Chipotle Improving Its Digital Menu to Support Its E-commerce Growth Runway

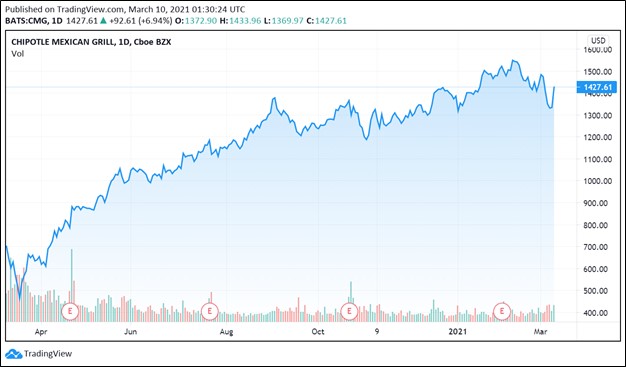

Image Shown: Over the past year, shares of Chipotle Mexican Grill Inc have been on an upward tear, supported by the restaurant’s improving omni-channel selling capabilities.

By Callum Turcan

Shares of Chipotle Mexican Grill Inc (CMG) surged higher during normal trading hours March 9 after the firm announced it was adding customizable quesadilla offerings to its digital menu in the US and Canada starting March 11. This offering is only available for customers ordering while using Chipotle’s digital platforms (potentially due to the longer preparation times) and will likely require new cooking equipment at the company’s restaurants. The company offers both home delivery and curbside/drive-thru pickup services (including its order ahead and pickup services) through its digital platform. We continue to be huge fans of Chipotle and include the company as an idea in our Best Ideas Newsletter portfolio. Here is how the press release described the new offering:

Chipotle's Quesadilla is filled with Monterey Jack Cheese and freshly prepared with Responsibly-Raised® Chicken, Steak, Carnitas, Barbacoa, Sofritas, or Fajita Veggies. The preservative-free flour tortilla is folded and pressed using a new custom oven in Chipotle's Digital Kitchen, which melts the cheese perfectly and enables restaurants to make Quesadillas more quickly and conveniently. The menu item is cut into triangular pieces and served in 100% compostable packaging that allows guests to pick three salsas or sides, including fresh tomato salsa, sour cream, or hand-mashed guac for a little extra.

Impressive Digital Momentum

Chipotle tested out the quesadilla offering through pilot projects in Cleveland and Indianapolis that were launched in the summer of last year before deciding to roll out the new customizable product company-wide. Whenever a restaurant operator decides to shake up their menu, the company needs to be cognizant of how the new menu will impact order times, margins, operating costs, and other important items. Chipotle wanted to make sure that adding quesadilla offerings would not lead to deteriorating customer service, order times, and product quality--and conducting pilot tests is a great way to go about testing the waters without rocking the boat.

Management noted that Chipotle used its “Digital Kitchen” operations to conduct these pilot projects and that these facilities were “using a new custom oven” to make the quesadilla offerings in the March 9 press release. This is not the first time Chipotle has added popular items to its digital-only menu. In September 2020, Chipotle announced it had added back carne asada (grilled and sliced beef) offerings in the US for a limited time, but only for digital orders. During the fourth quarter of 2020, Chipotle generated 49% of its revenues from digital sales (which were up over 177% year-over-year), and the launch of its new quesadilla offering should help keep the momentum going on this front.

Looking ahead, Chipotle’s growth strategy rests on its impressive omni-channel selling capabilities which the firm continues to heavily invest in. That includes adding “Chipotlane” drive-thru operations to its restaurants. According to management commentary given during Chipotle’s fourth quarter of 2020 earnings call, by the end of last year, the company had about 170 restaurants with Chipotlanes. For reference, Chipotle had almost 2,770 operating restaurants at the end of 2020, meaning there is ample room for the company to continue bulking up its drive-thru operations going forward.

This year, Chipotle intends to have more than 70% of its new store openings include a Chipotlane, up from about 62% in 2020. Additionally, management intends to remodel or relocate around 10 – 15 stores in 2021 to add a Chipotlane to those operations. Strong sales performance at stores that have Chipotlanes so far underpins management’s optimistic view on how that infrastructure will improve Chipotle’s company-wide financial performance going forward. Here is what management had to say on the issue during the firm’s fourth quarter of 2020 earnings call (emphasis added):

“As of year-end, we had a total of 170 Chipotlanes, including five conversions. Performance for these formats continues to be stellar. The digital gap versus non-Chipotlane restaurants remains around 10% driven entirely by higher-margin digital pickup orders. And sales at the Chipotlane cohort continued to outperform the non-Chipotlane results from the same open period.

In fact non-comp Chipotlane sales are opening close to our existing restaurant AUV [average volume unit] versus historical peak productivity in the mid to high 80% range. These results reaffirm our strategy of an accelerated pivot towards Chipotlane sites. Not only will this enhance customer access and convenience but it also helps increase new restaurant sales, margins, and returns.

While 62% of new restaurants in 2020 had a Chipotlane, our goal is to have more than 70% of openings include a Chipotlane in 2021 where we anticipate opening around 200 new restaurants. Of course this development guidance assumes no major COVID related delays in 2021.” --- Jack Hartung, CFO of Chipotle

Additionally, Chipotle is testing out online-only store formats. Management had this to say during the firm’s fourth quarter of 2020 earnings call:

“In addition we are opening up more and more Chipotlanes and are in the early stages of testing alternative formats like our first-ever digital-only restaurant outside of West Point. This new prototype allows us to enter more trade areas that wouldn't support a full-size restaurant and allows for greater flexibility with future locations. It's early days but this location has outperformed our expectations thus far.” --- Brian Niccol, CEO of Chipotle

Though these are still just early days, it appears that there is substantial room for Chipotle to improve its financial performance going forward by optimizing its restaurant operations to better handle digital orders (we're also big believers Chipotle has more upside if and when it addresses the breakfast daypart). Chipotle’s CEO also noted that “comparable restaurant sales for January accelerating to around 11% despite a double digit comparison” during the earnings call versus the just under 6% comparable restaurant sales growth the company reported in the final quarter of 2020. Chipotle entered 2021 with substantial momentum.

Concluding Thoughts

We are impressed by Chipotle’s ability to navigate the storm created by the COVID-19 pandemic. The company’s growing omni-channel selling capabilities underpins our optimistic outlook towards the name. We continue to like Chipotle as an idea in the Best Ideas Newsletter portfolio. The top of end of our fair value estimate range sits at $1,531 per share of CMG, and when we roll forward our discounted cash-flow model for the new year, we expect Chipotle’s fair value estimate will be revised higher. Chipotle’s digital prowess should help enable the company to continue generating impressive comparable restaurant sales growth going forward. To read more about our thoughts on Chipotle, check out this article here.

-----

Discretionary Spending Industry – ATVI, BBY, CBRL, CMG, DIS, DG, DLTR, DPZ, DNKN, EL, F, GM, HAS, HD, LOW, MCD, NFLX, NKE, SBUX, TSLA, YUM, DKS, TJX, ROST, WHR, KMX, AZO, RL

Tickerized for CMG, YUM, YUMC, QSR, MCD, WEN, DASH, WTRH, GRUB, APRN, TKAYF, HLFFF

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), Dollar General Corporation (DG), Domino’s Pizza Inc (DPZ) and The Walt Disney Company (DIS) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Dick’s Sporting Goods Inc (DKS) and Home Depot Inc (HD) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment