Extreme Volatility and Crisis Economics

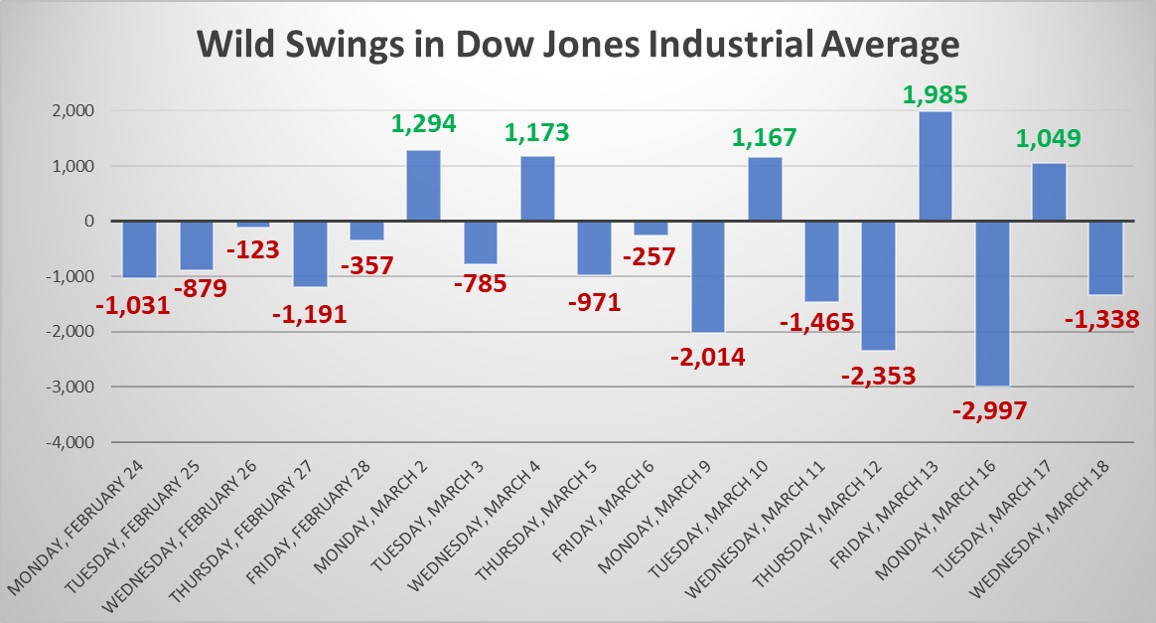

Image: The Dow Jones has now registered 8 consecutive trading days with a 4% move in either direction, from March 9 through March 18. This is the most volatile time in history, a streak that is longer than the 5 consecutive days registered in November 1929 (Great Depression), 4 consecutive days in 1987 (Crash of 1987), and 4 consecutive days in 2008 (Great Financial Crisis).

From Value Trap: “There may be just one other period in history that had more price-agnostic trading than today, and that may be the period pre-dating the publication of John Burr Williams’ work The Theory of Investment Value, or roughly 1928-1940. This was the most sustainably volatile period in stock market history, as measured by daily percentage changes in the S&P 500. In the 1920s, stocks and bonds were mass marketed to the general public, and many were just speculating on the price behavior of securities they didn’t understand. Back then, there may not have been much value-conscious trading activity at all. Today, as index investing and ETFs backed by traditional quantitative theory proliferate, market volatility may once again approach those levels, and if not checked, surpass them.

Indexers and quantitative investors rely on value-conscious active management to set the “correct” prices. Vanguard founder Jack Bogle has said that “if everybody indexed, the only word you could use is chaos, catastrophe.” The chances of everybody indexing may be zero, but what are the chances of both indexers and quantitative investing, or all price-agnostic trading, completely overwhelming fundamental value-conscious traders that calculate intrinsic value estimates, causing levels of market volatility we’ve never seen before? What are the chances that the arbitrage mechanism of the market in setting reasonable prices breaks down? That is a non-zero probability that can have widespread implications, impacting each and every one of our lives.

How should you prepare for what I believe will become one of the most volatile periods in stock market history, set off by the combination of indexing and quant trading proliferation? Within an equity portfolio, consider using enterprise valuation to estimate intrinsic value, and apply behavioral (relative) valuation to assess what others might be thinking. Think about assessing technical/momentum dynamics to evaluate the likelihood of price-to-estimated-fair value convergence, and don’t dismiss the valuable information in prices, which could help you avoid value traps. The Valuentum process employs these considerations but consider diversifying your portfolio well beyond stocks, too.

While it is almost certain that asset-return correlations will not act the same way they did during previous crises, the concept of diversification across asset classes may save you big in the event of a systemic crisis driven by price-agnostic investors that hits the equity markets hard. There are rules of thumb about what might be the best asset allocation for your age, but only your personal financial advisor would know best for your individual situation. A good mix of Valuentum stocks (the Best Ideas Newsletter portfolio, or Dividend Growth Newsletter portfolio), high-quality corporate bonds, private real estate or businesses, certificates of deposit, and dry powder in the form of cold-hard cash could make a lot of sense for many.” – Value Trap, published 2018

By Brian Nelson, CFA

The stock market continues to rack up record levels of volatility. The CBOE VIX Index recently reached levels higher than the highest of the Great Financial Crisis. On Monday, March 16, the Dow Jones Industrial Average fell nearly 3,000 points, the most in its history. The S&P 500 closed down nearly 12% that day, the worst day since the Crash of 1929 and Black Monday of 1987. The three consecutive prior trading days through Monday registered trading swings of greater than 9%, the first time since October 1929.

Here is the big one: For the first time in history, the Dow Jones Industrial Average (DIA) has had 8 consecutive days with a 4% move in either direction. The markets are in chaos, and until a vaccine for coronavirus is rolled out broadly, which won’t be for another 12-18 months, the economy could be headed for catastrophe. But the coronavirus is not only to blame for this whirlwind of volatility.

The bigger culprit is the proliferation of price-agnostic trading (indexing/quant), which continues to amplify the markets ups and downs. The Wall Street Journal ran a great article the other day that hit the front page, “Why Are Markets So Volatile? It’s Not Just the Coronavirus: The market is dominated by computer-driven investors that rely on signals such as volatility and momentum.”

As we write in Value Trap, today, only about 10% of trading comes from traditional fundamental investors, hardly enough to create a well-functioning marketplace. According to J.P. Morgan roughly 60% comes from passive investors and quantitative traders, investors that just aren’t paying attention to intrinsic value calculations. Jack Bogle might be right. Right now, the markets are in "chaos," but they can end in "catastrophe."

Most everyone continues to look the other way, in part because they are reaping huge fees on passive products. The industry has embraced pitching index funds and championing quantitative research that it has largely lost sight of what stock prices actually are--a claim on the assets of a business. Price discovery has largely been wrecked, and the ongoing market crash is acting as a cleansing mechanism to clear out the index and quant excess.

Crisis Economics

Yesterday, March 18, the Fed reinstated the Money Market Mutual Liquidity Fund, which will “create a backstop for prime money market mutual funds,” and the European Central Bank announced a new “Pandemic Emergency Purchase Programme” to help the European economy. Until a vaccine is rolled out across the globe, however, consumer purchasing behavior around the world will likely remain depressed, in our view. The implications on the energy complex (XOP), airlines (JETS), the hotel and leisure industry (PEJ), the restaurant industry, and the theater industry are enormous, and the subsequent effects on the weaker banks that will be reeling from small-business pain could be severe. Loan loss reserves are sure to rise.

Companies continue to pull down their revolving credit facilities (their corporate credit cards). Ruth’s (RUTH) and Norwegian Cruise Lines (NCLH) recently drew down their credit lines, following Micron (MU), Kraft Heinz (KHC), and Boeing (BA), the latter facing nothing short of a disaster, which may be the catalyst behind a dividend cut. U.S. banks could see $700 billion fly from their coffers as companies hunker down, and the Fed and Treasury is doing all that it can to keep the system stable, even opening the door to “implicitly” buying equities.

Political backlash from rampant buybacks in recent years could have implications on how well equity holders in Boeing and airlines inevitably make out under any bailout scenario. Terms to stay afloat may punish shareholders severely, and there’s no guarantee shareholders won’t be wiped out. With fiscal stimulus running rampant and the Trump gains in the stock market eviscerated, the probability of a Joe Biden win and a rollback of corporate tax policy is growing, with negative implications on long-term stock values.

Concluding Thoughts

The worst of the declines may still be ahead of us. The S&P 500 still is trading within our fair value estimate range of 2,350-2,750, and we wouldn’t be surprised to see panic/forced selling all the way down to 2,000 on the S&P. Expect more volatility, and please stay safe out there as the world declares all out war on COVID-19. Our best ideas remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio, and Exclusive publication.

God bless and good luck!

---

Restaurants - Fast Food & Coffee/Snack: ARCO, DPZ, DNKN, JACK, MCD, PZZA, SBUX, WEN, YUM

Related Airline: AAL, ALK, DAL, HA, JBLU, LUV, SAVE, UAL

Related Hotel: H, IHG, WH, CHH, RLH, STAY, BEL, WYN, EXPE, BKNG, TRIP, TZOO, TCOM, HTZ, CAR

Related Volatility ETFs: VXX, UVXY, TVIX, SVXY, VIXY, ZIV, VXXB, VIXM, VXZ, VIIX, XVZ, XXV

Also tickerized for the DIA.

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY and SCHG. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment