GasLog MLP Family Highlights Problems with Flawed Model

Image Source: GasLog Ltd - 2018 Analyst Day Presentation

By Callum Turcan

We’ve written about it many times in the past and we’re writing about it again: the master limited partnership (‘MLP’) model is fundamentally broken. Equity holders in this arrangement have little to no say over how the family of companies are run, and management is often beholden to no one. Only by converting to a C-Corp can this arrangement be rectified.

Massive Payout Cut

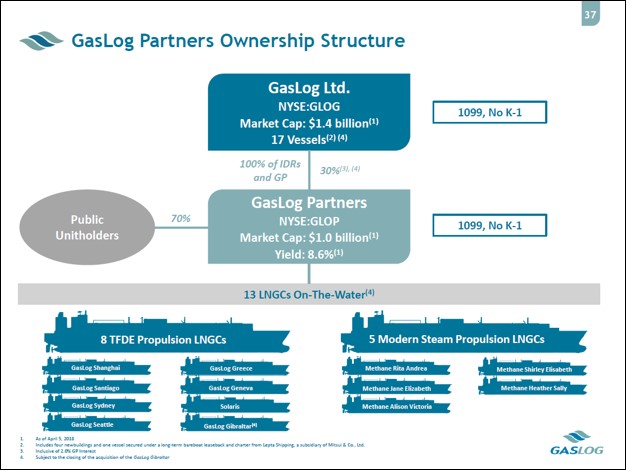

As you can see in the graphic below, the ownership structure of GasLog Ltd (GLOG), the general partner (‘GP’), and GasLog Partners LP (GLOP), the limited partner (‘LP’), is quite convoluted. This MLP family leases own vessels that transport liquified natural gas (‘LNG’) and seeks to capitalize on growing global trade for LNG, at least in theory.

Image Shown: The MLP model is fundamentally broken. Image Source: GasLog Ltd - 2018 Analyst Day Presentation

Recently, the LP GasLog Partners cut its per unit distribution by 78% sequentially after reporting fourth quarter and full year earnings for 2019. Now the LP’s distribution stands at $0.50 per unit on an annualized basis. Equity holders were crushed on February 6, 2020, with GLOG ending down 9% and GLOP falling by a whopping 49% on the trading session. This follows two other high profile MLP cuts at Alliance Resource Partners (ARLP) and Martin Midstream Partners (MMLP).

Management maintained GasLog Ltd’s quarterly dividend of $0.15 per share, and please note the firm paid out a special dividend at the end of the year in 2018 and 2019. The biggest takeaway is that management didn’t communicate to equity holders that an enormous payout cut was in the works, which came as a shock to the market (but not to some given the known problems of the MLP model). The MLP business structure remains severely out of favor.

Heart of the Problem

Here’s a key quote from GasLog Ltd’s 2018 Annual Report (emphasis added):

As of February 27, 2019, GasLog holds a 27.5% interest in the Partnership and, as a result of its ownership of the general partner and the fact that the general partner elects the majority of the Partnership’s directors in accordance with the Partnership’s partnership agreement, or the ‘‘Partnership Agreement’’, GasLog has the ability to control the Partnership’s affairs and policies. Consequently, GasLog Partners is consolidated in the Group’s financial statements. The Group’s control of the general partner and consequently of the Partnership could be challenged with a 66.67% vote by other unitholders.

However, as the Partnership Agreement limits any single unitholder to a maximum of 4.9% of the vote, it is highly unlikely that a coordinated vote of widely held unitholders will be organized to change the Group’s control of the general partner.As a result, the Group continues to assume that control of the general partner is a relevant basis on which to conclude control of the Partnership.

The GP (and more specifically, the very well insulated management team of the GP as it relates to outside influence) effectively calls the shots and the LP is simply along for the ride. That ride has not been a good one, as you can see in the graph below. The collapse has been enormous.

Image Shown: Units of GasLog Partners (depicted by the blue line) have underperformed shares of GasLog Ltd (depicted by the orange line) over the past five years. However, both equities have been decimated over the past five years, and while both companies have paid out a nice yield over this time, that isn’t enough to offset such large losses from capital depreciation.

IDRs Situation

To further complicate the picture, incentive distribution rights (‘IDRs’) effectively enable the GP to take a growing share of the LP’s incremental cash flows without contributing any additional capital. In the MLP world, most of an LP’s cash flow growth is funded by a combination of debt and equity issuance, as in almost every case, all of the free cash flows the firm generates (however meager they may be) are insufficient to cover both investments and dividend/distribution payments. MLPs are capital-market dependent to maintain their dividends/distributions in this regard.

On a consolidated basis, the MLP family generated negative free cash flows in 2019 as $317 million in net operating cash flows were outstripped by gross capital expenditures (defined as ‘payments for tangible fixed assets and vessels under construction’) of $480 million, keeping in mind the MLP family received $10 million back due to ‘return of capital expenditures’. Equity and debt issuances, and the ability to continuously tap capital markets for funds, are the only thing really keeping the MLP model alive. As capital markets begin to dry up, as they have been in select parts of the energy sector over the past few years, the MLP structure has shown its true colors.

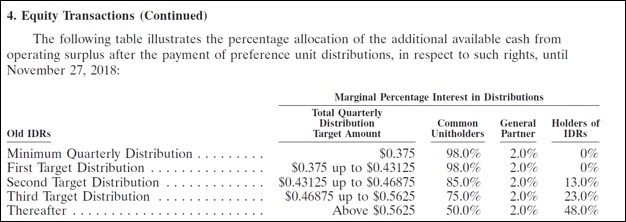

The IDR arrangement between the LP and GP was changed somewhat recently, but first let’s look at the previous arrangement which is laid out in the graphic below. As you can see, the IDRs (owned entirely by the GP) get a growing slice of the LP’s incremental cash flow. Additionally, common unitholders get a smaller and smaller slice of the pie as this plays out.

Image Shown: A look at the old IDR arrangement between GasLog Ltd and GasLog Partners LP. Image Source: GasLog Ltd – 2018 Annual Report

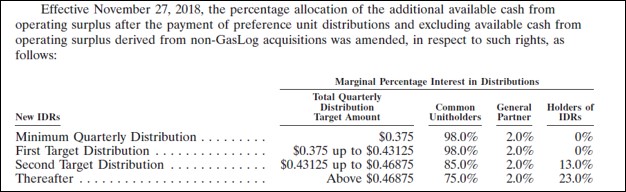

That arrangement was modified, but only somewhat given that only the most erroneous tier of ‘marginal percentage interest in distributions’ was changed, with the company noting that:

On November 27, 2018, we entered into an agreement with GasLog Partners to modify the partnership agreement with respect to the general partner’s incentive distribution rights (‘‘IDR’’). The modification reduced the distributions of cash upon liquidation and the general partner’s IDRs on quarterly distributions above $0.5625 per unit from 48% to 23%. We further agreed to waive IDR payments resulting from any asset or business acquired by GasLog Partners from a third party. In exchange for these modifications, we entered into an agreement among GasLog Partners and GasLog Partners GP LLC under which we received $25.0 million from GasLog Partners.

Here's what the new IDR arrangement looks like:

Image Shown: A look at the new IDR arrangement between GasLog Ltd and GasLog Partners LP. Image Source: GasLog Ltd – 2018 Annual Report

Furthermore, while the IDRs change notes that GasLog Partners won’t have to pay IDRs on assets acquired from third-parties, GasLog Partners’ entire business model is built upon acquiring LNG vessels from GasLog Ltd (using debt and equity issuances to do so).

Concluding Thoughts

Simply put, we wouldn’t touch GasLog Ltd or GasLog Partners with a ten foot pole. This MLP family has shown itself to be highly unreliable, and while equity holders have received some nice payouts over the years, that has been nowhere near enough to cover the enormous capital deprecation losses bestowed onto equity holders of either entity. Read more about the hazards of MLPs in our book Value Trap: Theory of Universal Valuation.

-----

Oil & Gas (Majors Industry) – BP CVX COP XOM RDS.A RDS.B TOT

Independent Oil & Gas Industry – APA COG CLR DVN EOG MRO OXY PXD

Industrial Minerals: ARLP, CCJ, CNX, HCR, NRP

Refining Industry – HES HFC MPC PSX VLO

Oil & Gas Pipeline Industry – ENB ET EPD KMI MMP

Related: USO, BNO, ARMCO, XLE, XOP, VDE, AMLP, AMZA

Also tickerized for top 10 holdings in the AMLP as of the time of this writing.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares or units in any of the securities mentioned above. Kinder Morgan Inc (KMI) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. BP plc (BP), Enterprise Products Partners L.P. (EPD), and Magellan Midstream Partners L.P. (MMP) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment