Lloyds Banking Group Is Struggling Against the Tide

Lloyds Banking Group’s business model focused on being a “digitized, simple low risk, customer focused, U.K. financial services provider” sounds good on the surface, but uncertainty surrounding the U.K’s recovery makes this bank much more risky than some of its U.S. counterparts, in our view. Investors should take note the inherent leverage and riskiness of any banking business model, and Lloyds is no exception.

By Matthew Warren and Brian Nelson, CFA

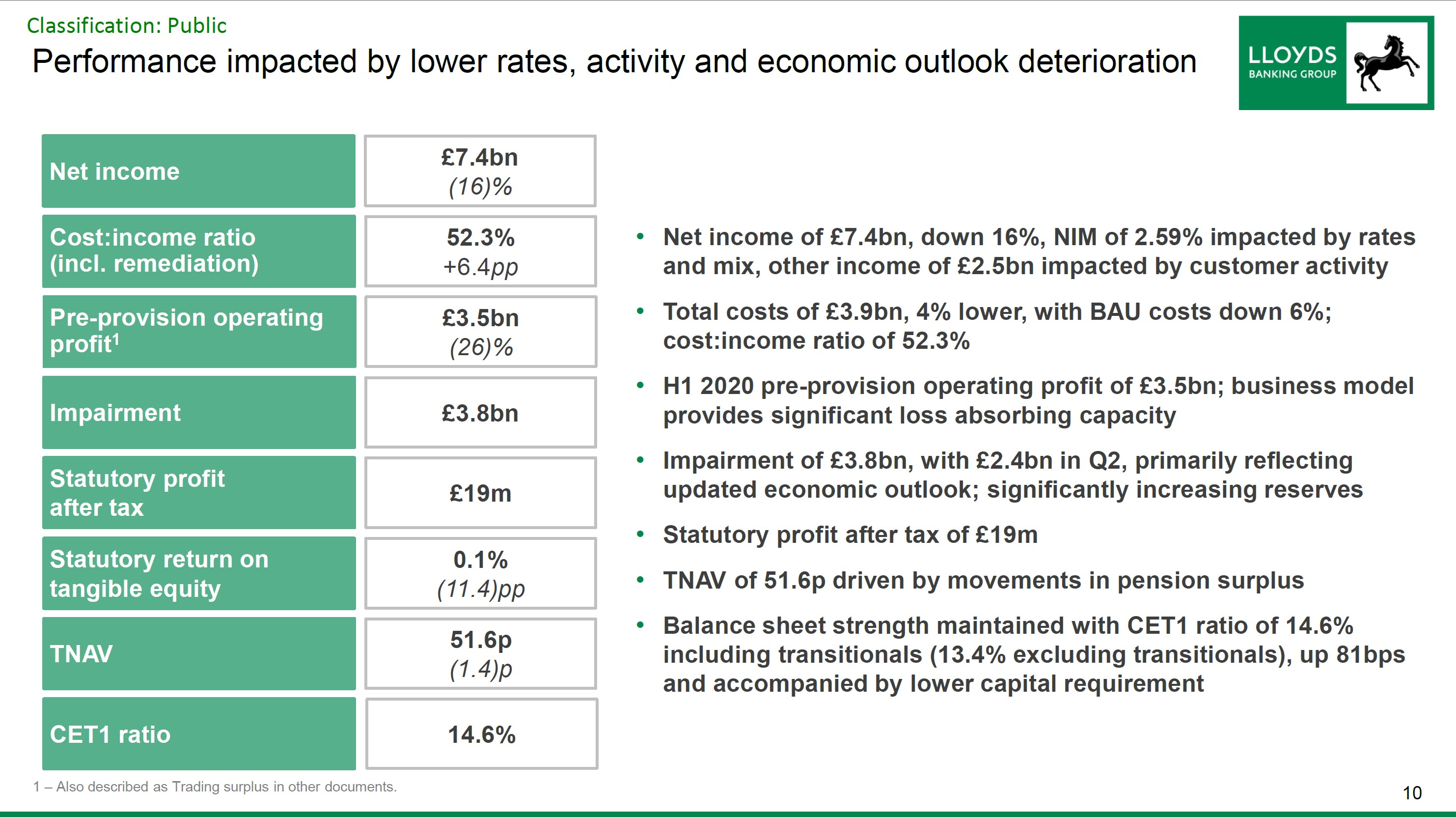

On July 30, Lloyds Banking Group (LYG) reported a dismal set of results for the first half of 2020. Net income was down 16% and statutory profit after tax was only GBP 19 million. Revenues came under pressure due to lower rates and lesser customer activity, while the provision for loan losses put a huge dent in the bottom line. The bank benefited a bit from its prior investments across digital, and the company was active in participating in government-backed stimulus programs during the period.

Image Shown: Lloyds’ first half results were pretty dismal indeed. Image Source: Lloyds 1H2020 Earnings Presentation

Impairments were GBP 2.388 Billion in the second quarter versus GBP 1.430 Billion in the first quarter of this year, showing the increased sequential pressure on the P&L statement. Management is guiding for the full year impairment to be GBP 4.5 Billion to GBP 5.5 Billion, so a sequential improvement on a quarterly basis from here. This of course will depend on how the economy and the pandemic progresses from this point, which is hard for anyone to predict.

Per its slide deck (and as we have heard from other companies), the “economy is starting to return to growth alongside easing of lockdown measures.” In particular, Lloyds noted that it was seeing a bounce during July in the areas of consumer spending and housing market activity, though it did note that the commercial recovery has been slower. Looking ahead to full-year 2020 numbers, the bank expects its net interest margin to remain “broadly stable,” resulting in an annual measure of c.250 basis points.

Concluding Thoughts

Some of the stronger global banks are handling the difficulties surrounding COVID-19 quite well, but other banks are suffering with losses and lower capital levels. Lloyds Banking Group falls somewhere in the middle as it has strong capital levels, but little earnings power at this point during the economic cycle. Its business model focused on being a “digitized, simple low risk, customer focused, U.K. financial services provider” sounds good on the surface, but uncertainty surrounding the U.K’s recovery makes this bank much more risky than some of its U.S. counterparts, in our view. Investors should take note the inherent leverage and riskiness of any banking business model, and Lloyds is no exception.

Related: EWU, SRLN, SNLN, FXB, FLGB

Be careful investing in banks!

View our latest video on how banks/financials performed during the COVID-19 crisis here.

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren and Brian Nelson do not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment