Facebook’s Promising Growth Outlook

Image Shown: Top-weighted Best Ideas Newsletter portfolio holding Facebook Inc has seen its stock price surge higher over the past year and we see room for considerably more capital appreciation upside. Facebook’s growth trajectory will depend in large part on how effective the firm is at generating more revenue per active user, especially in markets outside of the US & Canada. The emergence of a large global middle class should assist in these endeavors. We view Facebook’s growth outlook quite favorably and continue to be big fans of the social media giant.

By Callum Turcan

Facebook Inc (FB) continues to be one of our favorite companies out there. Shares of Facebook are included as a top-weighted holding in our Best Ideas Newsletter portfolio. Our fair value estimate for FB sits at $284 per share, though should the firm outperform our “base case” assumptions, Facebook could carry a fair value estimate as high as $355 per share. We are enormous fans of Facebook’s net cash balance (~$58.2 billion in net cash at the end of June 2020), high quality cash flow profile (relatively modest capital expenditures are required to maintain a certain level of revenue), and incredibly promising long-term outlook that is supported by secular growth tailwinds.

Resilient Business Model and Promising Outlook

During the second quarter of 2020, Facebook’s average revenue per user (‘ARPU’) came in at $36.49 in the US & Canada versus $11.03 in Europe, $2.99 in the Asia-Pacific region, $1.78 in the remaining international regions. Combined, Facebook’s worldwide ARPU stood at $7.05 in the second quarter of 2020. The digital advertising markets in both the US & Canada are mature, very lucrative, and incredibly resilient to exogenous shocks. In the first and second quarters of 2020, Facebook’s ARPU in the US & Canada region was up approximately 13% and 10% year-over-year, respectively. Please note the company also experienced strong active user base growth during these periods, which we will cover in just a moment.

While the ongoing coronavirus (‘COVID-19’) created meaningful short-term headwinds, those hurdles appear manageable and Facebook’s digital advertising business has held up incredibly well so far. Worldwide, Facebook’s APRU was up roughly 8% year-over-year in the first quarter and flat year-over-year in the second quarter of 2020, highlighting the resilience of its business model during the initial stages of the pandemic as strength in the US & Canada offset weakness elsewhere.

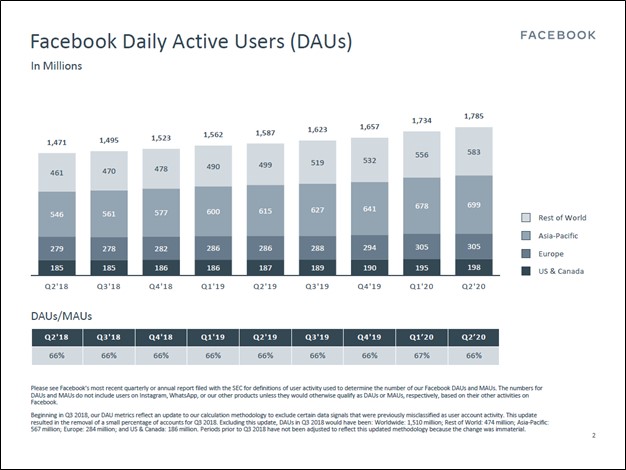

Facebook’s GAAP revenues were up 14% year-over-year during the first half of 2020. The firm’s revenue growth rate slowed down somewhat sequentially as Facebook reported its GAAP revenues grew by just 11% year-over-year in the second quarter of this year, though please note that includes the period when most of North America was under lockdown due to COVID-19. Impressive user base growth, as highlighted in the upcoming graphic down below, combined with stable APRU metrics allowed Facebook to continue putting up strong financials during the initial phase of the pandemic.

Image Shown: Facebook’s active user base grew significantly during the first and second quarters of 2020 as households sought out ways to stay connected during the pandemic. Image Source: Facebook – Second Quarter of 2020 Earnings IR Presentation

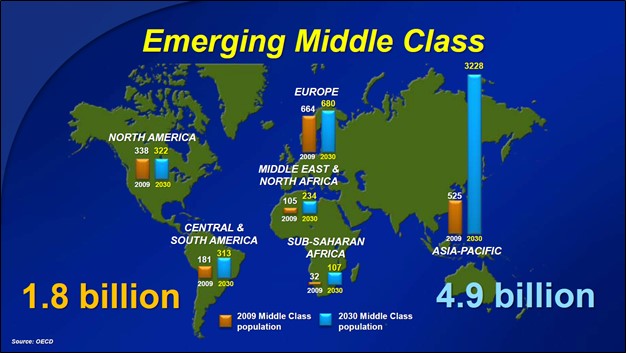

Going forward, the emergence of a significantly larger global middle class (in both nominal and relative terms) should support Facebook’s ability to steadily grow its ARPU over time, particularly outside of the US & Canada. Back in 2017, Colgate-Palmolive Company (CL) cited a study from the Organization for Economic Co-operation and Development (‘OECD’) that noted the global middle class population was expected to grow from around 1.8 billion in 2009 to about 4.9 billion by 2030. As you can see in the upcoming graphic down below, most of that growth is forecasted to occur in the Asia-Pacific region.

Image Shown: The global middle class population is forecasted to become much larger over the next decade compared to 2009 levels. Image Source: Colgate-Palmolive – September 2017 IR Presentation

The Asia-Pacific region was home to about two-fifths of Facebook’s total daily active users (‘DAUs’) and total monthly active users (‘MAUs’) during the second quarter of 2020, though this region generated less than one-fifth of its revenues during this period. We expect that this will change over time given the region’s promising long-term economic growth outlook which in turn should support Facebook’s ability to grow its APRU in this market.

Please note Facebook is one of many Western-based tech companies whose offerings are banned in China. With that in mind, the key nations to watch are India (population of ~1.35 billion), Vietnam (population of ~100 million), Indonesia (population of ~270 million), and the Philippines (population of ~110 million) given the strong economic outlooks in these countries and their relatively large populations. Over the years to come, the emergence of a sizable middle class population in these countries will help enable Facebook to charge higher rates for its digital advertising services in these markets as consumer spending per capita swells higher.

Facebook recently augmented its growth runway in the region by acquiring an equity stake in Jio Platforms, a provider of 4G telecommunications services and digital platforms in India, from Reliance Industries which we covered in detail here and here. As an aside, please note that Alphabet Inc (GOOG) (GOOGL), another top-weighted holding in our Best Ideas Newsletter portfolio, also acquired an equity stake in Jio Platforms which we covered previously here. We continue to be intrigued by the opportunities Facebook’s tie-up with Jio Platforms could yield, with an eye towards the e-commerce and payment processing space, along with the potential for Facebook to help connect a greater percentage of Indian households to the internet.

Concluding Thoughts

We continue to be big fans of large-cap tech companies with pristine balance sheets, strong cash flow profiles, and promising growth outlooks (in particular, growth runways that are underpinned by secular growth tailwinds) as those companies are best position to ride out the ongoing COVID-19 pandemic. Alphabet and Facebook are two perfect examples of great companies with ample capital appreciation upside.

-----

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Related: AAPL, CL, SOCL, MILN, SNAP, PINS, XLC, VOX, FCOM, IXP, FNGS

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple, Facebook Inc (FB), and Microsoft are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment