Banks Held Up in 3Q 2022 But Mortgage Market Dynamics and Consumer Health Are Big Economic Concerns

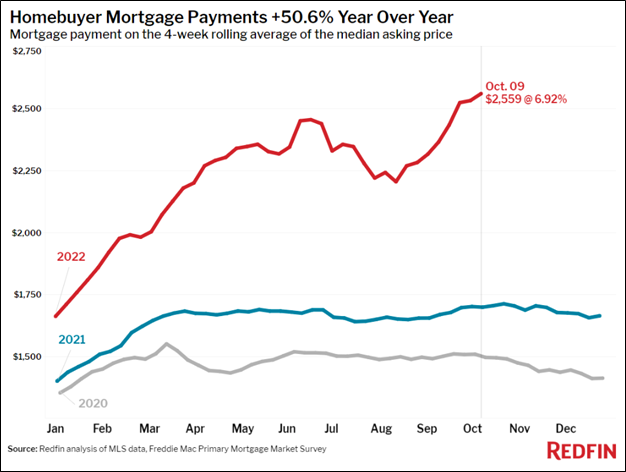

Image: Homebuyer mortgage payments on new homes have increased more than 50% since last year due to rising interest rates. We think this is a precursor to lower housing prices, which could have implications across the banking and financials sector. Image Source: Redfin

By Brian Nelson, CFA

We’ve never been huge fans of taking on outsized banking and financials exposure in the simulated newsletter portfolios for a number of reasons.

First, the banking industry, much like the insurance industry, is generally muted exposure to the broader economic environment. Though having some exposure to banking and financials may make sense, long-term investors are going to get a better bang for their buck with general operating entities that aren’t necessarily tied to unpredictable mortgage market dynamics, a hard-to-handicap yield curve, and generally opaque lending books, ones that are often magnified by leverage.

Second, while there are many ways to value banks including as a multiple to tangible book, through the free cash flow to equity (FCFE) process, or via residual income models, banking and financial entities use cash to make cash, which often muddies the view of true free cash flow generation, in the most traditional sense. Though, of course, there are ways to measure a bank’s earnings power and financial health, other investable areas are much easier to get one’s head around, and therefore are less risky, in our view.

Third, the prices of banking and financial equities often experience tremendous pressure during the worst of the economic cycle. This is also true with other capital-market operators such as REITs (VNQ) and master limited partnerships (AMLP), and while money can be made trading banking and financial stocks during good times, it often becomes hit or miss with a banking or financial entity as it relates to the timing of when to exit prior to the next inevitable crisis that does considerable damage to share prices.

Global Recession, A Weakening Consumer, and Global Contagion Risk

On October 10, J.P. Morgan (JPM) CEO Jamie Dimon warned that the world may tip into a global recession in the next 6 to 9 months, and we can’t disagree. We’re seeing many of the same things that Dimon is seeing, from increased inflationary pressures, interest rates that could cause dislocations in the mortgage markets, abrupt quantitative tightening by the Fed, and Russia’s ongoing aggression toward Ukraine. We think it’s already a done deal that a recession is in the cards, with the only question how long and how painful it will be.

Though the U.S. consumer remains resilient for now, we think that much of the savings built up during the COVID-19 shutdowns will be depleted in the coming quarters, and we’re already starting to see some cracks in the system, with total consumer debt surging to $4.68 trillion in August and revolving credit debt (i.e. credit cards and the like) up 18.1% on a year-over-year basis. U.S. personal savings rates have fallen considerably, and now are at the lowest levels in years after spiking considerably during the height of the COVID-19 crisis in 2020.

Though third-quarter earnings for the biggest banks were okay, we continue to be concerned about the health of the housing market and the impact on mortgage originations and fee revenue for the sector. It’s impossible to ignore that “the monthly mortgage payment on the median asking price home climbed to a record high of $2,559 at the current 6.92% mortgage rate. That’s up 51% from $1,698 a year earlier, when mortgage rates were 3.05% and up from a recent low of $2,210 during the four-week period ending August 14.”

This dynamic has yet to flow through the broader economy and the banking and financials sector, in particular. Asset prices will likely see considerable pressure, and many real estate players taking on too much leverage could become insolvent as the depth of this part of the economic cycle deepens. Such a backdrop certainly isn’t encouraging given the generally weak global economy, one that is exacerbated by questionable health at Credit Suisse (CS), Deutsche Bank (DB) and UBS (UBS). Things aren’t great right now.

Concluding Thoughts

Third-quarter 2022 earnings reports from the money center banks weren’t bad, but we’re concerned about the impact of rising mortgage rates on originations coupled with weakness in asset values across the residential and commercial real estate markets. Consumer personal savings rates are already suffering as many seek to use revolving credit to deal with inflationary pressures. We like the Financials Select Sector SPDR (XLF) as the best way to play diversified exposure to the banking and financials industry, an ETF that we include in the Best Ideas Newsletter portfolio, but there's a lot to worry about, including global financial contagion risk from Europe.

----------

Tickerized for holdings in the XLF and XHB, as well as other entities tied to the mortgage markets.

Video: Valuentum's President of Investment Research, Brian Nelson, CFA, explains the importance of diversification, how to think about firm-specific and systematic risk, how many stocks one should own to achieve 90% of the diversification benefits, how to think about active asset allocation versus active equity management, and why diversification is a means to achieve goals, not the goal itself. A content-packed 14-minute video. Don't miss it!

-----

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

0 Comments Posted Leave a comment