Apple Remains a Free Cash Flow Generating Powerhouse

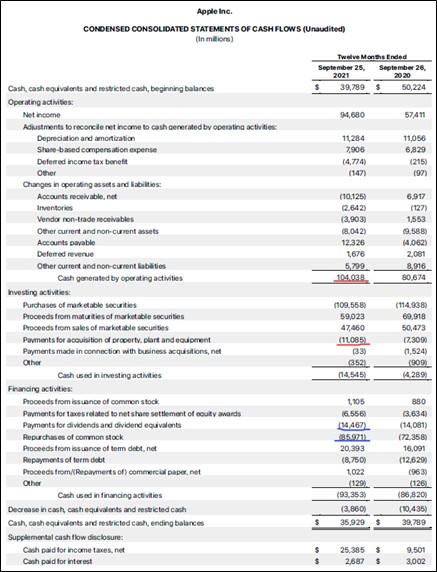

Image Shown: Apple Inc remained a free cash flow generating powerhouse in fiscal 2021. Key line-items are underlined in red and blue. Image Source: Apple Inc – Fourth Quarter of Fiscal 2021 Financial Supplement with additions from the author

By Callum Turcan

On October 28, Apple Inc (AAPL) reported fourth-quarter earnings for fiscal 2021 (period ended September 25, 2021) that missed consensus top-line estimates and matched consensus bottom-line estimates. Apple’s CEO, Tim Cook, noted during the firm’s latest earnings call that “we set a new September quarter record of $83.4 billion” though “supply constraints” weighed negatively on its performance and “had around a $6 billion revenue dollar impact” last fiscal quarter. Silicon shortages were cited as a key headwind, with an eye towards semiconductor supplies not able to keep up with surging demand. Keeping that in mind, we still appreciated the resilience of Apple’s business model in the face of enormous exogenous headwinds.

Apple’s CEO also noted that “we set an all-time record for Mac and quarterly records for iPhone, iPad, Wearables, Home and Accessories” last fiscal quarter. Sales strength was widespread across all of Apple’s core product and services categories, and across all its major geographic markets.

Recent launches of new products and services, which we will cover later in this note, support Apple’s near term growth outlook. Apple’s dividend growth outlook and capital appreciation upside remains stellar, and near term headwinds should abate as the world puts the worst of the coronavirus (‘COVID-19’) pandemic behind it. We continue to like Apple as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of AAPL yield ~0.6% as of this writing.

Overview

The firm’s GAAP revenues grew by 29% year-over-year last fiscal quarter with strength seen at both its ‘Products’ offerings (up 30% year-over-year) and its ‘Services’ offerings (up 26% year-over-year). Furthermore, Apple reported strong sales growth at its ‘Americas,’ ‘Europe,’ ‘Greater China,’ ‘Japan’, and ‘Rest of Asia Pacific’ geographical markets with each segment’s sales up double-digits on a year-over-year basis. The company’s Products sales represented just over three-quarters of its revenues during this period, with the balance generated by its Services sales.

Apple’s GAAP diluted EPS rose to $1.24 in the fourth quarter of fiscal 2021, up from $0.73 in the fourth quarter of fiscal 2020 (period ended September 26, 2020), aided by a combination of GAAP net income growth and a sharp reduction in its outstanding diluted share count.

Please note that we are in the process of updating our cash flow models for the technology industry and will have more to say regarding Apple’s fair value estimate once those updates are complete. As it concerns Apple’s dividend growth potential, the firm’s payout growth outlook is incredibly bright given management’s desire to return cash to shareholders.

Though we would prefer that Apple focuses on maintaining a nice net cash balance, management communicated during the firm’s second quarter of fiscal 2021 earnings call (period ended March 27, 2021) that “we continue to believe there is great value in our stock and maintain our target of reaching a net cash neutral position over time.” Given Apple’s fortress-like balance sheet and stellar free cash flow generating abilities, we expect it will take years for that to occur, if ever.

Margin Snapshot

Apple’s growing digital services business should enable the company to steadily expand its margins going forward. These services should also provide a major tailwind for Apple’s revenue growth trajectory, aided by secular growth tailwinds such as the growing adoption of fintech offerings (Apple Card is well-positioned here) and the ongoing proliferation of video streaming services (Apple TV+ is well-positioned here). The firm’s hardware margins are quite impressive, and we do not expect that to change anytime soon, though its digital services business is even more lucrative.

In the fiscal fourth quarter, Apple’s Products segment put up gross margins of ~34.3% and its Services segment put up gross margins of ~70.5%. Supply chain and other hurdles weighed on the gross margin performance of its Products segment, though both segments continued to perform well last fiscal quarter all things considered. The company’s Services segment generated over one-third of its gross margin last fiscal quarter, though it represented less than one-quarter of Apple’s total revenues.

Apple’s GAAP operating margin grew by ~570 basis points year-over-year last fiscal quarter as its GAAP gross margin rose by over 500 basis points. The firm also benefited from increasing economies of scale. Apple’s GAAP operating income surged higher by 61% year-over-year last fiscal quarter, an impressive feat for a company of its size.

Operational Updates

In September 2021, Apple unveiled the iPhone 13 lineup, the latest iterations of its popular and incredibly lucrative smartphones. Major telecom companies in the US and elsewhere have been heavily subsidizing the offering to win over customers that are willing to sign up for long-term wireless contracts. That dynamic in turn has supported Apple’s hardware sales and should continue to do so going forward. Apple’s hardware offerings remain incredibly appealing to consumers.

The company has also been expanding its offerings in the realm of health and fitness. For instance, Apple’s Fitness+ exercise tracking app powered by its Apple Watch is a prime example of its efforts on this front. In the recent past, Apple has improved the capabilities of its Apple Watch to include more health and fitness related offerings (such as adding heartbeat monitoring and electrocardiogram monitoring systems, and sleep tracking capabilities, among other things). Apple recently launched Apple Watch Series 7 with enhanced functionality over previous iterations. During Apple’s latest earnings call management noted:

“This quarter also saw major updates to Fitness+, including the addition of new activities like meditation and pilates, and the announcement of group workouts, a feature that brings fitness and friends together. We also shared that Fitness+ will soon be available in 15 new countries, bringing workouts for every age and skill level to millions more people around the world.” --- CEO of Apple

Looking ahead, Apple intends to continue growing its presence in the health and fitness space, with the WSJ recently reporting that Apple is considering upgrading its AirPods (wireless headphones) offerings to have hearing aid capabilities and to be able to take the core temperature of its users. The WSJ reports that the US Food and Drug Administration (‘FDA’) is overhauling its regulations for hearing aids, as part of a 2017 law, to allow for over-the-counter hearing aid options in a bid to lower prices for consumers, creating new growth opportunities for Apple.

On a side note, Apple recently “announced a new subscription tier to Apple Music called Apple Music Voice, which offers subscribers access to the services catalog of 90 million songs all through the power of Siri” according to recent management commentary. We appreciate that Apple continues to improve its digital services offerings.

Fiscal 2021 Financial Review

Apple put up tremendous performance in fiscal 2021 as its GAAP revenues grew 33% on an annual basis to reach $365.8 billion. Its Products segment sales grew 35% and its Services segment sales grew 27% year-over-year. Across all geographies and across most (if not all) of its main products and services offerings, Apple reported rock-solid year-over-year sales growth last fiscal year.

Its GAAP gross margin rose ~355 basis points year-over-year in fiscal 2021, aided by Apple’s immense pricing strength and ability to capitalize on surging demand for tablets, desktops, and laptops in the wake of the work-from-home trend. That in turn helped drive the company’s GAAP operating margin higher over 560 basis points during this period, enabling Apple’s GAAP operating income to grow by 64% year-over-year in fiscal 2021. Apple’s GAAP diluted EPS rose to $5.61 in fiscal 2021 versus $3.28 in fiscal 2020, aided by a material reduction in its outstanding diluted share count (which dropped almost 4% during this period) while its GAAP net income rose by 65% year-over-year.

Apple generated over $104.0 billion in net operating cash flow in fiscal 2021 while spending just under $11.1 billion on its capital expenditures, resulting in approximately $93.0 billion in free cash flow (up 27% year-over-year). Its dividend payouts stood at $14.5 billion in fiscal 2021, highlighting the tremendous growth runway as it concerns Apple’s income growth potential. The firm also spent $86.0 billion buying back its stock last fiscal year, some of which is covered by its balance sheet. Apple exited fiscal 2021 with a $65.8 billion net cash position (inclusive of marketable securities and short-term debt). Even as Apple strives towards reducing its net cash hoard, as noted previously, that process will take a long time, in our view, given its immense free cash flows.

Management Commentary

We would like to stress that demand for Apple’s hardware remains rock-solid, even though the firm, like many of its peers, is having trouble with its supply chains as the world continues to emerge from the worst of the COVID-19 pandemic. Here is some additional commentary on the issue and Apple’s near-term outlook (lightly edited, emphasis added):

“…[D]uring the September quarter, supply constraints impacted our revenue by around $6 billion. We estimate the impact from supply constraints will be larger during the December quarter. Despite this challenge, we are seeing high demands for our products and expect to achieve very solid year-over-year revenue growth and to set a new revenue record during the December quarter.

We expect revenue for each product category to grow on a year-over-year basis, except for iPad, which we expect to decline year-over-year due to supply constraints. For services, we expect our growth rate to decelerate from the September quarter but to remain strong.” --- Luca Maestri, SVP and CFO of Apple

While Apple is facing some challenges in the current fiscal quarter, its growth trajectory remains intact. The company had some great things to say about its Services segment during Apple’s latest earnings call (lightly edited, emphasis added):

“Turning to services… [W]e reached an all-time revenue record of $18.3 billion with all-time records for cloud services, music, video, advertising, AppleCare and payment services and a September quarter record for the App Store. Our continued investment and strong execution in services has helped us deliver a record $68 billion in revenue during fiscal 2021, nearly tripling this category in six years. These impressive results reflect the positive momentum we are seeing on many fronts.

First, our installed base continues to grow and reached an all-time high across each geographic segment. Next, we continue to see increased customer engagement with our services. The number of paid accounts on our digital content stores grew double digits and reached a new all-time high during the September quarter in each geographic segment.

Also, paid subscriptions continued to show very strong growth. We now have more than 745 million paid subscriptions across the services on our platform, which is up more than 160 million from last year and nearly 5 times the number of paid subscriptions we had less than five years ago.” --- SVP and CFO of Apple

On a final note, Apple’s SVP and CFO noted that “we continue to make progress towards our goal of net cash neutral over time” during the call. We expect that Apple will continue to grow its payout and repurchase its stock at a robust pace going forward.

Concluding Thoughts

Apple is not immune to the headwinds facing global supply chains, though its fortress-like balance sheet and stellar free cash flow generating abilities should enable the firm to ride out near term hurdles with its bright growth trajectory intact. We are huge fans of the tech behemoth and continue to like shares of AAPL as an idea in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

-----

Technology Giants Industry - FB, AAPL, GOOG, AMZN, MSFT, CSCO, V, MA, PYPL, INTC, ORCL, QCOM, TWTR, IBM, ADBE, NVDA, CRM, AMD, AVGO, BABA, BKNG, BIDU, TSM, FFIV, TXN, EBAY, ADP, PAYX, MU, KFY, MAN, KLAC, LRCX, AMAT, ADI

Tickerized for AAPL, SWKS, CRUS, QRVO, AVGO, QCOM, LITE, JBL, SITM, XLK

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Apple Inc (AAPL), Cisco Systems Inc (CSCO) and Microsoft Corporation (MSFT) are all included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Alphabet Inc (GOOG) Class C shares, Facebook Inc (FB), Korn Ferry (KFY), PayPal Holdings Inc (PYPL) and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Oracle Corporation (ORCL) and Qualcomm Inc (QCOM) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Facebook Inc, Oracle Corporation, and Taiwan Semiconductor Manufacturing Company, Limited (TSM) are all included in Valuentum’s simulated ESG Newsletter portfolio. Long put options on the SPDR S&P 500 ETF Trust (SPY) with an expiration date of December 31, 2021, and strike price of $412 are included in both Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

0 Comments Posted Leave a comment