This article originally appeared on our website November 17, 2021.

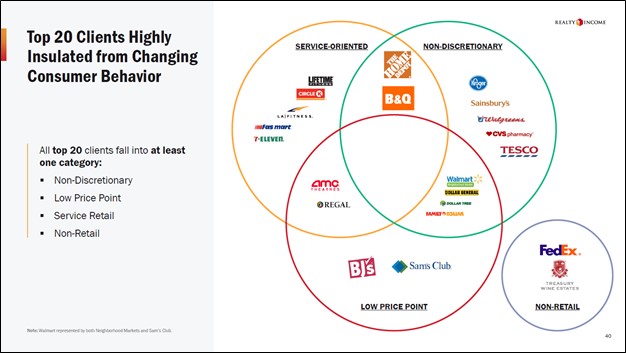

Image Shown: An overview of dividend growth idea Realty Income Corporation’s tenant base, though this appears to be before taking into account its recent merger with VEREIT and spinoff of its corporate office properties portfolio. Image Source: Realty Income Corporation – November 2021 IR Presentation

By Callum Turcan

On November 1, Realty Income Corporation (O) completed its stock-for-stock merger with VEREIT, a deal that according to an April 2021 press release had an enterprise value of ~$50 billion. When the merger closed, shareholders of Realty Income owned ~70% of the new entity and shareholders of VEREIT owned the remainder. Realty Income is a real estate investment trust (‘REIT’) with a vast commercial property portfolio that pays out monthly dividends. We are big fans of the REIT and include Realty Income as an idea in the Dividend Growth Newsletter portfolio. Shares of O yield ~4.0% as of this writing.

Merger and Spinoff

As part its merger strategy, Realty Income combined the corporate office property portfolio of both firms and spun that unit out as a standalone REIT under the name Orion Office REIT Inc (ONL). The rationale for the spinoff is straightforward. In the wake of the coronavirus (‘COVID-19’) pandemic and the acceleration of the work-from-home (‘WFH’) trend, the outlook for the broader office property industry was no longer as attractive as the outlook for other parts of Realty Income’s property portfolio. Here, we must stress that plenty of office properties remain attractive and that as the pandemic fades, many will return to the office in some form, whether that be full-time or through a hybrid work schedule. However, some office properties may become obsolete, and Realty Income wanted to pivot towards its best growth opportunities.

For Realty Income, the REIT wanted to streamline its operational focus. According to its April 2021 press release announcing the VEREIT merger, Realty Income noted that the pro forma company (post-merger, post-spinoff of office properties) would generate ~37% of its annualized contractual rent from convenience store, grocery store, dollar store, drug store, and home improvement tenants combined. Furthermore, another ~23% of its annualized rent on a pro forma basis was expected to come from casual dining and quick service restaurants, health & fitness, and movie theater tenants combined along with another ~4% from transportation services tenants. Around 45% of its annualized rent on a pro forma basis was expected to come from tenants with investment grade credit ratings.

Pivoting to Orion Office REIT, that spinoff’s portfolio consists of ~100 office properties. For every ten shares of Realty Income, investors received one share of Orion Office REIT. Roughly three quarters of the new REIT’s contractual annualized rent is expected to come from tenants with investment-grade credit ratings and around two thirds of its combined annualized rent is expected to come from the healthcare, telecommunications, insurance, financial services, and government services industries. The office REIT has an attractive and financially strong tenant base, though its growth outlook is limited to a degree by factors outside of its control, keeping the WFM trend in mind.

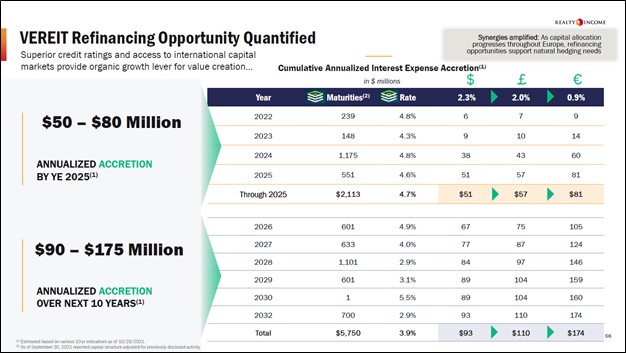

Looking ahead, Realty Income expects to retain its investment grade credit rating (A3/A- as of the end of September 2021). The REIT intends to try to refinance VEREIT legacy debt at lower rates over the coming years to reduce its interest expenses. Additionally, Realty Income aims to generate ~$45-$55 million in annualized corporate cost synergies from the merger (inclusive of stock-based compensation). Around three quarters of those annualized synergies are expected to be realized within the first twelve months post-closing. Improvements in Realty Income’s cost structure will support its future cash flow generating abilities, which we appreciate.

Image Shown: An overview of the refinancing upside Realty Income aims to generate in the wake of its merger with VEREIT, as Realty Income seeks to utilize its stronger financial position to its advantage. Image Source: Realty Income – November 2021 IR Presentation

Realty Income views the VEREIT merger as highly accretive to its non-GAAP adjusted funds from operations (‘AFFO’) per share performance. For reference, AFFO is an industry-specific metric that acts as a useful gauge to measure the trajectory of a REIT’s financial performance. The REIT’s April 2021 press release noted that “the transactions are expected to be over 10% accretive to Realty Income’s AFFO per share in year one, add meaningful diversification that further enables new growth avenues, strengthen cash flow durability, and provide significant financial synergies, particularly through accretive debt refinancing opportunities.”

Earnings Update

When Realty Income reported third-quarter 2021 earnings in early November, the REIT beat consensus estimates for revenue and matched consensus estimates on the bottom line (specifically for its AFFO per share performance). Its AFFO per share rose by 12% year-over-year last quarter. Realty Income’s financial performance is rebounding as almost all its tenants have resumed making contractual rent payments, after some of its tenants (particularly in the movie theater space) stopped making payments during the worst of the COVID-19 pandemic.

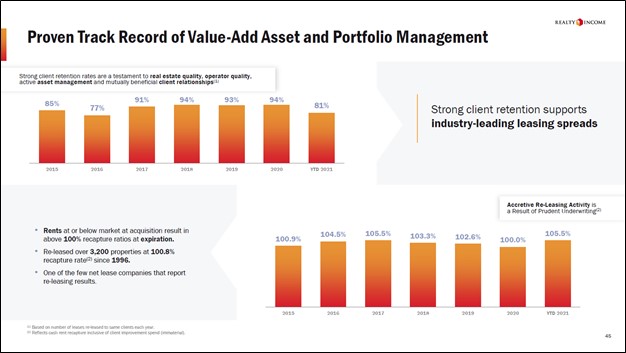

In the third quarter of 2021, Realty Income collected 99.5% of its contractual rent across its portfolio including 100% of the contractual rent owed from its tenants with investment-grade credit ratings. This speaks favorably towards Realty Income’s ability to push through rental rate increases in the future, which in turn supports its cash flow growth outlook. The upcoming graphic down below highlights Realty Income’s stellar historical performance as it concerns retaining its tenant base and pushing through rental rate increases.

Image Shown: Over the past several years and during the first nine months of 2021, Realty Income has done a solid job on the re-leasing and rental rate increasing front. Image Source: Realty Income – November 2021 IR Presentation

Realty Income, as is the case with virtually all REITs, is a capital-market dependent entity. During the first nine months of 2021, Realty Income generated sizable negative free cash flows given its large capital expenditure obligations. The REIT must continuously tap debt and equity markets to fund its growth ambitions, make good on its dividend obligations, and refinance maturing debt. In light of its improving outlook, investment grade credit rating, and recent capital market activity, we expect that Realty Income will be able to continue tapping capital markets at attractive rates as needed going forward.

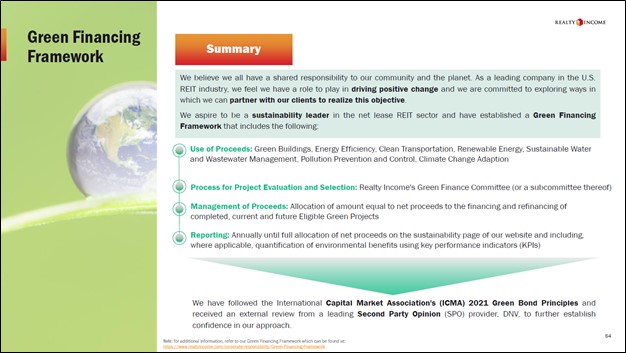

During the third quarter of 2021, Realty Income raised ~$1.6 billion through its at-the-market (‘ATM’) equity issuance program and a secondary offering in July 2021. Additionally, the REIT noted in its earnings press release that “in July 2021, we issued [GBP]£400 million of 1.125% senior unsecured notes due 2027… and [GBP]£350 million of 1.750% senior unsecured notes due 2033” and that these “issuances represented our debut green bond offering.” Green bond issuances are growing in popularity in the REIT world as ESG investing continues to proliferate. The proceeds from these types of bonds, generally speaking, need to be allocated towards projects that are considered green. In return, REITs can modestly lower their cost of capital. The upcoming graphic down below highlights Realty Income’s priorities in the realm of sustainability and green initiatives.

Image Shown: Realty Income recently issued its first green bond. Image Source: Realty Income – November 2021 IR Presentation

Realty Income also had a $3.0 billion revolving credit line that matures in March 2023 (with the option for two six-month extensions) with no borrowings against the facility as of the end of September 2021. The REIT can borrow up to 14 currencies on the revolving credit line, which also has a $1.0 billion expansion option (subject to Realty Income obtaining lender commitments). Its revolving credit line provides Realty Income with ample access to liquidity and should support its future growth endeavors.

At the end of September 2021, Realty Income had over $0.5 billion in cash and cash equivalents on hand and over $9.2 billion in total debt (inclusive of short-term debt) on the books. Please note this was before the VEREIT merger and spinoff of Orion Office REIT were completed. Before those transactions were completed, Realty Income had a well-staggered debt maturity schedule. We view Realty Income’s liquidity position quite favorably and view its net debt load as manageable.

Guidance

The REIT also offered up preliminary near-term guidance in conjunction with its latest earnings report that was favorable, in our view. Realty Income aims to generate $3.84-$3.97 in AFFO per share in 2022 (taking the spinoff of Orion Office REIT into account) and is forecasting to generate $3.55-$3.60 in AFFO per share in 2021 when including the impact of the VEREIT merger.

At the midpoint of guidance, Realty Income aims to grow its AFFO per share by ~9% in 2022 versus expected 2021 levels. Without taking the VEREIT merger into account, Realty Income aims to generate $3.53-$3.59 in AFFO per share this year and using that as a baseline would result in the firm’s AFFO per share growing by ~10% in 2022 versus expected 2021 levels at the midpoint of guidance.

Please note that Realty Income boosted its full-year guidance during the second quarter of 2021 (which included the firm raising its expected AFFO per share performance for 2021). Next year, Realty Income’s forecast for its acquisition volumes is to exceed $5.0 billion. We appreciate Realty Income’s improving near-term outlook.

International Expansion

Back in April 2019, Realty Incomed moved into the UK property market, which marked its first overseas expansion (the REIT’s geographical focus was previously on the US and Puerto Rico, a US territory). We have covered its international growth efforts extensively (see here and here) and view Realty Income’s growth runway in Europe quite favorably. Since then, Realty Income has significantly expanded its presence in the UK via numerous acquisitions (the firm spent $1.5 billion on acquisitions in Europe during the first nine months of 2021). As of the third quarter of 2021, its UK footprint represented almost one-tenth of its annualized contractual rental revenues, before taking its VEREIT merger and office property spinoff into account.

Image Shown: An overview of Realty Income’s property portfolio at what appears to be the end of September 2021. Please note that its property portfolio has changed somewhat since the end of the third quarter of 2021 due to the VEREIT merger and spinoff of Orion Office REIT, home to its former office property portfolio. Image Source: Realty Income – November 2021 IR Presentation

In September 2021, Realty Income announced that it was expanding into Continental Europe via a sale-leaseback transaction in Spain involving seven properties with Spanish food retailer Carrefour. During Realty Income’s third quarter of 2021 earnings call, management had this to say on the REIT’s international expansion plans and recent property acquisition activity (emphasis added):

“Our international pipeline continues to add meaningful value to our portfolio, and we believe it will remain an important driver of growth going forward. In total of the nearly $24 billion in acquisition opportunities that we sourced this quarter, approximately 34% was associated with international opportunities. In the third quarter, we added approximately $532 million of high-quality real estate in the UK and Spain across 31 properties, bringing our total international portfolio to over $3.2 billion.

This quarter, our international acquisition accounted for approximately 33% of total acquisition volume. As previously announced in September, we made our debut acquisitions in Continental Europe through a sale-leaseback transaction with Carrefour in Spain. Subsequent to quarter-end, we announced the completion of an additional Carrefour transaction in Spain, bringing the value of our Continental Europe portfolio to approximately EUR160 million.

We are optimistic about our momentum in Spain as we look to replicate the success of our international growth platform throughout the continent with best-in-class operators who are leaders in their respective industries. The health of our core portfolio remains of utmost importance as we continue to expand our platform.” — Sumit Roy, President and CEO of Realty Income

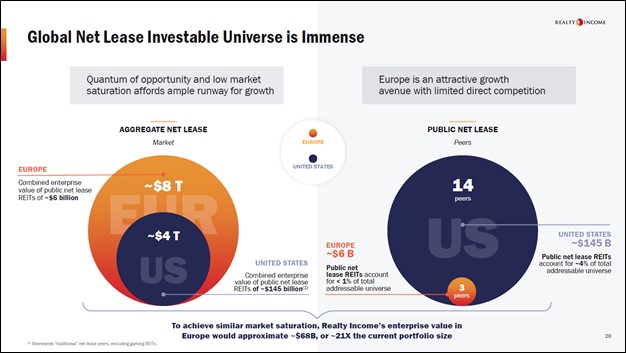

We are excited for what the future has in store on this front as Realty Income’s growth runway is enormous when including upside in the US (including US territories), the UK, and Continental Europe. The upcoming graphic down below highlights the total addressable market (‘TAM’) opportunity that Realty Income is targeting in these geographical markets.

Image Shown: Realty Income’s push into Europe has significantly bolstered its long-term growth runway. Image Source: Realty Income – November 2021 IR Presentation

Concluding Thoughts

Realty Income is a great dividend growth opportunity, and the REIT has not disappointed. Its international expansion plans support its longer-term growth trajectory and recent guidance increases indicate that Realty Income’s property portfolio is once again firing on all cylinders. The COVID-19 pandemic created some serious hurdles for its operations, though Realty Income has put many of those obstacles behind it as the financial health of its tenant base has staged a meaningful recovery (generally speaking) in recent quarters.

As of October 2021, Realty Income had paid out monthly dividends over the past 615+ consecutive months (51+ years) and the REIT last increased its payout (as of this writing) in September 2021. We expect that Realty Income will continue to steadily grow its payout going forward and continue to like the REIT as an idea in our Dividend Growth Newsletter portfolio.

—–

Real Estate Investment Trust Industry – CONE, DLR, FRT, O, REG, SPG, WPC, PEAK, HR, LTC, OHI, UHT, VTR, WELL, PSA, EQIX, CUBE, EXR, IRM

Other: ONL, VNQ, KIM, NNN, PLD, DRE, REXR, FR, EGP, CBRE, JLL, XLRE

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. CubeSmart (CUBE), CyrusOne Inc (CONE), Digital Realty Trust Inc (DLR), Public Storage (PSA), and Vanguard Real Estate Index Fund ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Digital Realty Trust Inc and Realty Income Corporation (O) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.