Philip Morris Is One of Our Favorite High-Yielding Income Generation Ideas

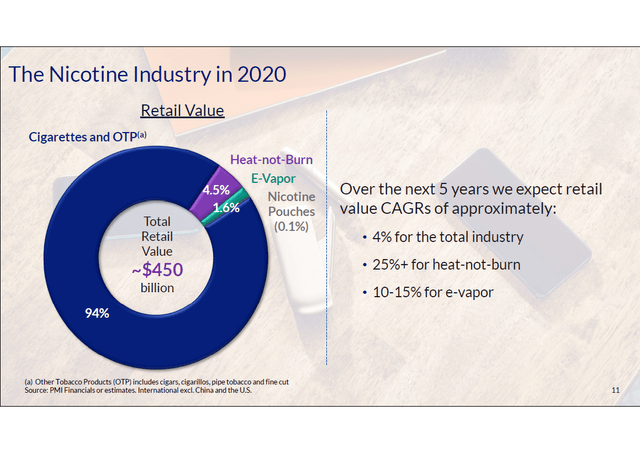

Image Shown: Philip Morris International Inc expects alternative nicotine products will grow at a robust pace over the coming years, with an eye towards heated tobacco units and oral nicotine products. By capitalizing on those opportunities, the company aims to diversify its revenues away from traditional cigarette sales. Image Source: Philip Morris International Inc – 2021 Investor Day Event Presentation

By Callum Turcan

The tobacco company behind international sales of the Marlboro cigarette brand and the IQOS heated tobacco offering, Philip Morris International Inc (PM), is one of our favorite high-yielding income generation ideas. Philip Morris is a stellar cash flow generator with ample pricing power, and management has laid out a sound strategy for how the firm intends to deal with the secular decline in cigarette unit volume sales. Its smoke-free IQOS heated tobacco products represent a key part of its longer term growth strategy given how sales of these products have boomed higher in recent years. Acquisitions in the realm of consumer health and biotech represent another way Philip Morris is diversifying its revenue streams away from traditional cigarette sales.

We include shares of PM as an idea in our High Yield Dividend Newsletter portfolio (more on that publication here). Shares of PM yield a nice ~5.9% as of this writing, and in our view, that payout is well-covered by Philip Morris’ robust free cash flow generating abilities.

IQOS Background Information

Philip Morris first launched its IQOS products in 2014 in Italian and Japanese markets before expanding sales globally. Its IQOS products heat tobacco without burning it and represents a healthier alternative to smoking traditional cigarettes. This claim is backed up by the US Food and Drug Administration (‘FDA’) which in July 2020 allowed the IQOS Tobacco Heating System to be marketed as modified risk tobacco products (‘MRTPs’), which came on the heels of the US FDA approving the sale of the company’s IQOS products in April 2019. In the US, Altria Group Inc (MO) markets IQOS products as part of a five-year strategic partnership with Philip Morris that was created in 2019 (for reference, Philip Morris was spun out of Altria Group in 2008, and Altria Group possesses some of the intellectual property covering heated tobacco products).

Here, we must stress that in the US market, Philip Morris has secured regulatory approval to both sell its IQOS products (as compared to some alternative tobacco products that did not secure regulatory approval) and to market these products as healthier alternatives to traditional cigarettes. Furthermore, IQOS products seek to imitate traditional cigarettes in terms of taste and fruity flavors of these products are not sold. While the European Commission is pushing to ban the sale of flavored tobacco heating products, this push would not negatively impact Philip Morris’ IQOS products and instead could support future sales of these offerings if the ban of its competitors is enacted.

Philip Morris’ latest IQOS device, IQOS Illumina, use TEREA SMARTCORE Sticks which are heated tobacco units exclusively designed for use by IQOS Illumina devices. The company also sells HEETS and HeatSticks which are used in earlier versions of its IQOS devices. Growing the user base of its IQOS products is expected to drive up sales of its TEREA SMARTCORE Sticks and volumes of its other heated tobacco units. While Altria Group markets IQOS devices and the related heated tobacco units in the US, Philip Morris markets these devices and products internationally.

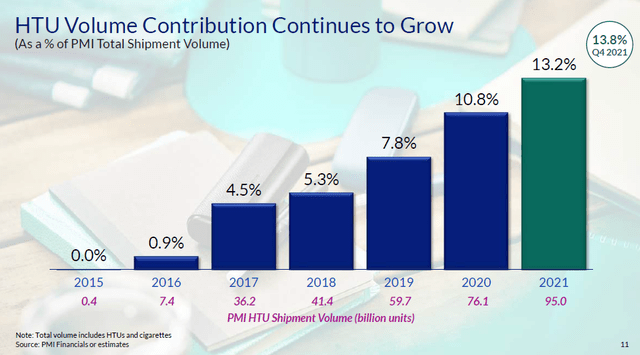

Sales of its heated tobacco units and IQOS devices have surged higher in recent years. Philip Morris shipped 0.4 billion heated tobacco units in 2015, the first full year after the launch of its IQOS offerings. In 2018, Phillip Morris shipped 41.4 billion heated tobacco units and by 2021, Phillip Morris’ heated tobacco unit shipment volumes stood at 95.0 billion and its IQOS user base stood around 21.2 million estimated users at the end of December 2021. Furthermore, in 2021, over 29% of Philip Morris’ adjusted net revenues were generated by smoke-free products (which also includes the sale of products such as its nicotine pouches along with the sale of heated tobacco units). The goal is to boost that figure up to ~40% in 2023 and north of 50% by 2025.

Image Shown: Unit shipment volumes of Philip Morris’ heated tobacco units have boomed higher in recent years and now represent a double-digit percentage of the company’s total shipment volumes. The company is well on its way to achieving its medium-term goal of generating over half of its revenues from smoke-less offerings by 2025. Growing the established user base of its IQOS devices is a key part of its strategy to achieve this goal. Image Source: Philip Morris – Fourth Quarter of 2021 IR Earnings Presentation

During the first three quarters of 2022, Philip Morris sold 77.1 billion heated tobacco units, up 11% year-over-year. Smoke-free products generated ~30% of Philip Morris’ total net revenues and ~30% of its net revenues on a pro forma basis (when adjusting for the impact of the Russian invasion of Ukraine in February 2022 and the negative impact that has had on Philip Morris’ global operations) during this period.

Expanding its IQOS manufacturing operations is expected to drive meaningful economies of scale at Philip Morris, resulting in substantial operating margin expansion over the coming years. Ongoing cost structure improvement initiatives are expected to further improve Philip Morris’ profitability levels.

During the company’s 2021 Investor Day event, Philip Morris noted that it aimed to achieve “around $2 billion in annualized gross cost efficiencies by 2023 (compared to the 2020 cost base)” and “an average annual increase in adjusted operating margins of at least 150 basis points on an organic basis.” While various exogenous shocks may force Philip Morris to adjust its timetable on these cost structure and operating margin improvement endeavors, we appreciate the firm’s focus on its bottom-line.

Acquisition Background Information

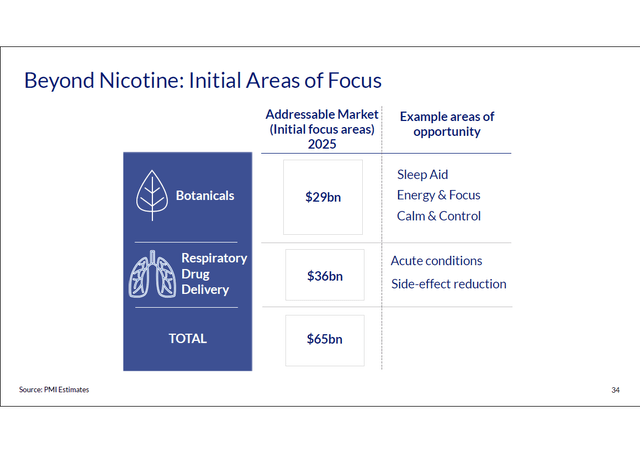

Philip Morris is leaning on more than just its IQOS products to grow its smoke-free revenues and diversify away from traditional cigarette sales. In 2021, Philip Morris acquired Fertin Pharma (a Danish pharmaceutical and consumer health company), Vectura Group (a UK pharmaceutical company), and OtiTopic (an American inhaled drug specialist company). Philip Morris also acquired AG Snus Aktieselskab and its subsidiary Tobacco House of Sweden AB, which sell oral nicotine products, last year.

Image Shown: An overview of some of the pharmaceutical and consumer health opportunities Philip Morris has its eye on. Image Source: Philip Morris – 2021 Investor Day Event Presentation

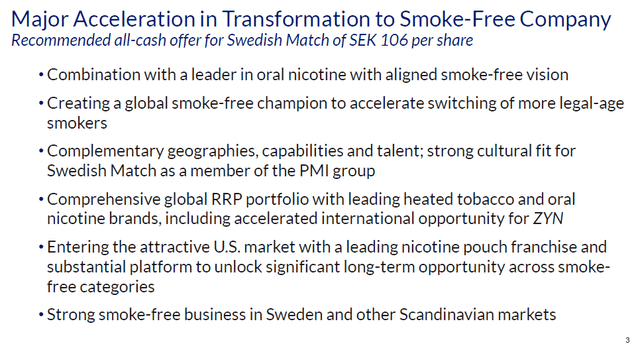

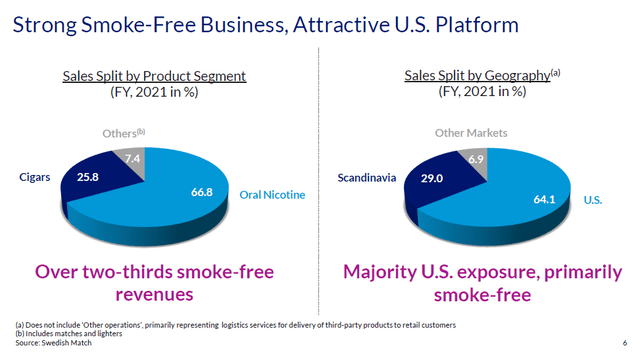

In May 2022, Philip Morris offered to acquire Swedish Match AB (SWMAY) through an all-cash deal that valued Swedish Match’s equity at ~USD$16 billion based on foreign currency exchange rates at the time (keeping in mind the US dollar has been quite strong of late). Swedish Match sells oral nicotine products, including the Zyn branded products, and demand for oral nicotine products has been quite robust in recent years, a trajectory Philip Morris expects will continue going forward. Additionally, Swedish Match also sells cigars under various brand names.

On October 20, Philip Morris raised its offer for Swedish Match. Now Philip Morris is offering 116 SEK per share in cash for each share of Swedish Match, up from 106 SEK per share previously. Philip Morris is expecting to receive antitrust approval from the European Union soon, and is doing its best to get the deal over the finish line.

Image Shown: Philip Morris’ pending deal for Swedish Match would significantly grow its exposure to the fast growing and lucrative oral nicotine market. Image Source: Philip Morris – May 2022 IR Presentation Covering Its Pending Swedish Match Acquisition

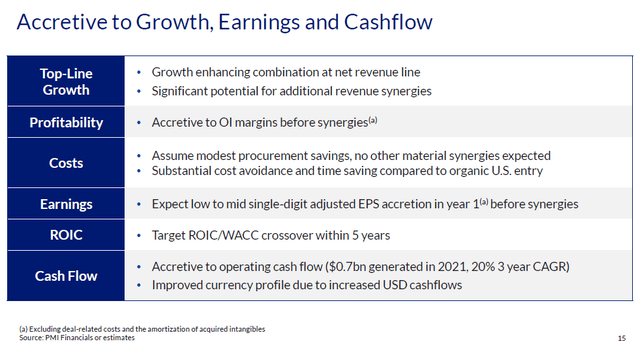

Should Philip Morris’ deal for Swedish Match go through, management expects the acquisition would be accretive to Philip Morris’ earnings and cash flows in the near term while creating ample growth opportunities over the long haul while generating substantial value for shareholders. Philip Morris expects the acquisition will improve its operating income margins, even before taking modest forecasted cost synergies via procurement savings into account. Most of the upside from this deal involves the future growth opportunities Philip Morris will gain access to, as compared to deals where the reasoning for the tie up rests heavily on targeted cost synergies.

Image Shown: Philip Morris views its pending Swedish Match acquisition as one that would significantly bolster its underlying financial performance. Image Source: Philip Morris – May 2022 IR Presentation Covering Its Pending Swedish Match Acquisition

Philip Morris is targeting revenue growth upside both in the US and internationally. As things stand today, most of Swedish Match’s revenues come from the US with its sales across various Scandinavian nations representing the bulk of the remainder. By leveraging Philip Morris’ global reach, the enlarged firm could push Swedish Match’s products into new geographical markets while maintaining its dominant position in its existing markets. In turn, that could generate material revenue and earnings growth over the coming years. We like its deal for Swedish Match, and Philip Morris expects the acquisition will close in the final quarter of 2022 if investors accept its sweetened offer.

Image Shown: Philip Morris can leverage its global reach to push Swedish Match’s oral nicotine and cigar offerings into new geographical markets, which in turn will generate substantial growth opportunities over the long haul. Image Source: Philip Morris – May 2022 IR Presentation Covering Its Pending Swedish Match Acquisition

One aspect of Philip Morris’ acquisition plan involves pushing into pharmaceutical and consumer health markets. The other involves Philip Morris scaling up its oral nicotine business. Combined, these deals and the potential for future acquisitions are expected to meaningfully diversify Philip Morris’ revenue streams.

In 2021, Philip Morris spent $2.1 billion in cash covering its aforementioned acquisitions that closed last year, utilizing its strong free cash flows to do so. From 2019-2021, Philip Morris generated ~$9.9 billion in annual free cash flow on average (including $11.2 billion in 2021) and its run-rate dividend obligations stood at $7.6 billion last year (along with $0.8 billion in ‘Payments to noncontrolling interests and Other’ financing activity cash outlays, some of which are similar to payout obligations).The company also spent $0.8 billion buying back its stock in 2021. However, Philip Morris has a sizable net debt load which we will cover in greater detail later on. We view its balance sheet obligations as manageable given Philip Morris’ stable cash flow profile.

Key Business Update

Philip Morris issued out a key business update on October 20, 2022. For starters, the commercial agreement between Philip Morris and Altria Group covering the sale of IQOS products in the US is set to expire in April 2024. Philip Morris will pay Altria Group $2.7 billion in total for the rights to market these products in the US, $1.0 billion of which was paid at the inception of the agreement. The remaining $1.7 billion, plus interest, will be paid by July 2023 at the latest. Here is an excerpt from Philip Morris’ October 2022 press release (emphasis added, lightly edited):

The original agreement between the two companies, which established a roadmap for the commercialization of heat-not-burn products in the U.S., was announced in 2013 and accounted for Altria’s ownership of certain U.S. intellectual property rights related to the IQOS technology that were developed prior to PMI’s 2008 spin-off. Following IQOS’s authorization for sale in the U.S. in 2019, the agreement covered an initial 5-year commercialization term for the product through April 2024, with potential renewal – subject to certain performance milestones – covering a second 5-year term through April 2029…

IQOS is the world’s leading smoke-free product, with strong growth achieved across a wide range of international markets. It established the innovative heat-not-burn category, driving its growth and becoming a $9 billion annual net revenue business outside the U.S. in 2021, some six years after its initial commercial launch. In this short time, the product has achieved double-digit national shares across a number of Asian, European and other markets – all with varying demographic profiles and adult smoker taste preferences.

The company views IQOS as a very substantial growth opportunity in the U.S. smoke-free market, whose retail value represents around 60% of that for the rest of the world, excluding China. The U.S. opportunity for IQOS is particularly significant given the clear demand from American adult smokers for credible smoke-free alternatives to cigarettes and the limited success to date of current offerings to fully switch adult smokers away from cigarettes. Furthermore, in the U.S., there are ample opportunities to build adult smoker awareness and understanding of smoke-free products, something that is particularly true for IQOS given its Modified Risk Tobacco Product authorizations.

We like this move as it will simplify Philip Morris’ business profile and give it direct exposure to a vast, lucrative, and fast growing market for its IQOS products.

Earnings Update

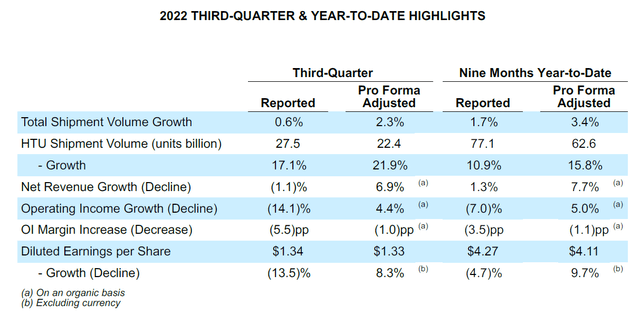

On October 20, Philip Morris reported third quarter 2022 earnings that beat both consensus top- and bottom-line estimates. While its GAAP net revenues declined by 1% year-over-year to $8.0 billion, Philip Morris’ non-GAAP adjusted revenues rose 7% in the third quarter due to 2% growth in its adjusted total shipment volumes, which was largely a product of its adjusted heated tobacco shipment volumes rising by 22%. Philip Morris’ reported financial performance was primarily held down by the strong US dollar seen of late and the negative impact that the ongoing Ukraine-Russia crisis has had on its operations. Its adjusted shipment volumes are supposed to remove the noise that various exogenous shocks have had on its recent operational performance.

The company’s GAAP diluted EPS fell by 14% year-over-year to reach $1.34 in the third quarter. Its non-GAAP adjusted pro forma diluted EPS came in at $1.33 last quarter, representing 8% year-over-year growth on a currency neutral basis. Here, we must stress that non-GAAP financial metrics always need to be taken into consideration with a pinch of salt, though its adjusted performance provides a useful snapshot of Philip Morris’ underlying performance.

Philip Morris’ pricing power continues to impress. The firm noted in its latest earnings press release that “combustible product pro forma adjusted net revenues increased by 4.1% on an organic basis, driven by a favorable pricing variance of 4.9%” in the third quarter on a year-over-year basis as consumers are apparently willing to pay up for Marlboro and other cigarette brands.

Image Shown: Philip Morris’ underlying business performed quite well in the third quarter, though foreign currency headwinds from the strong US dollar seen of late along with hurdles arising from the Ukraine-Russia crisis held down its reported financial performance. Image Source: Philip Morris – Third Quarter of 2022 Earnings Press Release

Philip Morris also adjusted its full-year guidance for 2022 once again during its third quarter earnings report, after adjusting its guidance during both its first and second quarter earnings updates. There is a fair amount of noise in Philip Morris’ near term guidance due to the Ukraine-Russia crisis, the strong US dollar seen of late, recent and pending acquisition activity, the lingering effects of the COVID-19 pandemic, supply chain hurdles, and other factors. As of its latest guidance, Philip Morris now expects to generate $6.09-$6.20 in non-GAAP adjusted diluted EPS on a pro forma, currency neutral basis in 2022, which represents 10%-12% annual growth.

Most importantly, Philip Morris is guiding to generate ~$10.5 billion in operating cash flow at current exchange rates (subjected to year-end working capital changes) and expects to spend ~$1.0 billion on its capital expenditures this year. That guidance implies that Philip Morris expects to generate ~$9.5 billion in free cash flow in 2022, which should enable the firm to keep making good on its dividend obligations going forward. In September 2022, Philip Morris boosted its dividend 2% on a sequential basis, bringing its quarterly payout up to $1.27 per share or $5.08 per share on an annualized basis.

At the end of September 2022, Philip Morris had $5.4 billion in cash and cash equivalents on hand versus $5.5 billion in short-term debt and $21.8 billion in long-term debt on the books. Philip Morris’ net debt to adjusted EBITDA ratio stood near 1.6x at the end of the third quarter, a manageable level of leverage, in our view.

Should Philip Morris’ deal for Swedish Match go through, we would like to see management take advantage of the enlarged firm’s stellar cash flow generating abilities and aggressively pare down Philip Morris’ net debt load over the coming years. Management noted that should the deal close, Philip Morris expects to have a net debt to adjusted EBITDA ratio of ~3x on a pro forma basis in 2022. Additionally, the stated goal is to quickly delever the balance sheet once the acquisition is completed, which we appreciate.

The company will need to tap capital markets, primarily debt markets, to cover its purchase of Swedish Match. Philip Morris also has several revolving credit facilities at its disposal. As Philip Morris has a stellar ‘A-rated’ investment grade credit rating (A2/A/A), we expect that debt markets should represent a solid financing option. However, we caution that Moody’s Corporation (MCO) changed its outlook on Philip Morris’ credit rating from stable to under review in May 2022 and may downgrade the firm’s credit rating. We are paying close attention to these events.

Concluding Thoughts

Philip Morris is a strong cash flow generator with ample pricing power and a bright growth outlook. Underlying demand for its IQOS heated tobacco offerings remains robust and demand for its traditional cigarette offerings is holding up well, even in the face of substantial inflationary pressures weighing negatively on consumer spending power around the global. Philip Morris’ near term guidance indicates that it should remain a strong free cash flow generator in 2022, allowing the firm to stay on top of its payout obligations.

Management remains committed to rewarding income seeking shareholders, and we continue to like exposure to shares of Philip Morris in our High Yield Dividend Newsletter portfolio.

-----

Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT, CHD, SYY, ADM, LANC, CASY

Tickerized for PM, SWMAY, MO, BTI, IMBBY, JAPAY, VGR, RLX, MCO

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE. PepsiCo Inc (PEP) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Philip Morris International Inc (PM) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment