Digital Realty’s Momentum Continues, Raises Outlook

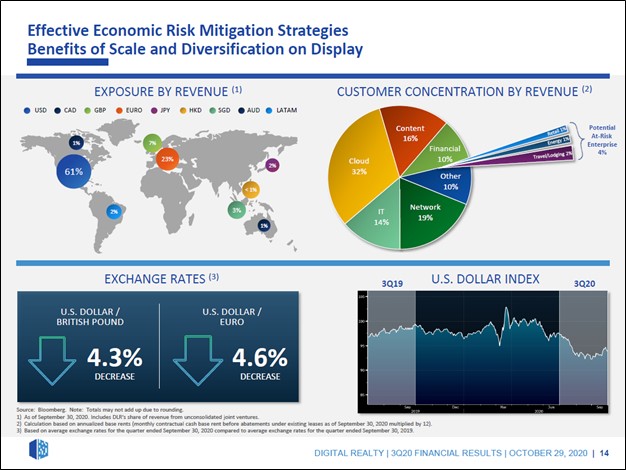

Image Shown: An overview of Digital Realty Trust Inc’s asset base. Image Source: Digital Realty Trust Inc – Third Quarter of 2020 IR Earnings Presentation

By Callum Turcan

On October 29, the data center real estate investment trust (‘REIT’) Digital Realty Trust Inc (DLR) reported third quarter 2020 earnings that beat consensus revenue estimates and consensus funds from operations (‘FFO’) estimates. Please note that while FFO is an imperfect metric, particularly because it does not incorporate the REIT-in-question’s need to refinance maturing debt and tap capital markets for funds for growth, it provides a useful snapshot of how well the REIT-in-question can maintain its dividend in the near term. Digital Realty posted $1.54 per share in core FFO last quarter (an adjusted non-GAAP figure), down 8% year-over-year but flat sequentially. In this article, we will cover Digital Realty’s short-term headwinds and why we expect that the REIT’s financial performance will rebound. Shares of DLR yield ~3.1% as of this writing.

Longer term, we use our adjusted Dividend Cushion ratio (includes funds raised via expected equity issuances over the next five full fiscal years) to gauge Digital Realty’s ability to keep making good on its dividend obligations. Digital Realty has an adjusted Dividend Cushion ratio of 1.1, earning the REIT a “GOOD” Dividend Safety rating. These metrics incorporate our expectations that the REIT will push through significant dividend increases over the coming years, and Digital Realty has an “EXCELLENT” Dividend Growth rating. We include shares of DLR as a holding in both our Dividend Growth Newsletter and High Yield Dividend Newsletter portfolios.

Near-Term Pressures

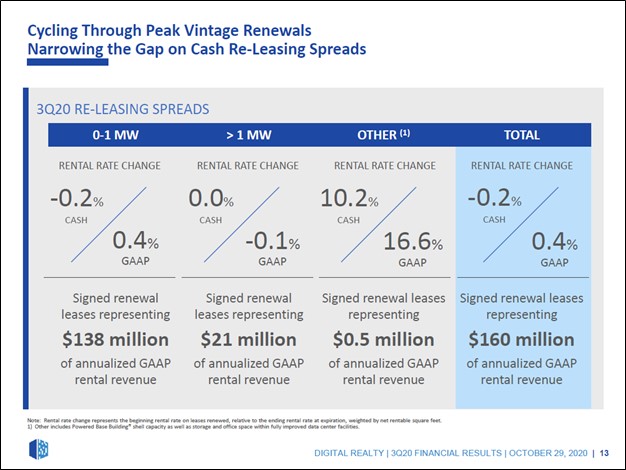

In 2019 and 2020, Digital Realty faced significant headwinds due to its legacy rental agreements rolling off and getting renewed at lower rates. Please note that these legacy rental rates were signed during different times, and the decline in rental rates on lease renewals Digital Realty has been contending with is transitory in nature. On a cash basis, the rental rates on lease renewals were down 1.5% in the first quarter, down 2.8% in the second quarter, and down 0.2% in the third quarter of 2020.

Going forward, Digital Realty will benefit from its purchase of a large economic interest in the Westin Building (located in Seattle, Washington) and its acquisition of Interxion (focused on major metropolitan areas in Europe), deals which we covered in this article here. During the REIT’s latest earnings call, management noted that “Interxion and the Westin Building are not included in the 2020 same-store pool, but we expect both acquisitions to be accretive to organic growth going forward.” Furthermore, management noted that recent renewal activity was “an encouraging sign for pricing” during Digital Realty’s latest earnings call. There is a good chance Digital Realty will be able to return to positive growth regarding its cash renewal rates in the near-term, potentially sometime next year.

Image Shown: A look at Digital Realty’s renewal rental rate performance during the third quarter of 2020. Image Source: Digital Realty – Third Quarter of 2020 IR Earnings Presentation

During its third quarter earnings report, Digital Realty raised its full-year guidance for 2020. Now the REIT expects to generate $6.10 - $6.15 in core FFO per share, up from previous guidance calling for $6.00 - $6.10 in core FFO per share. While that is down from the $6.65 in core FFO per share Digital Realty generated in 2019, we appreciate that the REIT’s near-term outlook is improving. Additionally, Digital Realty now expects to generate “same-capital cash NOI growth” of negative 1.5% to negative 2.5% in 2020, an improvement versus previous expectations calling for negative 2.5% to negative 3.5% “same-capital cash NOI growth” this year.

During Digital Realty’s latest earnings call, management stated that “although we expect to rollout the formal guidance early next year, we are currently targeting mid single-digit growth in both earnings and cash flow per share.” This reinforces our thinking as it concerns our view that a potential rebound could soon be underway. We will be monitoring Digital Realty’s guidance closely going forward.

Strong Financial Position Maintained

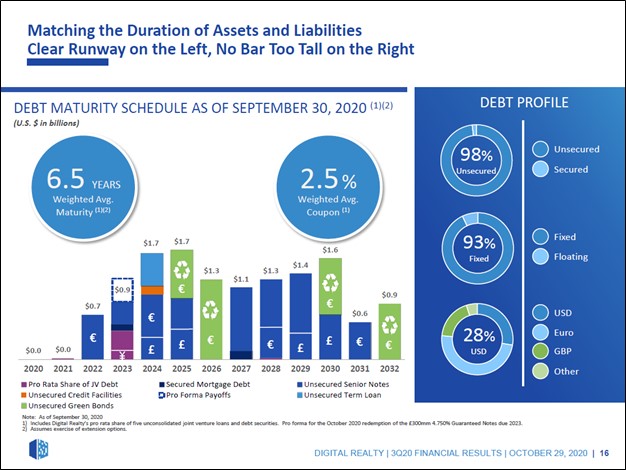

The REIT retained its strong financial position last quarter. Digital Realty does not have any significant debt maturities until 2022. The REIT was able to take advantage of its strong stock price performance in the third quarter by raising ~$0.25 billion in gross proceeds through its at-the-market (‘ATM’) equity issuance program in August 2020, with shares issued at a weighted average price of ~$160 per share. As of the third quarter of 2020, Digital Realty’s net debt to adjusted EBITDA ratio stood at 5.6x, down from 6.0x in the third quarter of 2019 and significantly lower compared to the 6.6x ratio seen during the first quarter of 2020.

Image Shown: Digital Realty has a manageable debt maturity schedule given that it does not have a significant amount of debt coming due until 2022 and due to the staggered nature of its debt maturities. Image Source: Digital Realty – Third Quarter of 2020 IR Earnings Presentation

Access to Capital Markets Maintained

Digital Realty continues to carry investment grade credit ratings (Baa2/BBB/BBB) with stable outlooks, which will help enable the REIT to tap credit markets for funds at attractive rates. In the third quarter, Digital Realty issued out €750 million (~USD$880 million) in 1.0% Euro bonds due 2032 and €300 million (~USD$350 million) in floating rate notes due 2022. Given Digital Realty’s ability to tap both credit and equity markets at attractive rates in the recent past, we see the REIT maintaining quality access to capital markets going forward.

The REIT settled its remaining forward sale agreements originally entered into during the third quarter of 2018 in late-September 2020, generating net proceeds of ~$1.0 billion. Also, Digital Realty retired various debt tranches and some of its preferred securities last quarter as part of its ongoing balance sheet optimization process.

Considering Digital Realty uses debt and equity issuances to refinance debt maturities, fund acquisitions and major growth investments, and to continue making good on its dividend obligations, its ability to tap capital markets needs to be closely monitored. Digital Realty generates sizable cash flows, but historically its capital investments have consumed most or all of its net operating cash flows. To cover its liquidity needs, Digital Realty had $1.0 billion in cash and cash equivalents on hand at the end of September 2020, along with $2.5 billion in available borrowing capacity under its global revolving credit facilities (matures January 2023 with two six-month extension options available).

Concluding Thoughts

We continue to be big fans of Digital Realty and appreciate that management sees the potential for the REIT’s financial performance (particularly its organic growth rates) to begin rebounding starting in 2021. The company should be able to continue meeting its dividend obligations going forward, with room for significant income growth upside.

-----

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: BIP, SPY, QQQ, VNQ, MDY

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Digital Realty Trust Inc (DLR), Microsoft Corporation (MSFT), Oracle Corporation (ORCL), and Realty Income Corporation (O) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple Inc, Dollar General Corporation (DG), Facebook Inc (FB), The Walt Disney Corporation (DIS), and Microsoft Corporation are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Digital Realty Trust, CyrusOne Inc (CONE), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment