Earnings Roundup: BYND, DASH, DPZ, NVDA

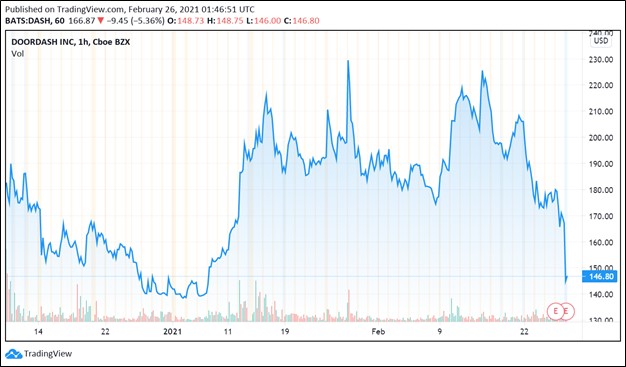

Image Shown: Shares of DoorDash Inc tumbled after the food delivery service reported its latest earnings report near the end of February 2021.

In alphabetical order by ticker: BYND, DASH, DPZ, NVDA

By Callum Turcan

In this article, we've highlighted four companies that just reported their latest results. Domestic and international economic activities continued to face major headwinds from the coronavirus (‘COVID-19’) pandemic near the end of last year and into the beginning of this year, though corporates are now starting to plan for a world when “pre-pandemic” activities (such as going to eat indoors at a restaurant) can resume in earnest. Global health authorities are working to put an end to the public health crisis via ongoing COVID-19 vaccine distribution efforts.

Beyond Meat (BYND)

On February 25, the fake meat producer Beyond Meat Inc (BYND) reported fourth quarter earnings for 2020 that missed both consensus top- and bottom-line estimates. The alternative “meat” manufacturer reported that its GAAP revenues were up almost 4% year-over-year in the fourth quarter as growth at its ‘Retail’ division offset headwinds facing its ‘Foodservice’ division given the myriad of headwinds facing the restaurant industry. Beyond Meat did not provide guidance for 2021 during its latest earnings report given the company’s inability to accurately predict how this year will unfold for the restaurant industry and its own business in the face of the ongoing COVID-19 pandemic.

Beyond Meat’s GAAP gross margins took a big hit last quarter on a year-over-year basis, in part due to extra costs related to dealing with the COVID-19 pandemic. Even on an adjusted non-GAAP basis, Beyond Meat’s adjusted gross margins still fell to 28.5% in the fourth quarter versus 34.0% in the same period the prior year. Management cited the curtailment of production volumes in the third quarter of last year as negatively impacting Beyond Meat’s fourth quarter gross margin performance in the firm’s latest earnings press release. Additionally, unfavorable product mix shifts and lower net price realizations (due to higher trade discounts) also weighed on Beyond Meat’s gross margin performance in the fourth quarter of 2020 on a year-over-year basis.

However, Beyond Meat also announced on February 25 that it had secured a three-year supply deal with McDonald’s Corporation (MCD). This agreement will see Beyond Meat become the “preferred supplier” for McDonald’s new plant-based burger offering, the McPlant, which is currently “being tested in select McDonald’s markets globally.” Beyond Meat will also work with McDonald’s to create other menu items with alternative “meat” products. Furthermore, Beyond Meat announced a strategic partnership with Yum! Brands Inc (YUM), which owns the Taco Bell, KFC, and Pizza Hut brands, on February 25 that involves working with Yum! Brands to develop new menu items that include Beyond Meat’s alternative “meat” products.

As of this writing, shares of Beyond Meat are trending down towards the top end of our fair value estimate range, which sits at $135 per share. The company’s new strategic partnerships are quite interesting, though shares of BYND still appear quite pricy as of this writing. Beyond Meat generated negative net operating cash flows and thus negative free cash flows in 2020. When restaurants can resume indoor dining activities at or near full capacity worldwide, that should go a long way in supporting Beyond Meat’s financial performance.

DoorDash (DASH)

On February 25, DoorDash Inc (DASH) beat consensus top-line estimates but missed consensus bottom-line estimates when it reported its first quarterly earnings report since going public back in December 2020. In the fourth quarter of 2020, the food delivery service firm reported 273 million orders (up 233% year-over-year) with a gross order value (‘GOV’) of $8.2 billion (up 227% year-over-year). DoorDash generated $1.0 billion in GAAP revenues in the final quarter of 2020, up 226% year-over-year, though its GAAP operating loss more than doubled to $0.3 billion during this period. While DoorDash noted it posted modestly positive adjusted EBITDA in the fourth quarter, we caution that this is a non-GAAP figure that needs to be taken with a pinch of salt.

Looking ahead, DoorDash guides that it will grow its marketplace GOV 8% sequentially in the first quarter of 2021 at the midpoint of its forecast. DoorDash’s business is expected to grow at a much slower rate when compared to the rapid growth rate witnessed last year. For the full year, DoorDash forecasts that its marketplace GOV will grow 28% annually in 2021 at the midpoint of guidance. Management also expects DoorDash will generate a modest amount of positive adjusted EBITDA in both the first quarter and for the full year in 2021. In its fourth quarter letter to shareholders DoorDash noted (emphasis added):

We expect 2021 Marketplace GOV to be in a range of $30.0 billion to $33.0 billion, with 2021 Adjusted EBITDA in a range of $0 million to $200 million. Our outlook anticipates the successful rollout of COVID-19 vaccines, among other things. Though we cannot predict the short or long-term effects this will have on consumer behavior, our guidance assumes it creates headwinds to growth in total orders and average order values.

When US consumers start to resume indoor dining activities at restaurants in earnest, that will create a major headwind for food delivery service demand which will be incredibly difficult to circumvent. Shares of DoorDash fell by double digits in after-hours trading on February 25 as investors began to factor in the expected steep deceleration in the company’s growth trajectory. As of this writing, shares of DASH are trading below their IPO price and there is room for its stock price to fall further, in our view.

Domino’s (DPZ)

On February 25, Domino’s Pizza Inc (DPZ) reported earnings for the fourth quarter of fiscal 2020 (period ended January 3, 2021) that missed consensus top- and bottom-line estimates, though the pizza chain raised its quarterly dividend by almost 21% on a sequential basis in conjunction with the report. Domino’s noted that it was able to maintain its same store sales growth trajectory last fiscal year while the company was also able to continue growing its store count, which is primarily represented by franchised locations. The company benefited from a 53rd week in fiscal 2020, though management noted during the firm’s latest earnings call that “our same store sales growth is not affected by the extra week.”

Here is what Domino’s had this to say in its latest earnings press release (emphasis added):

U.S. same store sales grew 11.2% during the quarter and 11.5% for the full year, continuing the positive sales momentum in the Company's U.S. stores business. The international business also posted positive results, with same store sales growth of 7.3% during the quarter and 4.4% for the full year. The fourth quarter marked the 108th consecutive quarter of international same store sales growth and the 39th consecutive quarter of U.S. same store sales growth.

The Company had strong fourth quarter global net store growth of 388 stores, comprised of 116 net U.S. store openings and 272 net international store openings. In fiscal 2020, the Company had 624 net store openings, comprised of 229 net U.S. store openings and 395 net international store openings.

Domino’s noted it benefited from rising orders and ticket sizes last fiscal year during its latest earnings call. Looking ahead, Domino’s aims to grow its global retail sales (ex-foreign currency movements) by 6%-10% and its global net unit count by 6%-8% over the next two to three years as management reinstated its longer term guidance during the firm’s latest earnings update. Management noted during Domino’s latest earnings call that “we [will] continue to invest in strategically growing our business, including in technology, innovation, new stores and supply chain capacity” and the firm’s capital expenditures are expected to grow modestly this fiscal year, hitting $0.1 billion.

In fiscal 2020, Domino’s generated $0.5 billion in free cash flow, up from $0.4 billion in fiscal 2019. The company’s dividend obligations are modest (totaled $0.1 billion in fiscal 2020) even after taking its latest payout increase into account. Domino’s approved a new $1.0 billion share buyback program on February 24 which replaced its existing share buyback program. In our view, stock buybacks at Domino’s are a solid use of capital given that shares of DPZ are trading below their intrinsic value as of this writing.

We continue to be big fans of Domino’s and include the company as an idea in the Best Ideas Newsletter portfolio. Shares of Domino’s are trading below our fair value estimate as of this writing, and please note that the top end of our fair value estimate range sits at $461 per share of DPZ. A combination of same store sales growth and an expanding store count underpins our expectations that Domino’s will be able to post sizable free cash flow growth going forward.

Nvidia (NVDA)

On February 24, Nvidia Corporation (NVDA) reported fourth quarter earnings for fiscal 2021 (period ended January 31, 2021) that beat consensus top- and bottom-line estimates. Nvidia generated record revenues last fiscal year though shares of NVDA still sold off initially after its latest earnings update in part due to the growth rate at its ‘Data Center’ business coming in broadly flat on a sequential basis. While its Data Center revenues were up 124% annually in fiscal 2021, it was only up marginally on a sequential basis in the fourth quarter of fiscal 2021.

As the company’s guidance for the first quarter of fiscal 2022 calls for 72% year-over-year revenue growth at the midpoint, Nvidia’s top line is still expected to grow at a rapid clip. However, we caution the firm is exposed to fluctuations in the value of cryptocurrencies given that its large ‘Gaming’ division sells a significant amount of graphics processing units (‘GPUs’) that can be used to “mine” for cryptocurrencies such as bitcoin. The value of many of the leading cryptocurrencies, including bitcoin, has soared over the past few months which could help Nvidia’s near-term performance along the margins, though these gains would likely be ephemeral.

Nvidia generated $4.7 billion in free cash flow in fiscal 2021, up from $4.3 billion in fiscal 2020, performance made all the more impressive when considering its capital expenditures more than doubled during this period. The company exited fiscal 2021 with $11.6 billion in cash and cash equivalents on hand versus $1.0 billion in short-term debt and $6.0 billion in long-term debt. Nvidia is in the process of acquiring Arm Limited from SoftBank Group Bank Corp. (SFTBY) and SoftBank’s Vision Fund through a transaction valued at ~$40 billion as we covered here. This is largely why Nvidia is building up cash on the books. As of this writing, shares of NVDA are trading near our fair value estimate of $533 per share, indicating they are fairly valued at this time.

Concluding Thoughts

Some companies that saw demand for their services surge during the COVID-19 pandemic, such as DoorDash, are now being forced to adapt to the changing landscape once again as households get ready to take advantage of an eventual resumption of pre-pandemic activities (such as utilizing indoor dining options at restaurants). Other companies that faced significant headwinds during the pandemic, such as Beyond Meat, are setting the stage for their potential rebound by securing major strategic partnerships and supply agreements.

Finally, many companies such as Domino's and Nvidia that were doing well before the pandemic were able to ride out (calendar year) 2020 with their growth trajectories intact. Both of these firms, in particular, continued to grow their free cash flows (on a year-over-year basis) last year. We continue to like exposure to Domino’s in the Best Ideas Newsletter portfolio.

Domino's 16-page Stock Report (pdf) >>

Domino's Dividend Report (pdf) >>

Beyond Meat's 16-page Stock Report (pdf) >>

-----

Related: BYND, DPZ, DASH, NVDA, SFTBY, MCD, YUM

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Domino’s Pizza Inc (DPZ) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment