Digital Realty Boosts Guidance, Extends Growth Runway

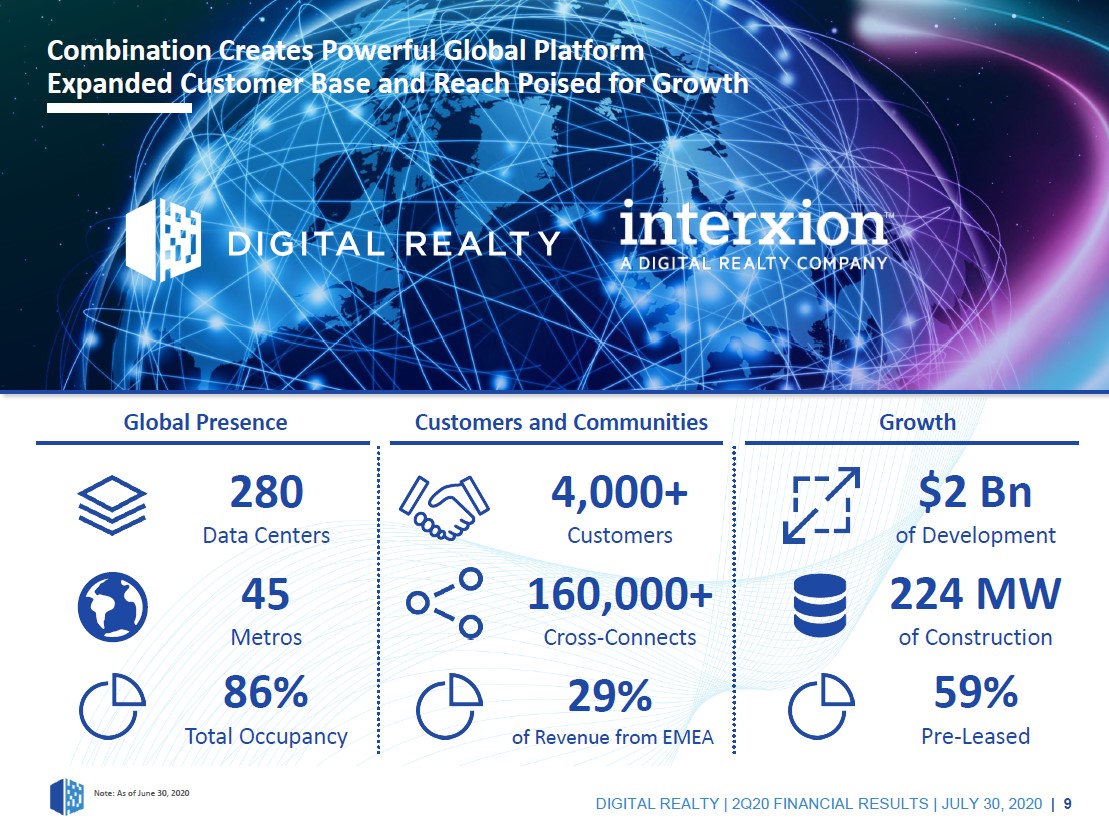

Image Shown: An overview of Digital Realty Trust Inc’s asset base. Image Source: Digital Realty Trust Inc – Second Quarter of 2020 IR Earnings Presentation

By Callum Turcan

Data center real estate investment trusts (‘REITs’) are well-positioned to ride out the storm created by the ongoing coronavirus (‘COVID-19’) pandemic due to surging demand for cloud computing services, which in turn is driving up demand for data centers. In short, data centers are primarily facilities that house server farms along with vast amounts of fiber-optic cables that interconnect with existing networks. These facilities form the backbone of modern IT infrastructure.

We include Digital Realty Trust Inc (DLR) as a holding in both our Dividend Growth Newsletter and High Yield Dividend Newsletter portfolio, and continue to like the name. Shares of DLR are up ~32% year-to-date as of this writing, and that does not include meaningful dividend considerations as shares of DLR yield ~2.8% as of this writing.

In mid-July, we significantly raised our fair value estimate for shares of DLR given its improving outlook, with the top end of our fair value estimate range sitting at $181 per share. Members that want to check out updated 16-page Stock Report covering Digital Realty should click this link here.

