Jernigan Capital Fundamentally Transforms Its Business Model

Image Source: Jernigan Capital Inc – March 2020 IR Presentation

By Callum Turcan

Jernigan Capital Inc (JCAP) is now an internally managed real estate investment trust (‘REIT’) that invests in self-storage properties, either directly or by providing funding for developers that build such properties. Shares of JCAP currently yield ~7.8% (as of this writing) in the wake of Jernigan Capital’s stock price selling off aggressively this year, as investor concerns mounted due to the ongoing coronavirus (‘COVID-19’) pandemic. Jernigan Capital is in the midst of a major shift in its business model and overall corporate strategy, and we like the changes management is in the process of making. While these are still early days, plenty is already known about this seismic shift and more information will become available in the coming weeks.

Business Strategy Shift

Recently, Jernigan Capital has pivoted from focusing primarily on providing financing to self-storage property developers to a business model built around seeking to fully own these properties outright (with those self-storage properties getting managed by an external self-storage operator, which we’ll cover later on), as described in this excerpt from Jernigan Capital’s 2019 Annual Report:

Our primary strategy moving forward is to continue to acquire 100% ownership of a majority of the self-storage facilities that we have financed either through the exercise of ROFRs [right of first refusals] or through privately negotiated transactions with our investment counterparties, subject to acquisition prices being consistent with our investment objective to create long-term value for our stockholders. As of December 31, 2019, we owned 100% of the membership interests in the LLCs that own fifteen facilities and fully consolidate these facilities in the accompanying consolidated financial statements. Subsequent to December 31, 2019, we acquired 100% of the membership interests in the LLCs that own nine additional self-storage facilities.

Additionally, please note Jernigan Capital’s previous business strategy, which is summed up in the excerpt down below, also from its 2019 Annual Report:

“Our principal business objective is to deliver attractive risk-adjusted returns by investing in new Generation V self-storage facilities primarily in urban submarkets. A majority of our investments to date have been first mortgage loans to finance ground-up construction of and conversion of existing buildings into new Generation V self-storage facilities. These investments, which we refer to as “development property investments,” are typically structured as loans equal to between 90% and 97% of facility costs (including land, pre-development and other “soft” costs, hard construction costs, fees and interest and operating reserves). We receive a fixed rate of interest on loaned amounts and up to a 49.9% interest in the positive cash flows from operations, sales and/or refinancings of self-storage facilities, which we refer to as “Profits Interest”. We also typically receive a right of first refusal (“ROFR”) to acquire the self-storage facility upon sale.”

Pivoting from a mortgage REIT to an equity REIT removes a lot of the opaqueness surrounding Jernigan Capital’s current financial standing and the trajectory of its future financial performance. Back in May 2013, my colleague Brian Nelson wrote an article highlighting why the mREIT or mortgage REIT space is a lot more complicated than first appearances suggest (link to that article here). In particular, taking on ample levels of leverage tends to be (generally speaking) the only way to generate a decent return on equity when the yield curve is flattening. Investing in the equity of physical properties is a much more straightforward way to play the self-storage growth story in the US and elsewhere, and we appreciate the transition. We strongly encourage our members to take a look at that article to get an idea of why the equity REIT space is far more attractive as an investment opportunity.

Overview

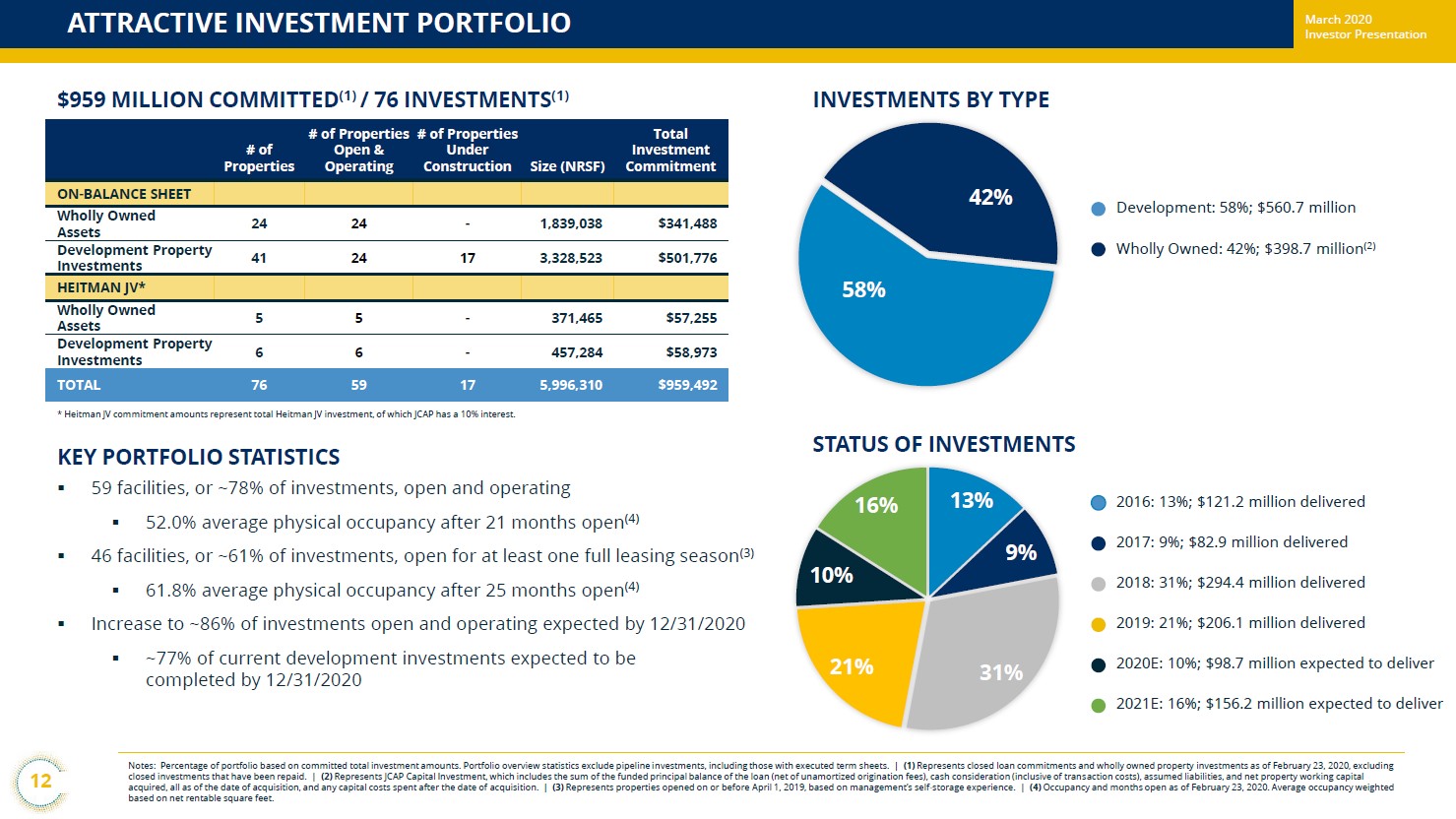

As of late February 2020, due to recent actions, Jernigan Capital now owns (the equity in) two dozen self-storage properties outright that house over 1.8 million net rentable square feet (‘NRSF’) with a ‘total investment commitment’ of over $341 million. The company also has a joint-venture with Heitman Capital Management LLC that owns five self-storage properties outright with almost 0.4 million NRSF and a ‘total investment commitment’ of over $57 million. Please note Jernigan Capital owns a 10% equity interest in the Heitman JV. In the upcoming graphic down below, Jernigan Capital highlights its self-storage portfolio.

Image Shown: Jernigan Capital’s asset base is split between development loans for self-storage properties and wholly owned self-storage properties. Image Source: Jernigan Capital – March 2020 IR Presentation

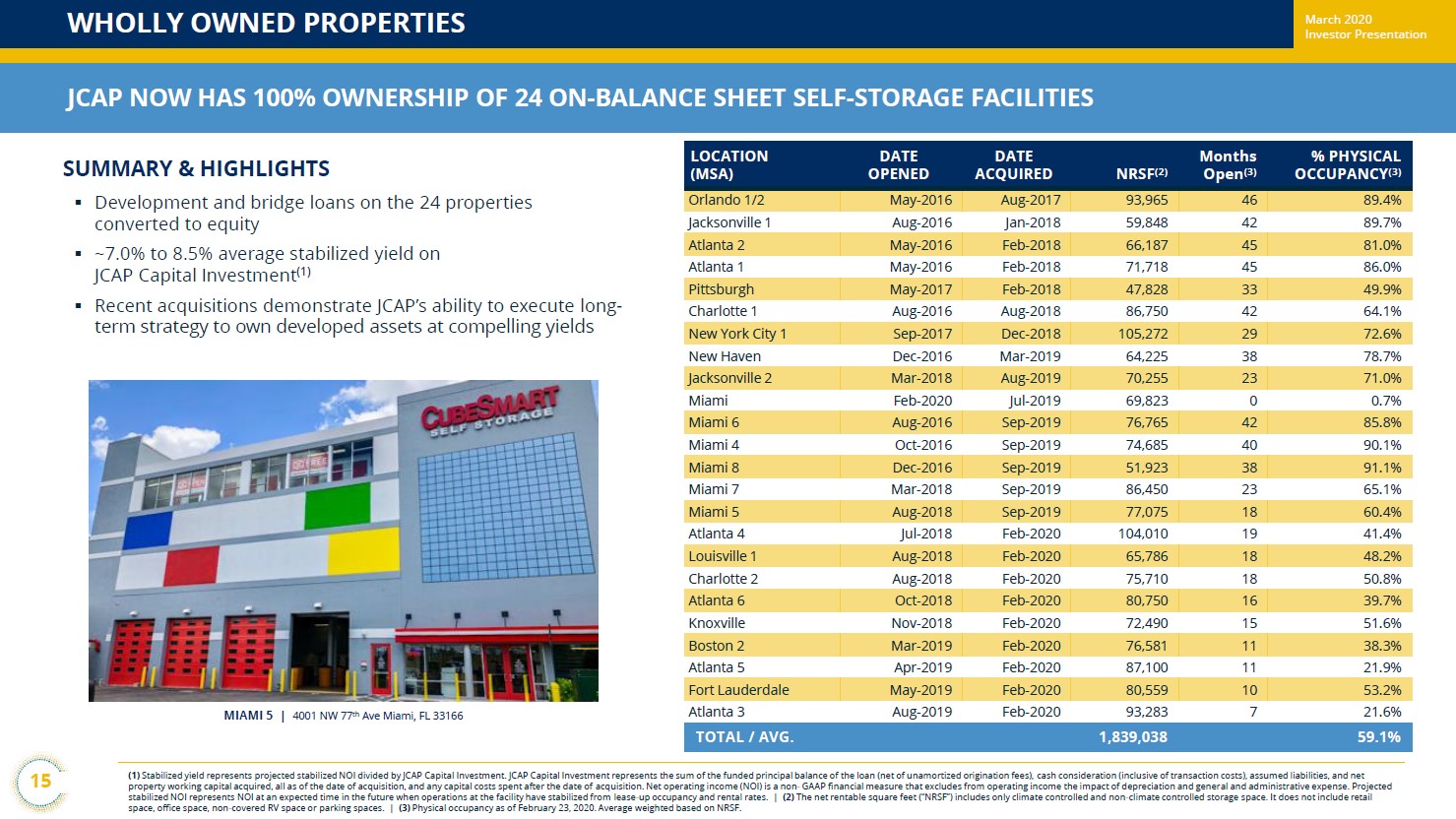

In the upcoming graphic down below, Jernigan Capital highlights its wholly owned self-storage property asset base, which the REIT aims to grow over time.

Image Shown: Jernigan Capital seeks to grow its wholly owned self-storage property asset base going forward. Image Source: Jernigan Capital – March 2020 IR Presentation

Assets that are wholly owned by Jernigan Capital are managed by well-known self-storage companies, namely CubeSmart (CUBE) [CubeSmart managed over 90% of Jernigan Capital’s self-storage properties, both those owned by the firm and ones that the firm has an economic stake in via development project investments and other considerations, at the end of 2019], with a small amount of properties managed by Extra Space Storage Inc (EXR), Life Storage Inc (LSI), and Public Storage (PSA) as of the end of 2019.

Considering CubeSmart manages the vast majority of the self-storage properties Jernigan Capital is invested in, as mentioned previously, the operational execution of CubeSmart has an outsize effect on Jernigan Capital’s ability to succeed (or not). We like CubeSmart as a holding in our High Yield Dividend Newsletter portfolio (more on that newsletter here), and we view the firm as a top quality self-storage REIT with a solid understanding of the business. Additionally, we like Public Storage as a holding in our High Yield Dividend Newsletter portfolio, meaning that in our view, Jernigan Capital has teamed up with high quality self-storage operators which we appreciate.

Key Recent Events

As noted previously in this research piece, very recently, Jernigan Capital transitioned to an internally managed REIT, summed up succinctly here (from its 2019 Annual Report):

Prior to February 20, 2020, we were externally managed and advised by JCAP Advisors, LLC (the “Manager”). The Manager was led by our founder and former Executive Chairman, Dean Jernigan, our Chief Executive Officer (“CEO”), John A. Good, and our President and Chief Investment Officer (“CIO”), Jonathan Perry. On February 20, 2020, our common stockholders voted to approve the internalization of management pursuant to an Asset Purchase Agreement (the “Purchase Agreement”) dated as of December 16, 2019. Later on February 20, 2020, we closed the internalization described in the Purchase Agreement, resulting, among other things, in the Operating Company acquiring substantially all of the operating assets and liabilities of the Manager and each of the employees of the Manager became an employee of the Company. As of February 20, 2020, we are an internally advised REIT.

Becoming an internally managed REIT should better allow for Jernigan Capital to align its interests with shareholders, which we are supportive of. The REIT notes that ~6% of the company is owned by senior executives and the board of directors, which is another way Jernigan Capital is communicating to shareholders that their interests are aligned.

Image Shown: Senior executives and the board of directors own a meaningful amount of Jernigan Capital’s equity. Image Source: Jernigan Capital – March 2020 IR Presentation

As an aside, Jernigan Capital was added to the MSCI US REIT Index in November 2019, and members can read about the index here. When a firm, especially a relatively smaller and lesser known firm like Jernigan Capital, is added to a major index that usually leads to meaningful fund flows into the entity. Please note that doesn’t mean the intrinsic value or fair value of the entity in question changes, but that simply general market awareness of the firm grows (which, potentially, could see shares converge towards their fair value over time at a quicker rate). That being said, the emergence of a unexpected event like COVID-19 can fundamentally alter the market’s outlook towards a company in an instant.

Industry Analysis

On March 1, 2020, we published a note that covered the self-storage REIT industry and its outlook (link here). We strongly suggest our members take a look at that article. In summary, while the industry (particularly in the US) is supported by very strong secular growth tailwinds over the long term, aggressive capacity expansions (again, particularly in the US) in recent years have put downward pressure on the same-store net operating income (‘NOI’) of self-storage properties (stemming from a combination of occupancy rate pressures and the inability to push through price increases in many areas, while property taxes and other operating costs are going up). That made 2019 a rough year for the self-storage space and would likely have made 2020 a rough year for the industry as well before taking the COVID-19 pandemic into account.

The pandemic will pose short-term headwinds for Jernigan Capital; however, given its debt-to-capital ratio is relatively low and the firm recently upsized its secured revolving credit facility (two things we’ll cover later on), Jernigan Capital appears to be in a position to ride out the storm.

Operational Overview

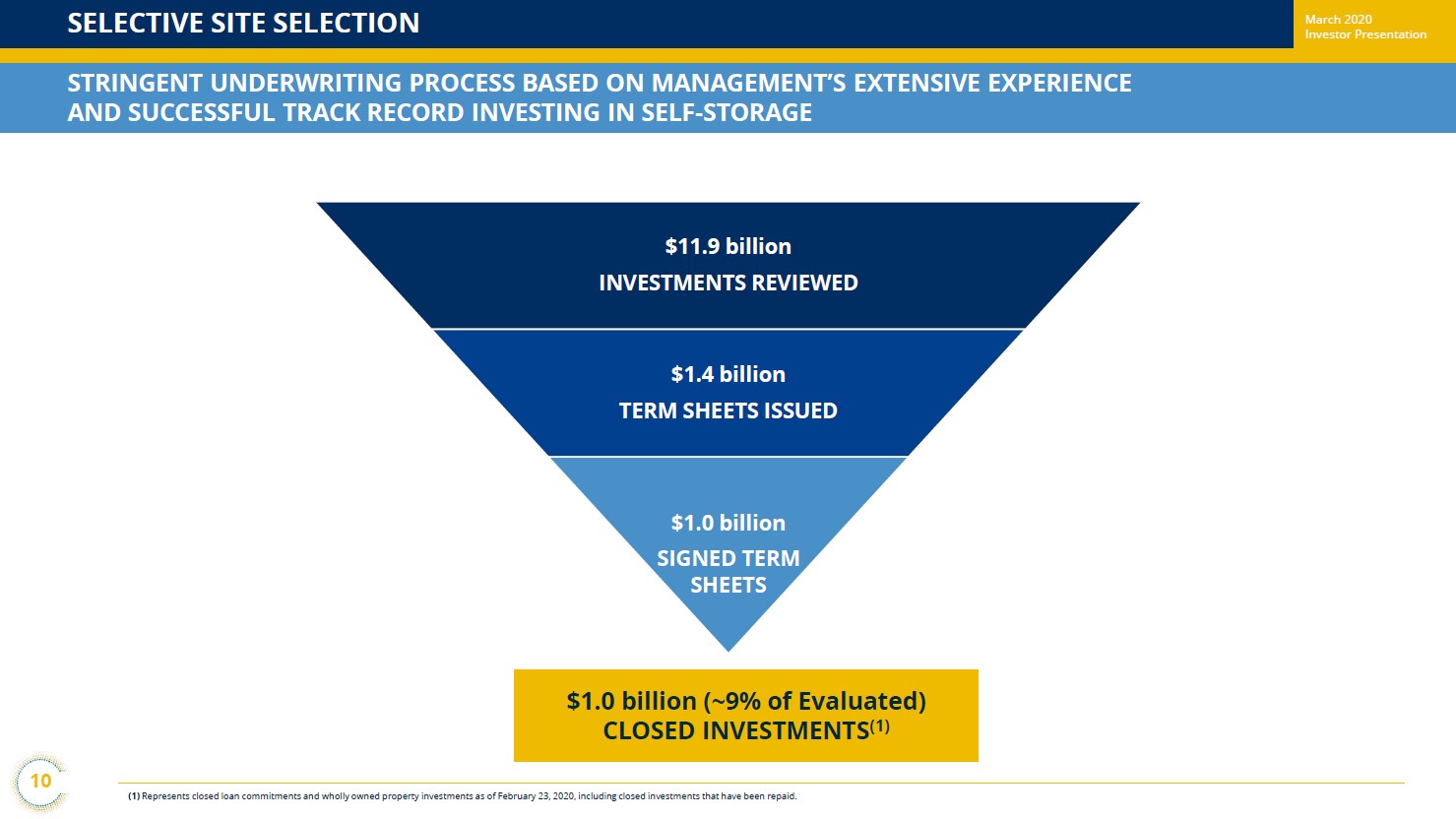

When seeking to make investments in the self-storage space, Jernigan Capital targets regions with very favorable demographics (a growing population with high incomes, particularly with average incomes in the six-figure range) and favorable industry dynamics (limited supply of self-storage properties in the vicinity). That’s how management attempts to offset industry-wide headwinds while generating meaningful upside, and the REIT is happy to note that out of all of the investment opportunities Jernigan Capital has seriously considered, it only invested in ~9% of those opportunities as seen in the upcoming graphic down below.

Image Shown: Jernigan Capital enjoys highlighting its disciplined approach to picking its self-storage investments. Image Source: Jernigan Capital – March 2020 IR Presentation

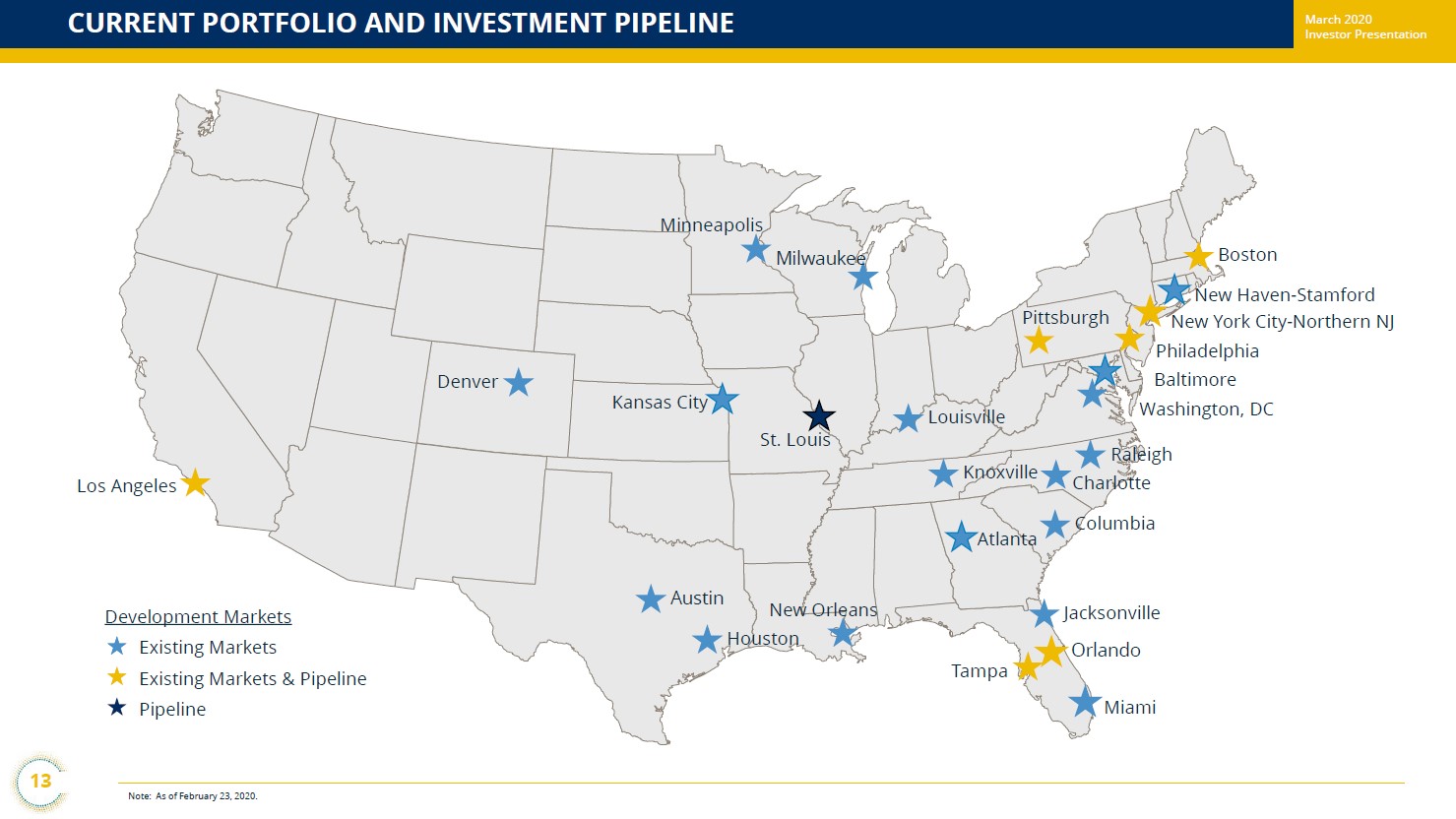

As you can see in the upcoming graphic down below, Jernigan Capital is targeting growth opportunities along coastal areas in the New England region (including the cities of Boston and New York City), Florida (Tampa and Orlando), California (Los Angeles), and Missouri (St. Louis).

Image Shown: A look at Jernigan Capital’s existing asset base and future growth markets. Image Source: Jernigan Capital – March 2020 IR Presentation

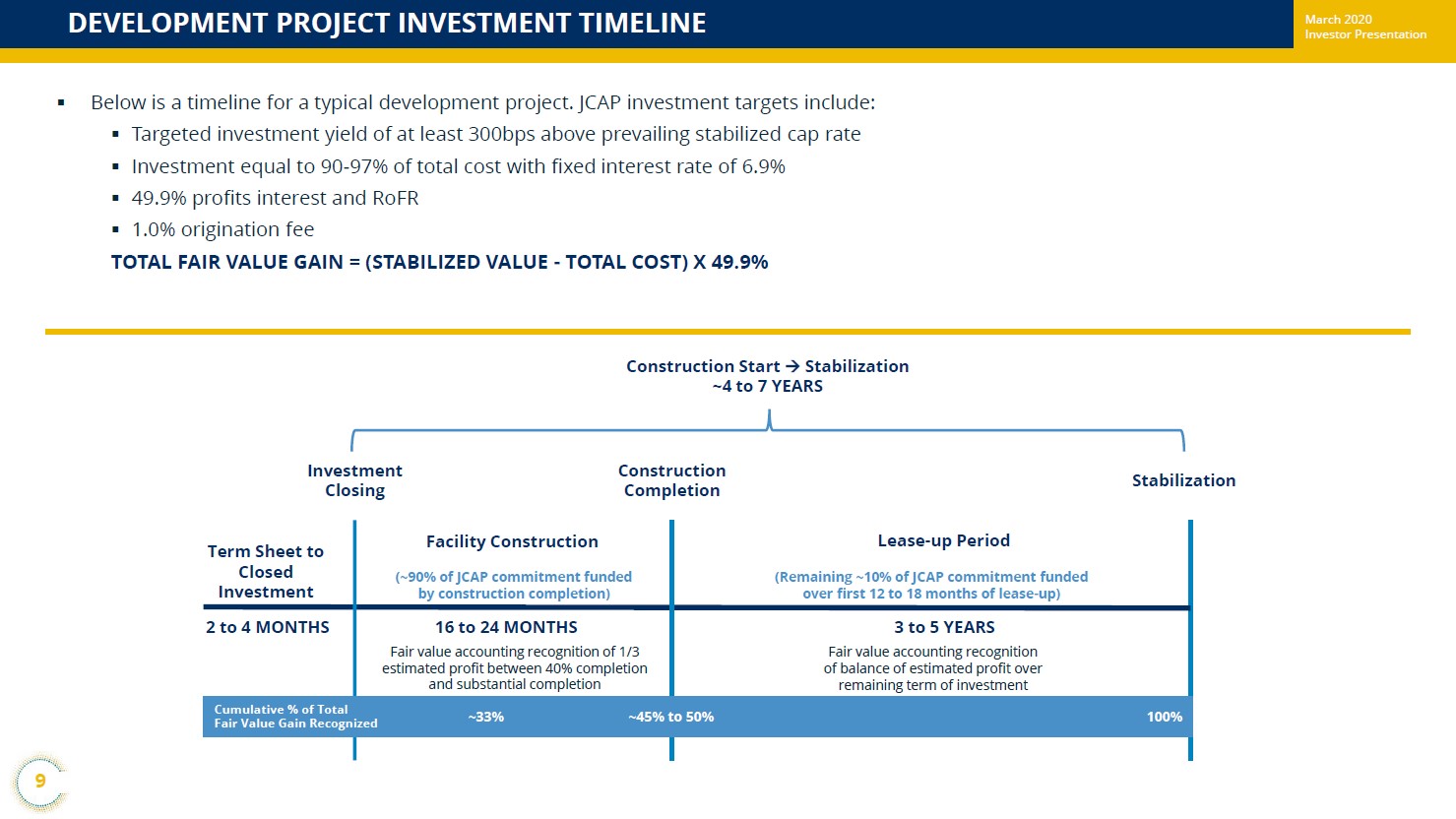

In the upcoming graphic down below, Jernigan Capital highlights how its previous business strategy (i.e. providing funding for developers to build self-storage properties) plays out over time.

Image Shown: A look at Jernigan Capital’s development project investment business strategy and timetable. Image Source: Jernigan Capital – March 2020 IR Presentation

As it relates to the REIT’s new business strategy, the firm generally includes in its contracts a provision that notes (from its 2019 Annual Report):

“[O]ur development property investment documents require that self-storage facilities we finance be operated for two years following opening before the developers can market and sell such facilities to third parties; however, during that two-year timeframe, our developer partners may seek to sell their interests to us. At such time, we are free to accept, reject and/or negotiate any such offer”.

Generally speaking, this allows for Jernigan Capital to acquire self-storage assets earlier in their lifecycle when occupancy rates are lower and arguably, when the properties carry a “cheaper” valuation. Having to wait two years to cash out can create a dynamic where the developer would prefer to sellout to Jernigan Capital early on rather than wait.

Financial Overview

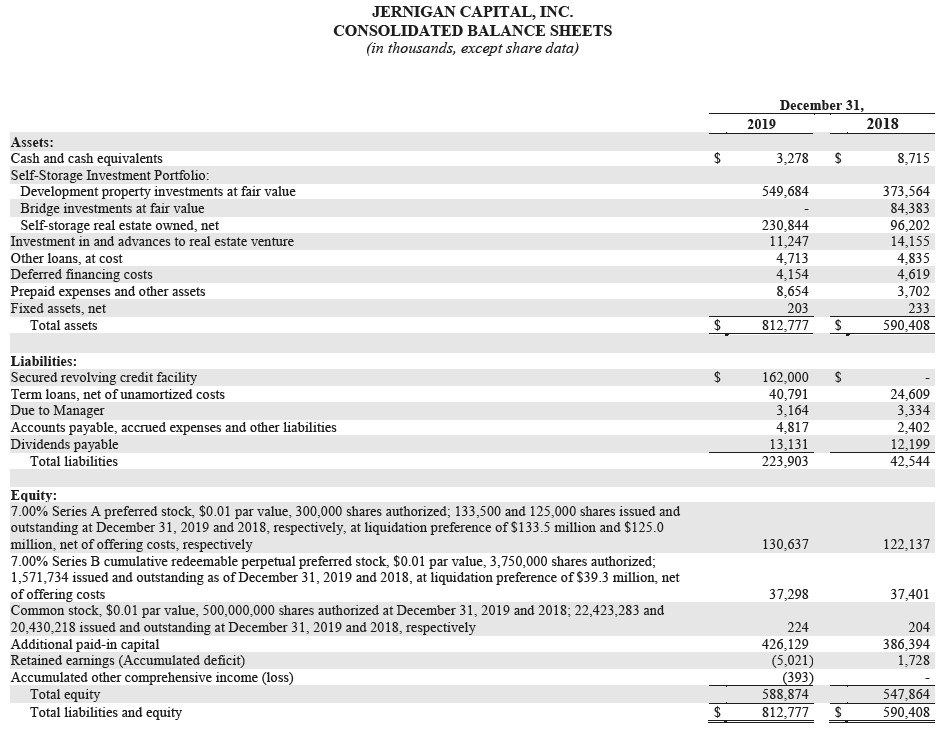

Looking at Jernigan Capital’s financials now, while the REIT has historically used equity issuances (both common and preferred securities) to fund its growth ambitions, the REIT turned more so towards credit markets in 2019 as seen by the REIT drawing down a meaningful portion of its secured revolving credit line. In the upcoming graphic down below, please note the relatively large increase in Jernigan Capital’s total liabilities from the end of 2018 to the end of 2019, almost entirely due to the firm drawing down its secured revolving credit line (the remainder came from growth in its outstanding term loans balance).

Image Shown: Jernigan Capital has historically leaned more so on equity issuances than debt to fund its growth ambitions, but that changed in 2019 when it drew down its secured revolving credit facility. Image Source: Jernigan Capital – 2019 Annual Report

On March 26, 2020, Jernigan Capital put out a press release noting that its credit facility was upsized to $375 million in borrowing capacity and the credit spread over LIBOR was reduced by 15-25 basis points (meaning the firm now has greater access to liquidity at a cheaper cost of debt). The revolving credit facility matures in March 2023 with two one-year extension options, with room to potentially expand the borrowing capacity of the credit line up to $750 million. It appears Jernigan Capital’s liquidity buffer remains sizable, which we appreciate, particularly when factoring in potential equity issuances this year.

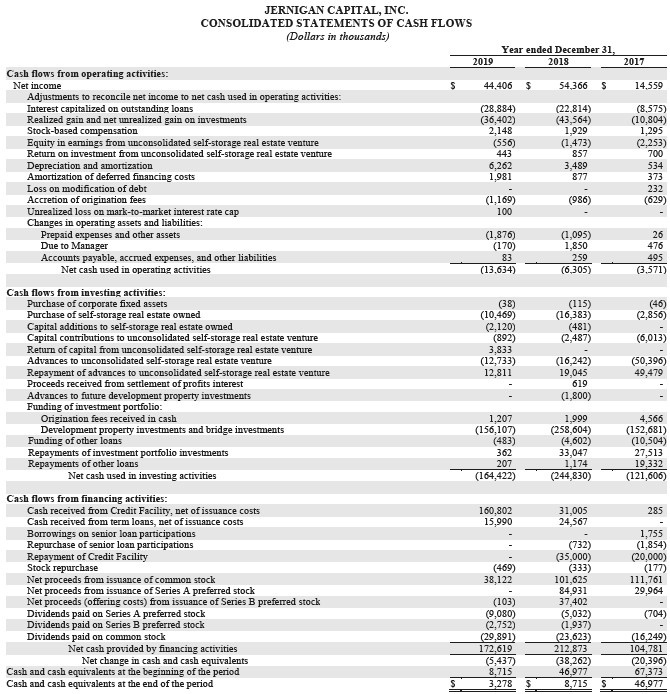

Like most REITs, Jernigan Capital hasn’t historically been free cash flow positive as you can see in the upcoming graphic down below. As a capital market dependent entity, Jernigan Capital must retain constant access to capital markets to refinance maturing debt and to issue equity to cover its growth ambitions, along with meeting its dividend obligations. Given that its secured revolving credit line was recently upsized, it appears that continues to be the case. Please note that this business model does come with significant risks, especially during times of great market turbulence.

The REIT has often used equity issuances to raise funds as mentioned previously but given the decline in the share price of JCAP over the past few months, that may be a less appealing option going forward until things improve. That being said, Jernigan Capital’s management team in the recent past has stated the remains part of the REIT’s strategy.

Image Shown: Jernigan Capital has not historically been free cash flow positive, and instead generated negative free cash flows from 2017 to 2019. That’s common in the REIT space, keeping in mind that the firm must retain constant access to capital markets at attractive rates to maintain such a business model which does pose serious risks during times of market turbulence. Image Source: Jernigan Capital – 2019 Annual Report

In 2019, Jernigan Capital reported adjusted (non-GAAP) diluted EPS of $2.00 per share for the full-year, which was down from 2018 levels of $2.92. Please note that a large part of this decline, aside from its growing outstanding diluted share count (which has been a material factor over the past couple of years and is expected to remain so going forward) and rising operating expenses (though the REIT’s GAAP revenues did grow nicely year-over-year in 2019), was due to fluctuations in ‘net unrealized gain on investments’ and it’s possible EPS and adjusted EPS figures may not be reflective of Jernigan Capital’s financial performance on a forward-looking basis for that and other reasons.

For 2020, the company was guiding for adjusted (non-GAAP) EPS of $0.52-$0.87, which is largely due to the changes in Jernigan Capital’s business model. Acquiring self-storage properties will be dilutive to the REIT’s near-term performance, but will enhance its long-term net asset value (‘NAV’) according to management during Jernigan Capital’s fourth quarter and full-year of 2019 conference call:

“…[W]e expect strong external growth in 2020, but that growth will look slightly different than it has in years past, with it being weighted more towards acquisitions to new development. Specifically, we are expecting one to two new development commitments this year, as we have become quite selective about development opportunities we are willing to pursue this late in the cycle and in the current environment of fundamentals. Additionally, we are expecting to acquire between 15 to 20 developer interest, inclusive of the nine we acquired year-to-date.

From a value creation standpoint, these acquisitions are very accretive to longer-term NAV and shareholder value and they will meaningfully add to NOI and AFFO growth during their lease-up. However, as we discussed publicly for several quarters, our development -- our developer acquisitions are near-term dilutive to earnings per share because we, one, discontinue recording fair value; and two, assume the operating burden of lease-up assets as they move towards stabilization.

On that note, we expect that the properties we consolidate in 2020 will be less mature than those consolidated in 2018 and 2019 with less in-place NOI at the time of acquisition and a longer period of stabilization. For frame of reference, the '19 operating assets that we consolidated prior to 2020 were approximately 21 months into lease-up and were on average 63% occupied when acquired. By comparison, the average physical occupancy of the nine assets acquired thus far in 2020 was about 39% and they were only 14 months into lease-up.

Overall the large quantity timing and relatively younger ages of these acquisitions are expected to have a greater near-term dilutive effect on adjusted EPS and in years past. Specifically, adjusted EPS is expected to be $0.35 to $0.42 per share lower than our targeted level of acquisitions than if our capital had remained in loans with profits interest that accretive fair value on a quarterly basis.” --- Kelly Luttrell, Senior Vice President, Chief Financial Officer, and Treasurer of Jernigan Capital

Management plans to “opportunistically” issue shares under Jernigan Capital’s at-the-market (‘ATM’) equity issue program to fund some of these acquisitions, including the acquisitions the firm has already pursued this year. 2020 will be a transformative year for the REIT, and we caution that its historical performance or guidance on an EPS basis (whether adjusted or not) likely won’t properly reflect its potential future performance. The ongoing pandemic will further obfuscate things, but in general, we like the material changes in Jernigan Capital’s business strategy.

Concluding Thoughts

On April 28, Jernigan Capital will host its virtual annual shareholders meeting, which will be followed up by the REIT reporting its first quarter 2020 results after the market close on May 7, to be proceeded by its quarterly conference call on May 8. During these events, we expect management will provide much greater detail on Jernigan Capital’s new business strategy and any recent self-storage property acquisitions the REIT has made or plans to make.

A bet on Jernigan Capital is a bet on the REIT’s new strategy playing out favorably and that the REIT, through a combination of equity issuances (such as through its ATM program) and by tapping its credit facility, will retain access to capital markets at attractive rates. While COVID-19 may make that a harder task, we do appreciate management’s pivot and the internalization of Jernigan Capital’s management structure.

-----

Rental and Leasing Stocks – UHAL CAR PSA R URI

Related: CUBE, EXR, JCAP, VNQ

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares of any of the securities mentioned above. CubeSmart (CUBE), Public Storage (PSA), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Vanguard Real Estate ETF is also included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment