Intel Plans to Repurchase a Lot of Its Stock

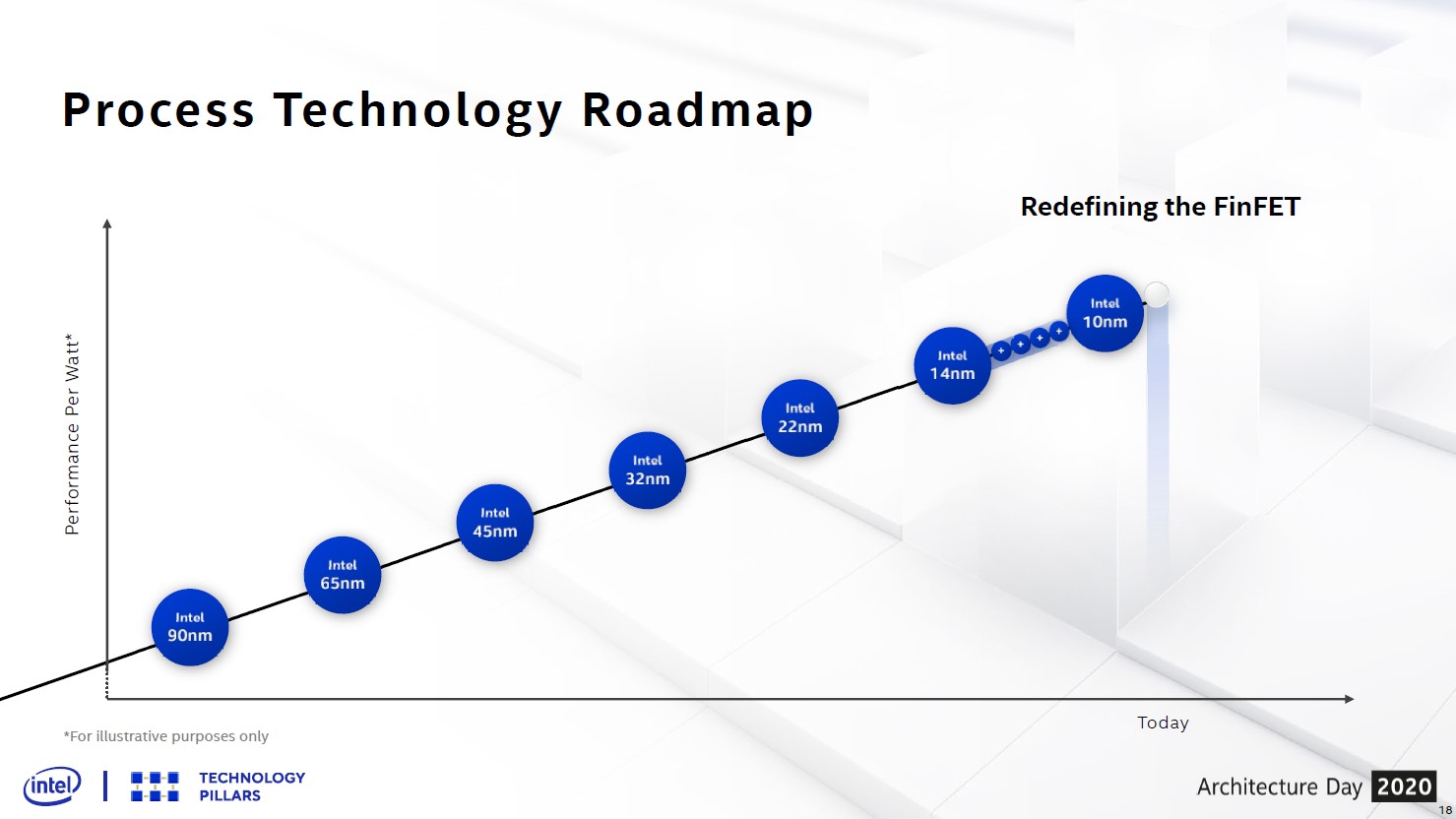

Image Shown: Intel Corporation is having trouble producing the next generation of chips (7-nm and smaller) as its current manufacturing process is having yield issues, which we covered previously. Image Source: Intel Corporation – Architecture Day 2020 Presentation

By Callum Turcan

On July 23, Intel Corporation (INTC) reported second quarter fiscal 2020 earnings (period ended June 27, 2020) that we covered in detail here. For members that have not yet read that note, we strongly encourage them to do so. Please note that delays in Intel’s 7-nm chip production schedule weighed negatively on its medium-term outlook, which sent shares of INTC meaningfully lower after its latest earnings report. Management recently responded by announcing a plan to aggressively buy back Intel’s stock, after previously suspending the company’s share buyback program in March 2020 due to uncertainties created by the ongoing coronavirus (‘COVID-19’) pandemic.

We give Intel a fair value estimate of $61 per share, meaningfully above where Intel is trading at as of this writing, and please note this represents our base case scenario. Though the low end of our fair value estimate range sits at $49 per share, which is right around where Intel is trading at as of this writing, we think Intel will outperform our bear case scenario by a wide margin. Investors are concerned that Intel may fall a generation behind its competitors (or worse), though Intel could simply outsource some of its production needs to third-party semiconductor foundries such as Taiwan Semiconductor Manufacturing Company Limited (TSM), just as Intel’s peers do.

How Intel can Pivot

TSMC, as Taiwan Semiconductor Manufacturing is often referred to, is a “pure-play” foundry meaning that it does not design chips itself, it only manufacturers chips for its clients. Additionally, there are companies like Samsung Electronics Co. Ltd. (SSNLF) that both manufacturer and design chips for internal uses and for third-parties. Intel’s peers, such as Advanced Micro Devices Inc (AMD) and Nvidia Corporation (NVDA), rely on companies such as these to produce the chips that AMD and Nvidia design. Here is what AMD’s Fiscal 2019 Annual Report had to say as it relates its 7-nm chip production process:

…[W]e are presently focusing our 7 nanometer (nm) product portfolio on Taiwan Semiconductor Co., Ltd.’s (TSMC) 7nm process. If TSMC is not able to manufacture our 7nm products in sufficient quantities to meet customer demand, it could have a material adverse effect on our business.

Here is what Nvidia had to say on the issue in its Fiscal 2020 Annual Report:

We do not manufacture the silicon wafers used for our GPUs and Tegra processors and do not own or operate a wafer fabrication facility. Instead, we are dependent on industry-leading foundries, such as Taiwan Semiconductor Manufacturing Company Limited and Samsung Electronics Co. Ltd., to manufacture our semiconductor wafers using their fabrication equipment and techniques.

We want to bring this to our members attention to highlight how Intel’s problems are more manageable than they first appear. Though Intel has its own semiconductor manufacturing base, one that it has been steadily building out over the past few years, it may have to follow its peers in seeking outside expertise when it comes to producing 7-nm and (relatively) soon 5-nm chips that Intel designed or is in the process of designing. For that reason, we see shares of INTC trading well below their intrinsic value as of this writing as its future free cash flow generating abilities remain strong, regardless if Intel is forced to adjust its business model.

Share Repurchases

Management intends to repurchase $10.0 billion of Intel’s common stock by the end of 2020 through accelerated share repurchases (‘ASRs’) which began August 21 according to its 8-K SEC filing published August 19. We see this as a good use of capital given that shares of INTC are trading well below their fair value estimate as of this writing, both in our view and in the view of Intel’s management team. In the firm’s 8-K SEC filing management noted that “Intel believes that its common stock is at the time of this announcement trading well below intrinsic valuation, and that these repurchases are prudent at this time, given the strength of the company’s balance sheet.”

This program is part of the $20.0 billion in share repurchasing authority Intel approved back in October 2019, a program that was suspended on March 24 in the face of COVID-19 as mentioned previously. By the end of 2020, Intel expects the ASRs will retire roughly 166 million common shares, keeping in mind Intel had 4,284 million shares outstanding on a diluted as of the end of the second quarter of fiscal 2020. In the 8-K filling Intel noted:

Pursuant to the ASR Agreements, Intel will make payments in an aggregate amount of $10 billion to the counterparty financial institutions on August 21, 2020, and expects to receive on the same day initial deliveries of approximately 166 million shares of Intel’s common stock in the aggregate from the counterparties.

The final number of shares to be repurchased by Intel will be based on the volume-weighted average stock price of Intel’s common stock during the term of the ASR Agreements, less a discount and subject to adjustments pursuant to the terms and conditions of the ASR Agreements… The final settlement under the ASR Agreements is scheduled to be completed by the end of 2020. Intel is funding the share repurchases under the ASR Agreements with existing cash resources.

Intel had $25.8 billion in cash, cash equivalents, short-term investments, and trading assets combined on the books at the end of its fiscal second quarter (all of which are cash-like assets). Furthermore, Intel had $2.9 billion in other long-term investments on hand (represented by corporate debt, commercial paper, US government debt, and similar investments in debt securities), which are cash-like assets, and $3.9 billion in long-term equity investments (some of which could be considered cash-like assets). Management intends to use those funds, along with Intel’s free cash flows, to cover the ASRs.

Though Intel’s total debt load (inclusive of short-term debt) stood at $38.4 billion at the end of its fiscal second quarter, Intel possess the financial firepower to cover the ASRs given its stellar free cash flow generating abilities, in our view. After the ASRs are completed, Intel’s remaining share buyback authority is expected to stand at $2.4 billion, and the firm noted it intends to resume conventional share repurchases when market conditions stabilize. Before then, Intel will be able to build up its cash pile through its free cash flows. During the first half of fiscal 2020, Intel generated $10.6 billion in free cash flow and spent $2.8 billion covering its dividend obligations.

Concluding Thoughts

We continue to be confident in Intel’s ability to generate meaningful free cash flows in the future and view its operational hurdles as more manageable than currently expected by the market. Intel remains a solid dividend growth play, with shares of INTC yielding ~2.7% as of this writing.

----

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Semiconductor Equipment Industry – AMAT CREE IPGP KLAC LRCX MKSI SNPS TER

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: TSM, SNNLF, SCWX, SPY

Other: VLUE, SMH, FTXL, SOXX, TDIV, DEEP, JHMT

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), Intel Corporation (INTC), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Alphabet Inc (GOOG) Class C shares and Facebook Inc (FB) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment