Image Shown: Intel Corporation (represented by the blue line in the graph above), a long time holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios, has substantially outperformed the NASDAQ 100 (QQQ) index (black line) and the S&P 500 (SPY) index (orange line) since the period just before announcing its ~$15 billion deal to acquire Mobileye in March 2017, before taking dividends into consideration (given that Intel pays out a decent dividend, that wouldn’t change this picture materially).

By Callum Turcan

Shares of Best Ideas Newsletter and Dividend Growth Newsletter portfolio holding Intel Corporation (INTC) have performed well since announcing back in March 2017 that it was going to acquire Mobileye, a maker of software for the automotive industry and the EyeQ chips that support various functions in automobiles, in an all-cash deal worth roughly $15 billion by enterprise value. That move added a powerful growth catalyst to its business portfolio, and so far, Intel’s Mobileye segment has performed quite well on a fundamental level (rising sales, expanding margins, rising operating income on a segment basis).

Intel forecasted at the time that the market for vehicle systems, data and services could be a $70 billion opportunity by 2030. This forecast is supported by the expected emergence of autonomous and semi-autonomous driving offerings in the 2020s, along with the rising amount of capabilities and functions in automobiles overall. By 2021, Mobileye plans to launch a version of the EyeQ5 chip that will enable the potential rollout of robo-taxis that year, and the company has already established numerous partnerships with major automobile manufactures to make that happen.

Image Shown: Mobileye, an Intel company, has consistently grown sales of the EyeQ chips and that trajectory is expected to continue over the years to come given the massive market opportunity being addressed here. Image Source: Intel – January 2020 CES IR Presentation

Intel acquired 97.3% of Mobileye’s outstanding common equity in August 2017, and in April 2018, Intel acquired Mobileye’s remaining outstanding shares. Net of $0.4 billion in cash acquired, Intel paid $14.9 billion in cash for Mobileye. We are optimistic on the long-term trajectory of the autonomous and semi-autonomous vehicle market but caution regulatory and engineering hurdles are quite material as it concerns the industry at-large.

Financial Commentary

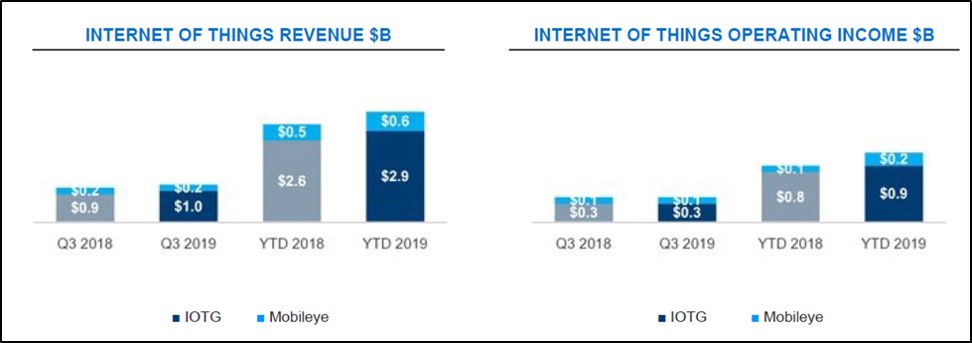

During the first three quarters of 2019 (period ended September 28, 2019), Mobileye generated $639 million in sales for Intel (up $124 million, or over 19%, year-over-year) and the segment’s operating income clocked in at $188 million (up $82 million, or over 77%, year-over-year). As the growth rate of the segment’s operating income substantially exceeded the segment’s revenue growth rate, it appears that economies of scale are kicking in allowing for segment-level margin expansion. The graphic below highlights the growing significance of Intel’s Mobileye segment, which comprises part of its Internet of Things Group (‘IOTG’).

Image Shown: Mobileye is apparently experiencing segment-level margin expansion which we appreciate, highlighting the positive impact economies of scale are having on this high-growth segment. Image Source: Intel – Third Quarter 2019 10-Q Filing

Intel’s growing total addressable market (‘TAM’) across numerous secular growth opportunities, such as autonomous and semi-autonomous driving, underpins management’s expectations for material top-line and revenue growth over the coming years as you can see in the graphic below. Please note this guidance was given out during Intel’s investor meeting back on May 2019.

Image Shown: Intel’s shift towards a ‘data-centric’ company underpins its expected top-line and revenue growth over the coming years. Image Source: Intel – May 2019 CEO Investor Meeting Presentation

Concluding Thoughts

We continue to like Intel in both our newsletter portfolios and its ~2.1% yield as of this writing provides investors with a nice income stream. Intel’s dividend will likely continue to experience strong per share growth over the coming years, in our view, a growth trajectory that’s well supported by Intel’s 2.1x Dividend Cushion ratio. In a previous article covering Intel we highlighted the company’s improving cost structure, stellar cash flow profile, promising growth trajectory, and recent guidance increase which our members can read about in more detail here—->>>>

Broad Line Semiconductor Industry – AMD AVGO FSLR INTC TXN

Integrated Circuits Industry – ADI MCHP MRVL NVDA SWKS TSM XLNX

Software Security Industry – CHKP FEYE IMPV PANW PFPT SYMC VRSN

Related: MU, SPY, QQQ

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Intel Corporation (INTC) is included in both Valuentum’s simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.