Cisco Responds to Near-Term Headwinds with Large Cost Cuts

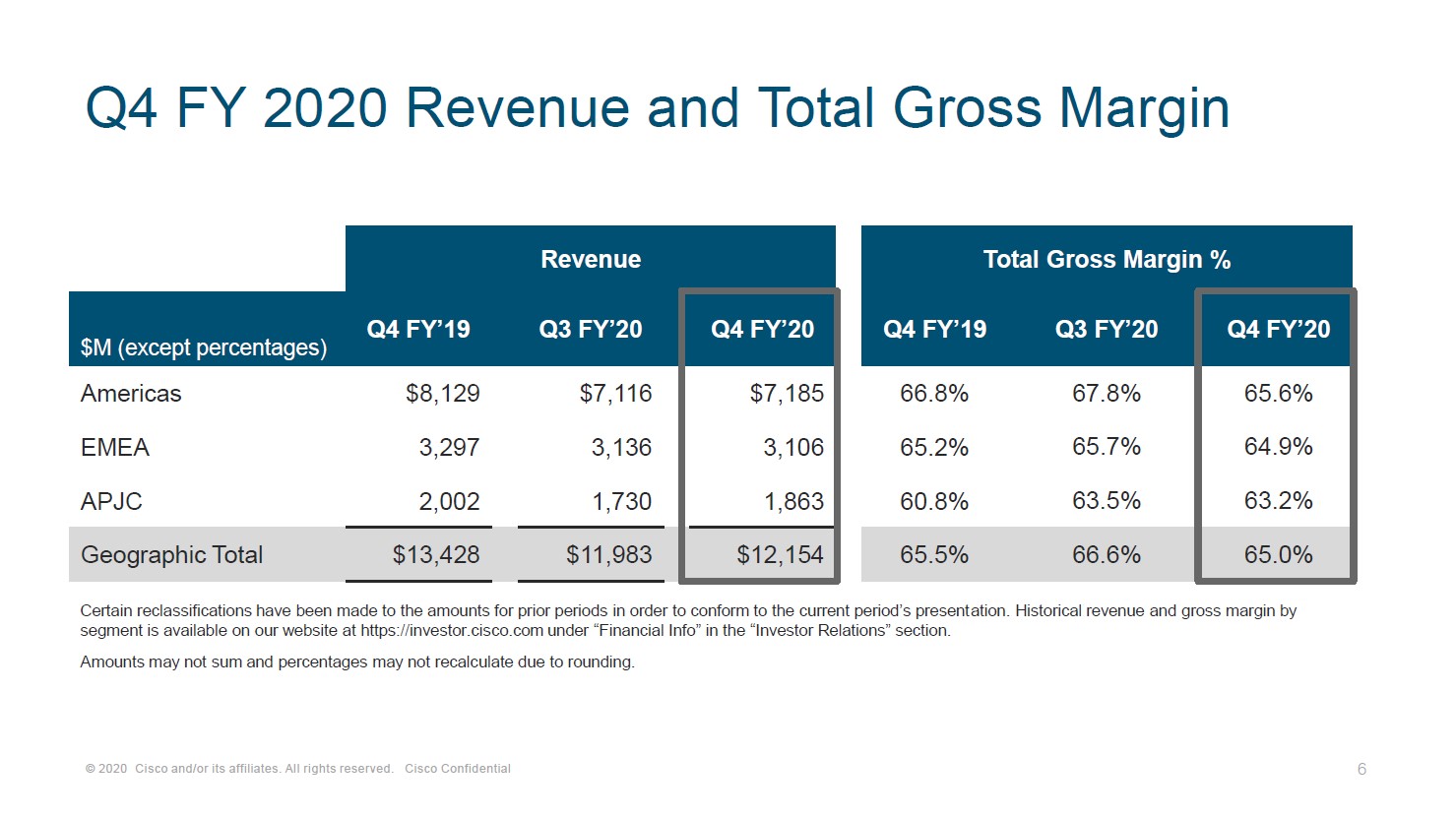

Image Shown: Cisco Systems Inc’s financial performance held up well, relatively speaking, during the initial stages of the pandemic. Image Source: Cisco Systems Inc – Fourth Quarter of Fiscal 2020 IR Earnings Presentation

By Callum Turcan

On August 12, Cisco Systems Inc (CSCO) reported fourth quarter fiscal 2020 earnings (period ended July 25, 2020) that beat consensus estimates on both the top- and bottom-lines. However, Cisco’s outlook for the current fiscal quarter was weaker than expected which weighed on shares of CSCO during normal trading hours on August 13. Cisco’s near-term performance is facing headwinds due to the ongoing coronavirus (‘COVID-19’) pandemic as many of its customers are delaying projects until after the storm has passed.

With that in mind, Cisco remained a free cash flow cow last fiscal year and that is likely to continue going forward, which supports its ability to continue paying meaningful dividends. Cisco’s strong cash flow profile is further supported by its pristine balance sheet, and we continue to like the firm as a holding in both our Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of CSCO yield ~3.4% as of this writing. Please note that Cisco recently announced its CFO for the past five years, Kelly Kramer, plans to leave the company once her replacement has been found.

Financial Strength Maintained

In fiscal 2020, Cisco generated $14.7 billion in free cash flow which was about flat with fiscal 2019 levels (period ended July 27, 2019) of $14.9 billion. Cisco spent $6.0 billion on its dividend obligations in both fiscal 2019 and fiscal 2020, which were well covered by its free cash flows. We give Cisco a Dividend Cushion ratio of 2.6 which provides for a “GOOD” Dividend Safety rating. In the event that Cisco’s Dividend Cushion ratio were to creep a tad higher, Cisco’s Dividend Safety rating could get upgraded to “EXCELLENT” and please note that these proprietary metrics incorporate our expectations that Cisco will push through annual double-digit per share dividend increases over the coming fiscal years.

Cisco spent $2.7 billion in fiscal 2020 on its common stock repurchasing program (down sharply from the whopping $20.7 billion spent in fiscal 2019), though please note that during this period Cisco also issued out $0.7 billion in equity and spent $0.7 billion repurchasing its stock for tax withholding purposes relating to restricted stock units vesting. From fiscal 2019 to fiscal 2020, Cisco’s outstanding diluted share count dropped by ~4.5%. After the recent tumble in Cisco’s share price, management could take advantage of the firm’s strong financial position and repurchase a meaningful amount of Cisco’s common stock at a nice discount to its intrinsic value.

Our fair value estimate for shares of CSCO sits at $51 (under our “base” case scenario), though the lower end of our fair value estimate range sits at $41 per share (under our “bear” case scenario). Given that we expect Cisco’s outlook to improve significantly over the coming fiscal quarters (we will cover that in just a moment), shares of CSCO appear to be trading at a meaningful discount to their fair value as of this writing considering recent moves undertaken by management should have a powerful impact on the firm’s financial performance.

Cisco exited fiscal 2020 with $24.9 billion in cash, cash equivalents, and short-term investments on hand versus $3.0 billion in short-term debt and $11.6 billion in long-term debt. We strongly appreciate Cisco’s net cash position as that has allowed the firm to continue making key acquisitions to support its medium- and long-term outlook. For instance, Cisco’s purchase of networking intelligence firm ThousandEyes which according to management closed in early-August. We covered that purchase back in June 2020 (link here) and continue to be intrigued by the potential upside that could be generated by integrating ThousandEyes’ software with Cisco’s hardware. Here is what management had to say on the acquisition during the firm’s latest earnings call (emphasis added):

“Within our Infrastructure Platforms business, we continue to see a strong ramp of our Catalyst 9K portfolio [more on that here] as many customers take advantage of their employees working from home to refresh their aging infrastructure, enabling them to simplify, secure, and automate the management of their networks.

Our acquisition of ThousandEyes will complement these capabilities by adding deeper and broader visibility and analytics across networks and applications, enabling us to deliver the best possible experiences for our customers. By integrating their SaaS-based offering with our AppDynamics application intelligence portfolio and SD-WAN technology, we can provide unparalleled intelligence and insights at cloud scale, driving improved customer experience as well as reliability of their applications.” --- Chuck Robbins, CEO and Chairman of Cisco

Revenue Pressure and Cost Cuts

Where Cisco had some trouble was on the top-line end of things, as its GAAP revenues declined by 5% year-over-year in fiscal 2020, hitting $49.3 billion. A small part of this decline was due to Cisco selling off its Service Provider Video Software Solutions business in the second quarter of fiscal 2019. However, on a non-GAAP adjusted basis, management still reported that Cisco’s revenues were down ~5% year-over-year in fiscal 2020.

Cisco’s GAAP operating income dropped by 4% year-over-year in fiscal 2020, hitting $13.6 billion. Its operating income was supported by a modest reduction in its R&D and sales & marketing (‘S&M’) expenses, though please note Cisco incurred $0.5 billion in restructuring and other charges last fiscal year (up from $0.3 billion in fiscal 2019). Cisco’s G&A expenses were up marginally year-over-year in fiscal 2020, though management touted a major restructuring program during the firm’s latest earnings call that may see those expenses shift lower over time (emphasis added):

“The changes we are making to our business reflect how we are leveraging our existing strengths, investing for growth, and unlocking new opportunities. We will also be very disciplined on our cost structure, as we always have been. Over the next few quarters, we will be taking out over $1 billion on an annualized basis to reduce our cost structure.

At the same time, we're going to rebalance our R&D investments to focus on key areas that will position us well for the future. More specifically, we will accelerate the transition of the majority of our portfolio to be delivered as a service. We will also accelerate our investments in the following areas: cloud security; cloud collaboration; key enhancements for education, healthcare, and other industries; increased automation in the enterprise; the future of work; and application insights and analytics.

At the same time, we will continue our focus in the following areas, many of which have been accelerated by the pandemic: multi-cloud investment; 5G and Wi-Fi 6; 400-gig; optical networking; next-generation silicon; AI; and more. These investments will help define the next phase of our transformation and allow us to bring the best, most relevant innovation to our customers in simpler, more easily consumables ways.” --- CEO of Cisco

Acquisitions like ThousandEyes will help revive Cisco’s revenue trajectory, which combined with meaningful cost cutting measures could see Cisco’s medium-term outlook improve materially. We expect Cisco will focus primarily on S&M and G&A expense reductions over the coming fiscal quarters to achieve its cost reduction target, though R&D expenses also appear to be on the chopping block. Cisco needs to continue making significant R&D investments to stay relevant in the fast paced world of tech, and we appreciate management stressing that the firm would evaluate its current approach to R&D to make sure funds are being allocated to projects with promising growth opportunities.

Near-Term Guidance

During Cisco’s latest earnings call, management provided guidance for the first quarter of fiscal 2021 that underwhelmed:

“Let me reiterate our guidance for the first quarter of fiscal 2021… We expect revenue to decline in the range of minus 9% to minus 11% year over year. We anticipate the non-GAAP gross margin rate to be in the range of 64% to 65%. The non-GAAP operating margin rate is expected to be in the range of 30% to 31%, and the non-GAAP tax provision rate is expected to be 19%. Non-GAAP earnings per share is expected to range from $0.69 to $0.71.” --- Kelly Kramer, CFO of Cisco

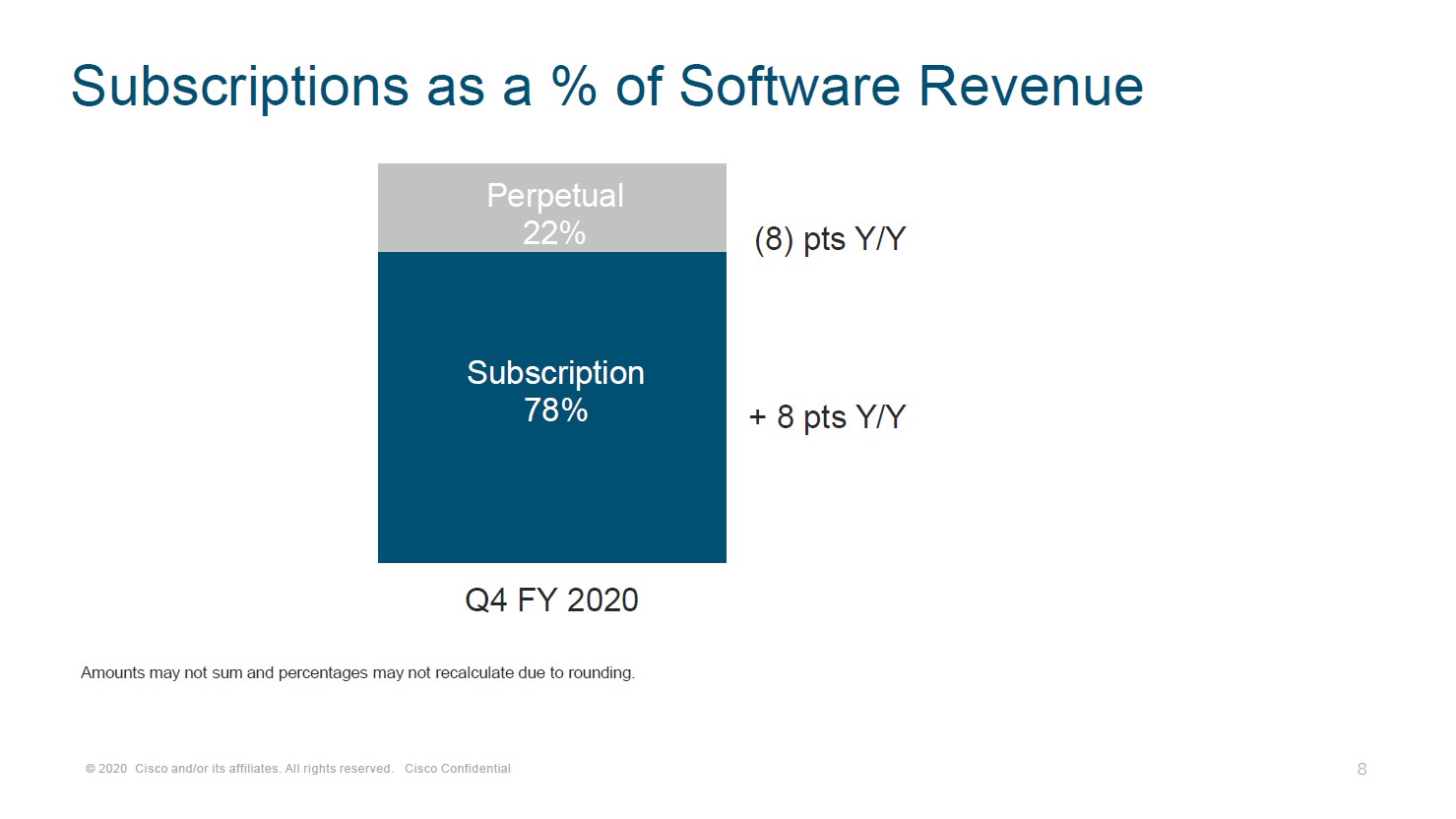

The ongoing pandemic is weighing on Cisco’s near-term outlook, though we expect that the firm will continue to generate meaningful cash flows. One key source of upside in the near-term that does not have to deal with cost cuts involves Cisco growing its subscription revenues as a percent of its software revenue, as you can see in the upcoming graphic down below. Recurring revenue streams provide for higher quality cash flow profiles. In fiscal 2020, just over half of Cisco’s revenues were generated by software and services sales according to its earnings press release.

Image Shown: Cisco’s subscription revenues continue to grow as a percentage of its total software-related revenues. Image Source: Cisco – Fourth Quarter of Fiscal 2020 IR Earnings Presentation

Concluding Thoughts

Though shares of CSCO took a beating on August 13, management has responded in an aggressive manner. Shaving $1.0 billion out of Cisco’s annual cost structure would significantly improve its free cash flow outlook, though investors are likely looking for greater clarity on how that program will proceed. Cisco remained a cash flow cow last fiscal year, and keeping near-term headwinds in mind, will likely continue being a cash flow cow this fiscal year. Eventually, Cisco’s customers will sanction new networking and IT infrastructure-related projects that were delayed by the pandemic, which should see Cisco’s revenue trajectory return to positive territory.

-----

Communications Equipment Industry – CSCO JNPR KN NOK SMCI

Related ETFs: IGN, TDIV, CIBR, WBIF, WBIE, WBIG, PXQ, WBIL, IYZ, PKW, SPY, QQQ

-----

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Cisco Systems Inc (CSCO) is included in both Valuentum’s simulated Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment