Levi Strauss Skips Dividend Payment

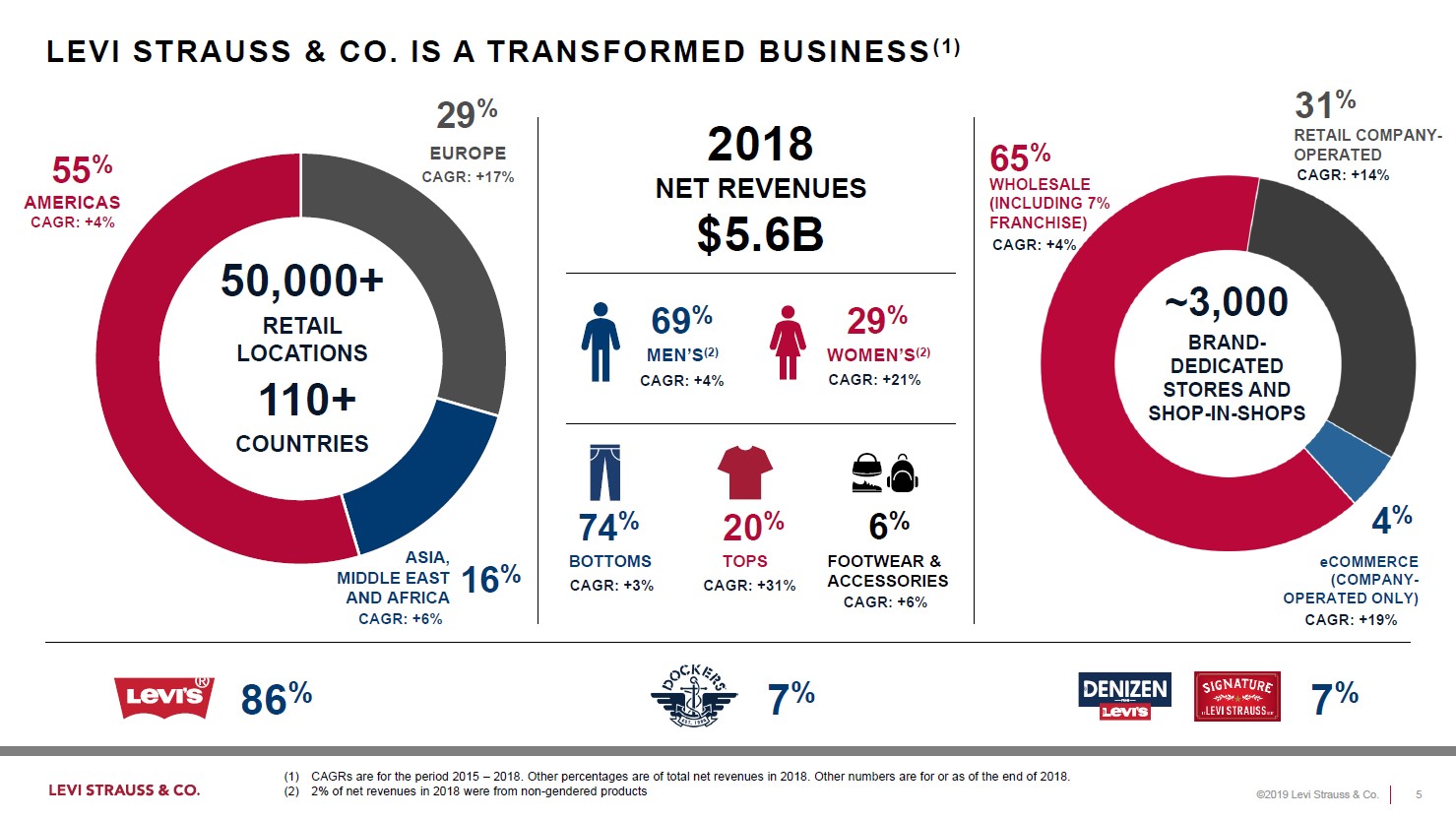

Image Shown: An overview of Levi Strauss & Co.’s historical financials and operational footprint. As you can see, most of Levi Strauss’ sales are conducted through its wholesale segment. The company’s own e-commerce sales channel has historically represented just a small part of Levi Strauss’ total net revenues. Image Source: Levi Strauss & Co. – December 2019 Investor Presentation

By Callum Turcan

On June 7, Levi Strauss & Co. (LEVI) reported second-quarter fiscal 2020 earnings (period ended May 24, 2020) that missed consensus estimates on both the top- and bottom-line. The apparel retailer noted it would reduce its “non-retail, non-manufacturing workforce” headcount by 700 employees to save an annualized $0.1 billion on corporate overhead as the ongoing coronavirus (‘COVID-19’) pandemic has devasted its financial performance. Levi Strauss touted its recent successes in the e-commerce arena but investors still sold off the name in the following days since as the firm opted to skip an upcoming dividend payment (and likely due to growing fears over how a second wave of COVID-19 infections in the US and elsewhere would impact the company’s future financial performance).

Please note that historically speaking, the vast majority of Levi Strauss’ sales were generated through its wholesale sales channels and through physical sales conducted at its company-operated stores as you can see in the graphic at the top of this article. Additionally, a little under half of the company’s GAAP net revenues were generated in the US on average from fiscal 2017 (period ended November 26, 2017) to fiscal 2019 (period ended November 24, 2019). Levi Strauss’ future financial performance depends largely on the in-store sales performance at both its company-operated stores and stores operated by its third-party partners. Though recently a growing part of its operations, Levi Strauss’ e-commerce business represents a relatively small portion of its total revenues, something management hopes to change in the medium-term.

Financial Update

Levi Strauss paid out dividends for the first half of fiscal 2020 but decided to forgo payment on its fiscal third quarter dividend and the firm “will reassess dividend payments for the fourth quarter as circumstances evolve” according to its latest earnings press release.

At the end of Levi Strauss’ fiscal second quarter, the firm had $1.5 billion in cash, cash equivalents, and short-term investments on the books versus $0.3 billion in short-term debt and $1.5 billion in long-term debt. The company had ~$0.45 billion in additional access to liquidity through the undrawn portion of its secured revolving credit facility (matures May 2022), supporting its near-term liquidity needs. Levi Strauss notes that the borrowing capacity of its secured revolving credit facility is based primarily on the value of its Levi’s trademarks and its working capital position in the US and Canada.

It appears that skipping one quarterly dividend payment (for now at least) was not a necessary financial maneuver but likely a prudent one given the retailer’s dour near-term outlook (keeping recent improvements in mind). Please note Levi Strauss repaid $0.3 billion in borrowings under its $0.8 billion secured revolving credit line in late-June during the fiscal third quarter.

Given the operational hurdles facing Levi Strauss due to the ongoing pandemic (particularly the chance for a renewed wave of store closings in the US in the wake of surging confirmed COVID-19 infections in numerous states), skipping a dividend payment was a way for the firm to conserve cash to ride out the storm. Though its net debt load is relatively small, Levi Strauss’ business model is hindered by hefty fixed costs. Levi Strauss generated -$34 million (negative $34 million) in free cash flow during the first half of fiscal 2020 due in part to a build in its inventory.

In the fiscal second quarter, Levi Strauss’ GAAP net revenues dropped 62% year-over-year, hitting $0.5 billion. Store closures and a lack of a large e-commerce presence were the main culprit here. The loss of economies of scale dragged down the retailer’s GAAP gross margins by over 1,900 basis points and its GAAP gross profit collapsed by 76% year-over-year. Management cited that Levi Strauss’ non-GAAP adjusted gross margin was down just 180 basis points year-over-year after adjusting for $0.1 billion in costs relating to COVID-19 and other factors. The retailer’s SG&A expenses only declined by 14% year-over-year, hitting ~$0.55 billion, highlighting the hurdles created by the need to maintain a large physical store presence in the retail world.

E-commerce Update

Levi Strauss cited that its e-commerce sales were “at nearly 70 percent growth for the month of June as compared to the same month in the prior year” and that “roughly 90 percent of company-operated doors and franchisee doors have reopened globally, as well as the majority of third-party retail locations” which speaks favorably towards at least a partial rebound in its financial performance this fiscal quarter. The retailer also cited that “weekly sales performance in company-operated doors is sequentially improving, as store sales productivity in the final week of June as compared to prior year approached 80%, with nearly 40% of open company-operated store locations delivering positive net revenues growth compared to the same week in the prior year” in its latest earnings press release.

According to management commentary during the company’s latest quarterly conference call, the firm had rolled out curbside pickup options at 80% of its stores. The retailer also noted that stores (as compared to its distribution centers) handled 30% of Levi Strauss’ e-commerce demand last fiscal quarter (management referred to these stores as “micro fulfillment centers”), which helped support 79% year-over-year e-commerce growth in May.

While Levi Strauss’ e-commerce operations have clearly started becoming a more significant part of its business, management noted that “total company e-commerce was slightly down to prior year in March as consumers focused on stocking necessities as they prepared to shelter in place. But in April, we saw a return to double-digit growth” indicating the retailer’s e-commerce sales were not performing well before widespread quarantine efforts to contain the pandemic. Levi Strauss will need to build on its recent e-commerce success if it wants to have a more promising long-term outlook.

The company did not offer new guidance for fiscal 2020 during its latest earnings update after pulling its full fiscal year forecast back in April 2020 due to uncertainties created by COVID-19. Management did offer commentary relating to Levi Strauss’ e-commerce segment “being profitable for both the [fiscal] second quarter and year-to-date should trends continue, we expect our e-commerce business to be profitable for the full year ahead of expectation” which we can appreciate.

Concluding Thoughts

Due to its large cash-like position and its additional access to liquidity that is provided by its secured revolving credit facility, Levi Strauss appears to be in a position to ride out the storm even if its stores do get shut down again as part of pandemic containment efforts. That said, the company likely will not resume dividend payments until its outlook starts to improve, something that may be beyond Levi Strauss’ control as the pandemic continues to rage. We remain optimistic that a vaccine for COVID-19 could get discovered within the coming quarters, if not sooner (link here).

----------

Dollar Store and Department Store Industries – KSS M JWN BIG DG DLTR PSMT

Specialty Retailers Industry – AAN BBBY BBY GME HD LOW LL ODP SHW TSCO WSM

Food Retailing Industry – CASY COST CVS KR SYY TGT WBA WMT

Related: AMZN, FDS, SPY, VDC

----------

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Dollar General Corporation (DG) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. The Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment