Image Source: Digital Realty Trust Inc – Fourth Quarter and Full-Year 2019 IR Earnings Presentation

By Callum Turcan

On February 13, the data center real estate investment trust (‘REIT’) Digital Realty Trust Inc (DLR) reported fourth quarter and full-year earnings for 2019 after the market close. The firm’s top-line marginally missed consensus estimates as its funds from operations (‘FFO’) per share modestly beat consensus estimates. Shares of DLR marched up 4% on February 14 as investors priced in the FFO per share beat and recent events. We continue to like shares of DLR as a holding in our Dividend Growth Newsletter portfolio. As of this writing, Digital Realty yields ~3.3%.

Earnings Overview and a Tough 2019

The REIT’s FFO per share on a diluted basis marched up over 5% year-over-year in the fourth quarter to $1.62, and for the full-year was up almost 5% year-over-year, reaching $6.66 per share in 2019. However, please note that Digital Realty’s adjusted FFO per share fell by a tad over 2% year-over-year in 2019 to $5.93. This was expected due to elevated levels of lease expirations last year and pressure on rental rates in numerous markets, with management having this to say during Digital Realty’s fourth quarter 2019 conference call (emphasis added):

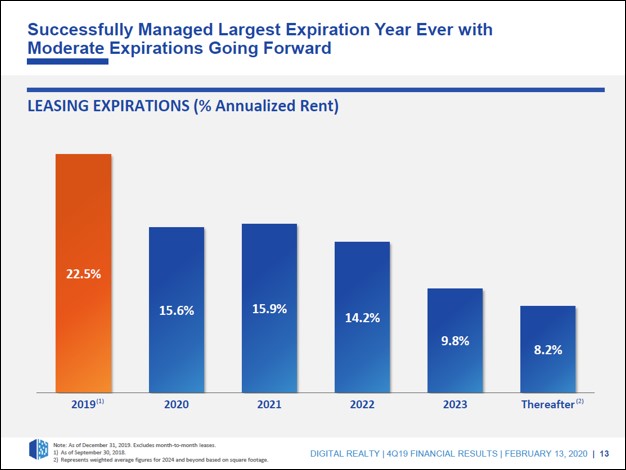

“We signed a $117 million of renewals during the fourth quarter in addition to new leases signed. As you may recall, 2019 was our all-time high in terms of lease expirations and we signed over $500 million of renewal leasing in 2019, more than 50% higher than our previous record year with a weighted average lease term of nearly nine years. For the full year, we retained a little over 80% of expiring leases right in line with our long-term average while cash rents rolled down 1.3%, much better than our initial expectation of down high single-digits.

As you may recall, we successfully executed both legacy deal our long-term top customer renewals, as well as the long-awaited legacy DFT customer renewal in 2019. As you can see from the lease expirations schedule on Page 13 [the upcoming graphic down below], less than 16% of the portfolio expires in any given year compared to the 23% we faced at the beginning of last year, which should set the stage for a low churn hurdle going forward. Aside from a few select supply constrained regions in metro areas, we have yet to see broad based rental rate growth across most markets.”

Pressures stemming from the US-China trade war and slowing global economic activity in key regions made 2019 a tougher year for data center firms than in the recent past. That being said, Digital Realty performed well relatively speaking and investors rewarded the REIT for its efforts. In the upcoming graphic down below, we included the graphic management cited in the above excerpt. Please note that we really appreciate Digital Realty’s more manageable lease expiration schedule going forward.

Image Shown: Going forward, Digital Realty’s lease expiration schedule is much more manageable. Image Source: Digital Realty – Fourth Quarter and Full-Year 2019 IR Earnings Presentation

Looking ahead, Digital Realty’s outlook is much brighter for several reasons that we’ll cover in just a moment. Before then, please note that Digital Realty’s AFFO payout ratio (dividends per share divided by AFFO per share) stood at 72.9% in 2019. While an imperfect metric, we like REITs that maintain AFFO payout ratios below 80% as that provides for a better buffer should problems arise, like elevated lease expirations. The REIT carries an adjusted Dividend Cushion ratio of 2.9x, earning Digital Realty a GOOD Dividend Safety rating (given its need to tap capital markets to refinance its large debt load, which we’ll cover later on) and an EXCELLENT Dividend Growth rating.

Moving Deeper into Europe

Back in October 2019, Digital Realty announced it planned to merge with InterXion Holding NV (INXN), a European-focused data center company, in an all-stock deal. For each share of INXN, InterXion shareholders would receive 0.7067 share of DLR. For Digital Realty, this deal further solidifies its position as a leader in the global data center space that provides colocation and interconnection services. Digital Realty already has a big presence in London and Dublin and wants to now expand its European operations into mainland Europe in a big way. The deal is expected to close relatively soon, subject to shareholder approval.

At the time of the announcement, InterXion serviced 11 countries and 13 major metropolitan areas that can offer “consistent, high-quality services with low-latency access to approximately 70% of the GDP in Europe” which provides Digital Realty a nice growth runway. We are supportive of this deal, as is Institutional Shareholder Services (the proxy advisor company). Please note that while Digital Realty isn’t seeing widespread rental rate growth, rental rates continue to rise in key metropolitan markets. Buying InterXion gives Digital Realty access to several of those markets, which is why we view this deal as augmenting its favorable outlook after a tough 2019.

Digital Realty Makes a Smart Buy

To keep the momentum going, Digital Realty announced on February 12 that it had reached a deal with Clise Properties (a privately-held property management firm) to acquire a 49% ownership interest in the Westin Building Exchange. That building is situated in the heart of the mega-tech hub Seattle, Washington, and marks another one of Digital Realty’s forays into a very high growth metropolitan market. When the deal closes, Digital Realty will take over operatorship of the building. Here’s what the press release had to say:

The Westin Building Exchange serves as the primary interconnection hub for the Pacific Northwest, linking Canada, Alaska and Asia along the Pacific Rim. The building is the sixth most densely interconnected facility in North America, and is home to leading global cloud, content and interconnection providers, housing over 150 carriers and more than 10,000 cross-connects. The 34-story tower is adjacent to Amazon’s (AMZN) 4.1 million square foot urban campus and overlooks Elliott Bay as well as the downtown Seattle skyline…

…The Westin Building Exchange occupies a unique position in the communications infrastructure landscape, given customers’ growing propensity to deploy IT infrastructure at centers of data exchange around the world, bringing users, things, applications, clouds and networks to the data. Digital Realty’s investment in the Westin Building will unlock new possibilities for customers to scale digital transformation by removing data gravity barriers.

The Westin Building Exchange sits at the digital crossroads of the Pacific Northwest and provides direct and virtual access to one of the richest communities of cloud and network providers, powered by Digital Realty’s Service Exchange. When fully integrated into PlatformDIGITAL™, the Westin Building Exchange will play a strategic role in addressing customers’ coverage, capacity and ecosystem connectivity needs with a single data center provider.

Financial terms weren’t disclosed, but it appears this purchase is highly complementary to Digital Realty’s long-term goal of targeting “network dense” areas that are more likely to experience rental rate growth and retain very high occupancy/usage rates. We like the firm’s strategic pivot.

Moving into India

Expanding its footprint in Europe and Seattle sets the stage for stronger near- and medium-term growth and moving into India underpins its long-term growth trajectory. In October 2019, Digital Realty signed a memorandum of understanding with India’s Adani Group to jointly develop and operate data centers in the sub-continent. As these are still early days, Digital Realty’s management team didn’t have much to say during the REIT’s latest quarterly conference call, but they did mention this;

“We also executed a memorandum of understanding with the Adani Group to pursue a joint venture in India and we are actively exploring opportunities to plant our first flag in this vast untapped market with tremendous growth potential.”

Digital Realty has contemplated moving into India and other south and southeast Asian markets (beyond its existing position in Singapore) for some time. The REIT is getting closer now to making that a reality.

Managed Debt Load

As you can see in the upcoming graphic down below, Digital Realty’s debt maturity schedule is quite manageable. Pro forma for a forward equity offering and expected asset sale proceeds, Digital Realty’s net debt to adjusted EBITDA ratio stood at 5.0x during the fourth quarter of 2019. We would like to see that shift down over time. Please note Digital Realty is capital market dependent and needs to retain access to debt and equity markets to refinance its large debt load (net debt stood at ~$10.0 billion as of December 30, 2019). Given its investment grade credit ratings (BBB/Baa2/BBB) and the strong performance of shares of DLR of late, we view Digital Realty as retaining quality access to capital markets at attractive rates.

Image Shown: We like Digital Realty’s managed debt maturity schedule. Image Source: Digital Realty – Fourth Quarter and Full-Year 2019 IR Earnings Presentation

Concluding Thoughts

When Digital Realty files its 10-K filing for 2019, we’ll have more to say on the company as it relates to its cash flow profile, balance sheet position, and other financials. For now, while 2019 was rough, it wasn’t as bad as management had expected. Moving into metropolitan markets and targeting “network dense” areas will go a long way in improving the REIT’s near- and medium-term outlook, which we appreciate. Investors seemed to have rewarded Digital Realty after its earnings report (arguably) in part due to the REIT’s recovery appearing to now be underway. We continue to like shares of DLR in our Dividend Growth Newsletter portfolio.

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Related: AMZN, VNQ, SCHH, ICF, SRVR

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Digital Realty Trust is also included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.