High Yield Dividend Newsletter Portfolio Continues to Deliver!

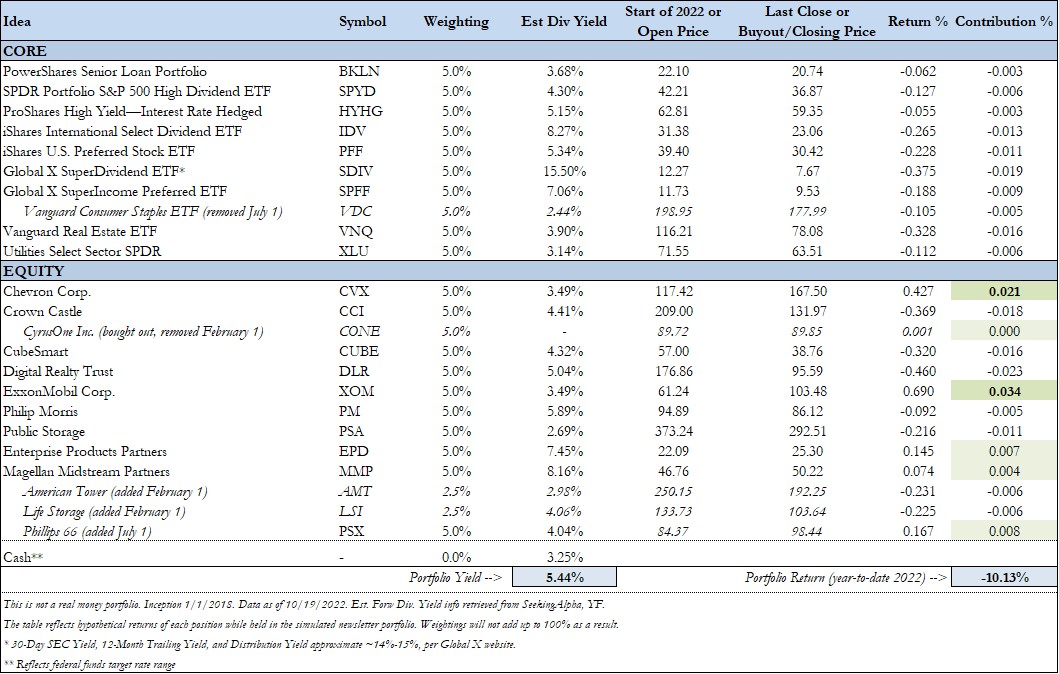

Image: The year-to-date simulated performance of the High Yield Dividend Newsletter portfolio, which continues to hold up well during 2022, while offering an attractive forward estimated dividend yield. Data retrieved interim session October 19.

By Brian Nelson, CFA

Valuentum's newsletter product suite continues to deliver in good times and bad. For those of you interested in high dividend paying stocks, we offer a High Yield Dividend Newsletter and a simulated High Yield Dividend Newsletter portfolio, which has been holding up well amid the weakness across both the stock and bond markets this year.

Based on our calculations, the simulated High Yield Dividend Newsletter portfolio now boasts an estimated forward dividend yield of ~5.44% and is down only approximately 10% on a price-only basis so far this year. Even though this year has been tough, the simulated High Yield Dividend Newsletter portfolio's track record speaks to fantastic stock selection and portfolio construction!

But why: Well, the Vanguard Real Estate ETF (VNQ), which many use to approximate the performance of REITs, is down ~32.6% so far this year, while the iShares Mortgage Real Estate Capped ETF (REM) is down ~39.4%. The S&P 500, as measured by the SPY, is down ~23.3% year-to-date. The simulated High Yield Dividend Newsletter portfolio has even outpaced bonds, as measured by the AGG, which is down ~16.8% this year, data according to Seeking Alpha.

Perhaps the best benchmark for the simulated High Yield Dividend Newsletter portfolio, however, is the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), and this one is down ~13.6% this year, while only sporting a forward estimated dividend yield of ~4.3%, both stats according to Seeking Alpha. The High Yield Dividend Newsletter portfolio simply is delivering for members!

We know we spend a lot of time talking about the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio, as well as the success rates in the Exclusive, but if we had to showcase perhaps the most value-add product so far this year, it is our high yield dividend newsletter product. Members are loving it!

What has been the biggest source of success in this area? For starters, our methodology. We're not "pitching" REITs at any price or "touting" double-digit yields of mortgage REITs, but rather we're laser-focused on a company's future free cash flow generation and net balance sheet -- the cash-based sources of intrinsic value -- and whether we can count on those attributes of the company to deliver during difficult times.

In this regard, adding Exxon Mobil (XOM) and Chevron (CVX) to the High Yield Dividend Newsletter portfolio last year has been a fantastic move, as has it's been for the simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Though the markets have been rough so far in 2022 for both stock and bond holders, it's good to see our methodologies holding up across the board.

The next year, 2023, will be tough, in our view, and we would not be surprised to see many high yield dividend stocks cut their dividends, especially those paying lofty 8%+ dividend yields today. When the economy sours, the credit markets may dry up -- and most high yield dividend paying stocks will require continued access to the capital markets, which can never be guaranteed. Dividend cuts may ensue. High dividend paying equities remain very risky propositions, but especially during tough times.

The bottom line is if you're interested in high dividend paying stocks, you should definitely be aware of our High Yield Dividend Newsletter and its simulated newsletter portfolio and how well it has done so far in 2022. Equity and mortgage REITs have been punished this year, but the simulated High Yield Dividend Newsletter portfolio is not only doing better than these areas, but also better than the S&P 500, other high-yield dividend benchmarks, and even the 60/40 stock/bond portfolio!

If you love high yield dividend paying stocks and you're not a member to the High Yield Dividend Newsletter and want to be, please be sure to let us know. As we enter what looks like a tough 2023, having access to Valuentum, even as a second opinion for your dividend-paying stocks, is well worth the cost of the newsletter publication. More information about our High Yield Dividend Newsletter (click here) >>

Let's keep going strong!

Correction: This article has been corrected to reflect our estimates of the High Yield Dividend Newsletter portfolio to be down approximately 10% through the publishing of this article. Interim October 19 prices were used in the calculation, and the VDC's interim October 19 price was used instead of its closing price in July 1. The changes are not material to the estimate of down approximately 10%, and we have provided notification at the bottom of this email. The table has not been updated for these changes.

---------------------------------------------

About Our Name

But how, you will ask, does one decide what [stocks are] "attractive"? Most analysts feel they must choose between two approaches customarily thought to be in opposition: "value" and "growth,"...We view that as fuzzy thinking...Growth is always a component of value [and] the very term "value investing" is redundant.

-- Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett's thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn't be more representative of what our analysts do here; hence, we're called Valuentum.