Our Thoughts on SelectQuote Going Public

Image Source: SelectQuote Inc – S-1 filing

By Callum Turcan

On May 22, the digitally-oriented insurance comparison company SelectQuote Inc (SLQT) went public, and shares of SLQT have performed quite well since then as of this writing, jumping meaningfully from the reference price of $20 per share. The company intends to use some of the proceeds for debt reduction, as it is obligated to allocate at least a quarter of the net proceeds (up to $150 million) of the IPO towards paying down its term loan due November 2024 per a disclosure in SelectQuote’s S-1 filing seen down below:

The Senior Secured Credit Facilities require that at least 25% of the net proceeds to the Company from this offering (up to $150.0 million) be applied to the prepayment of the Term Loan, which otherwise matures in November 2024.

Business Model Overview

What SelectQuote offers is an online way for consumers to compare prices and policies for various insurance plans including life, auto, home, and senior healthcare insurance products. SelectQuote does not underwrite the insurance policies but sells these products on behalf of its various partners and takes a commission for each sale. Thus, SelectQuote does not have any underwriting risk. SelectQuote has licensed insurance agents in all 50 states, and at the end of 2019, the firm had 1,850 “full-time equivalent employees” including 636 core agents and 392 flex agents.

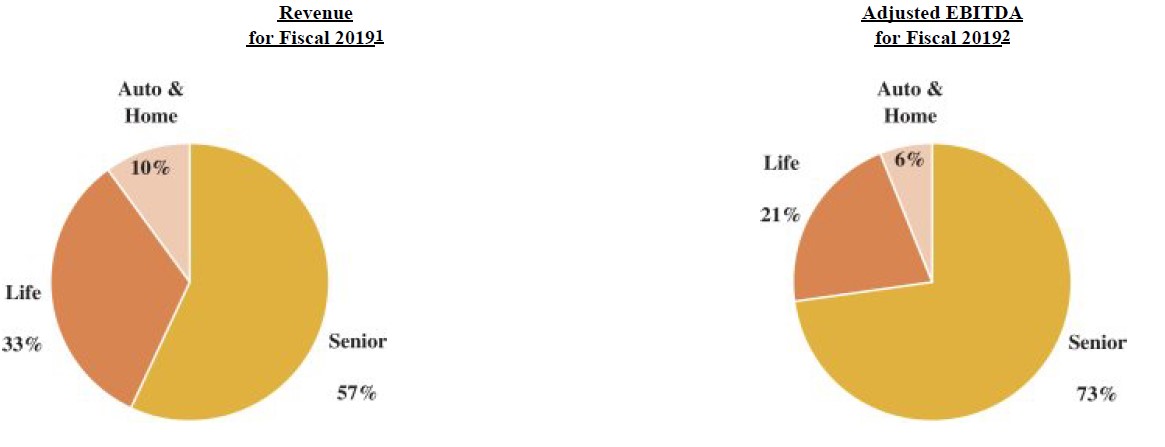

The vast majority of SelectQuote’s business model is built around senior healthcare products. That includes Medicare Advantage and Medicare Supplement insurance plans, along with supplemental insurance plans covering prescription drugs, dental, vision, hearing, and critical illness products. For reference, SelectQuote’s fiscal year starts July 1 (i.e. fiscal 2019 ended June 30, 2019). In the upcoming graphic down below, SelectQuote clearly highlights that senior healthcare insurance products are a core part of its business. This space is both the biggest generator of SelectQuote’s revenue and adjusted EBITDA (a non-GAAP figure).

Image Shown: SelectQuote’s business model is heavily weighted towards the revenues generated via commissions on senior healthcare insurance products. Additionally, the 1 and 2 both mean that the revenues and adjusted EBITDA for fiscal 2019 excludes “Corporate & Eliminations” factors. Image Source: SelectQuote – S-1 filing

Going forward, SelectQuote aims to aggressively expand its revenue and ultimately the bottom line by continuing to invest heavily in this space. On its website, SelectQuote touts that it is hiring licensed insurance agents as it seeks to use some of the IPO proceeds to expand its operations.

SelectQuote noted in its S-1 and S-1/A filings that a rising portion of those in the 65+ age group in the US are using the internet. From 2009 to 2019, the percentage of those in this demographic using the internet rose from 40% to 73%, according to data from Pew Research Center cited by SelectQuote’s securities filings. Combined with the “greying of America” trend that will see those in the 65+ age cohort grow substantially over the next decade, there is likely to be much greater potential demand for SelectQuote’s senior healthcare insurance products comparison service. Whether SelectQuote can take advantage of this trend depends on how well the company is able to stay ahead of its competitors. Humana Inc (HUM), UnitedHealth Group Inc (UNH), and CVS Health Corp’s (CVS) Aetna are SelectQuote’s major insurance partners in this arena.

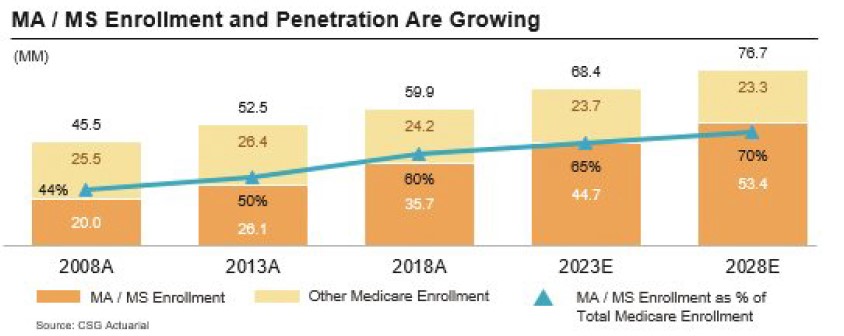

In the upcoming graphic down below, SelectQuote cites third-party data to indicate that the size of the Medicare Advantage, Medicare Supplement, and other Medicare enrollment insurance products market will grow materially in terms of enrollees. That, in theory, should support strong top-line growth at SelectQuote if it can properly capitalize on this trend, which would be seen through rising commissions-related revenues. In fiscal 2019, 74% of SelectQuote’s “approved Senior polices” were represented by its partner’s Medicare Advantage and Medicare Supplement plans. During what appears to be the first half of its fiscal 2020 (period ended December 31, 2019), 78% of SelectQuote’s approved ‘Senior’ policies were represented by its partner’s Medicare Advantage and Medicare Supplement plans.

Image Shown: SelectQuote cites data from CSG Actuarial that indicates the Medicare Advantage, Medicare Supplement, and other Medicare enrollment insurance products market should grow substantially through the end of this decade. Image Source: SelectQuote – S-1/A filing

Here’s a key excerpt from SelectQuote’s S-1 filing covering this trend:

Within the growing Medicare market, Medicare Advantage plans are gaining prominence, as these private market solutions displace the traditional, government Medicare program. At the end of 2018, there were approximately 20 million Medicare Advantage enrollees, representing approximately 33% penetration of the Medicare market, according to the Kaiser Family Foundation. By 2025, the number of Medicare Advantage enrollees is expected to swell to approximately 38 million, representing a 50% penetration rate of the Medicare market. Medicare Advantage is expected to reach 60% to 70% penetration between 2030 and 2040, according to LEK Consulting, highlighting the pace with which this already large segment of the Medicare market is growing.

Secular growth tailwinds and demographic trends support SelectQuote’s long-term growth trajectory. Commissions generated by selling its partner’s Medicare Advantage plans in particular represent a major source of SelectQuote’s revenues.

The market SelectQuote operates in is highly fragmented, offering both pitfalls and opportunities. SelectQuote’s growth trajectory will be heavily influenced by its technology investments, the ability to continuously improve its online user interface and the effectiveness of its advertising & marketing budgets. Primarily, its competitors are insurance providers that seek to sell their policies directly to consumers and third-party brokers. SelectQuote also competes with eHealth Inc (EHTH).

Financial Overview

Let’s now pivot towards SelectQuote’s historical financials. According to its S-1 filing, SelectQuote generated a little over $337 million in GAAP revenues in fiscal 2019, up from $234 million in fiscal 2018 (equal to over 44% year-over-year growth). Commissions represented 87.7% of SelectQuote’s fiscal 2019 revenues, down from 88.4% in fiscal 2018 as its ‘production bonus and other’ revenues grew by over 53% year-over-year during this period.

The firm’s operating expenses rose by a tad under 27% year-over-year in fiscal 2019, hitting $241 million, resulting in SelectQuote’s GAAP operating margin surging over 1000 basis points in fiscal 2019 (hitting ~28.5%) over fiscal 2018 levels. That allowed for SelectQuote to more than double its GAAP operating income on a year-over-year basis in fiscal 2019 as it reached $96 million. SelectQuote posted GAAP net income of $73 million in fiscal 2019, more than double fiscal 2018 levels.

Rising revenue has resulted in material economies of scale at SelectQuote, which is likely why shares of SLQT have performed so well initially. There is a powerful growth story here, and the firm is already profitable on a GAAP basis.

At the end of March 31, 2020, SelectQuote carried $411 million in total debt on the books versus $84 million in cash and cash equivalents. Considering SelectQuote intended to sell 18.0 million shares at $20 per share through its IPO (another 10.5 million are being sold by various stockholders which won’t raise proceeds for the company), that should have raised $360 million gross (before taking fees and other factors into account) for SelectQuote. Additionally, SelectQuote’s underwriters had the option to purchase an additional 4.275 million shares (within a 30 day window), which would raise an additional ~$86 million in gross proceeds for SelectQuote if fully exercised.

Either way, SelectQuote’s net debt position should have decreased materially after the IPO, especially considering that a chunk of the proceeds must go towards paying down its term loan (up to $150 million). The $425 million term loan due November 2024 was fully drawn as of the end of 2019, and that debt was largely to fund a $275 million distribution “on all classes of our stock and outstanding stock options” with the remainder used for “general corporate purposes” including working capital needs. That distribution was paid out on November 20, 2019.

Concluding Thoughts

When SelectQuote publishes its full fiscal year results for fiscal 2020 in the coming months, we will see how its growth trajectory is holding up and what the state of its financials are. This is a remarkably interesting company given its lack of underwriting risk, promising long-term growth outlook and the material margin expansion seen from fiscal 2018 to fiscal 2019, which may have carried on in fiscal 2020. We will have more to say as more information becomes available.

-----

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Data Sheet on Stocks in the Insurance Industry

Tickerized for companies in the SPDR S&P Insurance ETF (KIE)

Related: BRK.A, BRK.B, EHTH, HUM, SLQT, UNH

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc (BRK.A) (BRK.B) Class B shares are included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment