Our Thoughts on Philip Morris International’s Latest Earnings Report

Image Shown: Philip Morris International Inc has been able to maintain its global market share in the tobacco industry while pushing through price increases as indicated by its relatively strong ‘Combustible Tobacco Pricing’ performance seen through the first nine months of 2020. Image Source: Philip Morris International Inc – Third Quarter of 2020 IR Earnings Presentation

By Callum Turcan

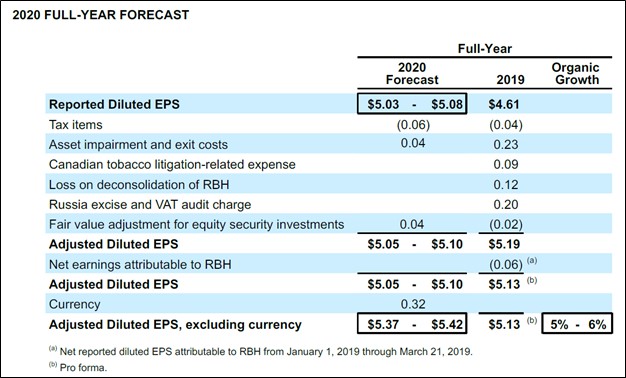

Tobacco giant Philip Morris International Inc (PM) reported third quarter 2020 earnings on October 20 which saw the company beat both consensus top- and bottom-line estimates. Philip Morris International also raised its full-year guidance for 2020 in part due to industry volumes holding up better than expected in Indonesia, which raised the minimum selling price for cigarettes while also increasing cigarette taxes at the start of 2020. For the full-year, the company now expects to generate $5.03 - $5.08 in GAAP diluted EPS (up from $4.84 - $4.99 previously) and $5.37 - $5.42 in non-GAAP adjusted diluted EPS (up from $5.23 - $5.38 previously).

Philip Morris International continued to maintain its ~28-29% market share (excluding China and the US) of the global tobacco industry in the third quarter. Additionally, the firm has been able to also push through price increases versus year-ago levels. We continue to like shares of Philip Morris International as a holding in our High Yield Dividend Newsletter portfolio. Shares of PM yield ~6.4% as of this writing on a forward-looking basis after the firm raised its quarterly dividend by roughly 3% in September.

Image Shown: Philip Morris International now expects its non-GAAP adjusted diluted EPS will grow by mid-single-digits on an annual basis in 2020. Image Source: Philip Morris International – Third Quarter of 2020 Press Release

In the third quarter, Philip Morris International’s GAAP net revenues were down 3% year-over-year though cost containment efforts and rising sales of non-conventional tobacco products helped boost its GAAP operating income by 16% year-over-year. The company posted $1.48 in GAAP diluted EPS last quarter, up 21% year-over-year. Philip Morris International is contending with serious headwinds from the ongoing coronavirus (‘COVID-19’) pandemic, and through various initiatives, management has been able to adeptly navigate the company through the storm.

Future of the Tobacco Industry

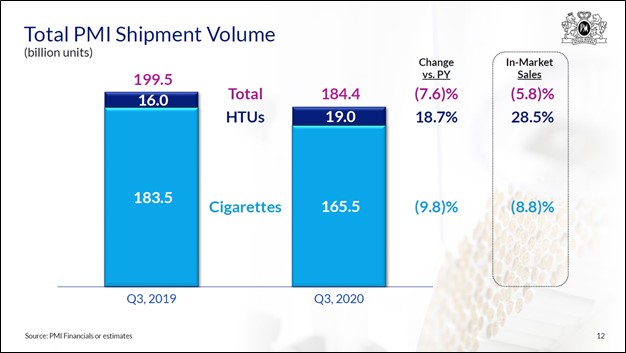

One realm of the tobacco industry Philip Morris International has had a lot of success in concerns the heated tobacco space. The company’s IQOS heated tobacco offerings are geared towards smokers of traditional cigarettes and the product was designed to replicate the conventional smoking experience. While Philip Morris International has other heated tobacco offerings, IQOS is its biggest bet on the future of tobacco. Global cigarette volumes are in secular decline while heated tobacco units (‘HTUs’) are experiencing strong sales growth, providing Philip Morris International a way to maintain and potentially grow its enormous cash flows going forward.

Image Shown: Philip Morris International is utilizing growing sales of its IQOS and other heated tobacco offerings to offset declines at its traditional cigarette business. Image Source: Philip Morris International – Third Quarter of 2020 IR Earnings Presentation

Management sees Philip Morris International’s IQOS user base now sitting at 16.4 million, with 72% of those users being former smokers of traditional tobacco products and the remainder are in what the company views as a transitional phase. Looking ahead, these users are a source of recurring revenues for Philip Morris International just as traditional cigarette smokers are. The company launched IQOS in nine new markets so far in 2020 and is currently available in over 60 markets worldwide. Upside in the future will come from the firm launching new HTU products and expanding into new markets, along with growing the user base of its existing products.

By 2021, Philip Morris International aims to sell 90 billion – 100 billion in HTUs. For reference, the firm sold just over 54 billion HTUs in 2020 through the end of September. Additionally, the company sold just under 60 billion HTUs in 2019, highlighting the rapid growth rate Philip Morris International is experiencing on this front. This momentum is expected to continue going forward.

During the first nine months of 2020, Philip Morris International generated almost one quarter of its net revenues from reduced risk products (‘RRPs’), up sharply from 2015 levels when RRPs were the source of less than 1% of the company’s net revenues. IQOS is considering an RRP. Additionally, RRPs are now the source of over 10% of the firm’s total shipment volumes (as of the first three quarters of 2020). During the company’s latest earnings call, management noted that “the positive effect of the shift in our sales mix towards RRPs can be seen in the 6.5% organic increase in net revenue per unit” and that should help support the firm’s margins going forward.

Financial Update

Cost containment efforts are also expected to improve Philip Morris International’s margins. During the company’s second quarter earnings call, management noted that the company was “on track to deliver our target of over $1 billion in efficiency by 2021 through both manufacturing productivity and SG&A savings.” Furthermore, Philip Morris International sees “additional opportunities” on this front which could be unlocked through “the acceleration of digital activities.” In its third quarter earnings presentation, the company noted that marketing, administration, and research costs as a percentage of its total net revenues were shifting lower. We appreciate Philip Morris International’s efforts to improve its cost structure.

At the end of September 2020, Philip Morris International had $4.8 billion in cash and cash equivalents on hand versus $2.1 billion in short-term debt and $27.3 billion in long-term debt. Though the company has a net debt load, we see Philip Morris International having a good handle on that burden given its ability to generate meaningful free cash flows in any environment.

Management forecasts that Philip Morris International will generate at least $9.0 billion in net operating cash flow and that the firm will spend $0.6 billion on its capital expenditures this year (keeping working capital movements and foreign currency fluctuations in mind). Please note the company moderately reduced its capital expenditure expectations for 2020 during its latest earnings report.

Concluding Thoughts

Though shares of PM sold off initially on the report, we view Philip Morris International’s latest update as validating our long-term income generating thesis. Its margins are improving, the company remains incredibly free cash flow positive, management recently pushed through another dividend increase, and Philip Morris International boosted its full-year outlook for 2020. We expect Philip Morris International will be able to maintain its generous payout policy throughout the pandemic.

-----

Recession Resistant Industry - BUD, CL, CLX, CPB, COST, FDP, GIS, HRL, K, KDP, KHC, KMB, KO, KR, MDLZ, MKC, MO, PEP, PG, PM, SJM, TAP, TGT, TSN, WMT

Related: SPY, VDC

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Philip Morris International Inc (PM) and Vanguard Consumer Staples ETF (VDC) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment