beat the more conservative 60/40 stock/bond portfolio last year, too. 2022 was one of the best years for the Valuentum strategy, as it revealed just how resilient it can be thanks largely in part to the energy exposure the newsletter portfolios held throughout the year.

Image: Excerpt from the January 5, 2022 email. We highlighted Exxon Mobil to start 2022, and the stock was one of the best performers in the S&P 500 last year. Exxon Mobil became a “Valuentum” stock last year, with shares being undervalued, exhibiting a strong technical breakout, and sporting an attractive dividend yield to boot. The stock became a huge winner.

Q: What about REITs?

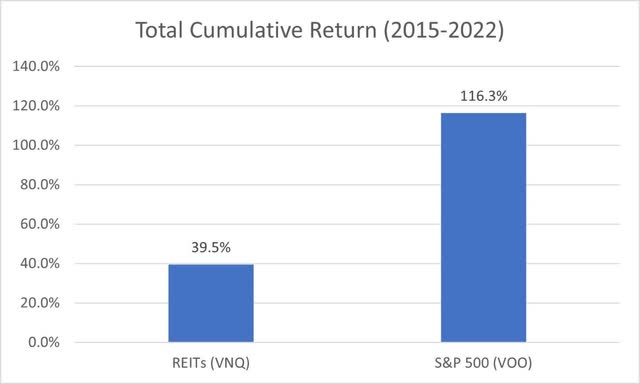

A: Where do I start? They seem to have a cult following these days, and it’s hard to explain because their aggregate performance hasn’t been great for some time, and subsegments of the REIT complex don’t have a very bright future, in my view. The yield on REIT ETFs is still lower than that on a near-term Treasury bill, too.

Investors would have missed out on a lot of total return over the past 8 years had they fallen into the trap of REIT investing. One has to go back a long time to see any real return from REITs, and changing working and shopping habits will likely punish REIT holdings for some time yet. In many ways, REITs are a game of leverage tied to the vicissitudes of the commercial real estate cycle, all for a dividend yield of ~4%.

They can sometimes fit in a dividend growth or high yield dividend portfolio, but for investors looking to maximize their returns and the longevity of their retirement savings, there are other better options, in my view.

Image: REITs have not performed as well as one might have thought. Source: Vanguard

Q: What are your thoughts on quantitative investing?

A: It’s another chess piece that impacts the stock market that one has to consider--in some ways like the Fed, the FDIC, Treasury and Congress. What do I mean here? Well, quant investing is part of the game, it’s part of the market, and one must understand it well…as well as one understands the ins and outs of the discounted cash-flow model.

As artificial intelligence proliferates via quant strategies, however, market structure will likely continue to be challenged over time. That doesn’t mean bull markets won’t still be awesome--they’ll just come with far more volatility. Lots more volatility.

Most quants use multiple analysis in their work, so quant ‘value’ strategies shouldn’t be expected to hold up over time, in my view, yet another reason to lean toward more cash-based, duration-oriented strategies that utilize the concepts behind the discounted cash-flow model.

I’ve talked extensively about these dynamics in the book Value Trap, so I won’t belabor these issues here. The third edition of Value Trap is forthcoming, and I’m pretty excited about it.

Q: Can you talk about your newsletter portfolio performance?

A: It’s been great. We talk about the simulated performance of the Best Ideas Newsletter portfolio in the second edition of the book Value Trap, but we’ve generally stopped measuring the simulated performance monthly following the move to weighting ranges in the newsletter portfolios several years ago. We tend to provide performance-related commentary for the newsletter portfolios near the end of each year, however. We’ll do so again this year.

We’re also considering providing another newsletter portfolio update in the third edition of Value Trap, but the number of permutations that result from weighting ranges compounded over time leaves a wide range of potential returns. It may not be a tremendous value-add as customers are aware of their own performance and returns. As a financial publisher, we don’t have performance, per se. The value of our work rests in the insights we deliver and the idea generation we provide.

That said, however, one way to broadly track the performance of our best ideas over time (following the move to weighting ranges) is to evaluate the performance of the Schwab Large-Cap Growth ETF (SCHG) versus the market and other strategies. Many of the top holdings of the SCHG today are the top considerations of the Valuentum strategy. The SCHG has performed very well since the inaugural edition of Value Trap back in 2018.

Q: Why don’t you own the stocks in the newsletter portfolios?

A: In some ways, I do.

The SCHG is one of my favorite individual holdings, and it’s a way for me to invest alongside readers, while avoiding any perceived conflicts of interest with individual stocks and adhering to our firm’s trading policy. I wear a lot of hats at Valuentum, and I want to make sure that putting out my best work for members is first and foremost.

I’m also an old school analyst that cut my teeth in this business following the Global Analyst Settlement, meaning I believe that writers should generally not be taking stakes in the individual stocks they write about. Writers with positions in the securities they write about can lead to biased research, or worse, terrible outcomes.

When it comes to my stock analysis and commentary, I have tons of skin in the game in a more direct manner: If my work does well and resonates, Valuentum will do well, and I will do well. My livelihood simply depends on how well I do my work at Valuentum. I couldn’t be more motivated or aligned with members in that regard.

Q: What advice would you give young analysts?

A: Keep going in your careers. The world changes fast. When I was in college around the dot com bust, sell-side analysts at the time were probably pulling in millions of dollars each year. Maybe more. They were kings of the world. Now many can’t find jobs.

During the 2000s/2010s, quant research went crazy with factors and hedge funds alike. Some quant researchers were making a lot of money doing statistical analysis. They all thought they could beat the market, but research during this period showed that quant strategies did poorly, with a huge percentage of them underperforming.

This decade, the 2020s, will find another area of finance that will dominate. Artificial intelligence will likely take over the coding work that is performed by many quant analysts these days, and the financial industry will have to continue to adapt. In some ways, quant funds may be able to run their programs through AI with little need for actual humans. What was once a hot area for jobs just a few years ago may see a lot of changes this decade.

Value investing will continue to go away, too. Market participants today generally don’t have the background in intrinsic value, perhaps in part because of modern portfolio theory or quantitative investing, as the lack of knowledge of cash-based intrinsic value heavily paved the way for things like crypto and NFTs to flourish—items that simply don’t have intrinsic value in the traditional sense. Images of monkeys were selling for millions of dollars during the COVID-19 “boom,” and Bitcoin, today, still sells for ~$30,000.

The foundation is not there for value investing as a business to come back. That said, I think the one true staple in the financial business for those seeking outsized returns remains research and analysis. If you put out great insights and deliver with great ideas, then you’ll be rewarded. There will be ups and downs with any profession, but the hardest workers often prevail--as it’s said, they tend to make their own luck.

Q: What do you think about active equity management? Will it make a comeback?

A: I don’t think it will. Government intervention has largely destroyed the business of active management during the past 20 years.

Let me explain. The role of the equity analyst within the portfolio management construct has been in part to steer portfolios away from poor ideas, some for example, that may eventually go bankrupt during the worst of times--an equity analyst that would, for example, keep their portfolio manager out of banks during the GFC, or airlines and restaurants during the COVID-19 crisis--keep them out of companies that would go belly-up…absent government intervention.

There was huge alpha generation by doing so (a ton of it!).

But the risks that many equity analysts work hard to reduce within a portfolio construct have now been largely absorbed by government intervention. Instead of equity analysts being rewarded for making great calls during market catastrophes, driving active management outperformance, their value-add has largely been nullified by government intervention as these market catastrophes are circumvented by one fiscal/monetary action or another. Think about the bailouts during the GFC and COVID-19, or PPP for businesses. Even Treasury seemed ready to act to stem the recent regional bank crisis.

With so many government chess pieces such as the Fed, FDIC, Congress, Treasury, and even the SEC (which banned short sales of financial stocks for a time back during the GFC) ready to intervene at the drop of a hat, even if an equity analyst or portfolio manager is right about major financial or economic risks that eventually may come to fruition, to succeed at long-term active equity management, these days one counterintuitively must “go long moral hazard.” Active management can no longer easily carve out as much relative outperformance as it had in the past, largely because their value-add is being countered and nullified by government intervention in the free markets.

Moral hazard is what indexers have benefited from for decades. It stands to reason that not paying attention to individual firm-specific dynamics, as in indexing, should be a recipe for disaster, but not with government intervention in the free markets. Government intervention has largely eliminated the need for some types of security analysis, putting active management in a bind, while collectively driving investors into index funds and “socialized” retirement accounts. Having indirectly worked against active management for the past 20 years, curtailing its merits and price discovery along the way, government agencies are now on the hook to stymie the next financial or health crisis, and I think they will.

Q: So final question: bullish or bearish?

A: Bullish on the markets and large cap growth big time. It’s the Roarin’ 20s again!

----------

NOW READ -- ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ -- ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ -- Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ -- There Are No Free 'Income' Lunches

----------

Tickerized for holdings in the SPY.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.