Lockheed Makes an Intriguing Acquisition

Image Source: Lockheed Martin Corporation – December 2020 IR Presentation covering Lockheed Martin Corporation’s pending acquisition of Aerojet Rocketdyne Holdings Inc

By Callum Turcan

On December 20, Lockheed Martin Corporation (LMT) announced it was acquiring Aerojet Rocketdyne Holdings Inc (AJRD) for $56.00 per share in cash, or $51.00 per share after taking into account a special $5.00 per share pre-closing cash dividend payment that Aerojet Rocketdyne plans to pay out. The deal has a total equity value of ~$5 billion when including the special dividend component and is expected to close in the second half of 2021. In our view, this deal is highly complementary to Lockheed Martin’s existing operations. Combining Aerojet Rocketdyne’s propulsion and power systems business segments with Lockheed Martin’s expansive aircraft, helicopter, missile, space, maritime, and weapon systems business segments should lead to sizable operational and developmental synergies.

In the upcoming graphic down below, Aerojet Rocketdyne provides an overview of its operational focus. Lockheed Martin has an extensive presence in all of these categories. We are intrigued by the potential synergies the combined firm could generate in the realm of space given expectations that space-related investment will grow materially over the coming decades.

Image Shown: Aerojet Rocketdyne’s operations are highly complementary with Lockheed Martin’s. We are intrigued by the potential synergies that could be generated as it concerns the combined entity’s space operations. Image Source: Aerojet Rocketdyne – September 2020 IR Presentation

Federal governments are expected to play a leading role in boosting space-related investment with an eye towards national security activities. In late 2019, the US Space Force was officially created when the 2020 National Defense Authorization Act was signed into law by President Trump. On the private-sector side of things, Virgin Galactic Holdings Inc (SPCE) plans to offer space tourism travel packages. Those trips could begin in 2021 but more likley a bit later as there are serious operational concerns with space flight. For instance, one of Virgin Galactic’s test flights in December 2020 did not go as planned, though the pilots were able to safely land the vessel.

Beyond space, missile systems and aerospace are two key areas where Lockheed Martin and Aerojet Rocketdyne’s operations overlap. Lockheed Martin is the prime contractor on the Joint Strike Fighter (‘JSF’) program which is developing and manufacturing the F-35 jet fighter for the US and various Western-allied nations worldwide. During the first nine months of its fiscal 2020 (period ended September 27, 2020), Lockheed Martin delivered 78 F-35 jet fighters. There is ample room for upside as Lockheed Martin’s total project backlog is enormous as of September 27, as one can see in the upcoming graphic down below. Furthermore, US defense spending remains resilient, and that will continue to support demand for the F-35 jet fighter and Lockheed Martin’s other offerings (such as its expansive missile defense portfolio).

Image Shown: Lockheed Martin’s total backlog continued to grow in fiscal 2020 versus levels seen at the end of fiscal 2019. Image Source: Lockheed Martin – Third Quarter of Fiscal 2020 Earnings Press Release

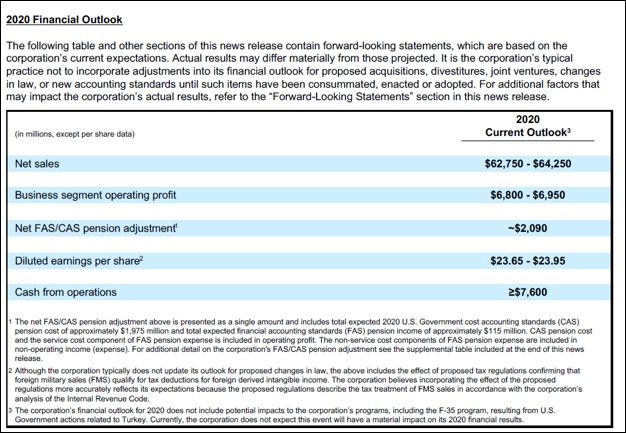

Financial Considerations

Lockheed Martin has the strength to acquire Aerojet Rocketdyne without harming its financial position. After taking the special dividend and expected debt repayments into account, Lockheed Martin forecasts that Aerojet Rocketdyne will have a ~$0.2 billion net cash position when the deal closes (for a total transaction value of ~$4.4 billion), though Lockheed Martin will likely tap debt markets for funds to cover the acquisition. From the end of fiscal 2018 (period ended December 31, 2018) to the end of Lockheed Martin’s third quarter of fiscal 2020 (period ended September 27, 2020), Lockheed Martin’s net debt load dropped from $13.3 billion to $9.1 billion (inclusive of short-term debt), putting the firm in a better position to cover this deal.

During the first three quarters of fiscal 2020, Lockheed Martin generated $5.3 billion in free cash flow while spending $2.0 billion covering its dividend obligations and another $1.1 billion buying back its stock. Given that Aerojet Rocketdyne has historically been comfortably free cash flow positive (the firm generated $0.1 billion during the first nine months of 2020) as has Lockheed Martin, the latter should be able to quickly improve its balance sheet once the deal closes. Though we prefer net cash positions, Lockheed Martin’s impressive cash flow profile and stellar ‘A-rated’ investment grade credit rating (I, II, III) indicates the company has the financial capacity to continue growing its dividend, fund its acquisition of Aerojet Rocketdyne, and maintain its financial strength going forward.

In the recent past, Lockheed Martin has been able to raise funds via debt issuances at attractive rates. In May 2020, the company issued $0.4 billion in 1.85% senior unsecured notes due 2030 and $0.75 billion in 2.80% senior unsecured notes due 2050. Those proceeds were used to retire debt and improve Lockheed Martins’ debt maturity schedule through various actions taken in June 2020. We expect Lockheed Martin will be able to continue tapping capital markets at attractive rates going forward.

Concluding Thoughts

We like Lockheed Martin’s dividend growth outlook and view its pending acquisition of Aerojet Rocketdyne as favorably augmenting its cash flow growth trajectory. Lockheed Martin is included in the Dividend Growth Newsletter portfolio at a moderate weighting, and shares of LMT yield a nice ~3.0% as of this writing. On a final note, Lockheed Martin has reportedly been selected to assist a consortium that seeks to develop a new jet fighter with Japan, with Mitsubishi Heavy Industries Ltd (MHVYF) taking the lead on that endeavor. When Lockheed Martin reports its next earnings report, we will be keeping a close eye on its integration plans for Aerojet Rocketdyne and any update on the news concerning Japan’s potential new jet fighter.

Disruptive Innovation Industry – W, ZM, SPCE, ROKU, WORK, MNST, SAM, SPLK, PENN, VRSK, ICE, LULU, ESTY, DOCU, UBER, BYND

Industrial Leaders Industry - MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Tickerized for LMT, AJRD, SPCE, MHVYF, SAFRY, SAFRF, NOC, MOG.A, MOG.B, GD, LHX, EADSF, EADSY, MAXR

Other: UFO, ROKT

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment