Dividend Growth Idea Republic Services Is a Stellar Enterprise

Image Source: Republic Services Inc – August 2021 IR Presentation

By Callum Turcan

The waste management industry is an incredibly attractive one for investors seeking dividend growth opportunities. One of our favorite firms in the space is Republic Services Inc (RSG), which is included as an idea in the Dividend Growth Newsletter portfolio. Roughly 75% of Republic Services’ revenues come from its collection business and approximately 80% of its revenue has an annuity-type profile, highlighting the incredibly stable nature of its cash flow profile.

On July 29, Republic Services posted second-quarter 2021 earnings that beat both consensus top- and bottom-line estimates, and its strong performance enabled the firm to raise its full-year guidance (again) for 2021. Furthermore, Republic Services announced it was increasing its quarterly dividend by 8% sequentially on July 29. Shares of RSG yield ~1.5% on a forward-looking basis as of this writing.

Earnings Update and Guidance Boost

In the second quarter of this year, Republic Services’ GAAP revenues grew 15% due to a combination of pricing strength and volume growth. The company’s recycling business also showed signs of significant improvement last quarter on both a year-over-year and sequential basis. Here is what management had to say during Republic Services’ second quarter earnings call (emphasis added):

“Retention on our small and large container business remains that historically high level at 94%. If you further consider all permanent units of service retention is even higher at 95%. As anticipated, the pricing environment was strong in the second quarter, total core price was 5.2% and average yield was 2.6%. This level of core price matches the highest level in our company's history.

During the second quarter, we delivered outsized growth in our business as the economy improved. Second quarter volume increased 8.1% compared to the prior year, which exceeded our expectations. The outlook for growth in the remainder of the year, both organically and through acquisitions is strong.” --- Jon Vander Ark, President and CEO of Republic Services

A core part of the company’s business model is built upon pursuing bolt-on acquisitions to enhance its growth trajectory. Republic Services sees its acquisition pipeline sitting north of $0.6 billion in 2021 according to recent management commentary. During the first half of 2021, Republic Services spent roughly $0.6 billion on acquisitions.

Economies of scale, pricing strength, and digital initiatives support the firm’s margin outlook. In the second quarter of 2021, Republic Services’ GAAP operating income rose ~230 basis points year-over-year, hitting approximately 18.4%. Republic Services noted its non-GAAP adjusted EBITDA margin rose ~110 basis points year-over-year in the second quarter, reaching ~30.6% of its revenues. Here is what we had to say regarding Republic Services’ digital initiatives in our June 2021 article covering the firm (link here):

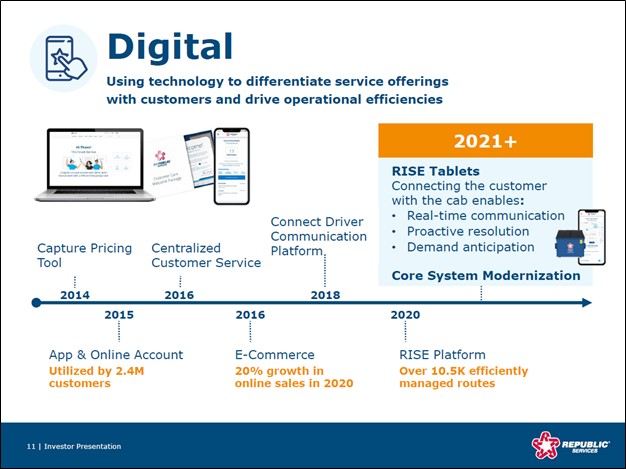

Republic Services’ website and mobile app function as online account management, tools and its e-commerce operations provide the firm with a lower cost sales channel that still enables it to meet the needs of its current and future customer base.

The rollout of the company’s RISE dispatch platform and RISE in-cab technology system offers Republic Services further cost savings. By providing more real-time routing information and data visualization tools, Republic Services aims to generate sizable productivity gains by improving the ability of its employees to efficiency and safely operate. The garbage hauler noted that “we continued our high-performing safety record, reducing safety incidents 18% versus the prior year” in the first quarter.

Additionally, Republic Services is focusing on improving customer connectivity and enabling automated service verification communications to further support its operations. In 2020, Republic Services largely completed the rollout of its RISE dispatch platform and this year, the firm will be focused on rolling out the RISE in-cab technology improvements. These types of digitally-oriented investments support Republic Services’ long-term outlook.

In the upcoming graphic down below, Republic Services provides a snapshot of its digital strategy and what the firm is focused on going forward.

Image Shown: We view Republic Services’ various digital initiatives quite favorably as these efforts support its margin outlook. Image Source: Republic Services – August 2021 IR Presentation

Republic Services posted $1.96 in GAAP diluted EPS during the first half of 2021 (up from $1.47 in the same period last year) and generated $0.9 billion in free cash flow during the first half of this year (up from $0.7 billion in the same period in 2020). The company spent $0.3 billion covering its dividend obligations during the first half of 2021 and less than $0.1 billion buying back its stock during this period. We view the strength of Republic Services’ forward-looking dividend coverage quite favorably as its Dividend Cushion ratio sits well above parity at 1.8, earning the firm a “GOOD” Dividend Safety rating. These metrics incorporate our expectations that Republic Services will steadily grow its payout going forward, and the firm also earns a “GOOD” Dividend Growth rating.

For all of 2021, Republic Services is now guiding to post $4.00-$4.05 in non-GAAP adjusted diluted EPS and adjusted free cash flow of $1.45-$1.475 billion after its latest guidance boost. Please note that Republic Services also raised its guidance during the first quarter of 2021. Back when Republic Services published its fourth quarter 2020 earnings report, the firm forecasted that it would post $3.65-$3.73 in non-GAAP adjusted diluted EPS and adjusted free cash flow of $1.3-$1.375 billion this year. We appreciate Republic Services’ growing confidence in its near-term performance and the company’s promising long-term growth trajectory.

Balance Sheet Update

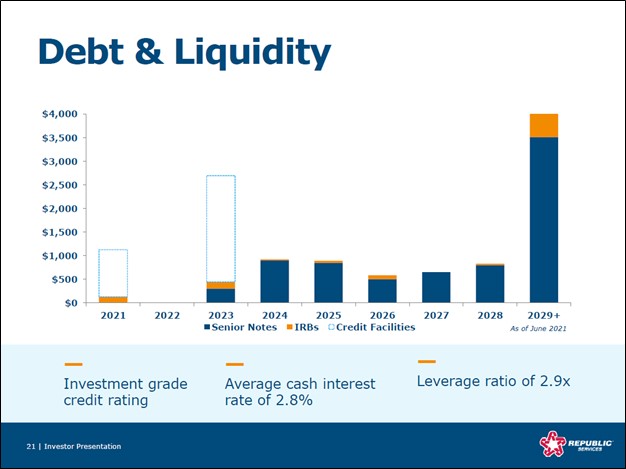

One of Republic Services’ biggest weaknesses from a financial perspective is its large net debt load, which stood at $8.9 billion at the end of June 2021 (inclusive of short-term debt, exclusive of ‘restricted cash and marketable securities’). We view that burden as manageable considering Republic Services had a well-staggered debt maturity schedule at the end of June 2021 (see upcoming graphic down below) along with an incredibly stable cash flow profile, a stellar business model (waste management is an essential service that is always in demand), and ample pricing power.

Image Shown: Republic Services had a well-staggered debt maturity schedule at the end of June 2021, and that should support its future refinancing activities. Image Source: Republic Services – August 2021 IR Presentation

As of the end of June 2021, Republic Services had a rock-solid investment grade credit (Baa2/BBB+/BBB) from the “Big 3” rating agencies. We expect the firm will retain ample access to capital markets at attractive rates going forward, aided by the recent technical strength seen at shares of RSG of late.

The company’s free cash flows easily covered its dividend obligations during the first half of this year, and its share repurchases have historically been relatively tame as Republic Services prefers utilizing its “excess” free cash flows (free cash flows after covering dividend obligations) and balance sheet strength to fund bolt-on acquisitions. Management remains committed to investing in the business and rewarding income-seeking investors, and we view Republic Services’ capital allocation priorities quite favorably.

ESG Consideration

On a final note, Republic Services announced in May 2021 that the firm had “been named to 3BL Media's 100 Best Corporate Citizens of 2021 ranking, recognizing outstanding environmental, social and governance ('ESG') transparency and performance among the 1,000 largest U.S. public companies. This is the second consecutive year Republic has received this recognition.” During Republic Services’ latest earnings call management had this to say on the topic of ESG (lightly edited):

“Next, we believe sustainability is more than environmental stewardship, but also a platform for growth… For example, we are proud to report a 5% reduction in operational greenhouse gas emissions in 2020 compared to the prior year, this year, we expanded and converted a landfill gas to energy plant to high BTU and have 15 additional projects in the pipeline. These projects, reduce landfill emissions, generate more renewable energy and improve our economics. We are also making the communities in which we operate better places to live. So far this year, we've supported more than 25 charitable efforts in neighborhood revitalization projects through financial contributions and volunteer efforts.” --- President and CEO of Republic Services

We appreciate Republic Services’ commitment to maintaining its ESG standing, and would like to note here that Valuentum is proud to announce the upcoming launch of our ESG Newsletter service (click here for more information).

Concluding Thoughts

Republic Services is a great company with a stellar income growth trajectory. We view the firm’s outlook quite favorably and continue to like Republic Services as an idea in our Dividend Growth Newsletter portfolio. The company’s recent guidance increases highlight the enduring resilience of Republic Services’ business model.

Downloads

Republic Services’ 16-page Stock Report>>

Republic Services’ Two-page Dividend Report>>

-----

Tickerized for RSG, WM, WCN, CWST, SRCL, EVX, USMV, CLH, CVA, DAR, ECOL, VEOEY, SZEVY, ENGIY

Industrial Leaders Industry - MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT), and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment