CubeSmart Is One of Our Favorite REITs

Image Source: CubeSmart – October 2020 Deluxe Storage Transaction IR Presentation

By Callum Turcan

On November 5, the self-storage real estate investment trust (‘REIT’) CubeSmart (CUBE) reported third quarter earnings for 2020 that missed consensus top-line estimates but beat consensus funds from operations (‘FFO’) estimates. The REIT’s financial performance has taken a hit from the ongoing coronavirus (‘COVID-19’) pandemic, though CubeSmart adjusted by launching its contactless online rental program SmartRental back in April. Furthermore, after suspending its normal schedule for rental rate increases earlier this year, CubeSmart resumed those increases in June and July. CubeSmart has also since resumed its normal delinquency process, on a jurisdiction by jurisdiction basis.

We include shares of CubeSmart as a holding in our High Yield Dividend Newsletter portfolio. As of this writing, shares of CUBE yield ~3.9%, and we view the self-storage REIT’s payout growth trajectory quite favorably.

The self-storage space is attractive because REITs operating in this arena are generally quite free cash flow positive, something that most REITs are not given their hefty capital expenditure programs. CubeSmart generated ~$140 million in free cash flows during the first half of 2020 (net operating cash flow less ‘additions and improvements to storage properties’ and ‘development costs’) and spent ~$129 million on ‘distributions paid to common OP unitholders’ though please note the REIT also spent a significant amount acquiring new self-storage properties during this period. When the REIT publishes its 10-Q SEC filing covering the third quarter of this year, we expect CubeSmart continued to generate meaningful free cash flows.

Quarterly Update

We appreciate CubeSmart adapting to the changing landscape due to COVID-19. Its same-store occupancy rate stood at 94.1% as of the end of October 2020, up from 92.0% at the end of October 2019, though we caution part of that is potentially due to the inability to go through the normal delinquency process in some jurisdictions. CubeSmart’s same-store net operating income (‘NOI’) fell by 1.6% year-over-year in the third quarter of 2020, as a 0.1% increase in revenues was offset by a 4.2% year-over-year increase in property operating expenses (some of the expense pressures of late have had to do with dealing with the pandemic).

However, even if the various headwinds CubeSmart has been facing, its FFO per share was flat year-over-year last quarter, coming in at $0.44 per share. Though an imperfect metric (FFO does not take into account the REIT in question’s need to tap capital markets for debt refinancing activities, growth activities, and in order to keep making good on its dividend obligations), FFO is useful for providing a snapshot of a REIT’s ability to keep making good on its payout. In the third quarter of 2020, CubeSmart’s FFO payout ratio (dividend per share divided by FFO per share) came in at 75.0%, which we appreciate because payout ratios below 80% are preferred.

CubeSmart added 37 stores to its third-party management platform last quarter, bringing its third-party managed store count to 733. On occasion, CubeSmart acquires stores that are not owned by the firm but managed by it through this platform. A growing third-party management platform provides multiple avenues for additional upside. Given headwinds created by the pandemic, CubeSmart did not provide 2020 guidance during its latest earnings report, though recent events seem to indicate its near-term outlook is improving.

Balance Sheet Update

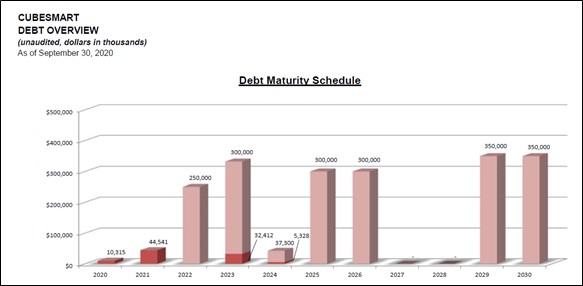

In October 2020, CubeSmart issued $450 million in 2.00% unsecured senior notes due February 2031 (priced at 99.074% of par). Some of those proceeds were used to redeem $250 million in 4.800% Senior Notes due 2022, and those activities were completed by the end of October. Additionally, the remaining proceeds were used to fully pay down its $750 million revolving credit facility due June 2024 ($37 million was drawn against the facility at the end of September 2020) and for general corporate purposes.

CubeSmart retains access to debt markets at attractive rates, in our view. Given its strong technicals of late, CubeSmart also appears to retain access to equity markets at attractive rates as well. The REIT did not issue out any common shares through its at-the-market equity issuance program in the third quarter, and CubeSmart has investment grade credit ratings (Baa2/BBB).

Image Shown: A look at CubeSmart’s debt maturity schedule as of the end of September 2020. Please note this picture does not take more recent refinancing activities into account, though we appreciate the staggered nature of its debt maturity schedule. Image Source: CubeSmart – Financial Supplement covering the third quarter of 2020

Recent Acquisition

In late-October, CubeSmart announced it was acquiring eight self-storage properties in New York City from privately-held Storage Deluxe for $540 million. This deal is expected to close in two tranches during the fourth quarter of this year, and includes properties in the boroughs of Brookland, Bronx, Queens. Here is what the press release had to say regarding the financial considerations:

Consideration for the acquisition will consist of approximately $201.7 million payable in cash, approximately $183.7 million payable in Class B Operating Partnership Units, and the assumption of approximately $154.6 million of existing fixed-rate secured debt. The Company expects to finance the cash portion of the purchase price at closing through cash on hand and borrowings under the unsecured revolving credit facility.

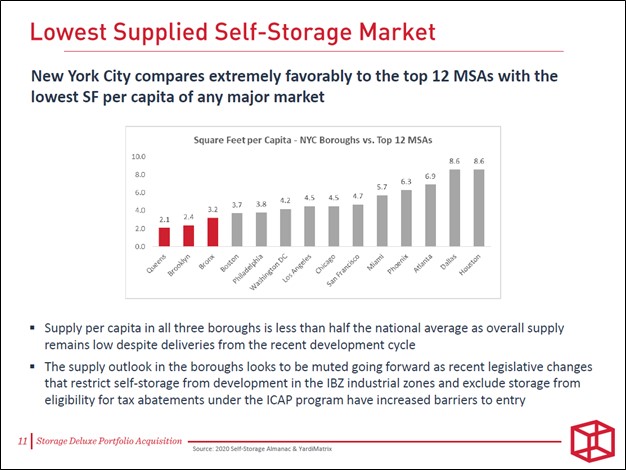

CubeSmart is expanding its footprint in high-quality regions where the self-storage industry benefits from favorable market dynamics, which we appreciate. CubeSmart views the three aforementioned boroughs in New York City as undersupplied markets (for self-storage needs).

Image Shown: CubeSmart is expanding its presence in New York City as the REIT views the market dynamics for the self-storage industry as quite favorable in this area. Image Source: CubeSmart – October 2020 Deluxe Storage Transaction IR Presentation

Concluding Thoughts

We continue to be huge fans of the self-storage industry, and CubeSmart is one of our favorite REITs in the space. The ability for self-storage REITs to generate sizable free cash flows in almost any operating environment highlights the resilience of their business model. Going forward, due to CubeSmart’s apparent ability to tap capital markets at attractive rates, we view the REIT’s forward-looking payout coverage favorably.

-----

Related: UHAL, CAR, PSA, R, URI, CUBE, EXR, JCAP, VNQ, PSTG, SPY

----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares of any of the securities mentioned above. CubeSmart (CUBE), Public Storage (PSA), and Vanguard Real Estate ETF (VNQ) are all included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment