Facebook’s Growth Story Continues

Image Shown: Shares of Facebook Inc are up ~23% year-to-date as of the end of normal trading hours on August 3. We continue to like shares of FB as a top-weighted holding in our Best Ideas Newsletter portfolio, and we see room for meaningful capital appreciate upside.

By Callum Turcan

On July 30, Facebook Inc (FB) reported second quarter 2020 earnings that beat consensus top- and bottom-line estimates by a mile. Advertising revenue was up 10% year-over-year last quarter, a slower growth rate than the 17% year-over-year increase posted during the first quarter of this year but still very impressive given the headwinds facing the digital advertising space due to the ongoing coronavirus (‘COVID-19’) pandemic. Facebook’s revenues and bottom-line grew materially due to strong user base and engagement growth, which we will cover later on in this piece.

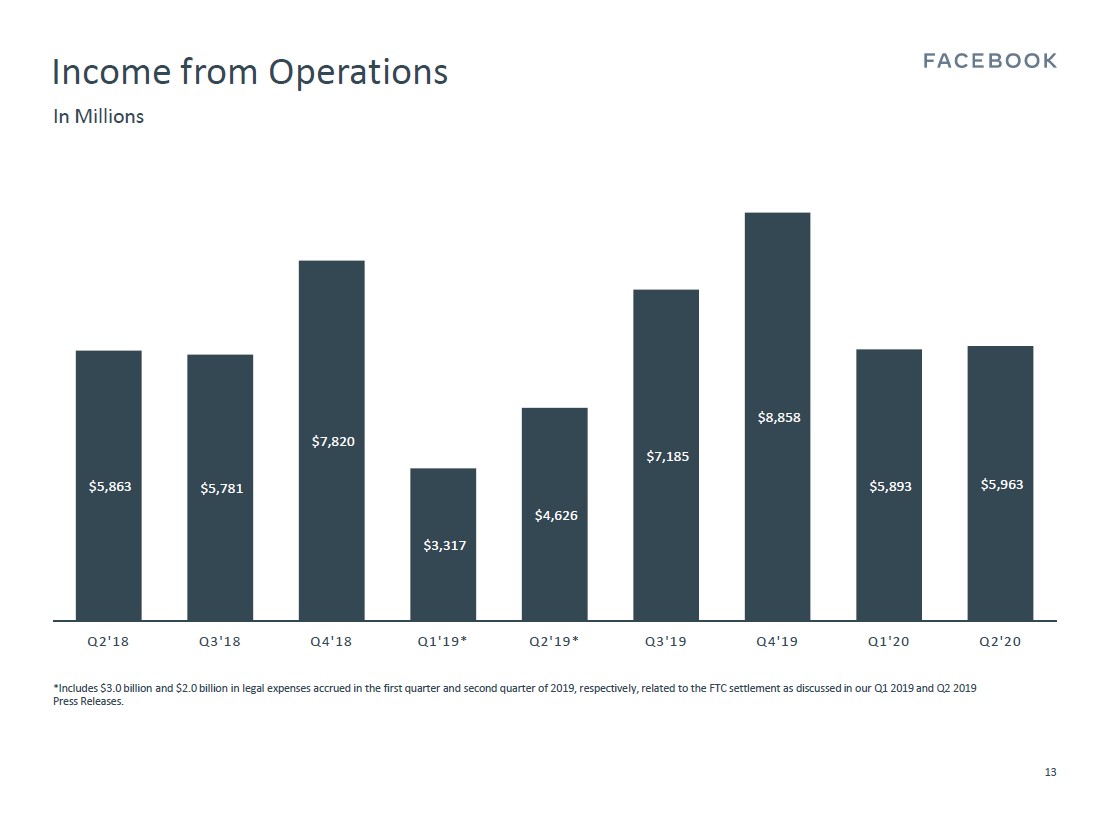

Facebook’s GAAP revenues were up 11% in the second quarter versus the same period a year-ago, aided by strong advertising sales and 40% sales growth at its ‘other’ business segments. Its GAAP operating income was up 29% year-over-year last quarter, though please note the firm recorded a large legal expense from the US Federal Trade Commission (‘FTC’) in the second quarter and first half of 2019. The social media giant’s GAAP diluted EPS roughly doubled last quarter versus the same period a year-ago, hitting $1.80. Shares of FB shot up significantly higher after the company reported its latest earnings.

We continue to like Facebook as a top-weighted holding in the Best Ideas Newsletter portfolio, and we see ample room for further capital appreciation as our fair value estimate sits at $284 per share, far above where shares of FB are trading at as of this writing. Additionally, the top end of our fair value estimate range sits at $355 per share of Facebook. Recent technical strength seen at shares of FB indicates that investors are starting to really warm up to Facebook’s high-quality business model, promising growth outlook, and pristine balance sheet.

Earnings Overview

At the end of June 2020, Facebook had $58.2 billion in cash, cash equivalents, and marketable securities on hand and no debt on the books. We strongly appreciate Facebook’s pristine balance sheet. During the first half of 2020, Facebook generated $8.1 billion in free cash flow ($14.9 billion in net operating cash flow less $6.8 billion in capital expenditures) which fully covered $2.1 billion in repurchases of Class A common stock. Though Facebook does not pay out a common dividend at this time, should it want to, Facebook has the financial strength to initiate a meaningful dividend program. Given that shares of FB are trading well below their fair value estimate as of this writing, we see its share repurchases as a good use of capital.

During the first half of 2020, Facebook generated $36.4 billion in GAAP revenues (up 14% year-over-year) and $11.9 billion in GAAP operating income (up 49% year-over-year), though please note that its financial performance last year was held down by the aforementioned legal settlements with the US FTC. Facebook’s GAAP diluted EPS came in at $3.51 during the first half of 2020, about double year-ago levels. Please note that Facebook’s outstanding diluted share count rose during this period on a year-over-year basis, albeit marginally, as stock-based compensation (and other dilutive measures) offset its share repurchases. All things considered, Facebook’s financials held up well during the initial phase of the ongoing COVID-19 pandemic as you can see in the upcoming graphic down below.

Image Shown: Facebook’s financial performance held up well during the initial phase of the pandemic. Image Source: Facebook – Second Quarter of 2020 IR Earnings Presentation

User Base Growth Speeds Up

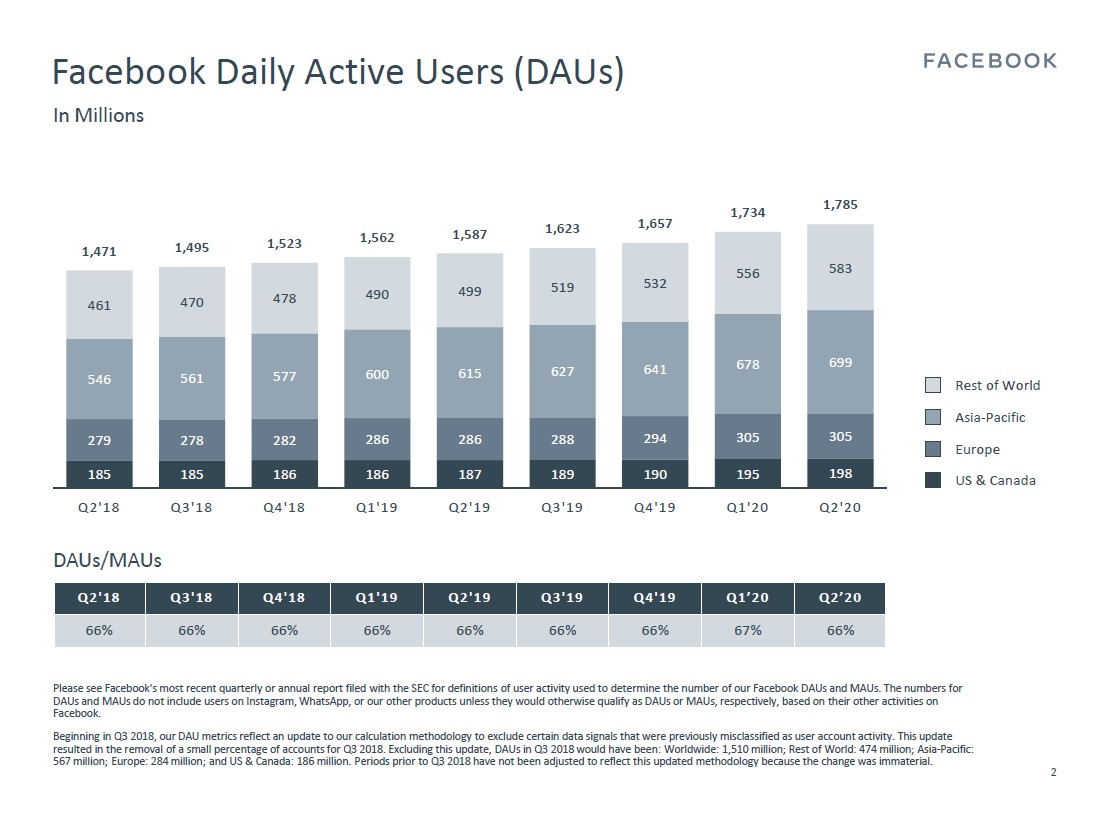

In the upcoming graphic down below, please note that the rate of growth in Facebook’s daily active users (‘DAUs’) picked up pace during the early stages of the COVID-19 pandemic. During the first half of 2020 (averaging quarterly DAUs during each half-year period), Facebook’s DAUs grew by 12% year-over-year, a faster rate of growth than the 9% year-over-year increase posted during the second half of 2019 and the 8% year-over-year increase posted during the first half of 2019. With the pandemic forcing many households to “cocoon” indoors for extended periods of time, it appears many have turned to social media to pass the time and stay connected with friends, family, and loved ones.

Image Shown: Facebook’s daily active user base grew significantly during the first half of 2020. Image Source: Facebook – Second Quarter of 2020 IR Earnings Presentation

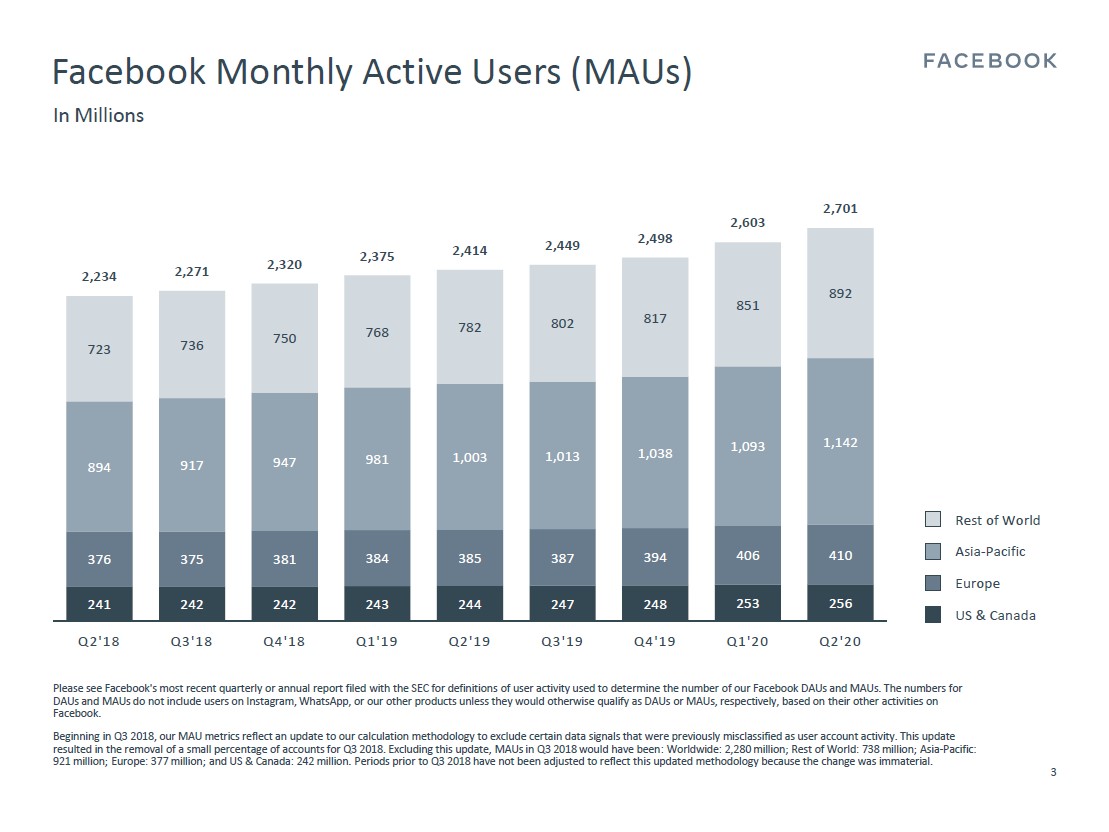

Additionally, Facebook noted that the percentage of DAUs to monthly active users (‘MAUs’) remained near historical levels at ~66-67% during the first half of this year. In the first half of 2020 (averaging quarterly MAUs during each half-year period), Facebook’s MAUs increased by 11% year-over-year, up from the 8% year-over-year growth rate posted during the second half of 2019 as you can see in the upcoming graphic down below. We appreciate that Facebook’s user base is growing at a faster pace than in the recent past, as that lends a tremendous amount of support to both its near- and long-term outlook.

Image Shown: Facebook reported that its monthly active user base grew at a faster year-over-year rate during the early stages of the pandemic (first half of 2020) than in the recent past, as many households are using social media to stay in touch with friends, family, and loved ones during these harrowing times. Image Source: Facebook – Second Quarter of 2020 IR Earnings Presentation

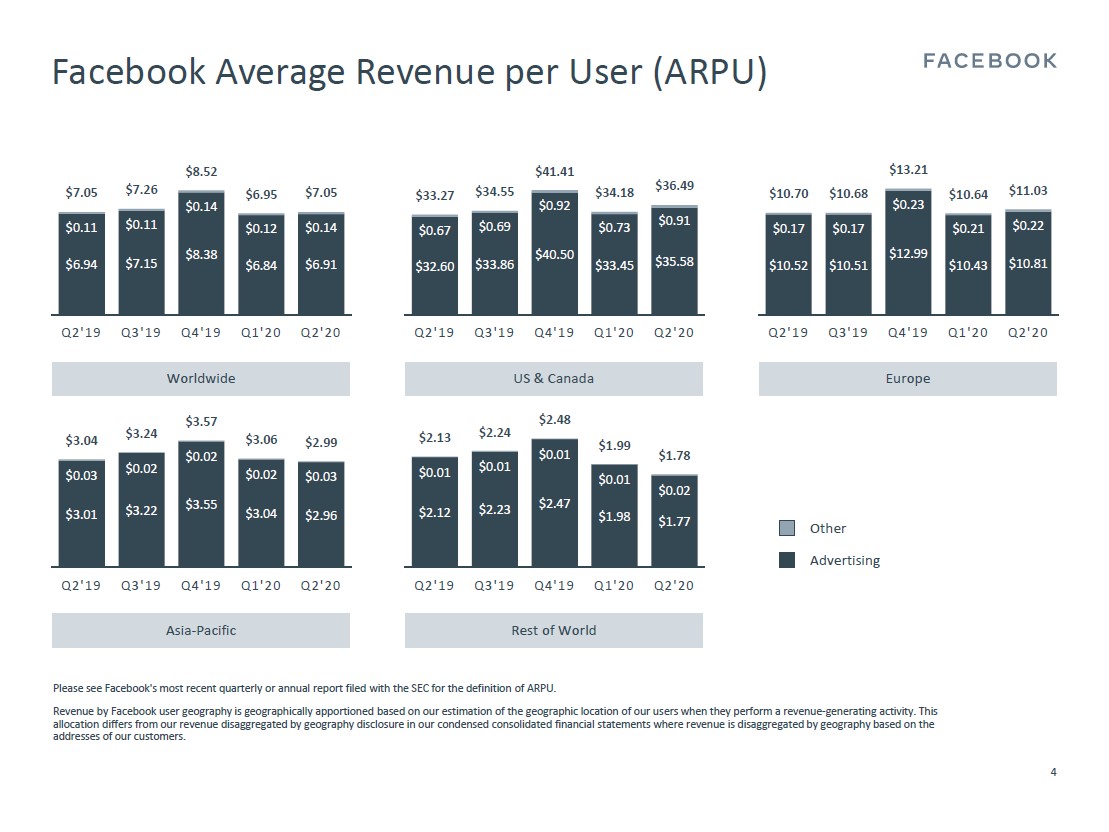

User growth was essential in enabling Facebook to grow its revenues and operating income last quarter, as its worldwide average revenue per user (‘ARPU’) was flat in the second quarter of 2020 versus the same period a year-ago as you can see in the upcoming graphic down below. During the first half of 2020 (averaging quarterly ARPUs during each half-year period), Facebook posted 4% year-over-year ARPU growth though please note that pressures facing its North American segment did not start to really build until late in the first quarter.

Image Shown: Facebook’s average revenue per user faced material headwinds in the second quarter of 2020, due namely to the pandemic, and was flat year-over-year. Image Source: Facebook – Second Quarter of 2020 IR Earnings Presentation

However, please note that management forecasted (during the firm’s latest earnings call) that Facebook’s near-term DAUs and MAUs may come in slightly this quarter on a sequential basis as quarantine measures are eased worldwide. With that being said, we continue to like Facebook’s strong operational execution of late.

Guidance

Facebook had this to say about its near-term guidance in the face of COVID-19 during the firm’s latest earnings call (emphasis added):

“…We are seeing signs of normalization in user growth and engagement as shelter-in-place measures have eased around the world, particularly in developed markets where Facebook’s penetration is higher. Looking forward, as shelter-in-place restrictions continue to ease, we expect the number of Facebook DAUs and MAUs to be flat or slightly down in most regions in Q3 compared to Q2.

In the first three weeks of July, our year-over-year ad revenue growth rate was approximately in-line with our Q2 ad revenue growth rate of 10%. We expect our full quarter Q3 year-over-year ad revenue growth rate to be roughly similar to this July performance.

There are several factors contributing to this: First, continued macroeconomic uncertainty including the pace of recovery and the prospects for additional economic stimulus; second, the expectation that some of the recent surge in community engagement will normalize as regions reopen; third, the impact from certain advertisers pausing spend on our platforms related to the current boycott which is reflected in our July trends; and lastly, headwinds related to ad targeting and measurement, including the impact of regulation, such as the California Consumer Privacy Act, as well as headwinds from expected changes to mobile operating platforms, which we anticipate will be increasingly significant as the year progresses.” --- Dave Wehner, CFO of Facebook

Given that Facebook’s management team is forecasting the company’s advertising revenue growth rate will continue this quarter roughly on par with second quarter levels (on a year-over-year basis), it appears that the sky is not falling for the digital advertising industry after all. Instead, Facebook provided guidance that given the circumstances, proved to be quite optimistic which pleased investors.

One final note, it appears that efforts by certain advertisers to (temporarily) boycott Facebook have not impeded its growth momentum (reportedly, several of those advertisers are returning to Facebook starting this August according to the WSJ), seen through the company guiding for a strong third quarter performance (which factors in these headwinds). Facebook has responded to complaints and criticisms from advertisers and civil rights groups by adding a new VP-level role to its corporate structure that will focus on civil rights work, agreeing to have the guidelines for content creation on its platforms audited, and other initiatives.

India

As we have covered in the past (link here), Facebook intends on acquiring almost 10% of Jio Platforms’ equity from India’s Reliance Industries for ~$5.7 billion in cash. Here is what Facebook’s management team had to say regarding the company’s Indian strategy during its latest earnings call in response to an analyst’s question (emphasis added):

“I can take the India question. It’s very connected to what I was just talking about around messaging commerce. A lot of people use WhatsApp [a messaging service and subsidiary of Facebook], especially in India, there’s a huge opportunity to enable small businesses and individuals in India to buy and sell things through WhatsApp. We want to enable that. That starts with enabling payments.

A big part of the partnership that we have with Jio will be to wire up and get thousands of… small businesses across India on-boarded onto WhatsApp, to do commerce there. And we’re really excited about the opportunity there. And once we prove that out with Jio in India, we’re planning on expanding it to more folks in India and to other countries as well.

But, there’s no doubt that India is a huge opportunity. It is the largest country by the size of our community that we’re serving already. And it should be one of the fastest growing business opportunities as well to help businesses grow there, and we’re very excited about that.” --- Mark Zuckerberg, Chairman, CEO, and co-founder of Facebook

In July, the transaction closed according to Facebook’s management team, and we are excited to see how Facebook’s partnership with Jio Platforms pans out. Please note Jio Platforms provides 4G telecommunications services to hundreds of millions of consumers in India and also owns digital platforms such as express grocery e-commerce platform JioMart. Going forward, we are paying close attention to Facebook’s e-commerce strategy in India, especially as the firm intends on using its operations there to potential launch similar services in other countries if proven successful.

As an aside, Alphabet Inc (GOOG) (GOOGL) recently announced it was investing $4.5 billion in Jio Platforms for a 7.7% equity stake in the firm. We are very optimistic on the long-term trajectory of India’s digital economy.

Concluding Thoughts

We continue to like shares of Facebook as a top-weighted holding in our Best Ideas Newsletter portfolio. Facebook’s pristine balance sheet, high quality cash flow profile, promising growth outlook, and solid performance during the initial stage of the ongoing COVID-19 pandemic underpins the technical strength seen at shares of FB this year. We are optimistic that Facebook will emerge on the other side of this pandemic with its growth trajectory and financials intact.

-----

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TECHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Related: SOCL, MILN, SNAP, PINS, XLC, VOX, FCOM, IXP, FNGS

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Microsoft Corporation (MSFT), and Oracle Corporation (ORCL) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple, Facebook Inc (FB), and Microsoft are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment