Cavco Industries Is an Intriguing Capital Appreciation Idea

Image Source: Cavco Industries Inc – July 2021 IR Presentation

Executive Summary: Cavco Industries designs and builds manufactured homes, modular homes, and similar offerings in the US. Additionally, Cavco Industries provides insurance and financing services that cater to this market. The company’s free cash flow generating abilities are stellar, its growth runway is underpinned by strong housing prices in the US, and the firm has a fortress-like balance sheet even after taking a recently announced acquisition into account.

Once the worst of the negative impacts of the COVID-19 pandemic fade away, Cavco Industries’ manufacturing operations will be able to run at more “normalized” levels, thus enabling its financial performance to benefit from rising economies of scale. Demand for Cavco Industries’ offerings and the offerings of its competitors remain incredibly strong, and there is room for multiple winners in this market. We are big fans of Cavco Industries’ capital appreciation upside and view its pending acquisition of Commodore quite favorably given the apparent synergies Cavco Industries should be able to realize.

By Callum Turcan

Cavco Industries Inc (CVCO) designs and builds manufactured homes, modular homes, vacation cabins, park model RVs, and commercial buildings. The company also has an insurance business, Standard Casualty, which offers a variety of insurance products to manufactured homeowners. Cavco Industries’ financing wing, CountryPlace Mortgage, offers various financing options to homebuyers.

Please note that since June 15, 1976, the design and construction of manufactured and similar housing options in the US has been tightly regulated. The ‘Manufactured Home Construction and Safety Standards’ set by the United States Department of Housing and Urban Development (‘HUD’) have enabled an industry to flourish as standards are closely monitored (to maintain compliance with the HUD Code).

There is a perception that manufactured and similar housing options are of “low quality,” though we want to stress that modern manufactured homes have an estimated lifespan of anywhere from 30 years to 55 years, or even longer if the property is properly maintained. Though that is not quite as long as a traditional home, these are not disposable assets by any means--and when factoring in upside from land value increases, these housing options can be quite appealing to various tranches of the US, Canadian, and other populations.

We are intrigued by Cavco Industries’ potential capital appreciation upside. To learn more, let's first look at the recent performance of one of its competitors.

Warren Buffett Likes the Industry

Here, we would like to point out that Warren Buffett and the industrial conglomerate he runs, Berkshire Hathaway Inc (BRK.A) (BRK.B), have been big fans of this space for a long time. Berkshire Hathaway owns 100% of Clayton Homes, which designs and makes manufactured homes, modular homes, park model RVs, and similar offerings (including on-site and off-site built housing offerings). Additionally, Clayton Homes and affiliated entities offer various financing and insurance products geared towards this market. Within Berkshire Hathaway’s 2020 Annual Report, Mr. Buffett has nothing but good things to say about Clayton Homes.

On a side note, we continue to be huge fans of Berkshire Hathaway and include Berkshire Hathaway Class B shares as an idea in our Best Ideas Newsletter portfolio.

At the end of December 2020, Clayton Homes’ off-site backlog was up 237% versus year-ago levels, hitting $1.3 billion. Clayton Homes’ site-built unit, Clayton Properties Group, reported that its on-site backlog stood at $2.2 billion in Berkshire Hathaway’s 2020 Annual Report. In 2020, Clayton Homes’ revenues grew by 17% year-over-year, hitting ~$8.6 billion, and its pre-tax earnings were up 14% year-over-year, hitting ~$1.25 billion. Greater units sold, higher selling prices per unit, and favorable changes in the sales mix all positively impacted Clayton Homes’ top-line performance last year, though rising materials prices weighed on the growth of its pre-tax earnings.

Furthermore, Clayton Homes posted ~22% year-over-year revenue growth and ~20% year-over-year pre-tax earnings expansion in 2019, highlighting the powerful historical growth trajectory of this subsidiary of Berkshire Hathaway. We view the industry’s growth outlook quite favorably.

In a world where skyrocketing housing prices in the US have put many would-be first-time home buyers perennially on the sidelines, firms like Cavco Industries and Clayton Homes are catering to a very important need here.

According to the Federal Reserve Bank of St. Louis' Federal Reserve Economic Data (‘FRED’) database, the US ownership rate stood at 65.4% in the second quarter of 2021. That is well below the level of US ownership rates seen during the second half of the 1990s and the first half of the 2000s, and most importantly, highlights how vast portions of the US population have been and continue to be unable to obtain a key source of wealth generation (i.e., home ownership and the related potential for price increases and equity building). Companies like Cavco Industries and Clayton Homes are well-positioned to address this issue, which has gotten an increased amount of attention in major media outlets and the policy platforms of major political parties in the US (and elsewhere) in recent years.

Let us now turn to Cavco Industries, the focus of this work.

Earnings Update

On May 26, Cavco Industries reported fourth-quarter earnings for fiscal 2021 (period ended April 3, 2021) that flew past consensus top- and bottom-line estimates. In the fiscal fourth quarter, Cavco Industries’ GAAP net revenues grew 20% year-over-year and its GAAP operating income surged higher 86% year-over-year. Both the company’s ‘factory-built housing’ and ‘financial services’ revenues climbed higher during this period.

For the full fiscal year, keeping in mind its business faced headwinds from the coronavirus (‘COVID-19’) pandemic, Cavco Industries’ GAAP revenues grew by 4% year-over-year in fiscal 2021 while its GAAP operating income grew by 5% year-over-year. Strength was widespread as both its ‘factory-built housing’ and ‘financial services’ revenues climbed higher during this period. Cavco Industries posted $88 million in free cash flow in fiscal 2021 and spent $1 million buying back its stock during this period--and please note the firm does not pay out a common dividend at this time.

As it concerns COVID-19 and the impact that it has had on Cavco Industries’ financial performance, it's fair to say its manufacturing facilities have been operating at subdued capacity levels of late. In its fiscal fourth quarter earnings press release, Cavco Industries noted that “our total average factory capacity utilization rate was approximately 75% during the fourth fiscal quarter of 2021, lower than pre-pandemic levels of more than 80%.” As Cavco Industries gets ready to operate at more “normalized” levels (i.e., capacity utilization rates north of 80%) in the near future as the worst of the COVID-19 pandemic is put behind the US, keeping variants of COVID-19 in mind, its margins should receive a powerful uplift due to rising economies of scale.

Furthermore, please note that as incremental costs associated with the pandemic fade away, that will provide an additional tailwind to Cavco Industries’ future margin performance.

Demand for Cavco Industries’ offerings remains rock-solid, too, and its growth runway is long, underpinned by rising home prices in the US (which helps support unit price increases). Here is what the company’s fiscal fourth quarter earnings press release had to say concerning its rising backlog (which grew by $131 million year-over-year during this period) and strong sales performance of late (emphasis added):

Sales order activity remained exceptionally strong during the fourth fiscal quarter of 2021 to the point where home sales order rates were nearly 50% higher than the comparable prior year quarter and 40% higher for the year. Increased order volume is the result of a higher number of well-qualified home buyers making purchase decisions, supported by reduced home loan interest rates. Increased orders outpaced production during the quarter, raising order backlogs to $603 million at April 3, 2021, compared to $124 million at March 28, 2020 and $472 million at December 26, 2020.

During Cavco Industries’ fourth quarter fiscal 2021 earnings call, management noted that it was facing inflationary headwinds, though the company’s pricing power (and related pricing increases of late) was enabling Cavco Industries to stay ahead of the curve and even grow its gross margins. In the fourth quarter of fiscal 2021, Cavco Industries’ GAAP gross margin stood at ~23.1%, up ~280 basis points year-over-year (however, its GAAP gross margins for fiscal 2021 were down modestly versus fiscal 2020 levels, keeping headwinds from the COVID-19 pandemic in mind). These factors and others highlight the company’s incredibly promising free cash flow growth trajectory, aided by Cavco Industries’ relatively modest capital expenditure requirements.

The firm generated just over $114 million in net operating cash flow in 2020 (its annual net operating cash flows averaged ~$83 million from 2018-2020) and spent less than $26 million on its capital expenditures during this period (its annual capital expenditures averaged ~$16 million from 2018-2020). It is hard not to like Cavco Industries' financials, and its balance sheet is pristine.

At the end of fiscal 2021, Cavco Industries had $342 million in cash, cash equivalents, and short-term investments on hand (excluding restricted cash and long-term investments) versus just $10 million in ‘secured credit facilities and other’ outstanding. While Cavco Industries had other non-cancellable financial liabilities on the books to be aware of at the end of fiscal 2021, such as $13 million in long-term operating lease liabilities, overall its liabilities were quite modest relatively to its massive cash-like holdings. Please note that some of Cavco Industries’ $35 million in long-term investments on hand at the end of fiscal 2021 could be considered cash-like holdings, while the rest is represented by strategic investments.

We are huge fans of Cavco Industries’ free cash flow generating abilities and its fortress-like balance sheet, which are key strengths for any enterprise. The company’s net cash position affords it numerous opportunities, and recently Cavco Industries put that cash to work making a significant acquisition that should generate substantial upside once it closes going forward, in our view. Please note this pending acquisition will not significantly weaken Cavco Industries’ pristine balance sheet.

Significant Acquisition with Ample Upside

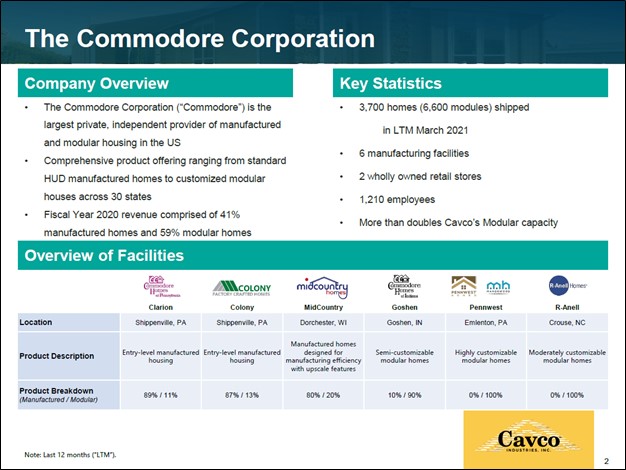

On July 26, Cavco Industries announced it would acquire The Commodore Corporation for about $153 million or roughly $140 million after adjustments and including transaction fees, which will be funded entirely via Cavco Industries’ (net) cash position on hand. Commodore has six manufacturing and two wholly-owned retail locations to build and sell manufactured and modular homes. For reference, Commodore’s brands include Commodore Homes of Pennsylvania, Commodore Homes of Indiana, Colony Homes, MidCountry Homes, Pennwest Homes and R-Anell Homes.

Image Shown: An overview of Commodore’s operations and business profile. Image Source: Cavco Industries – Acquisition of Commodore July 2021 Presentation

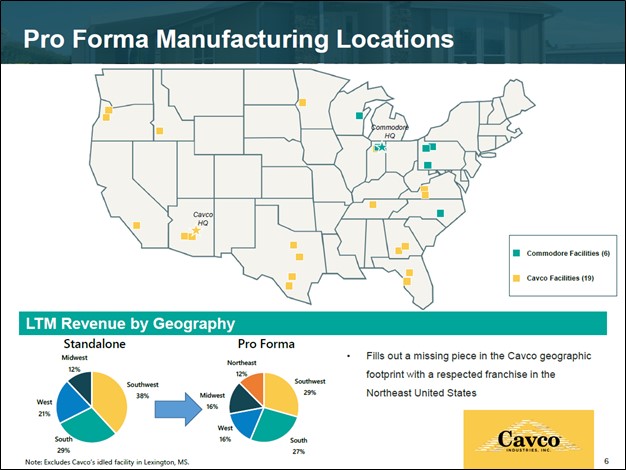

Commodore’s operations will join Cavco Industries’ ~20 domestic production lines alongside its ~40 company-owned retail locations and its network of independent distribution points that spans 43 US states and Canada. The deal is expected to close by the third quarter of Cavco Industries’ fiscal 2022 assuming regulatory approvals and other factors are completed as expected. Cavco Industries expects the deal to be “significantly accretive to earnings and cash flow from operations in fiscal year 2022” which we appreciate. This move will extend Cavco Industries’ presence into the Northeastern US region while bolstering its existing presence in the Midwest and Mid-Atlantic US markets.

Image Shown: The combination of Cavco Industries and Commodore will result in a company with significant scale in the manufactured and modular housing arena, with an eye towards expansive manufacturing, retail, and distribution operations in North America with room for numerous synergies. Image Source: Cavco Industries – Acquisition of Commodore July 2021 Presentation

As it concerns potential synergies arising from this deal, here is what the press release announcing the acquisition had to say (emphasis added):

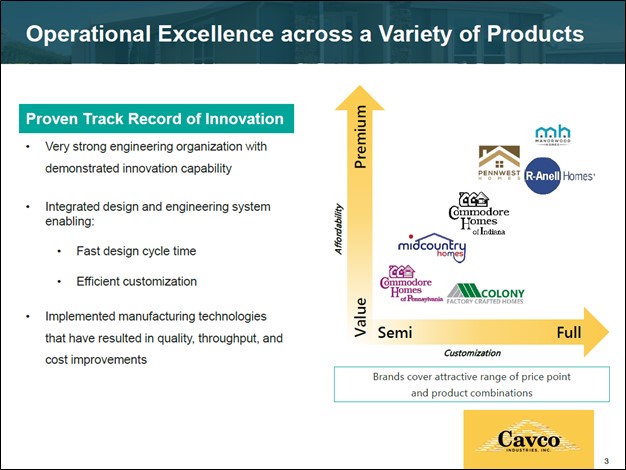

Best practice implementation will create significant manufacturing cost and efficiency improvements across the combined company. In addition to approaches Cavco can bring to the Commodore operations, Commodore has developed and implemented advanced manufacturing technologies that will lead to significant improvements to the Cavco operations. Additionally, the combined network of plants will create distribution improvement opportunities.

In our view, this deal was primarily about a few things. One, it grows Cavco Industries’ operations to a region in which it did not have a serious presence, the Northeastern US, a region where conventional site-built home prices are (generally speaking) quite high. Two, the deal enables Cavco Industries to support the sale of Commodore’s offerings through its vast retail and distribution network. Three, scale. Once completed, this deal will give the enlarged Cavco Industries significant scale, allowing room for ample cost structure improvements in the coming fiscal years. We like the deal, and Cavco Industries should retain its pristine balance sheet and ample liquidity levels in the process.

Image Shown: Commodore’s various brands cover a lot of different price points and market segments within the manufactured and modular housing industry. Image Source: Cavco Industries – Acquisition of Commodore July 2021 Presentation

Concluding Thoughts

This upcoming Thursday, August 5, Cavco Industries will report its first quarter earnings for fiscal 2022 after the market close and will host a conference call the following day. We will have more to say then, though from what we have seen so far, Cavco Industries is a stellar enterprise. The company posted great financial and operational performance in fiscal 2021, even in the face of serious headwinds from the COVID-19 pandemic, and its acquisition of Commodore offers multiple avenues for upside over the long haul.

Cavco Industries’ free cash flow growth outlook is bright and getting brighter by the day, aided by strong housing prices in the US which is the result of a confluence of factors as noted in this report (link here) on the domestic housing market by Harvard University. As the worst of the negative impacts of the COVID-19 pandemic fades and Cavco Industries’ manufacturing operations can once again operate at more “normalized” levels, that should provide another powerful tailwind to its future financial performance.

At the high end of our fair value estimate range, we value shares close to $275 each (shares are trading at ~$240 at this time), and its chart looks poised to break through all-time highs reached in 2018. We view Cavco Industries’ capital appreciation upside quite favorably.

-----

Related: BRK.A, BRK.B, CVCO, XLF, PSCD, NAIL, XSHQ

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Berkshire Hathaway Inc Class B shares (BRK.B) and Financial Select Sector SPDR Fund ETF (XLF) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

1 Comments Posted Leave a comment