Dividend Growth Idea Qualcomm Proactively Managing Fallout from Global Chip Shortage

Image Shown: Qualcomm Inc, one of our favorite semiconductor firms, noted in March 2021 that the rollout of 5G wireless networks is accelerating which in turn supports its outlook. We include shares of QCOM as an idea in our Dividend Growth Newsletter portfolio. Image Source: Qualcomm Inc – 2021 Annual Meeting of Stockholders IR Presentation

By Callum Turcan

One of our favorite ways to gain exposure to the semiconductor industry is Qualcomm Inc (QCOM), and we include shares of QCOM as an idea in the Dividend Growth Newsletter portfolio. Qualcomm’s IP portfolio and the “chips” that it designs play an essential role in enabling 5G connectivity in smartphones, powering the digital capabilities of modern automobiles, and supporting wireless network operations (including 5G networks).

Qualcomm’s business model remained resilient in the face of headwinds caused by the coronavirus (‘COVID-19’) pandemic. The company’s asset-light business model (relatively modest capital expenditure requirements to maintain a certain level of revenues) enables Qualcomm is generate sizable free cash flows in almost any environment, and its promising growth outlook is underpinned by secular tailwinds.

Managing Supply Constraints

The entire world economy is contending with a shortage of semiconductor components, though Qualcomm is not just sitting around waiting for things to improve on their own. Please note that while Qualcomm designs chips and has a large patent licensing business, it outsources production of its semiconductor offerings to third-parties. This is a common practice in the semiconductor industry.

Qualcomm is reportedly working with United Microelectronics Corp (UMC) and Samsung Electronics Co. (SSNLF) to shore up its supply chain according to a report from Taiwan Economic News. As one of Qualcomm’s biggest suppliers, Taiwan Semiconductor Manufacturing Company Ltd. (TSM) operates numerous fabrication sites that are capable of producing high-end chips, though demand has swamped its production capacity of late.

During a June 2021 investor meeting, Qualcomm was asked about how semiconductor supply constraints were impacting its business. Qualcomm’s President and CEO-elect, Cristiano Amon, responded by first covering why the global economy was facing these headwinds. Mr. Amon highlighted how an increasing part of the economy is going digital with an eye towards “the enterprise transformation of the home” in the wake of the work-from-home trend due to the COVID-19 pandemic. Mr. Amon also noted the pitfalls of the just-in-time model, specifically as it concerns the auto industry, before covering how Qualcomm intended the navigate these headwinds going forward (emphasis added):

“Here is the good news. The good news is, it’s good to have scale. So, we have, based on our scale, even with the supply constraint, you see that our numbers are going up, and we’re very happy with the growth, especially we saw in the quarter and the guide.

But most important is, we have been redesigning products across different sources, making sure we get all the different supply that is available to us, we had leveraged the fact that we have multi-sourcing, one of the few companies that actually multi-source the leading nodes and we put capacity plans in place, those take time as the semiconductor manufacturers have to bring in new equipment.

And we’re going to see those coming into online towards the end of the calendar year. So, it is definitely an issue. We have more demand to supply. We’re happy with the numbers, but if we have more parts, we’ll ship more. But we see that we’re going to start to equalize supply and demand towards the end of the calendar year.” --- President and CEO-elect of Qualcomm

Earnings Update

Qualcomm reported second quarter fiscal 2021 earnings (period ended March 28, 2021) in late April that beat consensus top- and bottom-line estimates. Management cited strong sustained demand for smartphones and scale at its non-handset business as being key here within Qualcomm’s earnings press release. However, the firm’s near-term guidance came in a little softer than expected due to the aforementioned supply constraints, though we continue to view the company’s longer term outlook quite favorably. Qualcomm’s GAAP revenues were up 52% and its GAAP operating income more than doubled year-over-year in the fiscal second quarter, though the COVID-19 pandemic creates a significant amount of noise here.

The company generated $5.1 billion in free cash flow during the first half of fiscal 2021 while spending $1.5 billion covering its dividend obligations and $2.0 billion buying back its stock. Qualcomm exited the fiscal second quarter with a net debt load of $4.2 billion (inclusive of short-term marketable securities and short-term debt). After making good on its dividend obligations, Qualcomm’s excess free cash flows are quite sizable, and we view the firm’s debt burden as manageable given its financial strength.

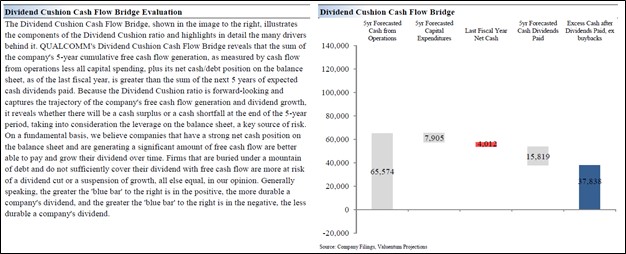

We expect Qualcomm will steadily grow its dividend over the coming fiscal years, supported by its stellar Dividend Cushion ratio of 3.4. This means that over the next five full fiscal years, Qualcomm’s forecasted free cash flows less its net debt position (at the end of fiscal 2020, the latest full fiscal year) is expected to cover its forecasted dividend obligations (which incorporates our dividend growth expectations) more than three times over during this period. Shares of QCOM yield ~2.0% as of this writing.

Image Shown: A visual cash flow bridge highlighting the construction of Qualcomm’s Dividend Cushion ratio, which at 3.4 is incredibly strong and underpins its promising payout growth trajectory.

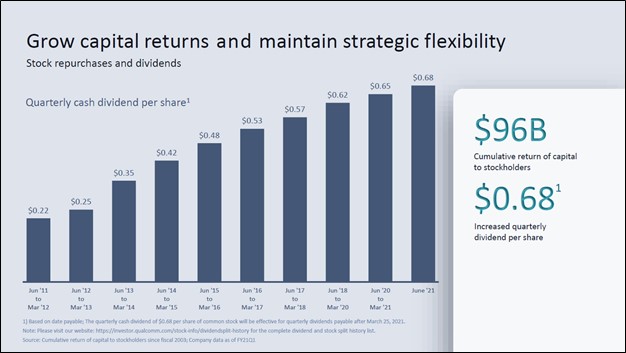

Qualcomm’s management team is very shareholder friendly. The firm’s quarterly payout has grown at a brisk pace over the past decade as you can see in the upcoming graphic down below. Share buybacks are also a key capital allocation priority.

Image Shown: Qualcomm’s dividend grew substantially over the past decade with ample room for upside going forward. Image Source: Qualcomm – 2021 Annual Meeting of Stockholders IR Presentation

Outlook

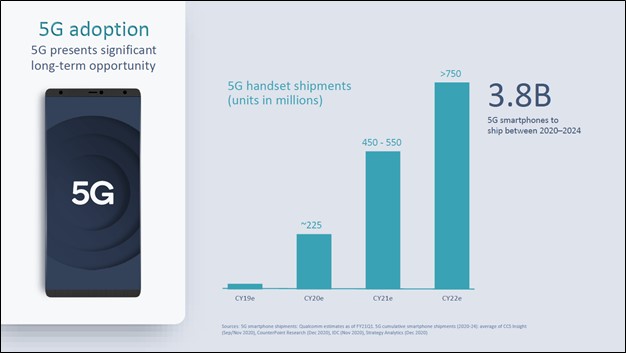

The pace of the proliferation of 5G technology has an outsized impact on Qualcomm’s growth trajectory. Rising 5G-capable smartphone unit sales, for example, should provide a nice tailwind to Qualcomm’s medium-term performance. In the upcoming graphic down below, Qualcomm cites data provided by third-parties along with its own estimates to highlight why its growth outlook is bright.

Image Shown: Expected growth in 5G-capable smartphone unit sales underpins Qualcomm’s promising growth outlook. Image Source: Qualcomm – 2021 Annual Meeting of Stockholders IR Presentation

Rising 5G-capable smartphone sales in turn encourages greater investment in 5G wireless networks, another realm Qualcomm is a key player in. Qualcomm announced in October 2020 that it was launching “a full portfolio of 5G infrastructure semiconductor platforms designed for broad deployment scenarios, ranging from macro base stations with massive MIMO to micro base stations with compact designs, to accelerate the cellular ecosystem transition toward virtualized and interoperable radio access networks (RAN) – a trend driven by 5G.” The company’s 5G RAN platforms represent a major growth opportunity going forward, and Qualcomm is actively working with mobile network operators to assist in the rollout of 5G networks worldwide.

As noted previously, Qualcomm is taking advantage of its scale to stay ahead of the curve in the hypercompetitive industry it operates in. During the first half of fiscal 2021, Qualcomm spent $3.4 billion on its R&D expenses, up over 19% year-over-year. These investments have been put to good use as Qualcomm continues to innovate.

Concluding Thoughts

We continue to be big fans of Qualcomm and like the firm as an idea in the Dividend Growth Newsletter portfolio. As of midday trading on June 11, Qualcomm’s stock price is hovering just above the low end of our fair value estimate range ($131 per share of QCOM) though its technical performance has shown signs of improvement since mid-May 2021. Once the worst of the chip shortage is behind it, Qualcomm should have plenty of positive operational updates to share as it continues to capitalize on secular growth tailwinds. Share buybacks at these levels represent a good use of capital, in our view, given that our fair value estimate sits at $164 per share of Qualcomm.

Downloads

Qualcomm's 16-page Stock Report (pdf) >>

Qualcomm's Dividend Report (pdf) >>

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for NVDA, UMC, QCOM, AVGO, SSNLF, INTC, AMD, MU, AMAT, LRCX, KLAC, TSM, SWKS, CRUS, QRVO, SYNA, STM, MKSI, CREE, LITE, JBL, IDCC, KN, GLW, ON, AMBA, MDTKF, WDC, SOXX, SMH

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO), and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment