CyrusOne Is a High-Quality Data Center REIT

Image Shown: CyrusOne Inc’s financials and near-term growth outlook held up well during the ongoing pandemic, all things considered. Image Source: CyrusOne Inc – Second Quarter of 2020 IR Earnings Presentation

By Callum Turcan

One of the newest additions to our High Yield Dividend Newsletter portfolio is CyrusOne Inc (CONE), a data center real estate investment trust (‘REIT’). Demand for data centers has been extremely strong during the ongoing coronavirus (‘COVID-19’) pandemic as employees are often working from home (driving up demand for productivity programs which in turn is driving up data consumption worldwide) while demand for data-hungry video streaming services has surged. Over the long haul, we like the outlook for the industry, and more broadly, we prefer companies supported by secular growth tailwinds.

Shares of CONE yield ~2.4% on a forward-looking basis as of this writing after management pushed through a 2% per share sequential dividend increase during CyrusOne’s second quarter earnings report (growing the REIT’s quarterly per share payout to $0.51 from $0.50 previously). Though shares of CONE carry a more modest yield compared to traditional high yield plays, we view its dividend growth trajectory quite favorably.

When factoring in CyrusOne’s apparent ability to tap equity markets for funds (a task made easier by the strong technical performance of CONE seen year-to-date), we give the REIT an adjusted Dividend Cushion ratio of 2.0 which earns CyrusOne a “GOOD” Dividend Safety rating. For reference, the numerator in our Dividend Cushion ratio is the REIT’s forecasted free cash flows over the next five full fiscal years, while the denominator is the REIT’s forecasted dividend obligations during this period. Balance sheet considerations are also factored in (with net cash added to the numerator and vis-versa for net debt). Please note those proprietary metrics assume CyrusOne pushes through decent per-share dividend increases on an annual basis over the coming years, which is why we give the REIT a “GOOD” Dividend Growth rating.

Quarterly Update

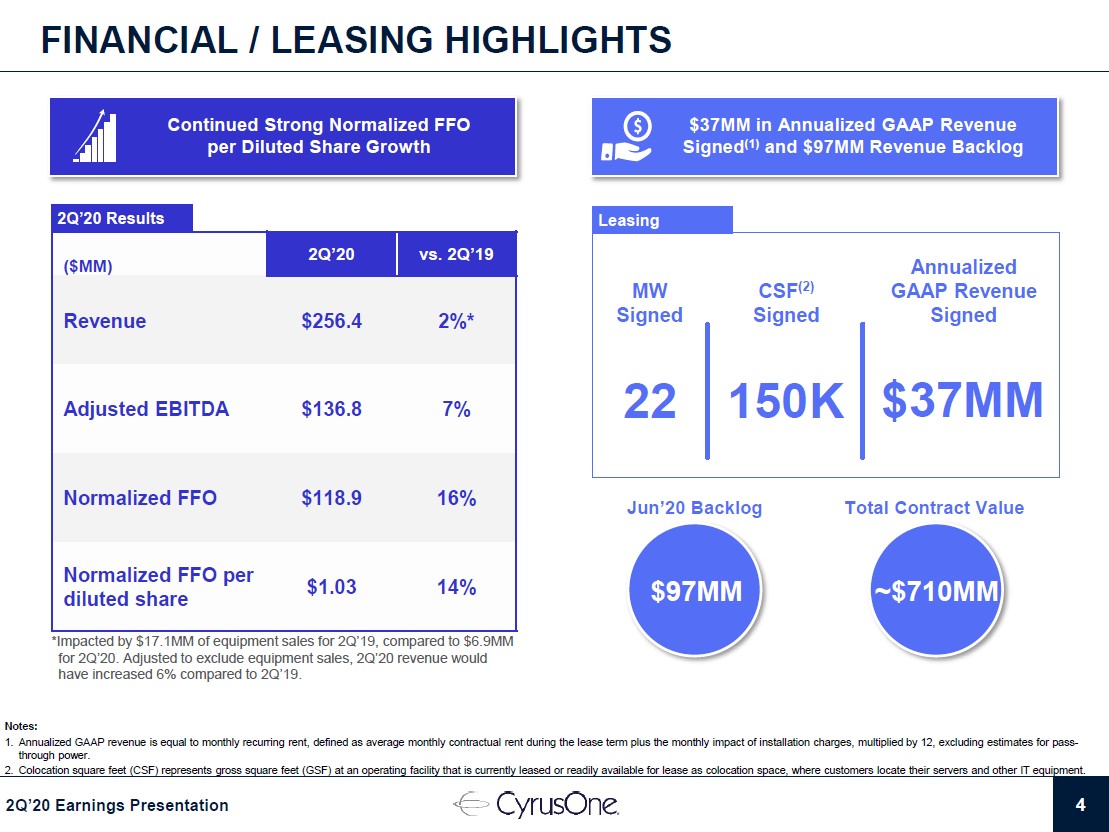

CyrusOne reported second-quarter 2020 earnings on July 29 that saw the REIT’s normalized funds from operations (‘FFO’) per share grow by 14% year-over-year, hitting $1.03. The REIT’s total normalized FFO grew by 16% year-over-year while its weighted-average common shares outstanding grew by 2% year-over-year during this period. While FFO is an imperfect metric, it gives REIT investors a baseline when analyzing the trajectory of a REIT’s financial performance, and we strongly appreciate CyrusOne’s resilience during the initial phases of COVID-19.

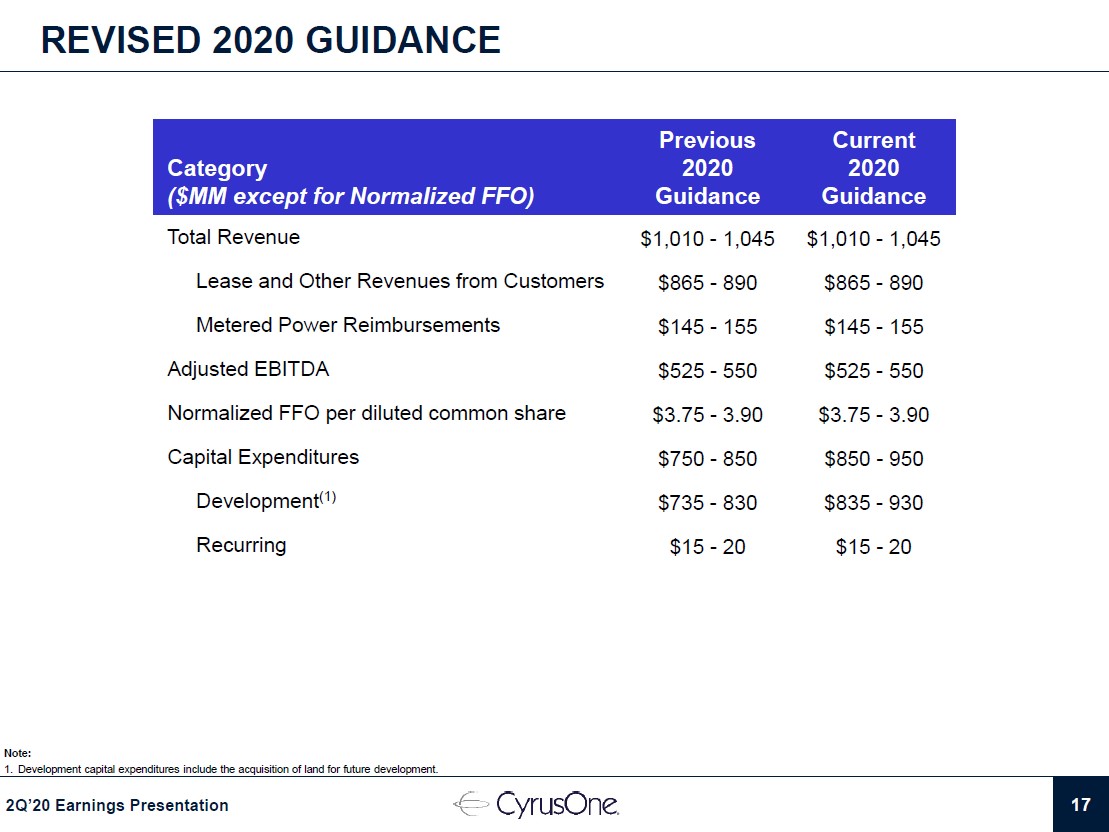

Management reiterated CyrusOne’s previous guidance for 2020 during the firm’s latest earnings report for every key item except development-related (or growth-related) capital expenditures. CyrusOne increased its capital expenditure expectations for 2020 to capitalize on the REIT’s improving growth outlook which we will cover in just a moment. In the upcoming graphic down below, please note CyrusOne forecasts it will generate $3.75-$3.90 in normalized FFO per share this year, up from $3.63 in 2019. As an aside, CyrusOne’s current full-year guidance calls for marginally less revenue and adjusted EBITDA than forecasted in February 2020 (the REIT has adjusted its 2020 guidance at least a couple times this year so far), though its normalized FFO per share forecast remained the same.

Image Shown: CyrusOne is confident in its near-term financial trajectory, which we appreciate given the hurdles created by the ongoing pandemic. Image Source: CyrusOne – Second Quarter of 2020 IR Earnings Presentation

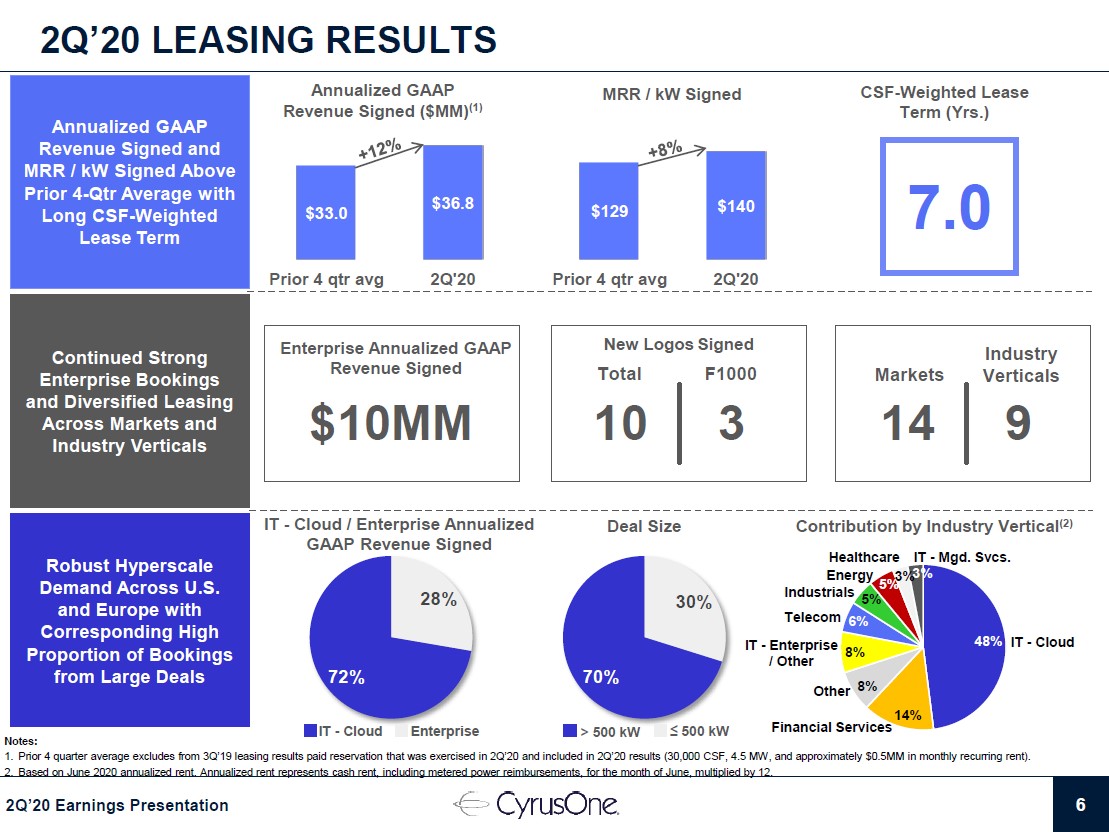

CyrusOne’s leasing activity has been quite favorable this year. The REIT noted during its latest earnings call that it experienced strong lease pricing on enterprise deals as it moved deeper into the “hyperscale” side of the data center space (generally speaking, these are deals often signed with very large cloud computing service providers). Management noted that “leasing was well diversified across markets and industry verticals [last quarter], which has also been a long-term trend and reflects the broad appeal of our platform. Hyperscale companies accounted for 72% of revenue signed in the quarter” and we would like to stress here that the REIT’s apparent lease pricing strength during a pandemic highlights how important CyrusOne’s asset base is as it concerns supporting the digital economy.

Additionally, management mentioned that “nearly 90% of leases signed had an interconnection component” last quarter which was “driven by a couple of factors: the first being the expansion of ecosystems within our data centers, resulting in additional demand for cross connect.” Scale in the data center industry brings about new revenue generating opportunities, with CyrusOne’s interconnection revenues growing by 15% year-over-year in the second quarter (the REIT’s GAAP revenues were up 2% year-over-year during this period). For reference, interconnection services provides data centers access to multiple internet service providers (‘ISP’) and a direct physical contact point between servers. The REIT highlights its strong leasing performance last quarter in the upcoming graphic down below.

Image Shown: CyrusOne had plenty of success signing leases at favorable rates with large enterprises last quarter. Image Source: CyrusOne – Second Quarter of 2020 IR Earnings Presentation

Growth

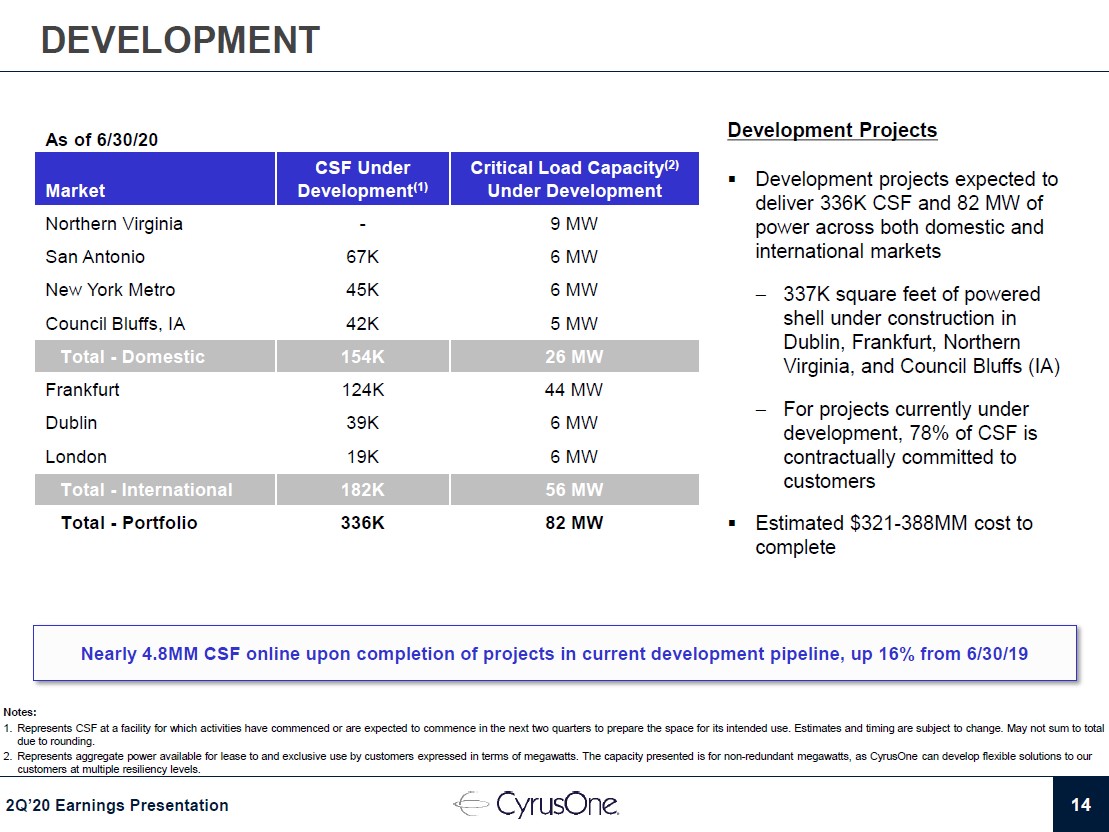

As mentioned previously, CyrusOne recently boosted its development-related capital expenditure expectations for 2020. Management cited strong leasing activity seen during the first half of the year for justifying the move. In the upcoming graphic down below, CyrusOne highlights the various projects the REIT is working on. CyrusOne is focused on establishing and growing its presence major metropolitan markets in the US and Western Europe. Additionally, CyrusOne is pursuing projects in Council Bluffs, Iowa. Please note Council Bluffs is home to some of Alphabet Inc’s (GOOG) (GOOGL) Google segment’s data center operations, which has been steadily growing in the region over the past decade.

Image Shown: An overview of CyrusOne’s development portfolio. Image Source: CyrusOne – Second Quarter of 2020 IR Earnings Presentation

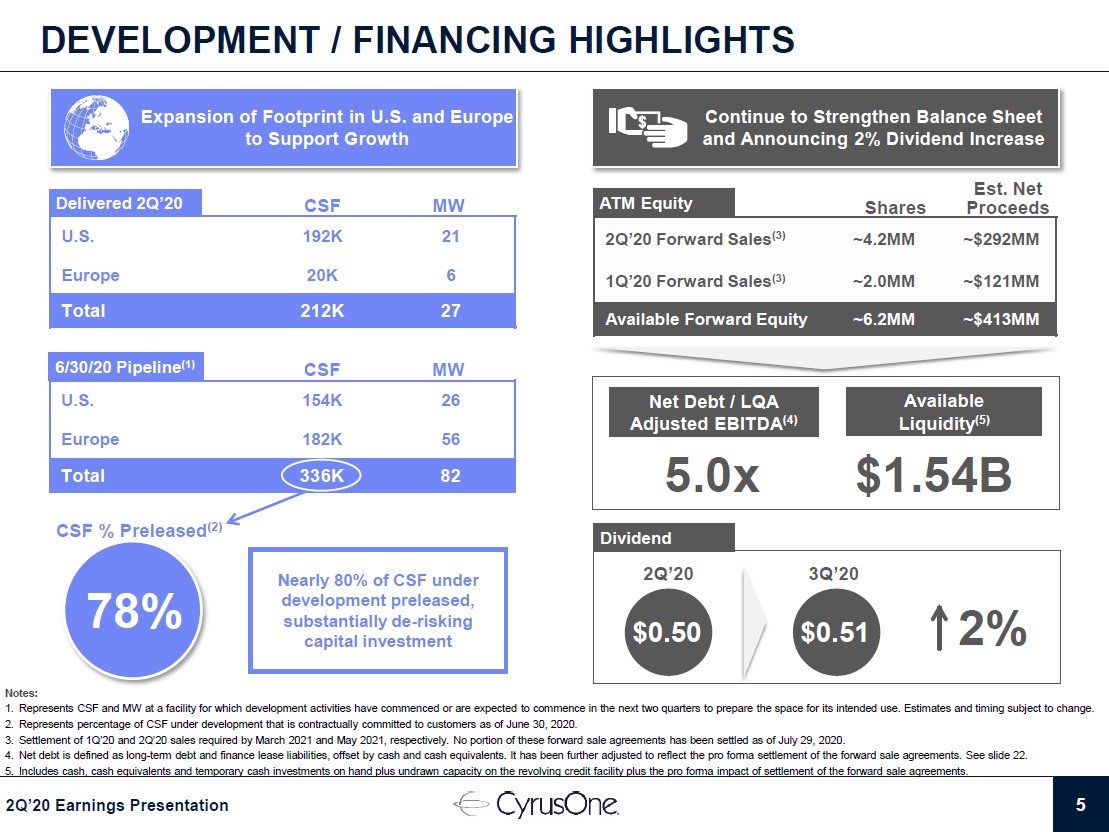

In the upcoming graphic down below, CyrusOne highlights that most of the collocation space (‘CSF’) under development had already been pre-leased as of the end of June 2020. This provides for greater clarity on the trajectory of CyrusOne’s financials and underpins its growth strategy (the REIT can grow its asset base knowing that there are tenants out there ready to start paying rent and other fees as soon as its projects are completed).

Image Shown: CyrusOne had already preleased the majority of its collocation space under development as of the end of June 30, 2020. Image Source: CyrusOne – Second Quarter of 2020 IR Earnings Presentation

Financing Concerns

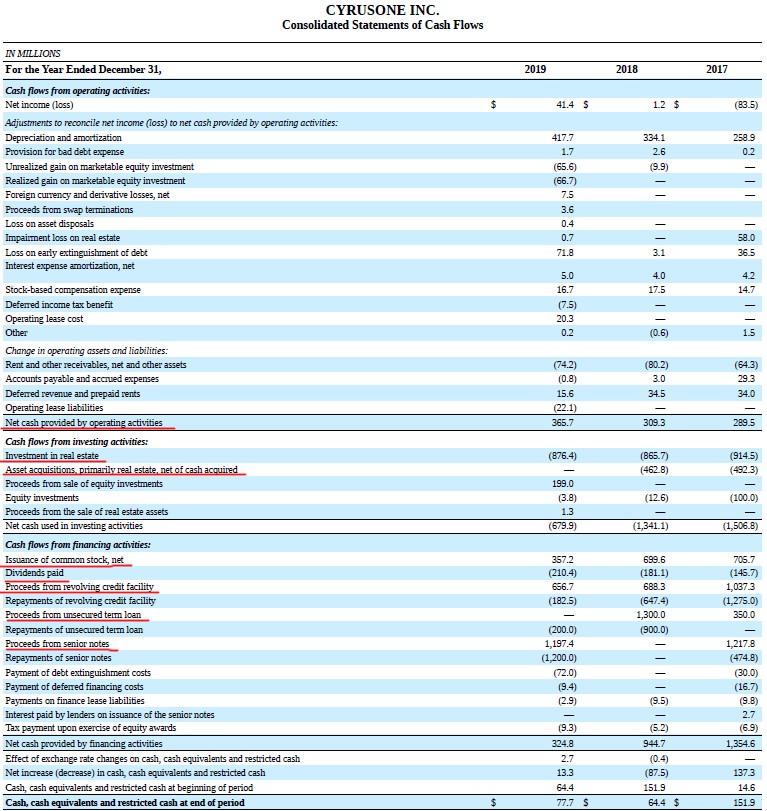

As a REIT, CyrusOne has not historically been free cash flow positive. From 2017 to 2019, CyrusOne used a combination of net operating cash flows, equity issuances, and debt issuances to cover its hefty capital expenditures and dividend obligations. CyrusOne must retain constant access to capital markets at (ideally) attractive rates to keep making good on its dividend obligations and its growth ambitions. In January 2020, the operating partnership of CyrusOne and its wholly-owned financing subsidiary issued out €0.5 billion in 1.450% senior Euro notes due 2027, highlighting its ability to tap debt markets at attractive rates.

Please note that most of CyrusOne’s capital expenditures are spent on projects relating to growing its asset base as its reoccurring (or maintenance) capital expenditures represent just a sliver of its total capital investments. For instance, the REIT forecasts that its 2020 maintenance-related capital expenditures will represent just 2% of its total capital investments at the midpoint of guidance. In the upcoming graphic down below, we highlight the nature of CyrusOne’s cash flows and financing needs, with key line-items underlined in red.

Image Shown: CyrusOne has historically tapped both equity and debt markets for funds to cover its growth spend while making good on its dividend obligations. Image Source: CyrusOne – 2019 Annual Report

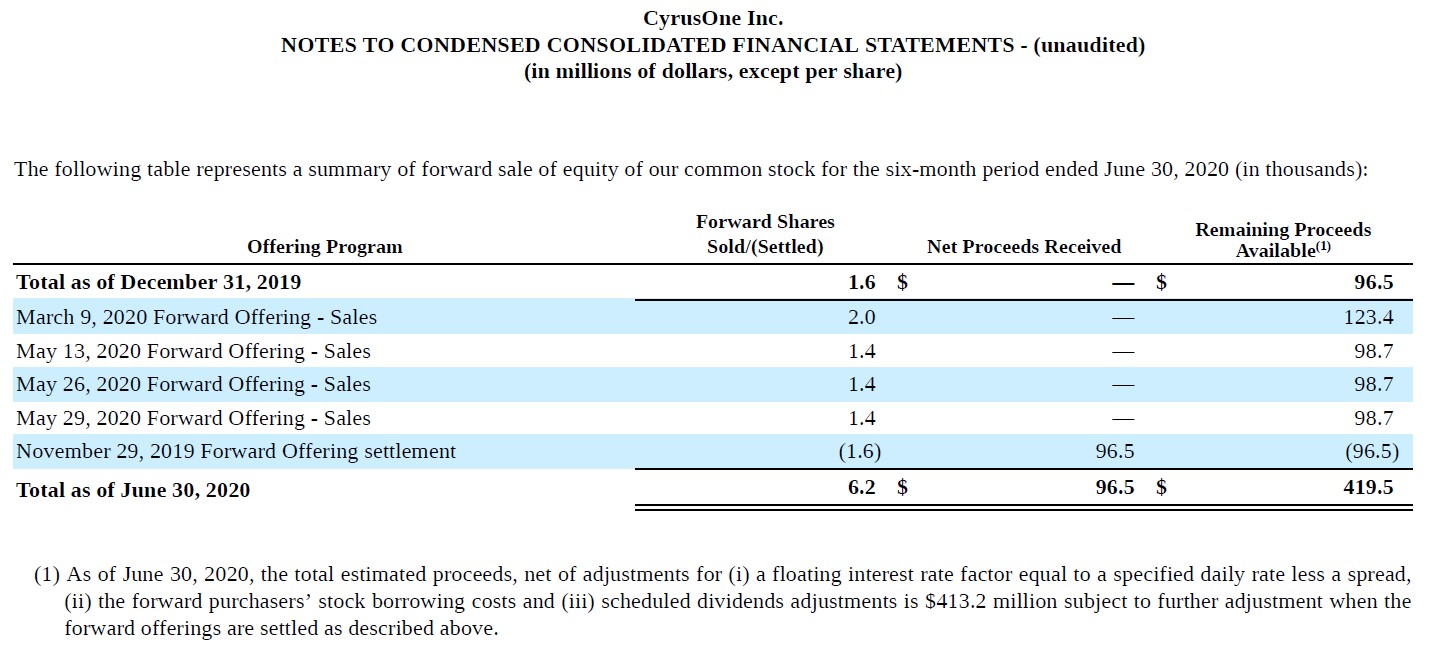

During the first half of 2020, CyrusOne utilized its at-the-market (‘ATM’) equity issuance program and forward equity sales to raise funds. In the upcoming graphic down below, CyrusOne notes it had a little over $0.4 billion in “remaining proceeds available” at the end of June 2020 through its forward equity sales.

Image Shown: CyrusOne uses forward equity sales to fund its growth spend and for other financing needs. Image Source: CyrusOne – 10-Q SEC filing covering the Second Quarter of 2020

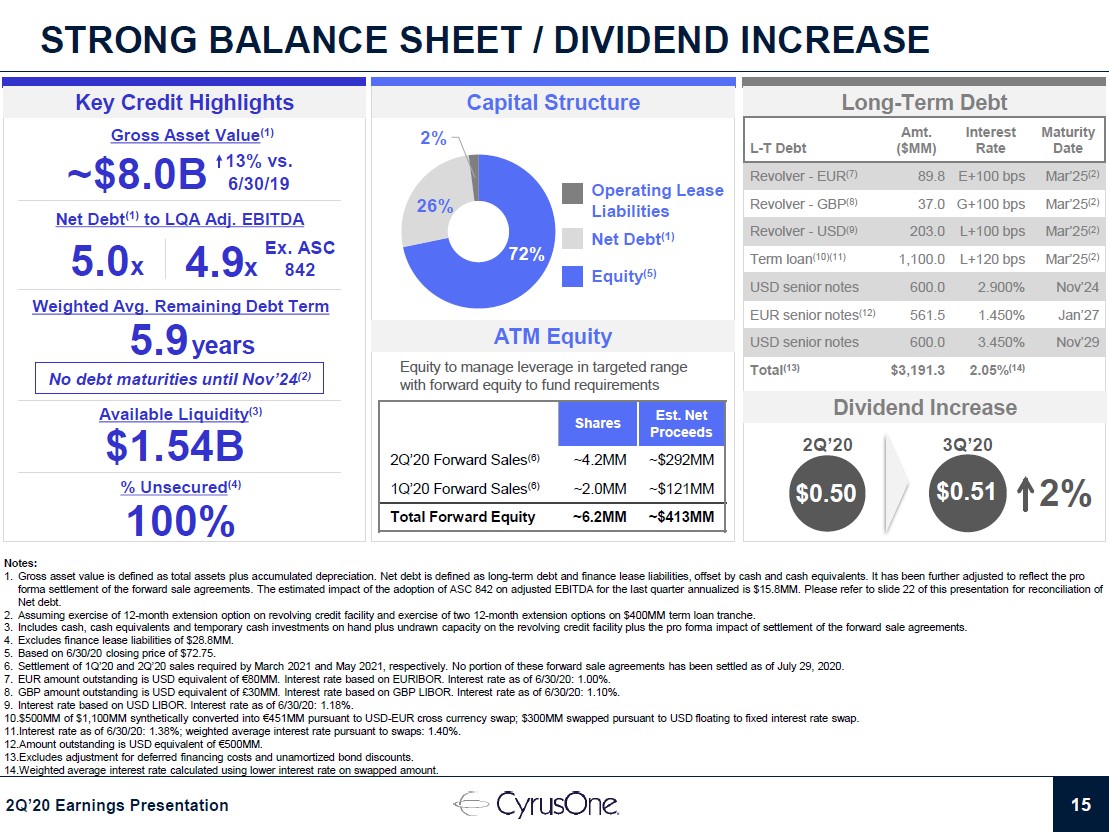

CyrusOne also has a $3.0 billion unsecured revolving credit facility that is made up of a term loan that matures March 2023 (with the option for two one-year extensions), a revolving credit line that matures March 2024 (with the option for one 12-month extension), and a term loan that matures March 2025. The terms of these facilities were amended back in March 2020. At the end of June 2020, the firm had ~$1.1 billion in total remaining borrowing capacity on its revolving credit facility, all of which was available through its revolving credit line due March 2024. In the upcoming graphic down below, CyrusOne highlights that the REIT does not have any meaningful amounts of debt coming due until 2024, assuming extension options are utilized.

Image Shown: CyrusOne’s financial position is strong and the REIT had ample access to liquidity at the end of June 2020. Image Source: CyrusOne – Second Quarter of 2020 IR Earnings Presentation

At the end of June 2020, CyrusOne had $0.1 billion in cash and cash equivalents on hand versus $3.2 billion in total debt (inclusive of short-term debt and finance lease liabilities). We appreciate that the REIT has access to ample liquidity and that the firm does not have a significant amount of debt maturing for several years, providing it with ample flexibility to ride out the storm while still making major growth investments. Here is what management had to say regarding CyrusOne’s financing needs and overall financial position during the REIT’s latest earnings call:

“…During the second quarter, we executed forward sales through our ATM equity program, resulting in nearly $300 million in proceeds upon ultimate settlement. Combined with our first quarter ATM forward sales, we have a total of $413 million in available forward equity.

On a pro forma basis, inclusive of the impact of this equity, our net debt to last quarter annualized EBITDA is five times and we have more than $1.5 billion in available liquidity including our undrawn revolver balance. With the projects in our development pipeline having a total completion cost of approximately $350 million at the midpoint, we have significant runway to fund potential capital requirements in support of leasing well into next year.

During the quarter, we settled the forward-sale agreement that we entered into in the fourth quarter of 2019 and this resulted in net proceeds of approximately $97 million, which were used to pay down a portion of the amounts outstanding on our unsecured revolving credit facility.” --- Diane Morefield, CFO of CyrusOne

The data center REIT reported that its revenue backlog at the end of the second quarter of 2020 stood at $0.1 billion which was the “highest quarter-end backlog in the company's history and positions us very well for continued growth into 2021 and thereafter.” We appreciate CyrusOne’s strong performance during the initial phase of the pandemic. However, we caution that in 2019, Microsoft Corporation (MSFT) represented 21% of its revenues, highlighting its customer concentration risk.

On one final note, the REIT announced that Diane Morefield, CyrusOne’s CFO, is stepping down with an effective retirement date of March 2021 during its latest earnings report. This move does not appear to reflect concerns with CyrusOne’s outlook.

Concluding Thoughts

Shares of CONE have performed very well year-to-date and are up 28% as of this writing, before taking dividend considerations into account. We continue to like CyrusOne as a holding in our High Yield Dividend Newsletter portfolio. Additionally, Digital Realty Trust Inc (DLR) is another high quality data center REIT that we include in our newsletter portfolios. To read more about the space, please check out our latest thoughts on Digital Realty by clicking this link here.

-----

Computer Hardware Industry – AAPL BB HPQ IBM TDC

Internet Content & Services Industry – GOOG GOOGL BIDU FB JD TCEHY TWTR

Internet Content and Catalog Retail Industry – BABA AMZN BKNG EBAY EXPE GRPN IAC OSTK QRTEA STMP

Retail REIT Industry – CONE DLR FRT O REG SPG WPC

Software Industry – ADBE ADSK EBIX INTU MSFT ORCL CRM

Related: BIP, SPY, QQQ, VNQ, MDY

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Digital Realty Trust Inc (DLR), Microsoft Corporation (MSFT), Oracle Corporation (ORCL), and Realty Income Corporation (O) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Apple Inc, Dollar General Corporation (DG), Facebook Inc (FB), The Walt Disney Corporation (DIS), and Microsoft Corporation are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Digital Realty Trust, CyrusOne Inc (CONE), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment