Lumen’s Dividend Cut Highlights Effectiveness of Valuentum’s Dividend Methodology and Uniqueness of Dividend Cushion Ratio

Image Source: Valuentum

By Brian Nelson, CFA

The Dividend Cushion ratio considers the company’s net cash on its balance sheet (total cash less long-term debt) and adds that to its forecasted future free cash flows (cash from operations less capital expenditures) over a five-year period and divides that sum by the company’s future expected cash dividend payments over the next five years.

At its core, the Dividend Cushion ratio tells investors whether the company has enough cash to pay out its dividends in the future, while considering its debt load (capital structure). If a company has a Dividend Cushion ratio above 1, it can cover its dividend, but if it falls below 1, trouble may be on the horizon.

The Dividend Cushion ratio is found within each company’s Dividend Report on its respective stock landing page, which can be found using the ticker search function at the top right of Valuentum.com (in the header of the website). We update our Dividend Reports on companies regularly, and we encourage members to check the Dividend Cushion ratios on their dividend growth and income investments periodically.

Even subtle changes in the Dividend Cushion ratio could reveal the trajectory of dividend health.

Lumen Is a Quintessential Example of the Differentiation and Effectiveness of the Dividend Cushion Ratio Relative to Dividend Payout Ratios and Even Cash Flow Coverage Ratios

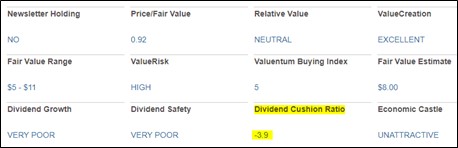

Lumen Technologies (LUMN), a provider of cloud storage and IT solutions as well as IP and data applications, announced in its third-quarter press release November 2 that it will eliminate its stock dividend and that there would be no dividend paid in the fourth quarter of 2022. Lumen’s Dividend Cushion ratio, a measure we calculate to assess the likelihood of a dividend cut (the lower the ratio, the worse) stood at -3.9 (negative 3.9) at the time of the cut.

Image Source: Lumen’s stock page on Valuentum’s website.

A lot of times investors only focus on the dividend payout ratio – dividends paid per share divided by earnings per share – or free cash flow coverage of the dividend, but the balance sheet is so very important to the sustainability of the dividend, too – something that the Dividend Cushion ratio embraces but other dividend health metrics do not.

For example, Lumen’s dividend payout ratio was 50% ($0.75 in dividends divided by $1.50 in earnings per share during the first three quarters of the year), and its free cash flow was enough to cover its cash dividends paid during the first nine months of 2022, too. Free cash flow generation was $1.7 billion during the first three quarters of 2022, while cash dividends paid came in at $780 million.

However, the company held a massive ~$25 billion net debt position at the end of the quarter, which pushed its Dividend Cushion ratio deep into negative territory, raising a huge red flag with respect to the sustainability of the payout. Ignoring the balance sheet both with respect to intrinsic value and dividend analysis could be a recipe for disaster. Other metrics are lacking when they ignore the important analytical information contained on the balance sheet.

Concluding Thoughts

Shares of Lumen have languished this year, and the firm authorized up to a $1.5 billion, two-year share repurchase program, but even that may be ill-advised as the firm retains a mountain of net debt, which should be pared down. The company doesn’t need any more leverage.

The writing was on the wall with respect to concerns over the sustainability of LUMN’s dividend payout, not only with respect to its tremendously weak and deeply negative Dividend Cushion ratio, but also as it relates to the company’s share price action. We will be dropping coverage of LUMN in the coming quarters, but what a great example that showcases the effectiveness of our dividend methodology.

Make sure you are paying attention to your Dividend Cushion ratios >>

Tickerized for holdings in the SPYD.

---------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.

---------------------------------------------

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment