Lockheed Martin Raises Guidance

Image Shown: Lockheed Martin Corporation posted a strong fiscal second quarter earnings report which saw shares of LMT move higher over the following trading days. Image Source: Lockheed Martin Corporation – Second Quarter Fiscal 2020 IR Earnings Presentation

By Callum Turcan

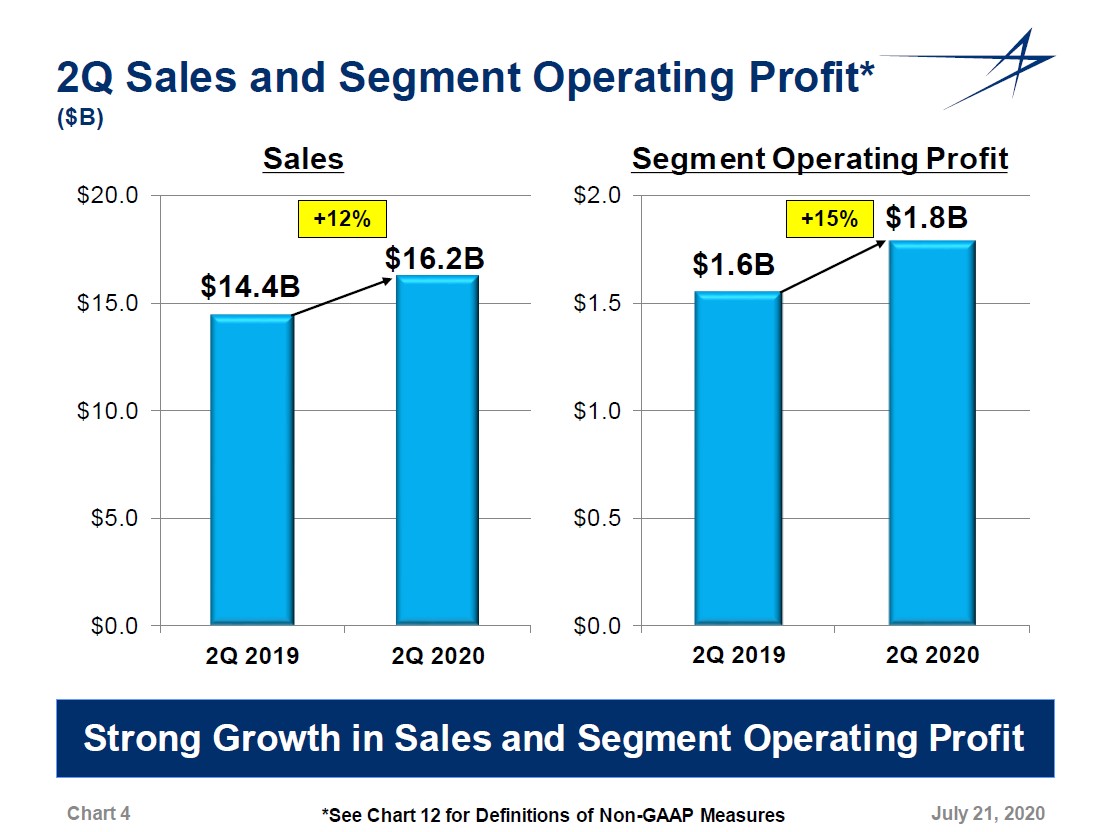

On July 21, Lockheed Martin Corporation (LMT) reported second quarter fiscal 2020 earnings (period ended June 28, 2020) that beat both consensus top- and bottom-line estimates. Furthermore, Lockheed Martin boosted its guidance for fiscal 2020, even in the face of the ongoing coronavirus (‘COVID-19’) pandemic. Shares of LMT yield ~2.5% and are trading well below their fair value estimate of $432 per share as of this writing. We continue to like Lockheed Martin as a holding in the Dividend Growth Newsletter portfolio.

Guidance Boost

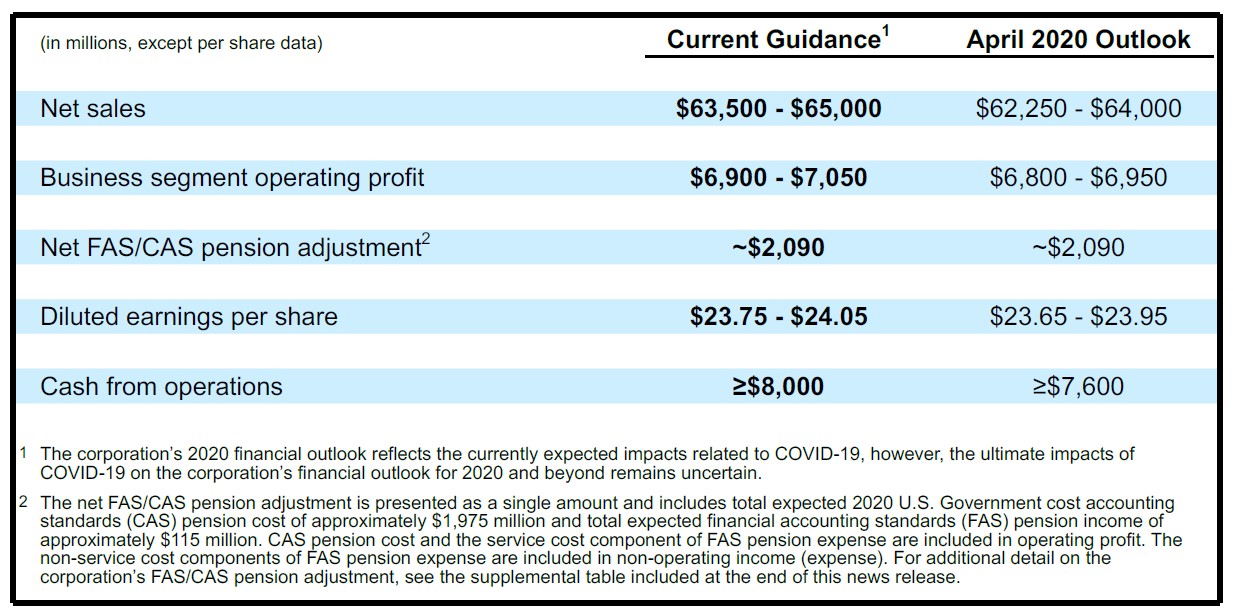

Lockheed Martin provided an overview of its improved full year fiscal 2020 guidance, as shown in the upcoming graphic down below. We appreciate management’s confidence in Lockheed Martin’s financial trajectory, a product of the company’s top notch operational performance over the past several years. Lockheed Martin’s new CEO James Taiclet just took over from former CEO Marillyn Hewson, who did a stellar job running Lockheed Martin after she took over the CEO role in 2013. Please note she continues to serve as executive chairwoman of the board, and the executive transition appears to have gone smoothly.

Image Shown: Lockheed Martin increased its guidance for fiscal 2020 during its latest earnings report. Image Source: Lockheed Martin – Second Quarter Fiscal 2020 Earnings Press Release

The increase in Lockheed Martin’s forecasted fiscal 2020 net sales lends support to its near-term free cash flow generating abilities (management also increased the firm’s expected cash flow generation this fiscal year). Management had this to say regarding Lockheed Martin’s improving outlook during the firm’s latest earnings call:

“We have updated our full year guidance increasing our estimates for sales, earnings and operating cash flow as COVID-19 mitigation plans and our outstanding performance and minimize our year-to-date impacts. Overall, it was a strong quarter for the business in challenging times…

We have adjusted our estimates for Aeronautics, Space and RMS [Rotary and Mission Systems], increasing the midpoint of our sales range by $1.125 billion. And based on our current assessment of the full year, while COVID-19 has caused disruption in our supply chain and as some of our key locations, we have had non-COVID performance that has offset the impacts and gives us confidence to increase our 2020 outlook…

And in total, we have raised the midpoint of our segment operating profit guidance by $100 million [due to stronger than expected performance at its Aeronautics, Space, and RMS business segments].”

Compared to the guidance given out during Lockheed Martin’s fiscal first quarter earnings reported (which we covered here), management appeared to have a lot more confidence in the company’s near-term trajectory than before. Shares of LMT have started to recover additional lost ground recently, likely in part due to investors realizing Lockheed Martin is better positioned than most to ride out the storm.

Financial Update

Defense contracting activities were deemed essential during the pandemic (in the US and elsewhere), allowing Lockheed Martin to continue operating. The firm’s GAAP net sales grew by over 12% versus the same period last fiscal year and its GAAP net income climbed higher by a little under 15% year-over-year in the fiscal second quarter. Combined with a modest reduction in Lockheed Martin’s weighted average shares outstanding, the company’s GAAP diluted EPS rose to $5.79 in the fiscal second quarter, up ~16% year-over-year.

The defense contractor reported strong sales growth across the board last fiscal quarter. Sales growth was reported at its ‘Aeronautics,’ ‘Missiles and Fire Control,’ ‘Rotary and Mission Systems,’ and ‘Space’ business segments, and all but the later also posted strong operating income growth as well (the firm’s Space business saw its segment-level operating income fall year-over-year). Both Lockheed Martin’s Aeronautics and Rotary and Mission Systems businesses posted significant segment-level operating margin expansion in the fiscal second quarter, though an impairment charge held down the firm’s company-wide GAAP operating margin on a year-over-year basis.

Lockheed Martin’s backlog hit a record last fiscal quarter, reaching $150.3 billion, which was up over $6.3 billion from the end of fiscal 2019 (period ended December 31, 2019). The company exited the fiscal second quarter with $2.9 billion in cash and cash equivalents on hand versus $0.5 billion in short-term debt and $12.2 billion in long-term debt, good for a net debt position of ~$9.8 billion. That was a significant improvement from a net debt position of ~$11.1 billion at the end of fiscal 2019. We appreciate Lockheed Martin’s growing backlog, as that lends ample support to its growth outlook, and strongly appreciate management paring down Lockheed Martin’s net debt position.

During the first half of fiscal 2020, Lockheed Martin generated $4.5 billion in net operating cash flow and spent $0.6 billion on capital expenditures, allowing for ~$3.9 billion in free cash flow. The company paid $1.4 billion covering its dividend obligations and $1.0 billion repurchasing its stock during this period. Lockheed Martin’s cash flow profile has held up incredibly well during the pandemic, and we expect that to continue being the case going forward.

We like Lockheed Martin’s dividend coverage strength on a forward-looking basis. Lockheed Martin’s Dividend Cushion ratio sits at 1.8, earning the firm a “GOOD” Dividend Safety rating. That forward-looking metric factors in strong forecasted per share dividend growth over the coming fiscal years. Lockheed Martin earns a “GOOD” Dividend Growth rating for that reason.

Concluding Thoughts

We continue to like Lockheed Martin in the Dividend Growth Newsletter portfolio and view it as a solid hedge against rising geopolitical tensions, which have continued to simmer during the pandemic. The US Senate just passed a massive defense bill (the National Defense Authorization Act or NDAA) with bipartisan support (86-14 voted in favor) that calls for over $740 billion in defense-related spending for the upcoming fiscal year, and the US House also recently passed its own version of the bill with bipartisan support (295-125 voted in favor) that calls for a similar amount of spending. Please note that represents modest growth over budgeted defense spending in the US federal government’s fiscal 2020, highlighting the resilience of the domestic defense industry.

-----

Prime Aerospace & Defense Industry – BA FLIR GD LMT ROC RTX

Conglomerates Industry – MMM DHR GE HON [UTX is now part of RTX]

Aerospace Suppliers Industry – ATRO HEI HXL TDY TXT SPR

Related: SPY, XAR

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Lockheed Martin Corporation (LMT) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment