German Industrial Conglomerate Siemens Remains an Attractive Income Generation Idea

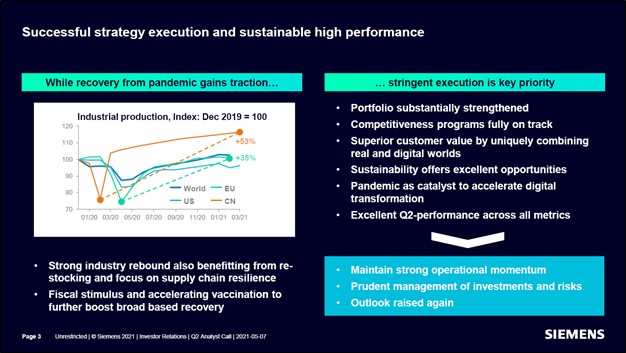

Image Shown: Siemens AG sees the global industrial economy staging a recovery from the COVID-19 pandemic, which in turn supports the firm’s outlook. The company raised its full-year guidance when Siemens published its latest earnings report. Image Source: Siemens AG – Second Quarter of Fiscal 2021 IR Earnings Presentation

By Callum Turcan

The German-based industrial conglomerate Siemens AG (SIEGY) has four core industrial business operating segments that are as follows: Digital Industries (‘DI’), Smart Infrastructure (‘SI’), Mobility (‘MO’), and Siemens Healthineers. Its operations are supported by Siemens Financial Services (‘SFS’) which provides support for its industrial businesses and services to third-parties. Siemens has put up strong underlying operational and financial performance of late and remains an interesting income generation idea.

Siemens is recovering from the ongoing coronavirus (‘COVID-19’) pandemic and the company’s long-term outlook is bright. The industrial conglomerate pays out an annual dividend in euro terms, and we caution that its payout is influenced by foreign currency movements. Shares of SIEGY, traded over-the-counter in the US, yield ~2.5% as of this writing. Two shares of SIEGY American Depositary Receipts (‘ADRs’) are equal to one ordinary share of Siemens.

Background

In April 2021, Siemens Healthineers completed its ~USD$16.4 billion all-cash acquisition of Varian Medical Systems, a maker of radiation oncology systems and related software. By joining forces, Siemens Healthineers aims “to establish a comprehensive digital, diagnostic and therapeutic ecosystem that includes treatment management” that “will leverage AI-assisted analytics to advance the development and delivery of data-driven precision care and redefine cancer diagnosis, care delivery and post-treatment survivorship.” Siemens aims to realize at least EUR$300 million in annualized EBIT synergies by fiscal 2025 through this deal.

Image Shown: An overview of Siemens Healthineers’ acquisition of Varian. Image Source: Siemens – Second Quarter of Fiscal 2021 IR Earnings Presentation

A month earlier in March 2021, Siemens completed the divestment of Flender, which makes mechanical and electrical drive systems, to Carlyle Group Inc (CG) through a deal worth about USD$2.4 billion by enterprise value. Please note Siemens is constantly optimizing its business portfolio.

The German industrial conglomerate completed its acquisition of just over 99% of C&S Electric Limited’s equity this past March for roughly USD$0.3 billion. C&S Electric is based in India and is billed as “one of the leading providers of electrical and electronic equipment for infrastructure, power generation, transmission and distribution.” Over the long haul, Siemens envisions this deal as “supporting the export of electrification solutions to fast-developing markets around the world” as the firm intends to build a design and manufacturing hub in India. This deal for C&S Electric covers operations that are materially different from the core operations of Siemens Energy.

Siemens spun off its energy business, Siemens Energy, as a publicly-traded standalone entity last calendar year as part of its major structuring strategy (it spun off a majority stake in Siemens Energy’s to shareholders of Siemens while retaining a minority equity interest in Siemens Energy that Siemens intends to sell down going forward). For reference, Siemens Energy’s business profile consists of gas and power operations (focused on manufacturing products such as gas turbines and distribution transformers, and providing related services) and its ~67% stake in Siemens Gamesa Renewable Energy SA (GCTAF) (focused on manufacturing wind turbines and providing related services).

Earnings Update and Guidance Boost

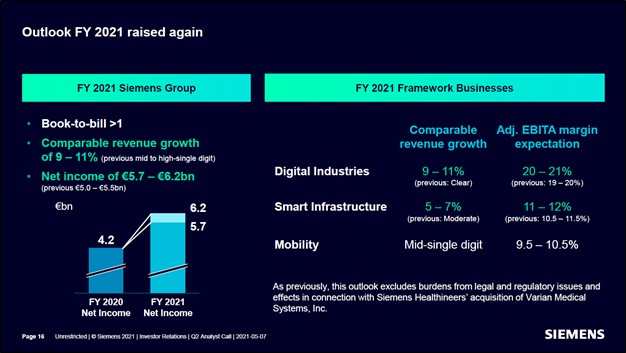

On May 7, Siemens reported financial results for the second quarter of fiscal 2021 (period ended March 31, 2021), and we liked what we saw. Its revenues on an IFRS basis grew over 6% year-over-year while its net income more than tripled year-over-year on an IFRS basis during the fiscal second quarter. Considering that the COVID-19 pandemic was raging in the background while Siemens pursued major corporate restructuring efforts, there was plenty of noise but the thing that stood out the most was that Siemens boosted its full-year guidance for fiscal 2021 during its latest earnings report. In the upcoming graphic down below, Siemens lays out its upgraded guidance for fiscal 2021 and provides an overview of how the firm views its various industrial segments performing going forward.

Image Shown: Siemens raised its revenue and net income guidance for fiscal 2021 during its latest earnings report. Image Source: Siemens – Second Quarter of Fiscal 2021 IR Earnings Presentation

Siemens has been working with BioNTech SE (BNTX) to help the German-based biotech firm scale up its COVID-19 vaccine production efforts. BioNTech developed a safe and viable COVID-19 vaccine through a partnership with Pfizer Inc (PFE) which has been approved for emergency use in the US, the EU, and elsewhere. Here is what Siemens’ management team had to say during the firm’s latest earnings call:

“Considering the pandemic time to market has never been more important. We helped BioNTech company's - BioNTech to convert its existing Marburg site to produce the COVID-19 vaccine in record time of five months. We collaborated closely to rapidly implement our technologies such as for process control, and manufacturing execution. Production is end-to-end digitalized, to enable paperless documentation right from the start.” --- Roland Busch, CEO of Siemens

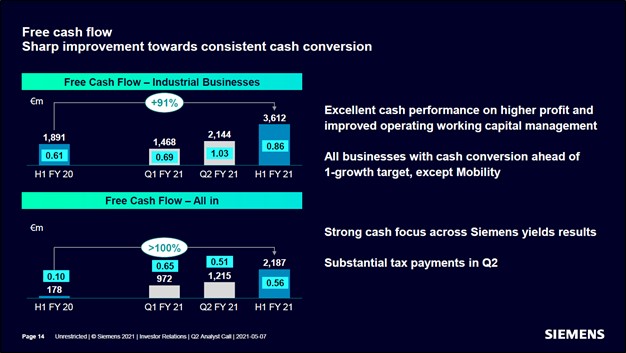

The COVID-19 pandemic created major headwinds for Siemens though things are beginning to turn around. Management noted during Siemens’ latest earnings call that the credit rating division of S&P Global Inc (SPGI) recently upgraded the outlook for Siemens’ credit rating to stable from negative. As of mid-May, Siemens had a rock-solid long-term ‘A-rated’ investment grade credit rating (A1/A+) with a stable outlook from S&P and a negative outlook from Moody’s Corporation (MCO). During the first half of fiscal 2021, Siemens generated ~EUR$2.2 billion in free cash flow as its net operating cash flow more than doubled year-over-year.

Image Shown: Siemens’ free cash flow generating abilities are improving as its various business segments steadily recover from the COVID-19 pandemic. Image Source: Siemens – Second Quarter of Fiscal 2021 IR Earnings Presentation

Digital Industries Strength

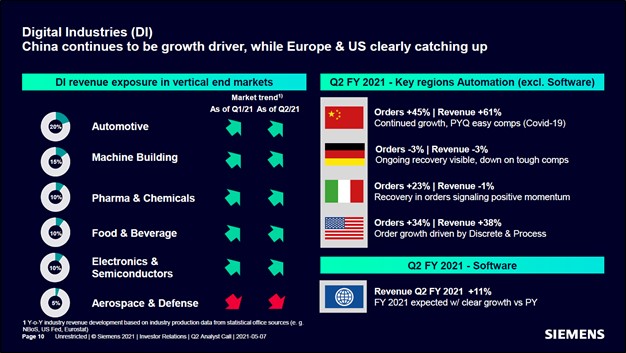

Siemens reported that it was seeing a pickup at its DI, Digital Industries, segment across the geographical board as you can see in the upcoming graphic down below. All of this segment’s divisions, excluding aerospace and defense, were seeing positive market trends as of the end of the first half of fiscal 2021. China and the US stood out as outperforming geographical regions on this front.

Image Shown: Siemens’ DI business reported widespread strength during the second quarter of fiscal 2021. Image Source: Siemens – Second Quarter of Fiscal 2021 IR Earnings Presentation

Here is what management had to say on Siemens’ DI segment during the company’s latest earnings call (emphasis added, moderately edited):

“We are excited that Digital Industries for the first time ever achieved more than EUR1 billion of free cash flow in a single quarter [during the fiscal second quarter]. This exceptional performance is based on stringent working capital management and early customer payments in the software business…

When looking at our key vertical end market expectations for the next quarters we see a continued recovery along broad based improved sentiment in the wide range of industries. Yet, we are fully aware there's still uncertainty regarding the pandemic development. And our team is very dedicated and determined to mitigate risk from supply shortages, such as electric components and plastics… We expect a strange supply chain for the month to come and have included a certain negative impact from rising commodity prices in our assumptions.” --- Ralf Thomas, CFO of Siemens

Additionally, Siemens’ management team noted that its DI segment posted strong margin performance in the fiscal second quarter as “the execution of our program to structurally improve the cost base is bearing fruit now” during the firm’s latest earnings call. Looking ahead, Siemens’ DI segment is expected to post “further significant comparable revenue growth on similar level as seen in the second quarter” during the fiscal third quarter according to recent management commentary. The company’s various digital initiatives are playing out favorably and underpin its promising cash flow growth trajectory over the long haul.

Siemens is also working towards developing infrastructure for electric vehicles (‘EVs’) with an eye towards charging stations, related infrastructure, and related services through its SI, Smart Infrastructure segment. The company’s Mobility business is beginning to see signs of a rebound and management communicated during Siemens’ latest earnings call that “revenue momentum [at the firm’s Mobility segment] is expected to accelerate with mid-single digit growth” and that “free cash flow is expected to rebound” during the second half of fiscal 2021.

Concluding Thoughts

Siemens has identified a number of growth avenues and is leaning on its digital capabilities to bring various industrial processes into the 21st Century. Siemens generates strong free cash flow, has a promising growth outlook, and its ‘A-rated’ long-term credit rating is impressive. Shares of SIEGY have been on a nice upward climb during the past year, as investors continue to warm up to its promising growth story. There could be room for substantial upside as the global economy recovers from COVID-19, and investors get paid a nice ~2.5% dividend yield to have exposure to this global industrial powerhouse. We think Siemens could be an interesting income generation idea for consideration.

-----

Related: SIEGY, CG, GCTAF, BNTX, PFE, SPGI, MCO, GE, SMEGF, EWG, DAX

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment