More Earnings Reports: BA, CMCSA, MCD

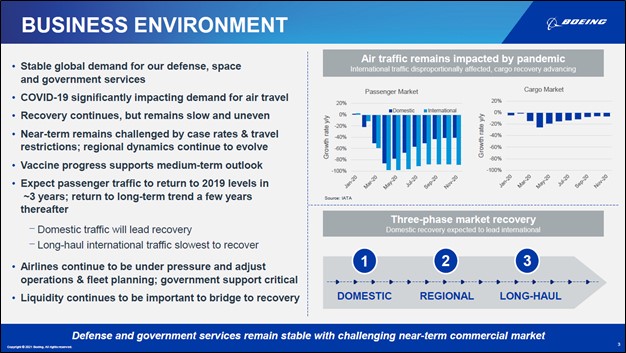

Image Shown: Though the past year has been brutal for the commercial airliner and aerospace industries and it will continue to be rough sledding in the near term, Boeing is optimistic that within a few years passenger traffic will return to pre-pandemic levels and resume its growth trajectory thereafter. Image Source: Boeing Company – Fourth Quarter of 2020 IR Earnings Presentation

By Callum Turcan

In alphabetical order by ticker: BA, CMCSA, MCD

We are continuing with our coverage of key earnings reports. Ongoing vaccine distribution activities should help global health authorities bring the coronavirus (‘COVID-19’) pandemic under control, though risks remain as new variants of the virus are popping up all over the place (and then spreading aggressively).

Boeing (BA)

Embattled aerospace giant Boeing Company (BA) reported fourth quarter earnings for 2020 on January 27 that missed both consensus top- and bottom-line estimates. It was a brutal earnings report as expected. Boeing’s GAAP revenues declined 15% year-over-year while its GAAP operating loss came in at $8.0 billion in the final quarter of 2020. Last quarter, Boeing’s GAAP operating loss grew by four-fold year-over-year. At the end of 2020, Boeing’s net debt load stood at $38.0 billion (inclusive of short-term debt) and that is on top of hefty long-term pension and retiree health care obligations.

Problems at its 737 MAX offering, delays in aircraft deliveries due to the COVID-19 pandemic (resulting in a large inventory buildup), and sharp reductions in its monthly aircraft production rates (reduced economies of scale) have weighed very heavily on Boeing’s operational and financial performance.

Recently, the US Federal Aviation Administration (‘FAA’), the European Union Aviation Safety Agency (‘EASA’) and the UK Civil Aviation Authority (‘CAA’) all gave approval for the 737 MAX to fly again which helps push things in the right direction, but much more needs to be done. Additionally, Boeing has received approval from the aviation regulatory bodies in Brazil and Canada to resume flights of its 737 MAX aircraft. Boeing generated negative net operating cash flows in both 2019 and 2020, resulting in large negative free cash flows. Its cash burn rate swelled primarily due to a large build in its inventory. Here is what management had to say on the issue during Boeing’s latest earnings call (emphasis added):

“Next, we're focused on safely delivering our 737 MAX airplanes that are in inventory, which began in December of last year. Prior to the delivery teams are performing all the necessary tests and ensuring each airplane receives customized care and rolls into a delivery stall ready for customer acceptance and FAA review.

Since the FAA’s approval to return the operations on November 18, we’ve delivered more than 40 737 MAX aircraft to our customers, and 5 airlines have safely returned their fleets to service, safely flying over 2,700 flights and approximately 5,500 flight hours as of January 25. Based on conversations with our customers, passenger load factors to date have been relatively consistent with the airline total fleet averages.

We're encouraged by the progress to date and also pleased with the confidence our customers have placed in us and the airplane, highlighted most recently by Ryanair [RYAAY] and Alaska Air [ALK] announcement. In addition to our 737 progress, we continue delivering for our Defense, Space & Services customers.” --- David Calhoun, President and CEO of Boeing

Boeing embarked on a massive cost cutting program which in the past few months has gotten even bigger as the firm attempts to rightsize the ship. That strategy involves consolidating production of the 787 aircraft at its production facilities in South Carolina, something Boeing aims to accomplish by March 2021. This year, Boeing aims to produce five 787 aircraft per month starting this upcoming March. At its ‘Commercial Airplanes’ division, Boeing has a total backlog of more than 4,000 airplanes (worth north of $280 billion). By early 2022, Boeing aims to boost its 737 Max production up to 31 aircraft per month as it seeks to catch up to its enormous project backlog.

As of this writing, Boeing is trading in the bottom half of our fair value estimate range and its weak technical performance of late indicates investors are not convinced that the company’s problems are going to go away anytime soon. In our view, it will be a long time until Boeing resumes its dividend payouts, which were suspended last year, as the company is now focused on reducing its elevated inventory levels (by resuming aircraft deliveries in earnest) and slowly ramping its production capabilities (to realize better economies of scale). Eventually, once Boeing is in a position to start generating significant positive free cash flows again, management would be wise to focus on deleveraging activities first before resuming share repurchases and dividend payouts. We think the company will.

Comcast (CMCSA)

On January 28, Comcast Corporation (CMCSA) beat both consensus top- and bottom-line estimates when it reported fourth quarter earnings for 2020. The firm noted its high-speed Internet business reported 538,000 net customer additions while its European-focused Sky pay TV business reported 244,000 in net customer additions (returning to 99.8% of pre-pandemic levels as it concerns its Sky business) in the fourth quarter. As it concerns Comcast’s Sky pay TV business, net customer gains in the fourth quarter helped limit the segment’s net customer loss to just 56,000 for all of 2020. In conjunction with its earnings release, Comcast announced it had increased its annualized dividend to $1.00 per share (good for a 9% year-over-year increase). Shares of CMCSA yield ~1.9% on a forward-looking basis as of this writing.

Most of Comcast’s revenues and adjusted EBITDA (a non-GAAP metric) are generated by its ‘Cable Communications’ business operating segment, which posted 6% sales growth and 12% adjusted EBITDA growth last quarter on a year-over-year basis. For the full-year, this segment posted 3% sales growth and 9% adjusted EBITDA growth on an annual basis, aided by the enduring strength of its high-speed internet provider business. If it were not for Comcast’s strong performance on this front, its financial performance in 2020 would have likely been dire. Here is what management had to say on the issue during Comcast’s latest earnings call (emphasis added):

“This year's Cable results were nothing short of exceptional, hitting a number of company records. We generated 2 million net broadband additions for the year, and 538,000 for the fourth quarter, reaching record low churn. High speed internet drove our highest ever full year net customer relationship additions of 1.6 million, bringing us to 33 million total customer relationships. Yet with just only 50% penetration of our footprint, there remains plenty of opportunity for future growth.

We also delivered outstanding EBITDA growth of nearly 9% and cash flow growth of 16% all of 2020. Broadband is the cornerstone of what we do, powered by our robust, flexible and reliable network. And many years of investments we've made have been on full display.

We've continued to enhance our market leading competitive position, while keeping people connected, protected, informed and entertained by proactively managing our network, increasing broadband speeds, expanding our internet essentials program for low-income households, providing payment plans for customers struggling the most, and offering Peacock and Flex for free.” --- Brian Roberts, CEO of Comcast

Comcast’s NBCUniversal segment reported that its revenue and adjusted EBITDA took a big hit in 2020 and these headwinds persisted into the fourth quarter. NBCUniversal’s theme park business is slowly recovering, with management noting that the firm’s “theme parks in Orlando and Osaka reached breakeven” last quarter in Comcast’s latest earnings press release. However, its theme park operations in California (Universal Studios Hollywood) remain closed and its open theme parks are operating at limited capacity. The financial and operational performance of Comcast’s Sky business also was hit hard by the COVID-19 pandemic, though things started to improve in the final quarter of last year.

On a positive note, Comcast’s new Peacock video streaming service has had 33 million sign ups across the US as of its latest earnings report. Additionally, please note Comcast owns a third of popular video streaming service Hulu with Disney (DIS) owning the remaining two thirds (for reference, Disney effectively controls Hulu through an agreement reached in 2019). Comcast’s Peacock service has a free ad-supported package (with limited content) along with additional packages that have significantly more content and no ads. Video streaming services have been in high demand during the COVID-19 pandemic, which indirectly drove up demand for Comcast’s high-speed internet offerings.

In 2020, Comcast generated ~$11.1 billion in free cash flow and spent $4.1 billion covering its dividend obligations and another $0.5 billion on ‘repurchases of common stock under employee plans’ with both activities fully covered by its impressive free cash flow generating abilities. However, we caution that Comcast’s total debt load (inclusive of short-term debt) stood at $103.8 billion at the end of 2020, which was moderately offset by $11.7 billion in cash and cash equivalents (Comcast also has considerable long-term investments on the books). We appreciate the resilience of Comcast’s cash flow profile, though its enormous total debt load weighs very negatively on its forward-looking dividend coverage. Shares of CMCSA are trading in the top half of our fair value estimate range as of this writing and are supported by decent technical performance of late.

McDonald’s (MCD)

When McDonald’s Corporation (MCD) reported fourth quarter earnings for 2020 on January 28, the company missed both top- and bottom-line consensus estimates as its business continues to face meaningful headwinds from the COVID-19 pandemic. Its drive-through and delivery operations have offered some reprieve, though its global comparable store sales were still down 1.3% (on what appears to be a year-over-year basis) during the fourth quarter of 2020. However, that was significantly better than its full-year performance considering the company’s global comparable store sales fell by 7.7% in 2020.

There were some bright spots as its comparable store sales in the US grew by 5.5% last quarter. McDonald’s is getting ready to launch three new chicken sandwich offerings in the US soon: the Crispy Chicken Sandwich, Spicy Chicken Sandwich, and Deluxe Chicken Sandwich. The Golden Arches is competing with Restaurant Brands International's (QSR) Popeyes Louisiana Kitchen, Yum Brands' (YUM) KFC, privately-held Chick-fill-A, and Wendy's (WEN). We covered this news in the past (link here) and conducted a survey on Twitter (TWTR) covering the “US Chicken Sandwich War” that can be viewed in the upcoming graphic down below.

Image Shown: It appears that social media users continue to view Chick-fil-A and Popeyes as the two dominant quick-service restaurants in the “US Chicken Sandwich War” as McDonald’s gets ready to enter the fray.

Here is what the management team of McDonald’s had to say regarding the new chicken sandwich offerings during the firm’s latest earnings call (emphasis added):

“C stands for our commitment to the core menu. Our delicious core is something people rely on it and return to again and again. Our core classics comprise roughly 70% of our food sales across our top market. They drive growth and profitability and we saw that this past year. Developing a reputation for great chicken represent one of our highest ambition. That's why markets are activating multi tiered strategy and holistic approaches that integrate great products, strong and sustained marketing and operations excellence.

Rebuilding on the strength of core equities like Chicken McNuggets, and McChicken sandwiches, which have seen significant growth as we continue to focus on improving our large chicken sandwich offerings around the world. The U.S., we are excited about the return of spicy Chicken McNuggets and the launch of the new crispy chicken sandwich at the end of February.” --- Chris Kempczinski, CEO of McDonald’s

McDonald’s remained very free cash flow positive in 2020, a product of its asset-light business model after the company increased the percentage of its restaurant locations that are franchised over the past several years. Last year, McDonald’s generated $4.6 billion in free cash flow and spent $3.8 billion covering its dividend obligations along with another $0.9 billion buying back its stock. Though McDonald’s generated $5.7 billion in free cash flow in 2019, its 2020 performance was still impressive given the enormous exogenous headwinds the company had to deal with.

At the end of 2020, McDonald’s had $3.4 billion in cash and cash equivalents on hand versus $35.2 billion in long-term debt (its current liabilities line-item was provided as one figure and not broken down in the earnings press release). In our view, it would be prudent for management to pare that debt load down when the company’s financial and operational performance shows signs of sustained improvement. Shares of MCD are trading near our fair value estimate of $206 per share and yield ~2.5% as of this writing.

Concluding Thoughts

We are closely monitoring the markets as trading activity in numerous firms, usually heavily shorted firms, remains erratic. Recently, brokerages like Robinhood have limited their user’s ability to trade certain equities in a bid to try and calm financial markets down, though these actions have not prevented the share prices of firms like GameStop (GME) and AMC Entertainment (AMC) from swinging around wildly, at least not as of this writing.

-----

Related: BA, CMCSA, MCD, DIS, WEN, QSR, YUM, TWTR, RYAAY, ALK

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment