Jobless Claims Spike; Restaurants, REITs In Trouble

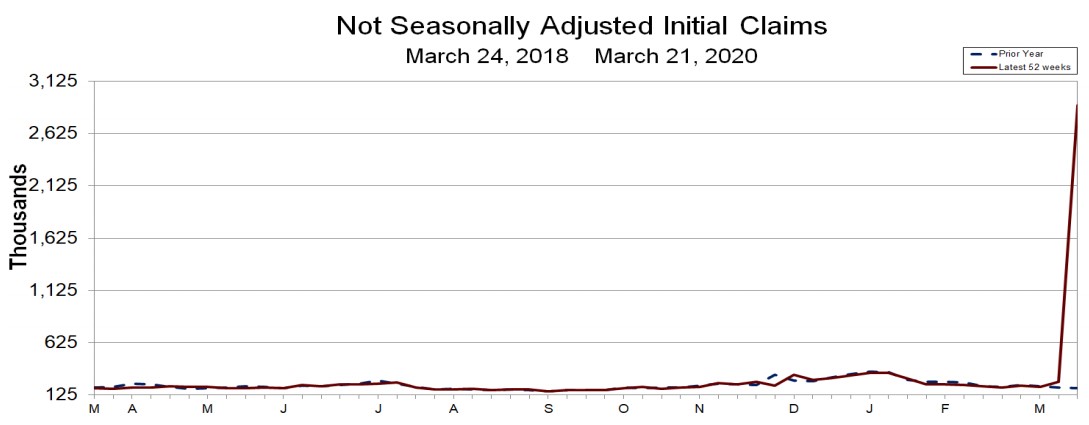

Image: DOL. “The advance number of actual initial claims under state programs, unadjusted, totaled 2,898,450 in the week ending March 21, an increase of 2,647,034 (or 1,052.9 percent) from the previous week.”

By Brian Nelson, CFA

On March 26, the Department of Labor reported a surge in jobless claims for the week ending March 21 to 3.28 million, a number that “shatters the Great Recession peak of 665,000 in March 2009 and the all-time mark of 695,000 in October 1982.” The economic situation remains dire as the White House struggles to contain COVID-19 amid what could become one of the worst economic periods since the Great Depression, or one that can turn into the next Great Depression.

We’ve written about the growing probability of another Great Depression (huge unemployment and large GDP declines, not necessarily bread lines, though the latest stimulus package may be a modern day version), and while we’re not being alarmist, the huge spike in jobless claims this week speaks to what the U.S. economy could be staring down for the next 12-18 months until a vaccine is widely available to combat the fear of COVID-19 spread. We could be looking at a 30% decline in GDP during the second quarter.

We wanted to address a couple questions from members. In hindsight, we should have ditched Cracker Barrel (CBRL) as soon as we warned members about the coming crash on February 22, and it should have been part of the alert on February 24; the put option ideas guarded against a large portion of the portfolio's declines, however. I have been watching its share-price action closely for weeks, and we never pulled the trigger to remove it from the Dividend Growth Newsletter portfolio. I’ve been waiting for some stability, and some bounce back.

On March 25, Cracker Barrel announced that it would suspend its regular dividend program after the September 2, 2020 payment (which reflects a deferral of the original May 5 payment). The restaurant also suspended its buybacks. Unlike many of the dividend cuts out there that may be permanent--the ones we’re seeing across the energy midstream MLP arena (AMLP), for example (e.g. NBLX, DCP)--we think Cracker Barrel’s dividend suspension is temporary.

We may look to exit Cracker Barrel’s shares at the right price (closer to our fair value estimate), but we’re going to leave it in the Dividend Growth Newsletter portfolio for now. We also don’t necessarily want to remove exposure to any bear-market rally, especially with respect to any high-beta rebound among the most beaten-down names. CBRL has already reclaimed March 12 levels, for example, up 76% from its bottom. It pays not to panic, and that’s why we’ve been patient.

That said, what has us most concerned about Cracker Barrel and the broader economic environment, in general--irrespective of the stimulus package in Washington--is the view that, if companies like CBRL rival Cheesecake Factory (CAKE) ‘can’t pay the rent,’ as has been recently reported (H&M, Mattress Firm, and Subway are three others that can't pay rent), the $2.2 stimulus package on Capitol Hill is nowhere near enough, and the impact across the dine-in publicly-traded restaurant space and REIT space as it relates to dividend health could be tragic.

Our team is monitoring the stimulus bill in Congress, which just passed the Senate last night. We’ll have more to say about restaurants and REITs as our team pours over the bill and assesses long-run implications. We think this bear-market rally may be short-lived, as we don’t think we’ll see stabilization in the markets until about 6-9 months before a vaccine is widely available, and that may imply a market bottom that may still be 3-6 months ahead.

Moral hazard continues to run rampant. The market is bouncing back on what looks to be expectations of an unlimited Fed/Treasury/Congress put, as well as new expectations for hyperinflationary pressures in the longer run in the midst of runaway government spending. Stocks are therefore in demand. We remain skeptical of the sustainability of this bounce, however.

---

Restaurants - Fast Food & Coffee/Snack: ARCO, DPZ, DNKN, JACK, MCD, PZZA, SBUX, WEN, YUM

Staffing Services: ADP, DLX, EFX, KFY, MAN, NSP, PAYX, RHI

Related REITs: SKT, SPG, MAC, KIM, EPR, WSR, BRX, O, VER, STOR

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

3 Comments Posted Leave a comment