The REIT’s adjusted Dividend Cushion ratio sits at 1.1, providing for a “GOOD” Dividend Safety rating. Please note that this factors in our expectations that Digital Realty will push through modest annual payout growth over the coming years, which earns the REIT an “EXCELLENT” Dividend Growth rating. Our adjusted Dividend Cushion ratio takes into account the REIT’s ability to tap equity markets in the future for funds and given Digital Realty’s strong stock price performance of late, that should be a relatively easy task. Digital Realty has an at-the-market equity issuance program that allows it to issue equity in an efficient manner. Members looking to view Digital Realty’s updated two-page Dividend Report can do so by clicking this link here.

Image Shown: Shares of Digital Realty have performed quite well year-to-date as of this writing on August 10, 2020.

Guidance Boost and Growth Outlook

In 2019, Digital Realty generated $6.65 in core funds from operations (‘FFO’) per share, up from $6.60 in 2018. Considering the headwinds created by recent and upcoming lease renewals (particularly, leases signed at very generous rates in the past getting renewed at lower rates) and the ongoing COVID-19 pandemic, the data center REIT is expecting to generate $6.00 - $6.10 in core FFO per share this year. With that in mind, please note Digital Realty boosted its 2020 guidance during its second quarter earnings report (from $5.90 - $6.10 in core FFO per share previously) by increasing the lower bound of its core FFO per share range and we appreciate management’s confidence in the company’s near-term performance.

When the lease renewal and pandemic-related headwinds fade, we are optimistic Digital Realty will return to growing its core FFO per share now that its acquisition of InterXion is complete. The acquisition significantly grew its presence in Europe, especially in key metropolitan regions where rental rates have held up well and in some instances are increasing. We see the deal as significantly extending its growth runway while also allowing for greater economies of scale and potential revenue-related synergies. We are excited to see how Digital Realty integrates its new mainland European operations with its operations in the UK and Ireland.

During the REIT’s latest earnings call, management noted that Digital Realty was “already seeing the benefits of the significant cross-selling opportunities” after the InterXion deal closed (in March 2020). Management cited demand for data centers in London (UK), Paris (France), Frankfurt (Germany), and Marseille (France) as being “particularly robust” during the earnings call. Digital Realty also noted demand was strong in the Pacific Northwest (US), New York Metro area (US), Northern Virginia (US), and Mexico City (Mexico).

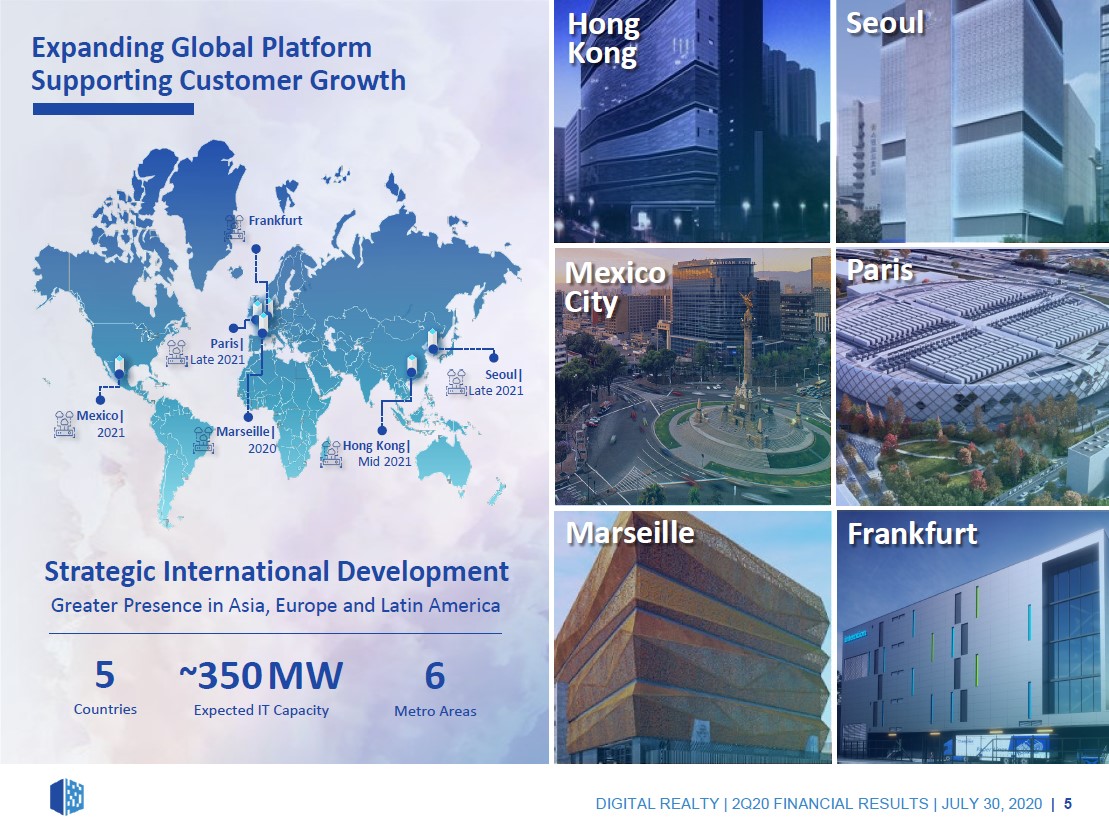

The firm announced this past June that Digital Realty’s Ascenty joint-venture with Brookfield Infrastructure Partners LP (BIP) was entering the Mexican data center market. The JV intends on building two data center facilities in the state of Querétaro that are anchored by long-term agreements with a major cloud provider, which will be interconnected via an underground fiber-optic network. Ascenty bills itself as “Latin America's largest data center provider” and these projects will help further solidify the JV’s position in this market. The press release noted that “both initial phases are scheduled for delivery in 2021” which seems to indicate the projects will be developed in stages. In the upcoming graphic down below, Digital Realty highlights some of its growth markets.

Image Shown: A look at some of the markets Digital Realty is targeting for growth. Image Source: Digital Realty – Second Quarter of 2020 IR Earnings Presentation

Financial Update

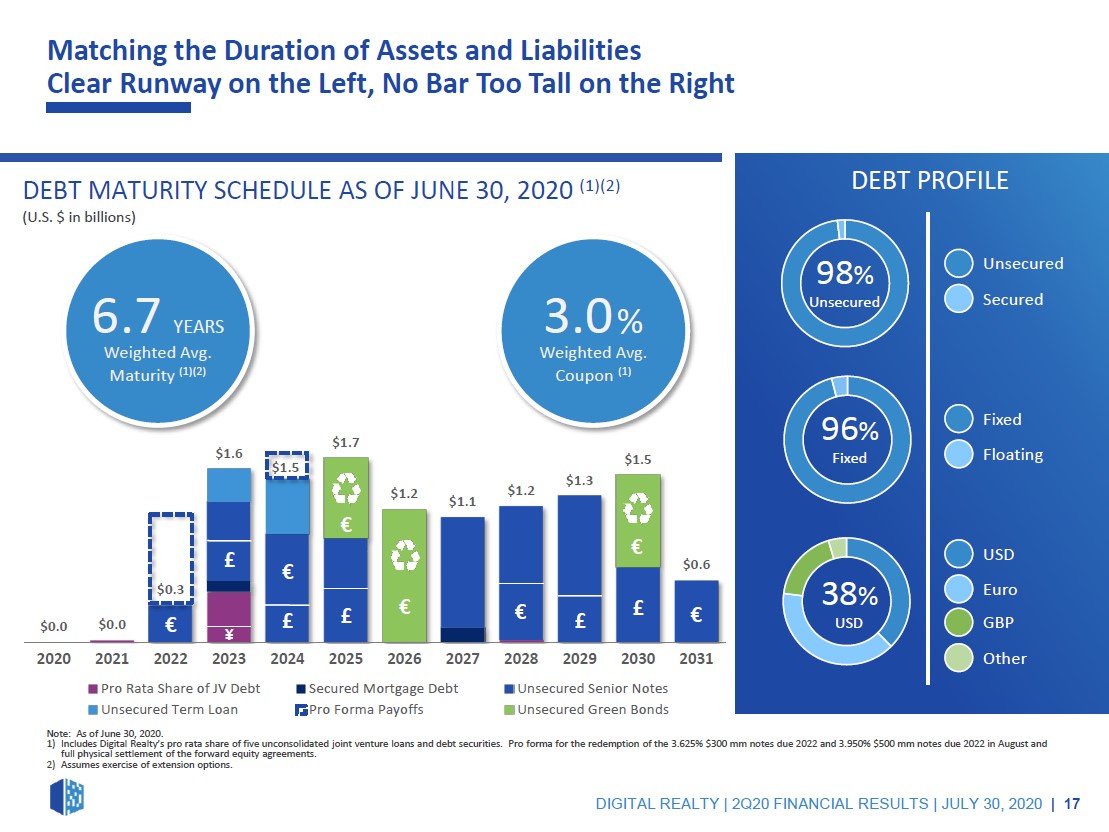

Like most REITs, Digital Realty is generally not free cash flow positive as it invests heavily in growing its asset base. Being capital market dependent means the REIT must always retain access to capital markets at (ideally) attractive rates to refinance maturing debt, cover its growth spend, and make good on its dividend obligations. That appears to be the case, as the firm issued out €0.5 billion 1.250% Guaranteed Notes due 2031 late in the second quarter that raised ~$0.55 billion in net US dollars (based on the exchange rate as of June 26, 2020). Digital Realty noted it would the proceeds from its Euro-denominated bond issuance to pay down borrowings on its revolving credit facilities, fund acquisitions, and for general corporate purposes.

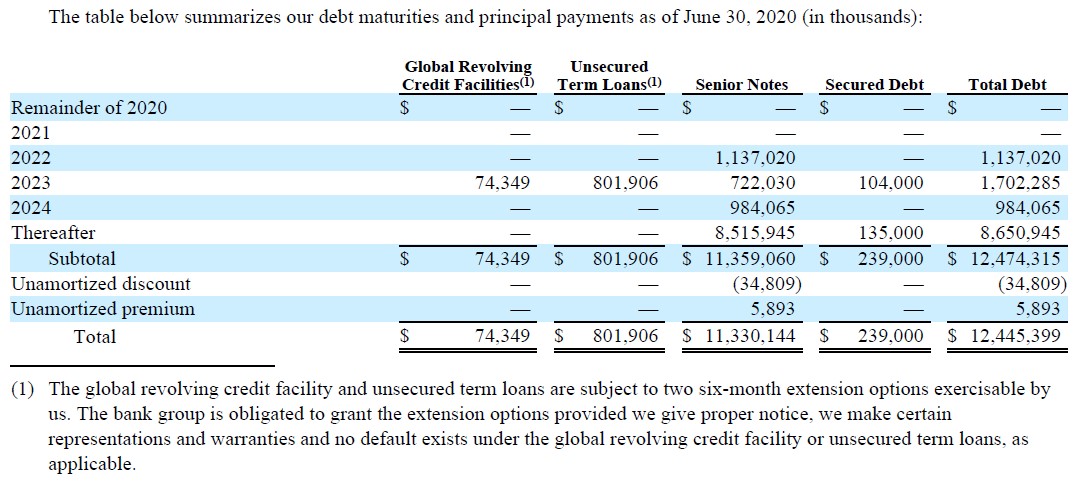

As you can see in the upcoming graphic down below, Digital Realty does not have a significant amount of debt coming due until 2022. In early-July, the REIT announced its intend to redeem of its 3.625% Notes due 2022 ($0.3 billion in principal outstanding at the time of the announcement) and 3.950% Notes due 2022 ($0.5 billion in principal outstanding).

Image Shown: We appreciate that Digital Realty does not have a significant amount of debt coming due until 2022. Image Source: Digital Realty – 10-Q SEC filing covering the second quarter of 2020

During the REIT’s latest earnings call, management noted the firm had approximately $4.0 billion in pro forma liquidity (and access to liquidity) when including expected proceeds from a forward equity offering, its $2.5 billion in remaining borrowing capacity under its revolving credit facilities (which mature January 2023), and the $0.5 billion in cash and cash equivalents on hand at the end of June 2020, but not including the planned redemption of the aforementioned 2022 notes. In the upcoming graphic down below, Digital Realty provides an overview of its financial position on a pro forma basis.

Image Shown: Digital Realty has done a quality job managing its debt maturity schedule through the end of this decade. Image Source: Digital Realty – Second Quarter of 2020 IR Earnings Presentation

Concluding Thoughts

We continue to like Digital Realty as a holding in both our Dividend Growth Newsletter and High Yield Dividend Newsletter portfolios. Though its growth story is facing significant headwinds in 2020, we view these headwinds as temporary. Digital Realty’s outlook shines bright, and its strong share price performance of late indicates the market is becoming increasingly optimistic on the name as well.

-----

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Related: BIP, SPY, VNQ

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Dollar General Corporation (DG) and The Walt Disney Corporation (DIS) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Digital Realty Trust, CyrusOne Inc (CONE), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment