Covering One of Newmont’s Lowest Cost Gold Mining Operations

We covered Newmont’s first quarter 2020 earnings back in early-May and continue to like the gold miner in the Dividend Growth Newsletter portfolio. Newmont’s Dividend Cushion ratio stands at 2.2 which provides for a “GOOD” Dividend Safety rating and we like the firm’s payout growth trajectory which earns the firm a “GOOD” Dividend Growth rating as well. Please note our Dividend Cushion ratio and Dividend Safety rating incorporates our expectations that Newmont will push through modest dividend increases over the coming years.

By Callum Turcan

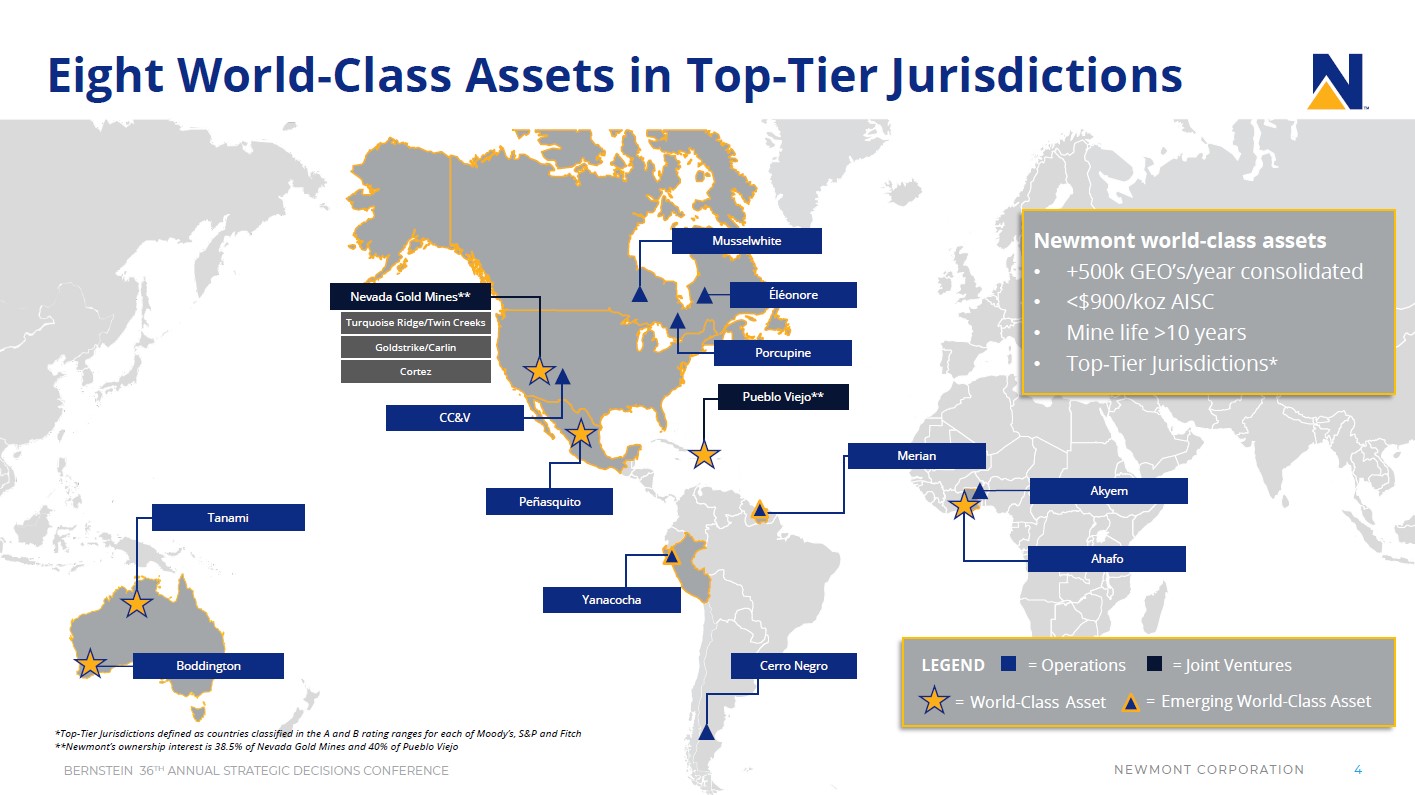

Newmont Corporation (NEM) is our favorite gold miner and we added shares of NEM to our Dividend Growth Newsletter portfolio back on January 13, 2020 (link here). Shares of NEM are trading in the upper bound of our fair value estimate range as of this writing, which is partially because gold futures have been very strong year-to-date and partially because the company has been performing very well since acquiring Goldcorp last year (for a total consideration of ~$9.5 billion). That deal is now expected to generate $500 million in annualized synergies by 2021, up from $365 million initially as we have covered previously (link here).Shares of NEM yield ~1.7% on a forward-looking basis as of this writing. As an aside, Newmont paid out a substantial special dividend of $0.88 per share in 2019.

Tanami Overview

The Tanami gold mining operation located in Australia’s Northern Territory is 100% owned by Newmont. Gold was first discovered in the area around 1900. Last year, Newmont’s Tanami operation produced 500,000 ounces of gold and at the end of 2019, the gold miner reported the asset had 5.7 million ounces of gold reserves (it is not made readily clear if these are troy ounces or ounces in Newmont’s press releases and SEC filings). Underground mining operations are located at Dead Bullock Soak mining camp and processing facilities are located 25 miles away from mining operations. Newmont uses road trains (long combination trucking vehicles) to ship ore from the mine to the processing facilities.

In 2019, Newmont added 1.5 million ounces of gold reserves to its asset base from the Tanami mining operation. Newmont is primarily targeting Callie and Auron ore bodies at the underground Dead Bullock Soak mining camp, though the Federation and Liberator ore bodies could provide additional upside. Furthermore, Newmont is interested in exploring the Oberon ore body for potential gold resources and reserves.

From 2020 to 2024, Newmont expects its Tanami gold mining operation will produce 500,000 – 600,000 ounces of gold per year. Even better, Newmont sees its Tanami mining operation as being one of its lowest cost assets (lowest all-in sustaining costs [‘AISC’] per ounce of gold produced across Newmont’s core properties), as you can see in the upcoming graphic down below.

Image Shown: Newmont’s Tanami gold mining operations in Australia represent one of the company’s most lucrative operations. Image Source: Newmont – May 2020 IR Presentation

Expansion Underway

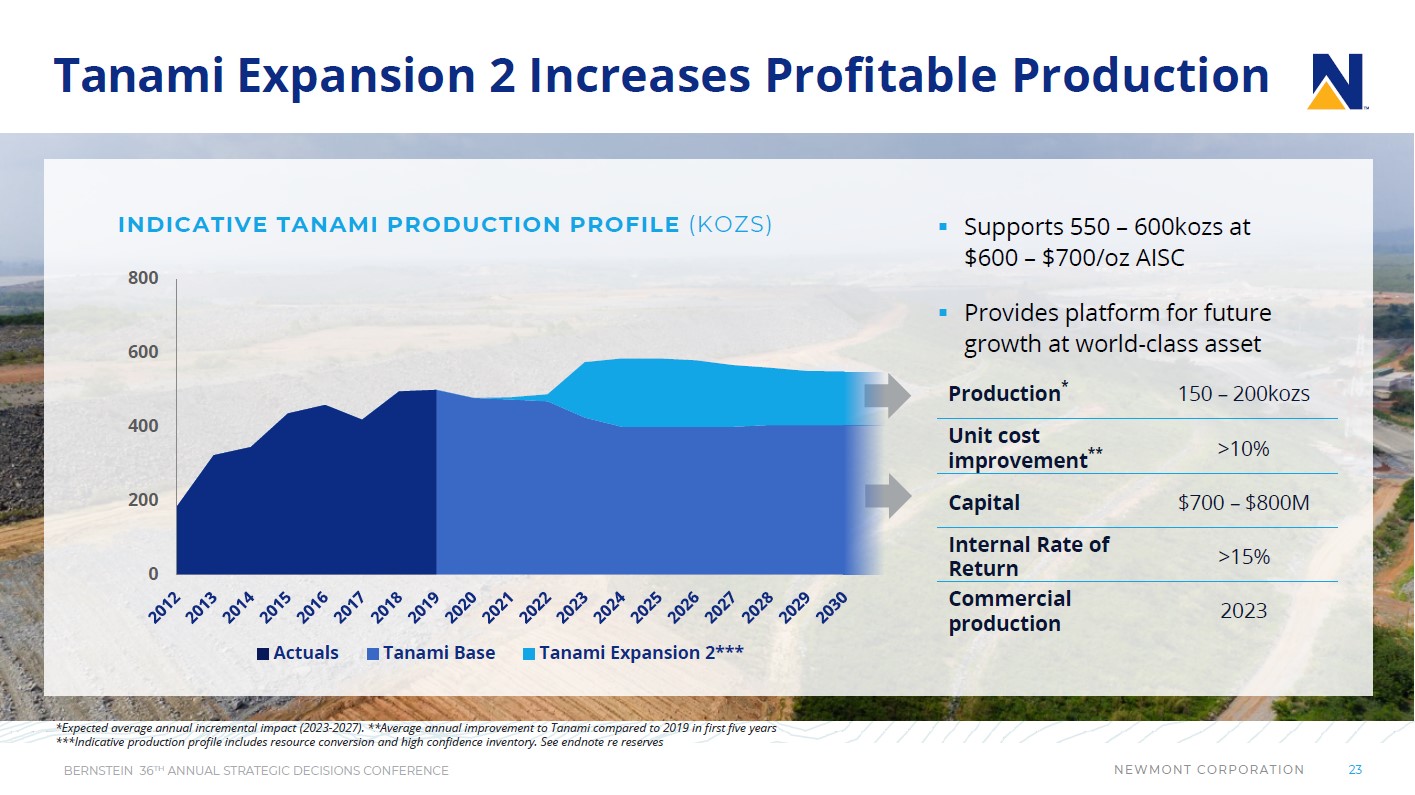

Management approved fully funding for the ‘Tanami Expansion 2’ project back in October 2019, which seeks to extend the life of the mining operation out to 2040. The project will add an almost one-mile long hoisting shaft and supporting infrastructure to the mining operation which are expected to increase the asset’s gold production by 150,000 – 200,000 ounces of gold per year for the first five years starting in 2023 (when commercial production from the development are expected to begin).

Newmont forecasts the development will cost between $700 million - $800 million to complete, and the endeavor is forecasted to cut operating costs on a per unit basis by roughly 10%. In the upcoming graphic down below, management provides an overview of how the project will impact Newmont’s Tanami gold production profile.

Image Shown: Newmont needs to bring the Tanami Expansion 2 project online to offset expected declines in the asset’s gold production base. Image Source: Newmont – May 2020 IR Presentation

Past Projects

Back in March 2019, Newmont completed the ‘Tanami Power’ project on schedule. That endeavor involved installing two power stations, a 41-mile long interconnected power line, and a 275-mile long natural gas pipeline that connects the mining operation to the Amadeus Gas Pipeline owned by APA Group (APAJF). Third-parties built and are managing most of those new assets.

For Newmont, the “completed project is expected to provide the Tanami gold mine a safe and reliable energy source while lowering power costs and carbon emission by 20 percent. The project is expected to generate net cash savings of $34 per ounce from 2019 to 2023, delivering an Internal Rate of Return of greater than 50 percent” according to the press release announcing the successful completion of the development. We appreciate the various cost saving and mine life extension programs Newmont has embarked on and completed at the Tanami gold mining operation in recent years.

Concluding Thoughts

We covered Newmont’s first quarter 2020 earnings back in early-May (link here) and continue to like the gold miner in the Dividend Growth Newsletter portfolio. Newmont’s Dividend Cushion ratio stands at 2.2 which provides for a “GOOD” Dividend Safety rating and we like the firm’s payout growth trajectory which earns the firm a “GOOD” Dividend Growth rating as well. Please note our Dividend Cushion ratio and Dividend Safety rating incorporates our expectations that Newmont will push through modest dividend increases over the coming years.

In the event gold prices remain elevated for a sustained period of time over the coming quarters and potentially years, Newmont’s ability to push through meaningful per share dividend increases while paring down its debt load would be enhanced significantly. Newmont exited the first quarter of 2020 with $3.7 billion in cash and cash equivalents on hand versus $0.1 billion in short-term debt and $6.0 billion in long-term debt.During Newmont’s latest quarterly conference call the firm noted (emphasis added):

“Using our conservative $1,200 gold price planning assumption, our free cash flow would still total more than $5 billion over the next five years and at current gold prices our portfolio will generate around $15 billion of free cash flow over the same five-year time frame. In addition, we have the potential for further upside with tailwinds from favorable oil prices and foreign currency exchange rates. The excess free cash we generate will be used to reduce our net debt and provide additional returns to shareholders. Looking forward, we are well positioned to continue executing our capital priorities and staying focused on creating long term value.” --- Tom Palmer, CEO of Newmont

As of this writing, COMEX gold futures for August 2020 deliveries are trading just under $1,800 per troy ounce. Members looking for more of our coverage of the mining industry at-large are encouraged to check out our June 2020 article covering BHP Group (BHP) (BBL) (that can be accessed here) and our May 2020 article covering Southern Copper Corporation (SCCO) (that can be accessed here) if you have not already done so.

-----

Diversified Mining Industry – BHP FCX NEM RIO SCCO VALE WPM

Related: APAJF, BBL, GLD, SLV, GOLD

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment