Citigroup Holding Up Fairly Well

As with its large banking peers, Citigroup posted ugly performance in the first quarter of 2020, results released April 15. While there are probably more losses to come in terms of reserve build and future charge offs, especially in the company’s card business, Citigroup has held up reasonably well thus far in the early innings of this downcycle (and as compared to how poorly the bank fared during the Global Financial Crisis last time around).

By Matthew Warren

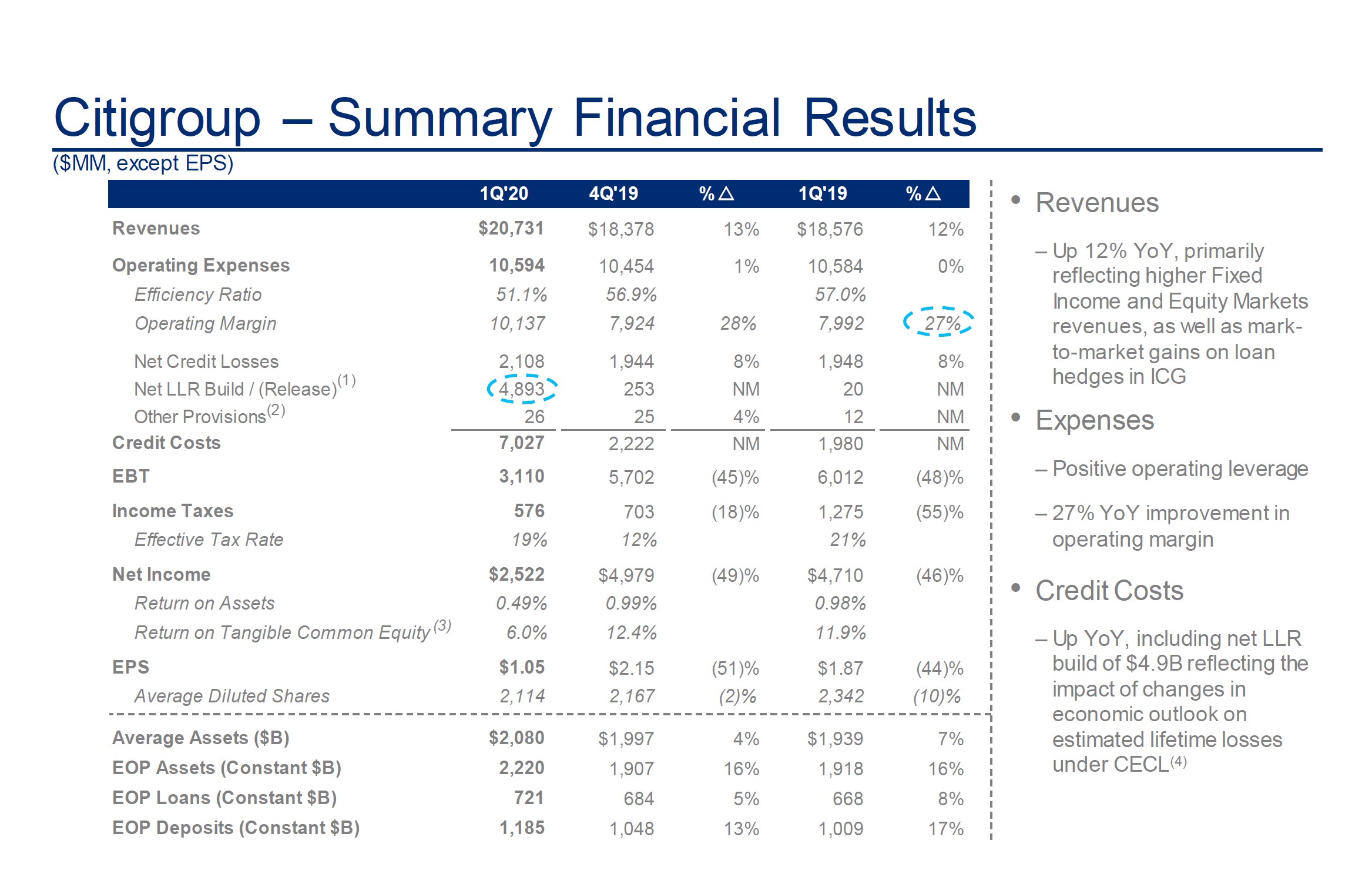

As with its large banking peers, Citigroup (C) posted ugly performance in the first quarter of 2020, results released April 15. While the bank beat consensus estimates on the top line with revenue of $20.73 billion ($1.75 billion better than expected), it missed earnings expectations with earnings per share of $1.05, or $0.31 less than expected.

As one can see in the graphic down below, the biggest swing factor for Citigroup’s bottom line was the $4.893 billion net loan loss reserve build, which catapulted earnings before taxes 48% lower despite revenues that were up an impressive 12% (thanks in large part to 39% revenue growth in both Fixed Income Markets and Equity Markets).

Image Source: Citigroup 1Q2020 Earnings Presentation

While there are probably more losses to come in terms of reserve build and future charge offs, especially in the company’s card business, the business model has held up reasonably well thus far in the early innings of this downcycle (and as compared to how poorly the bank fared during the Global Financial Crisis last time around).

Due to balance sheet growth, Citigroup’s Common Equity Tier I ratio dropped to 11.2% from 11.8% last quarter, but with share buybacks suspended across the big banks, the bank might be able to hold its dividend in place as long as reserve builds don’t take off from current levels. This point is very much economy dependent, however.

Though no bank dividend may be safe in this market environment, we are maintaining our recently reduced $63 fair value estimate, which is just below tangible book value of $71.52 per share. With a current quarter return on tangible equity of only 6%, the bank must successfully navigate the cycle and put up higher returns on the other side in order to justify our fair value estimate.

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Matthew Warren does not own any of the securities mentioned. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment